HMRC Letter Received? Guidance For UK Households

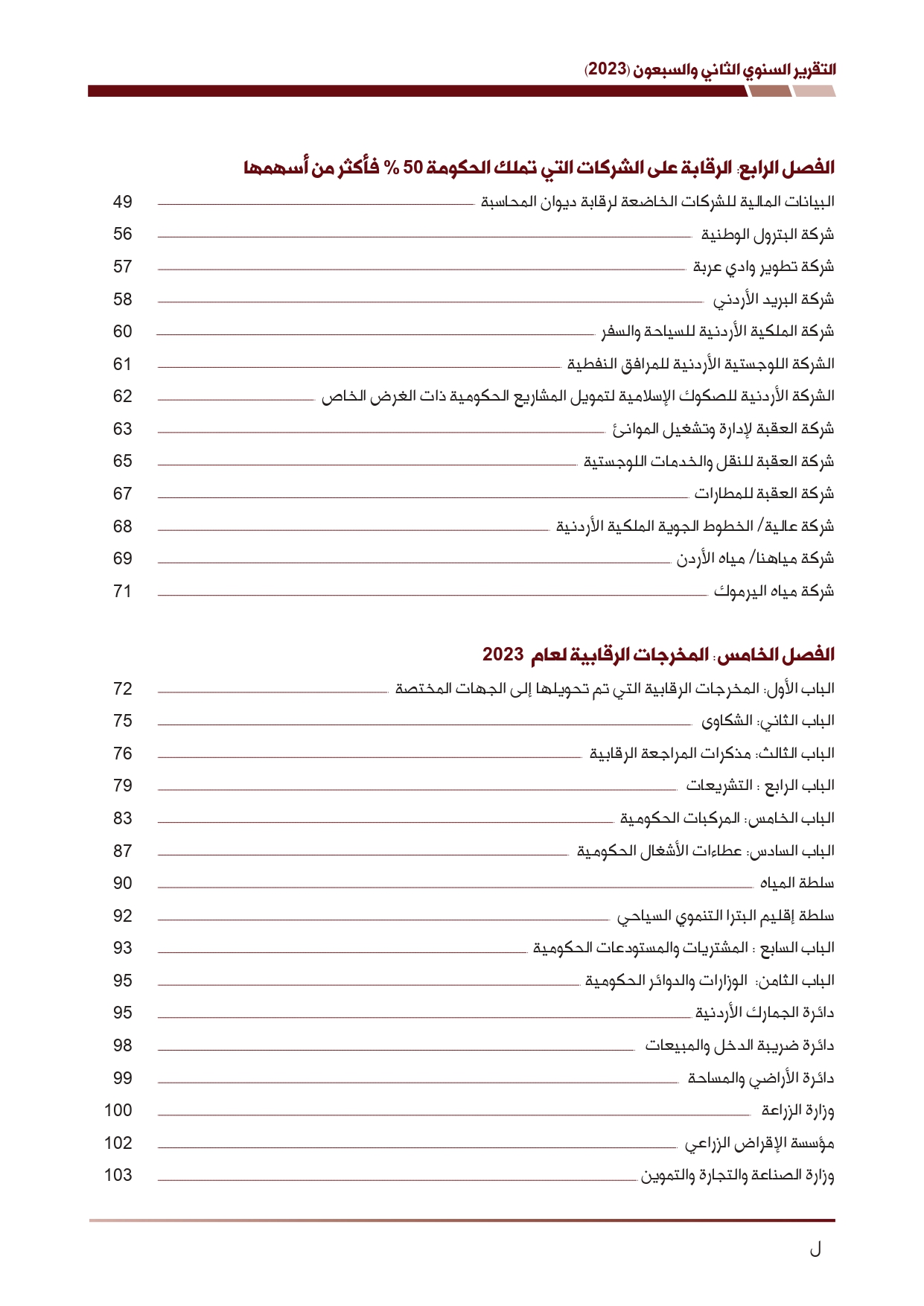

Table of Contents

Identifying the Type of HMRC Letter

The first step when you receive an HMRC letter is to carefully examine it. The subject line and contents will provide crucial clues about its purpose. Don't panic; take your time to read it thoroughly. Understanding the type of letter is key to formulating the appropriate response.

