HMRC Payslip Check: Millions Eligible For Refunds

Table of Contents

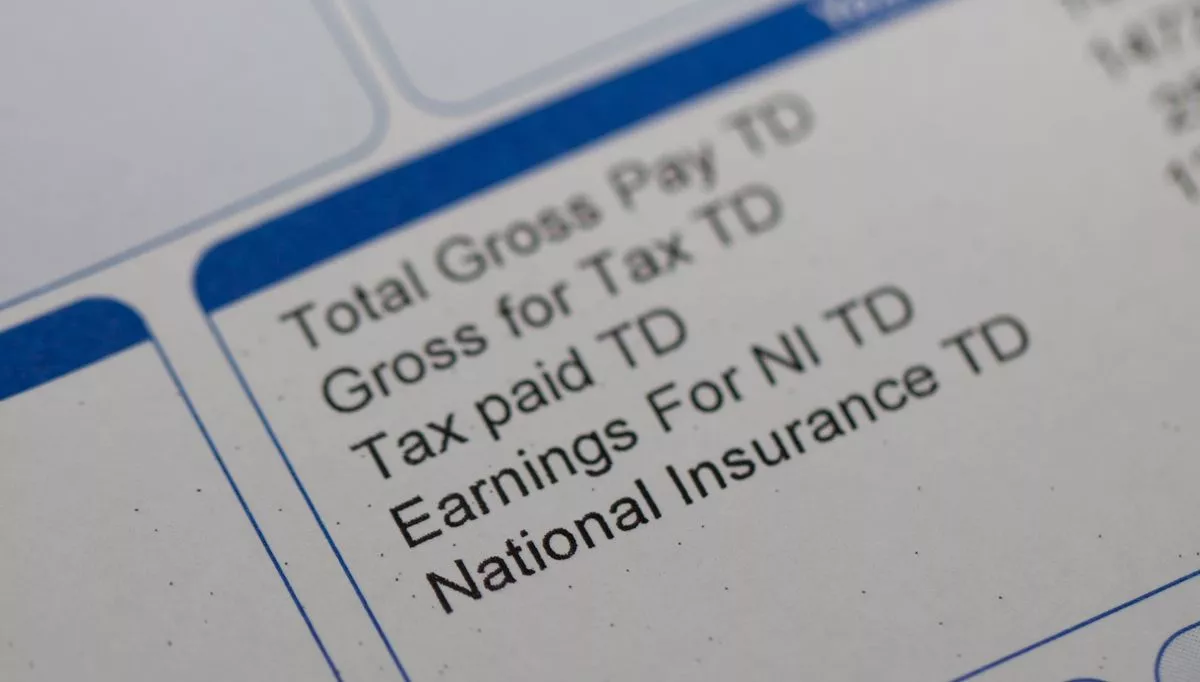

Understanding Your HMRC Payslip and Tax Code

Your payslip is more than just a record of your earnings; it's a crucial document reflecting your tax liability. Understanding your tax code is paramount to ensuring you're paying the correct amount of tax. Your tax code dictates how much income tax your employer deducts from your salary. An incorrect tax code can lead to overpayment or, more commonly, underpayment of tax.

- Common Tax Code Issues: Incorrect tax codes are frequently caused by administrative errors, changes in circumstances (marriage, new job), or failure to update your details with HMRC.

- Examples of Incorrect Tax Codes: A common mistake is an incorrect tax code reflecting a higher tax band than you should be in, leading to excessive tax deductions. Another issue involves tax codes not accounting for allowances, such as the Marriage Allowance.

- Potential Consequences: An incorrect tax code can result in significant underpayment over time, leaving you with a substantial tax bill later or, if you leave it unreported, the inability to claim your refund.

To understand your payslip, refer to the official HMRC guidance: [Insert link to relevant HMRC guidance here]. Your payslip should clearly show your gross pay, deductions (tax, National Insurance), and net pay.

Common Reasons for Underpayment and HMRC Payslip Errors

Several factors can contribute to underpayment of tax reflected in your HMRC payslip:

- Incorrect Tax Codes: As discussed above, this is a primary reason for discrepancies.

- Changes in Circumstances Not Reported: Life changes such as marriage, starting a new job, or changes to pension contributions must be reported to HMRC to adjust your tax code accordingly. Failing to do so often results in underpayment.

- Employer Errors: Employers are responsible for calculating and deducting tax correctly. However, human error can occur, leading to inaccurate tax deductions.

- Marriage Allowance: If eligible, you might not be claiming the Marriage Allowance, which could reduce your tax bill.

- Student Loan Repayments: Incorrect calculation of student loan repayments can lead to over-deduction of tax.

- Pension Contributions: Your pension contributions should reduce your taxable income. Errors in reporting these can result in overpayment of tax.

For example, forgetting to inform HMRC about a change in your employment status could lead to your employer deducting tax at the wrong rate for several months, resulting in considerable underpayment.

How to Perform Your Own HMRC Payslip Check

Regularly checking your payslips for errors is crucial for ensuring you receive the correct amount of pay. Here's a step-by-step guide:

- Review Your Tax Code: Verify that your tax code is correct and matches your circumstances.

- Check Tax Deducted: Compare the tax deducted with what you expect based on your income and tax code.

- Examine National Insurance Contributions: Ensure the National Insurance contributions deducted are accurate.

- Compare Payslips Over Time: Look for inconsistencies in deductions over several payslips.

