Historic £202m Euromillions Jackpot: Your Path To Financial Freedom

Table of Contents

Understanding the £202m Euromillions Win

The Odds and the Reality

Winning the Euromillions lottery is a dream for many, but the odds are astronomically low. The reality is that achieving this level of financial success through the lottery is exceptionally rare. It's crucial to approach lottery participation responsibly and manage expectations.

- Euromillions Odds: The odds of winning the jackpot are approximately 1 in 140 million. This emphasizes the importance of responsible gambling.

- Responsible Gambling: Always gamble within your means and never chase losses. If you or someone you know is struggling with gambling addiction, seek help from organizations like GamCare (link to GamCare).

- Realistic Expectations: While winning the lottery is exciting to contemplate, it's vital to remain grounded and understand the improbable nature of such an event.

Tax Implications of a £202m Win

A £202m Euromillions win in the UK comes with significant tax implications. While lottery winnings themselves are generally tax-free in the UK, associated investments and income generated from your winnings will be subject to tax. Seeking professional financial advice is paramount.

- UK Lottery Tax Laws: While the prize itself isn't taxed, income generated from investments made with the winnings will be subject to income tax and potentially capital gains tax.

- Professional Tax Advice: Engage a qualified accountant and tax advisor immediately after winning to understand the tax implications and optimize your tax strategy.

Securing Your Euromillions Fortune

Building a Robust Financial Team

Assembling a skilled team of financial professionals is essential to protect and grow your £202m win. This team should provide comprehensive support across various financial aspects.

- Financial Planner: Develops a long-term financial plan, encompassing investment strategies, retirement planning, and wealth preservation.

- Lawyer (Specializing in Trusts and Estates): Provides legal guidance on estate planning, asset protection, and establishing trusts to maintain privacy and manage inheritance.

- Accountant: Handles tax obligations, financial reporting, and ensures compliance with all relevant regulations.

Investment Strategies for Your £202m Win

Diversifying your investments across various asset classes is crucial for long-term financial security. This minimizes risk and maximizes the potential for growth.

- Low-Risk Investments: Government bonds offer stability and capital preservation.

- Medium-Risk Investments: Index funds provide diversified exposure to the stock market with moderate risk.

- High-Risk Investments: Private equity or venture capital can offer higher returns but involve greater risk. Proceed with caution and only after thorough due diligence.

Protecting Your Privacy

Maintaining your privacy after winning a substantial lottery prize is paramount. Public knowledge of your win can lead to unwanted attention and potential security risks.

- Avoid Public Announcements: Don't publicly announce your win.

- Anonymous Trusts: Consider using anonymous trusts to manage your assets discreetly.

- Security Personnel: If necessary, hire security personnel to protect your safety and privacy.

Planning for Long-Term Financial Freedom

Charitable Giving

Giving back to the community is a rewarding aspect of achieving significant wealth. Charitable donations also offer tax benefits.

- Tax Benefits: Donations to registered charities are often tax-deductible, reducing your overall tax liability.

- Choosing Charities: Select charities aligned with your values and make informed decisions about your philanthropic endeavors.

Estate Planning and Legacy

Creating a comprehensive estate plan ensures your assets are distributed according to your wishes and protects your loved ones' future.

- Wills: A legally binding document outlining how your assets will be distributed after your death.

- Trusts: Legal entities that can hold and manage your assets, offering flexibility and tax advantages.

- Inheritance Tax Planning: Strategies to minimize inheritance tax payable on your estate.

Maintaining a Healthy Lifestyle

Financial freedom should not come at the cost of your well-being. Prioritizing mental and physical health is crucial.

- Stress Management: Practice stress-reducing techniques like meditation or yoga.

- Financial Wellness Resources: Seek professional help if you're struggling to adjust to your newfound wealth.

Conclusion

Winning a massive lottery prize like the £202m Euromillions jackpot is a life-changing event. However, achieving lasting financial freedom requires careful planning, expert guidance, and a strategic approach to wealth management. By building a strong financial team, diversifying investments, and prioritizing long-term financial security and well-being, you can navigate this journey successfully. Remember, securing your financial future is not just about the size of your win; it's about making informed decisions and planning wisely. Start planning your path to financial freedom today, even if it's not with a £202m Euromillions jackpot. Learn more about responsible financial planning to secure your financial future.

