High Stock Valuations: BofA's Analysis And Investor Guidance

Table of Contents

BofA's Assessment of Current High Stock Valuations

BofA regularly publishes reports assessing market conditions and stock valuations. Their analyses typically incorporate a range of metrics, including Price-to-Earnings (P/E) ratios, market capitalization trends, and discounted cash flow models. While specific data points change frequently, BofA’s recent reports often highlight concerns regarding certain sectors being overvalued.

- Key Findings on Overvaluation: BofA's research frequently identifies specific sectors, like [mention sector examples based on recent BofA reports, e.g., technology or consumer discretionary], as potentially exhibiting high valuations relative to historical averages and future earnings expectations. They often compare current P/E ratios to long-term averages to gauge overvaluation.

- Potentially Overvalued Stocks/Indices: BofA's analysts may point to specific companies or indices showing signs of overvaluation. For example, [mention a specific example if available, citing the source]. It's crucial to note that these are indications and not definitive predictions.

- BofA's Valuation Methodology: BofA employs a variety of sophisticated valuation methodologies, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions, to assess the intrinsic value of stocks and compare it to market prices.

Factors Contributing to High Stock Valuations

Several macroeconomic factors contribute to the current environment of high stock valuations. Understanding these factors is essential for making informed investment decisions.

-

Low Interest Rates: Historically low interest rates have fueled investor appetite for riskier assets, including stocks, pushing up prices. The search for yield in a low-return environment contributes significantly to higher stock market valuation.

-

Quantitative Easing (QE) and Monetary Policy: Central bank policies, such as QE, have injected significant liquidity into the market, further supporting stock prices. This increased liquidity can inflate asset bubbles, including stocks.

-

Strong Corporate Earnings (if applicable): Periods of strong corporate earnings can justify higher stock valuations. However, it’s crucial to analyze the sustainability of these earnings and consider the overall economic climate.

-

Inflation's Impact: Inflation erodes the purchasing power of money. While inflation can drive up earnings and therefore stock prices, high inflation also increases interest rates and makes future earnings less certain, potentially creating a negative impact on stock valuations.

-

Technological Advancements and Growth Sectors: Breakthroughs in technology and the growth of innovative sectors often attract significant investment, driving up valuations in those areas. However, rapid technological change also introduces significant risk.

-

Geopolitical Events and Uncertainty: Geopolitical events and global uncertainty can significantly impact investor sentiment and stock valuations. Periods of instability often lead to increased volatility.

Investment Strategies in a High-Valuation Environment

Given BofA's analysis and the factors contributing to high stock valuations, investors need to adopt prudent strategies.

-

Diversification: Diversifying across different asset classes (stocks, bonds, real estate) and sectors is crucial to mitigate risk. This reduces the impact of any single sector's underperformance.

-

Undervalued Sectors/Stocks: Identify sectors or individual stocks that BofA or other reputable analysts deem undervalued. This requires thorough research and a cautious approach.

-

Long-Term Investment Horizon: High valuations don't necessarily mean immediate market crashes. A long-term investment horizon helps weather short-term market fluctuations and benefit from long-term growth.

-

Alternative Investments: Consider diversifying into alternative investments like bonds or real estate to balance your portfolio's risk profile.

-

Risk Management: Employ strategies like stop-loss orders to limit potential losses in a volatile market. Regular portfolio rebalancing can help maintain your desired asset allocation.

-

Identifying Undervalued Companies: Thoroughly analyze financial statements, compare companies to their peers, and assess their long-term growth potential to identify potentially undervalued companies.

-

Due Diligence: Always conduct comprehensive due diligence before investing in any stock. Don't rely solely on analysts' recommendations.

Risks Associated with High Stock Valuations

Investing in a market characterized by high stock valuations carries inherent risks.

-

Market Corrections/Crashes: High valuations often precede market corrections or crashes. These events can lead to significant and rapid declines in stock prices.

-

Capital Losses: Investors risk substantial capital losses if the market experiences a downturn. The higher the initial valuation, the greater the potential for loss.

-

Impact on Long-Term Returns: While long-term returns are still possible, high starting valuations can reduce the potential for exceptionally high returns compared to investments made at lower valuations.

-

Correlation with Future Performance: Historically, periods of high valuations have sometimes been followed by periods of lower returns. This isn't guaranteed, but it's a factor to consider.

-

Historical Context: Studying historical periods with similar high valuations provides valuable context, although past performance doesn't predict future results.

-

Risk Tolerance: Your investment decisions should always align with your risk tolerance and investment goals. A high-risk tolerance may be appropriate for some, but not all.

Making Informed Decisions About High Stock Valuations

BofA's analysis, while valuable, is just one piece of the puzzle. Their reports frequently highlight concerns about high stock valuations in certain sectors, urging investors to proceed cautiously. Factors like low interest rates, quantitative easing, and strong (or unsustainable) corporate earnings have contributed to this environment. However, the risks associated with high valuations – market corrections, potential capital losses, and the impact on long-term returns – cannot be ignored.