- Use HMRC Online Tools: Utilize HMRC's online tools and resources to check your tax code and understand your tax liability. [Insert link to relevant HMRC tool here]

- Keep Accurate Records: Maintain a secure record of all your payslips for at least six years.

By comparing your payslips over several months or years, you can easily spot any inconsistencies that might suggest an error.

Claiming a Tax Refund from HMRC

If you identify an error resulting in underpayment, you can claim a refund from HMRC:

- Gather Necessary Documentation: Collect copies of your payslips, P60s, and any other relevant documents supporting your claim.

- Complete the Relevant Form: Use the appropriate HMRC form for claiming a tax refund. [Insert link to relevant HMRC form here]

- Submit Your Claim: Submit your claim online or by post, following HMRC's instructions.

- Contact HMRC: If you have trouble with the process or your claim is taking longer than expected, contact HMRC directly. [Insert link to HMRC contact information here]

The processing time for tax refund claims varies, so be patient and keep a record of your claim.

Seeking Professional Help with Your HMRC Payslip Check

While performing your own HMRC payslip check is straightforward, seeking professional help might be beneficial in complex situations:

- Complex Tax Situations: If you have a complex tax history or numerous sources of income, professional advice can ensure accurate calculations.

- Large Discrepancies: If you identify significant discrepancies, seeking assistance from a tax advisor can streamline the refund process.

Consulting an accountant or tax advisor comes with a cost, but it may be worthwhile if you expect a substantial refund.

Conclusion

Millions of UK taxpayers could be owed significant tax refunds due to errors on their payslips. Regularly performing an HMRC payslip check is vital to avoid underpayment. By understanding your tax code, identifying common errors, and following the steps to claim a refund, you can ensure you're receiving the money you're entitled to. Don't miss out on your potential tax refund! Start your HMRC payslip check today and claim your money back!

Featured Posts

-

82 Ai

May 20, 2025

82 Ai

May 20, 2025 -

Huuhkajat Saavat Vahvistuksen Benjamin Kaellmanin Maalintekotaidot

May 20, 2025

Huuhkajat Saavat Vahvistuksen Benjamin Kaellmanin Maalintekotaidot

May 20, 2025 -

Iatrikes Efimeries Patras Savvatokyriako Imerominia

May 20, 2025

Iatrikes Efimeries Patras Savvatokyriako Imerominia

May 20, 2025 -

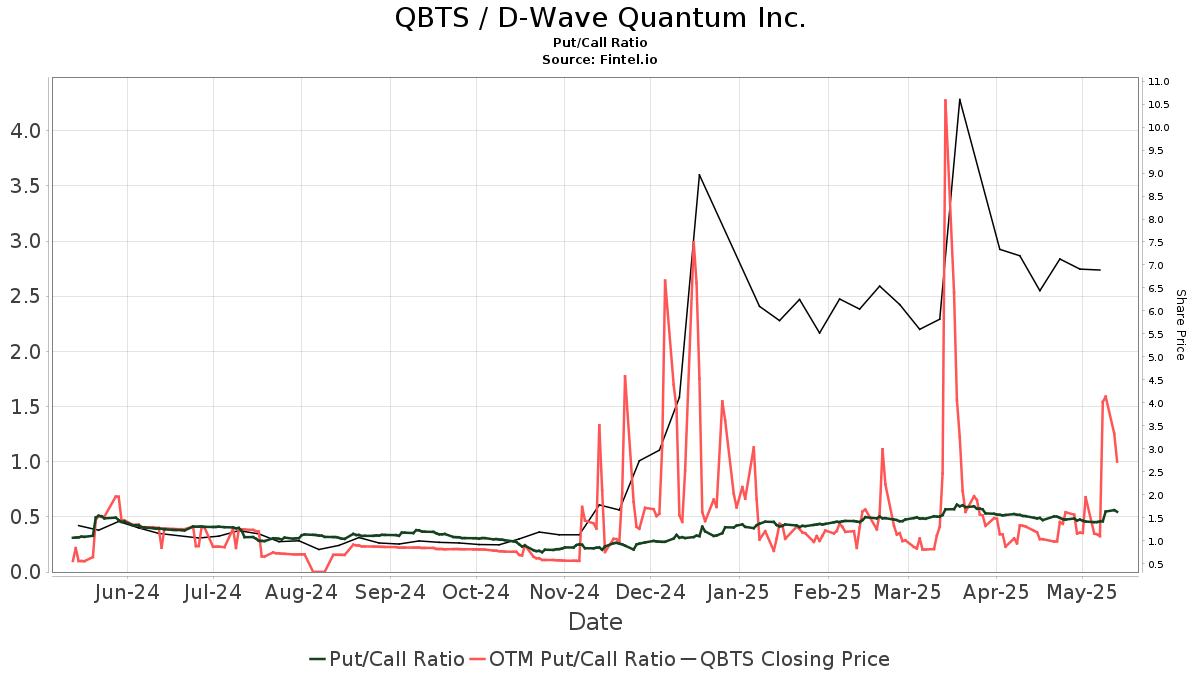

Factors Contributing To D Wave Quantum Qbts Stocks Monday Increase

May 20, 2025

Factors Contributing To D Wave Quantum Qbts Stocks Monday Increase

May 20, 2025 -

Bangladeshinfo Com Your Comprehensive Guide To Bangladesh

May 20, 2025

Bangladeshinfo Com Your Comprehensive Guide To Bangladesh

May 20, 2025