Here are some common types of HMRC letters:

-

HMRC Tax Assessment Letter: This could be related to your self-assessment tax return or your PAYE (Pay As You Earn) tax. It details your tax liability for a specific period. An HMRC tax assessment letter may require you to pay additional tax or confirm the accuracy of the assessment.

-

HMRC Payment Reminder: This letter indicates an outstanding tax payment. An HMRC payment reminder usually specifies the amount due, the deadline, and potential penalties for late payment.

-

HMRC Tax Investigation Letter: This is a more serious matter, indicating HMRC is investigating your tax affairs. An HMRC tax investigation can involve a review of your tax returns and financial records.

-

HMRC Tax Code Change Letter: This letter informs you of a change to your PAYE tax code, which affects the amount of tax deducted from your salary or pension. Understanding your HMRC tax code change is important for budgeting purposes.

-

HMRC Penalty Letter: This letter notifies you of penalties for late payment or other tax-related infractions.

Key information to look for in any HMRC letter includes:

- Unique reference number

- Specific deadlines

- Contact details for inquiries

Understanding Your Tax Obligations

As a UK household, understanding your tax responsibilities is paramount. Failure to meet your tax obligations can result in penalties and further complications. Several types of taxes apply in the UK:

- Income Tax: Tax on your earnings from employment, self-employment, and investments.

- National Insurance: Contributes to social security benefits.

- Capital Gains Tax: Tax on profits from selling assets like property or shares.

- And more...

To fully grasp your tax obligations, utilize these resources:

- The official HMRC website: A comprehensive source of information on UK tax laws and regulations.

- Tax advisors and accountants: Professionals who can provide personalized guidance.

Responding to an HMRC Letter

Responding promptly to an HMRC letter is crucial to avoid penalties. Ignoring an HMRC letter is not an option; it can lead to escalating penalties and further investigation. You can respond in several ways:

- Online: Through your online tax account, the most efficient method.

- By post: Using the address provided on the letter.

- By phone: Contacting the HMRC helpline.

When responding, ensure you include:

- The reference number from the letter.

- Any requested information or documentation.

- A clear explanation of your situation, if necessary.

Seeking Professional Help

While many HMRC letters can be handled independently, seeking professional advice from a qualified accountant or tax advisor is sometimes necessary. This is especially true for:

- Complex tax situations

- HMRC tax investigations

- Disputes with HMRC

Finding a qualified tax professional:

- Use online directories of chartered accountants and tax advisors.

- Ask for recommendations from trusted sources.

Avoiding HMRC Letter Scams

Be aware of potential scams impersonating HMRC. Never respond to unsolicited emails or phone calls claiming to be from HMRC that request personal information. Legitimate HMRC communications will never:

- Ask for your bank details via email or phone.

- Threaten immediate arrest or legal action unless you act immediately.

- Demand payment via unusual methods.

Report suspected scams to HMRC immediately using the official resources provided on their website.

Conclusion: Taking Action on Your HMRC Letter

When you receive an HMRC letter, carefully identify its type, understand your obligations, and respond promptly using the appropriate method. Utilize the official HMRC website for information and guidance. Seek professional help when needed, particularly in complex situations or if dealing with an HMRC tax investigation. Don't ignore your HMRC letter! Understand your responsibilities and take action today. Learn more about managing your HMRC correspondence on the official HMRC website. [Link to HMRC Website]

Featured Posts

-

Radostnaya Novost Dzhennifer Lourens Rodila Vtorogo Malysha

May 20, 2025

Radostnaya Novost Dzhennifer Lourens Rodila Vtorogo Malysha

May 20, 2025 -

Nyt Mini Crossword Answers April 2nd

May 20, 2025

Nyt Mini Crossword Answers April 2nd

May 20, 2025 -

New Richard Mille Rm 72 01 Collaboration With Charles Leclerc

May 20, 2025

New Richard Mille Rm 72 01 Collaboration With Charles Leclerc

May 20, 2025 -

Ivoire Tech Forum 2025 La Plateforme Internationale Pour La Transformation Numerique En Cote D Ivoire

May 20, 2025

Ivoire Tech Forum 2025 La Plateforme Internationale Pour La Transformation Numerique En Cote D Ivoire

May 20, 2025 -

Mwafqt Alnwab Ela Mkhalfat Tqryry Dywan Almhasbt 2022 2023

May 20, 2025

Mwafqt Alnwab Ela Mkhalfat Tqryry Dywan Almhasbt 2022 2023

May 20, 2025