HMRC Child Benefit: How To Identify And Respond To Official Contact

Table of Contents

Identifying Genuine HMRC Communication Regarding Child Benefit

It's crucial to be able to distinguish genuine HMRC Child Benefit correspondence from fraudulent attempts. Here's how to identify official communication:

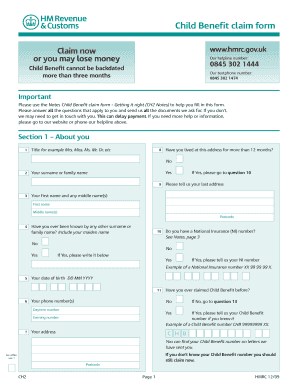

Official Letter Characteristics

Legitimate HMRC Child Benefit letters possess several key features:

- Official HMRC Letterhead: The letter will display the official HMRC logo and address. Look for clear, professional printing.

- Your Personal Details: The letter will accurately reflect your name and address as registered with HMRC.

- Security Features: Authentic letters may contain security features such as watermarks, unique reference numbers, or specific paper stock.

- Formal Language and Tone: The language used will be formal and professional, avoiding colloquialisms or overly casual phrasing.

- Verification: You can find examples of genuine HMRC correspondence on the official GOV.UK website to compare against any letters you receive.

Official Email and Text Message Characteristics

HMRC rarely initiates contact regarding Child Benefit via email or text message. If you receive such communication, treat it with extreme caution. Be wary of:

- Suspicious Sender Addresses: Check the sender's email address or phone number carefully. Legitimate HMRC communications will use official government domains and numbers.

- Generic Greetings: Unsolicited emails or texts often use generic greetings like "Dear Customer" instead of your name.

- Urgent or Threatening Language: Scammers often create a sense of urgency to pressure you into acting quickly.

- Requests for Personal Information: HMRC will never ask for your full banking details, password, or National Insurance number via email or text.

- Links to External Websites: Avoid clicking on any links within suspicious emails or texts. Instead, navigate directly to the official GOV.UK website.

Official Phone Call Characteristics

HMRC will never ask for your personal or financial information during an unsolicited phone call. If you receive a call claiming to be from HMRC about your Child Benefit:

- Never disclose sensitive information.

- Do not engage in extended conversations. Politely end the call and contact HMRC directly using their official contact number found on GOV.UK.

- Verify the caller's identity independently. Use the official HMRC contact number to verify the authenticity of the caller. They will be able to provide a reference number.

Responding to Legitimate HMRC Child Benefit Contact

Once you've verified the communication as legitimate, responding appropriately is crucial:

Responding to Letters

- Read Carefully: Thoroughly review the letter to understand the request and any deadlines.

- Gather Required Information: Collect all the necessary documents and information requested.

- Respond Promptly: Respond by the stated deadline to avoid potential issues.

- Keep Records: Maintain copies of all sent and received correspondence.

Responding to Online Communications

- Access Your Account Securely: Only access your HMRC online account through the official GOV.UK website.

- Verify URLs: Double-check the website address to ensure you're on a legitimate government site.

- Use Strong Passwords: Ensure your online account password is strong and unique.

Responding to Phone Calls (If Verified)

If you've independently verified the caller's identity through the official HMRC contact number:

- Ask for a Reference Number: Request a reference number to confirm the legitimacy of the call.

- Keep Records: Note down the date, time, and details of the conversation.

Reporting Suspicious HMRC Child Benefit Contact

If you suspect a scam, reporting it immediately is vital:

How to Report a Scam

Report suspicious contact immediately using the following channels:

- Report to HMRC: Use the HMRC phishing reporting service on their official website.

- Report to Action Fraud: Action Fraud is the UK's national reporting centre for fraud and cybercrime.

Protecting Yourself from Future Scams

Take proactive steps to protect yourself from future scams:

- Regularly Check the Official HMRC Website: Stay updated on the latest information and security advice.

- Be Wary of Unsolicited Communication: Never respond to unsolicited emails, texts, or calls requesting personal or financial information.

- Never Click on Unknown Links: Avoid clicking on suspicious links in emails or texts.

- Use Strong Passwords: Use unique and strong passwords for all your online accounts.

- Enable Two-Factor Authentication: Add an extra layer of security to your online accounts.

Staying Safe with Your HMRC Child Benefit

Protecting your HMRC Child Benefit from fraudulent activity requires vigilance and awareness. Remember to carefully scrutinize all communications, verify their authenticity using official channels, and report any suspicious activity immediately. By following these guidelines, you can significantly reduce your risk of becoming a victim of a scam. Share this guide with your family and friends to help everyone stay safe and informed about protecting their HMRC Child Benefit.

Featured Posts

-

Agatha Christies Private Letters A Clash Over A Pivotal Work

May 20, 2025

Agatha Christies Private Letters A Clash Over A Pivotal Work

May 20, 2025 -

Ajatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt Libdaeatha

May 20, 2025

Ajatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt Libdaeatha

May 20, 2025 -

La Fire Victims Face Price Gouging A Real Estate Agents Perspective

May 20, 2025

La Fire Victims Face Price Gouging A Real Estate Agents Perspective

May 20, 2025 -

Haekkinen On Schumacher F1 Comeback Still Possible

May 20, 2025

Haekkinen On Schumacher F1 Comeback Still Possible

May 20, 2025 -

Securing European Citizenship An Alternative For Disaffected Americans

May 20, 2025

Securing European Citizenship An Alternative For Disaffected Americans

May 20, 2025