Featured Posts

-

Today In Chicago History Picassos First American Solo Exhibition

May 28, 2025

Today In Chicago History Picassos First American Solo Exhibition

May 28, 2025 -

Cristiano Ronaldo Al Nassr A Imza Atiyor Mu Iste Ayrintilar

May 28, 2025

Cristiano Ronaldo Al Nassr A Imza Atiyor Mu Iste Ayrintilar

May 28, 2025 -

Prakiraan Cuaca Kaltim Terbaru Ikn Balikpapan Samarinda And Sekitarnya

May 28, 2025

Prakiraan Cuaca Kaltim Terbaru Ikn Balikpapan Samarinda And Sekitarnya

May 28, 2025 -

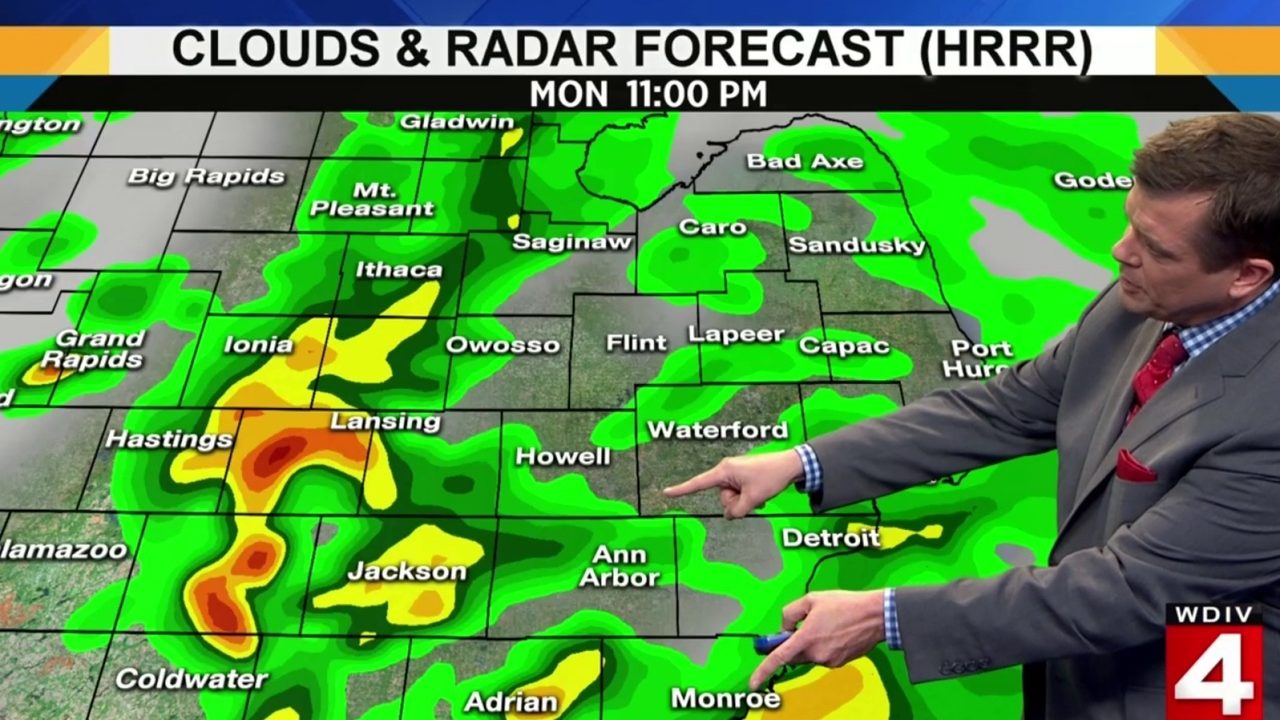

Metro Detroit Weather Forecast Mostly Sunny Skies Monday

May 28, 2025

Metro Detroit Weather Forecast Mostly Sunny Skies Monday

May 28, 2025 -

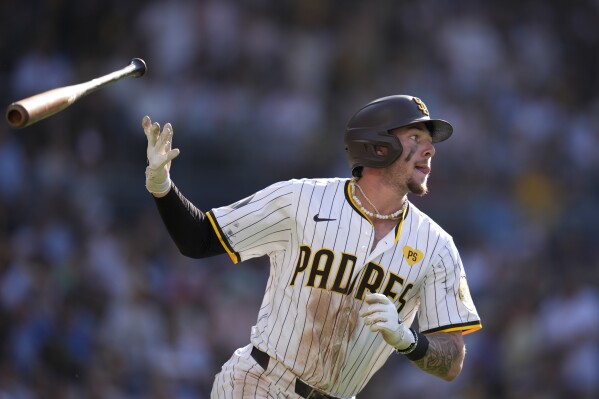

Seven Game Win Streak Padres Merrill Hits Game Winning Homer In 5 2 Victory

May 28, 2025

Seven Game Win Streak Padres Merrill Hits Game Winning Homer In 5 2 Victory

May 28, 2025

Latest Posts

-

Swiatek Advances Ruud And Tsitsipas Fall Short At The French Open

May 30, 2025

Swiatek Advances Ruud And Tsitsipas Fall Short At The French Open

May 30, 2025 -

Roland Garros 2024 Ruud And Tsitsipas Early Losses Swiateks Strong Performance

May 30, 2025

Roland Garros 2024 Ruud And Tsitsipas Early Losses Swiateks Strong Performance

May 30, 2025 -

French Open Upsets Ruud And Tsitsipas Exit Early Swiatek Dominates

May 30, 2025

French Open Upsets Ruud And Tsitsipas Exit Early Swiatek Dominates

May 30, 2025 -

Can Sinner And Djokovic Conquer The French Open

May 30, 2025

Can Sinner And Djokovic Conquer The French Open

May 30, 2025 -

Ruud Loses To Borges At Roland Garros After Knee Injury Setback

May 30, 2025

Ruud Loses To Borges At Roland Garros After Knee Injury Setback

May 30, 2025