To navigate this complex landscape effectively, investors should utilize diversification strategies, focus on potentially undervalued opportunities, maintain a long-term perspective, consider alternative investments, and prioritize thorough due diligence and risk management. By carefully considering BofA's insights and conducting further research using their reports and other reliable sources, you can make informed decisions and refine your own high stock valuation investment strategies to better protect your portfolio. Remember, understanding high stock valuations and their implications is crucial for successful long-term investing.

Featured Posts

-

April 19th Nyt Mini Crossword Puzzle Complete Answers And Clues

May 31, 2025

April 19th Nyt Mini Crossword Puzzle Complete Answers And Clues

May 31, 2025 -

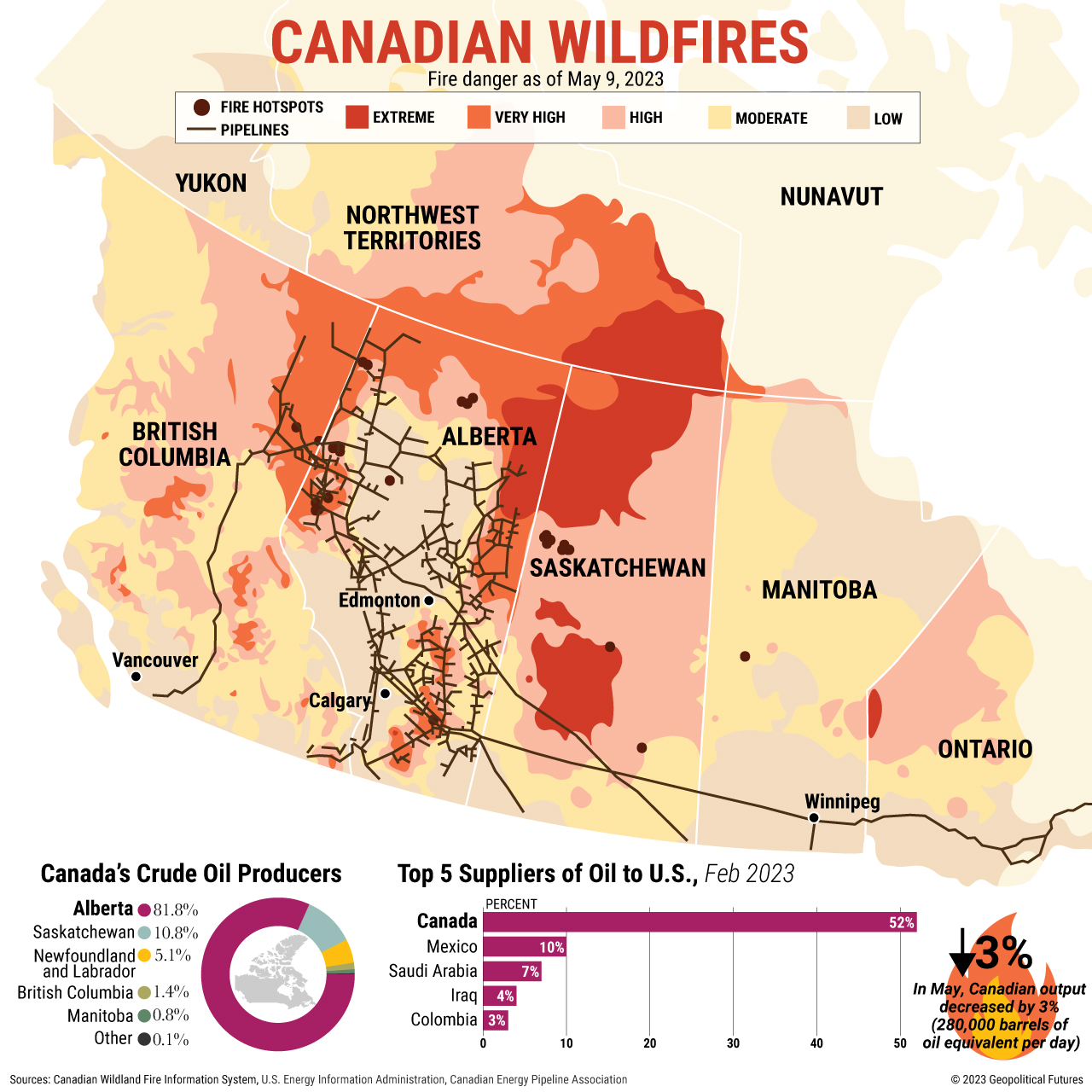

Early Wildfires A Growing Concern For Canada And Minnesota

May 31, 2025

Early Wildfires A Growing Concern For Canada And Minnesota

May 31, 2025 -

Court Ruling Opens Door To Increased Profits For Mobile Game Developers

May 31, 2025

Court Ruling Opens Door To Increased Profits For Mobile Game Developers

May 31, 2025 -

Banksy Auction Iconic Broken Heart Wall On The Block

May 31, 2025

Banksy Auction Iconic Broken Heart Wall On The Block

May 31, 2025 -

Bannatyne Supports Childrens Charity In Morocco A Life Changing Impact

May 31, 2025

Bannatyne Supports Childrens Charity In Morocco A Life Changing Impact

May 31, 2025