HMRC Refunds: Are You Missing Out On Millions? Check Your Payslip Today

Table of Contents

Common Reasons for HMRC Underpayments and Overpayments

Several factors can lead to HMRC underpayments or, less commonly, overpayments of tax. Understanding these reasons is crucial in identifying potential refunds.

Tax Code Errors

Incorrect tax codes are a frequent cause of overpayment or underpayment. Your tax code dictates how much income tax is deducted from your earnings. A wrong code can result in too much or too little tax being taken.

- Examples of common tax code errors: Incorrectly entered digits, codes not updated after a life event (marriage, change in employment), codes not reflecting pension contributions.

- Consequences of incorrect codes: Overpayment leading to a refund, or underpayment resulting in a tax bill.

- How to check your tax code online: Visit the GOV.UK website to access your personal tax information and verify the accuracy of your tax code. Look for discrepancies between your online tax code and the one shown on your payslips. You can also contact HMRC directly to request a review. Using keywords like "HMRC tax code lookup" will help you find this information.

Pension Contributions

Pension contributions can significantly impact your tax liability. The government offers tax relief on pension contributions, meaning you effectively pay less tax on the money you contribute. However, errors in processing this relief can sometimes lead to overpayments.

- How pension relief works: Tax relief reduces the amount of income tax you pay, effectively increasing your net pension contribution.

- Situations where overpayment might occur: Incorrect recording of contributions by your pension provider, delays in HMRC processing your contributions.

- Checking your pension contribution records: Carefully review your annual pension statement to ensure all contributions are correctly reported to HMRC. Any discrepancies should be reported promptly. Searching for "pension contributions HMRC" online can provide helpful information.

Marriage Allowance

Married couples and civil partners can claim the marriage allowance, which can reduce the amount of income tax paid by the lower-earning spouse. This can result in a tax refund.

- Eligibility criteria: One partner must be a basic-rate taxpayer, and the other must not use their personal allowance.

- How much the allowance is worth: The amount varies depending on the tax year but typically results in a reduction in tax liability.

- How to claim the marriage allowance: This can be easily done online via the GOV.UK website using the "HMRC marriage allowance" service.

Self-Assessment Errors

Mistakes on self-assessment tax returns are another common source of potential overpayments or underpayments. Accuracy is paramount.

- Common mistakes on self-assessment forms: Incorrectly reported income, missing expenses, errors in calculating tax owed.

- How to amend a self-assessment return: HMRC provides options to correct mistakes online or via post.

- Contacting HMRC for assistance: If you're unsure about any aspect of your self-assessment, contacting HMRC directly for guidance is advisable. Use terms such as "HMRC self-assessment helpline" for assistance.

How to Check Your Payslip for Potential HMRC Refunds

Your payslip contains valuable information that can indicate potential overpayments. Carefully reviewing your payslips is the first step in identifying potential HMRC refunds.

Key Information to Look For

Several key details on your payslip can highlight potential overpayment. Regularly reviewing these can assist in early detection.

- Tax paid year-to-date: Compare this figure to your expected tax liability based on your income and tax code.

- Tax code: Verify that your tax code is correct and up-to-date. Use keywords like "HMRC payslip tax code" for verification information.

- National insurance contributions: Ensure your national insurance contributions are accurately calculated.

- Any other relevant deductions: Pay attention to any unusual deductions that might indicate errors.

Comparing Your Payslip to Your Tax Code

Regularly compare the tax code on your payslip to the one you find on the GOV.UK website.

- Accessing your tax code online via GOV.UK: Use the GOV.UK website to verify your tax code. Searching for "check tax code online" will guide you.

- Comparing the code on your payslip with the one on GOV.UK: Any discrepancies should be investigated and reported.

- Reporting discrepancies to HMRC: Contact HMRC immediately to report any inconsistencies and initiate a correction.

How to Claim Your HMRC Refund

Once you've identified a potential overpayment, the next step is to claim your refund.

Gathering Necessary Documents

Gathering the correct documents will streamline the claim process.

- Payslips: Provide payslips covering the period of the alleged overpayment.

- P60s: These annual tax summaries are crucial for supporting your claim.

- Self-assessment tax returns (if applicable): Include relevant self-assessment tax returns.

- Marriage certificate (if claiming marriage allowance): This is necessary to support your marriage allowance claim.

The Claim Process

HMRC offers multiple ways to submit your claim.

- Using the online portal: The online portal is the fastest and most efficient way to submit a claim. Use the search term "HMRC online claim" to find the relevant portal.

- Filling out the necessary forms: If you prefer a paper-based approach, download and complete the appropriate forms from the HMRC website.

- Providing supporting documentation: Attach all necessary documentation to support your claim.

- Contacting HMRC if needed: If you encounter any issues, contact HMRC customer service for assistance.

Conclusion

Many individuals unknowingly overpay tax each year. By understanding common reasons for HMRC underpayments, regularly checking your payslips for discrepancies, and promptly claiming any owed refunds, you can recover money rightfully yours. Don't miss out! Check your payslip today and claim your HMRC refund. Millions are waiting! Visit the GOV.UK website to learn more and start your claim. [Link to relevant HMRC website]

Featured Posts

-

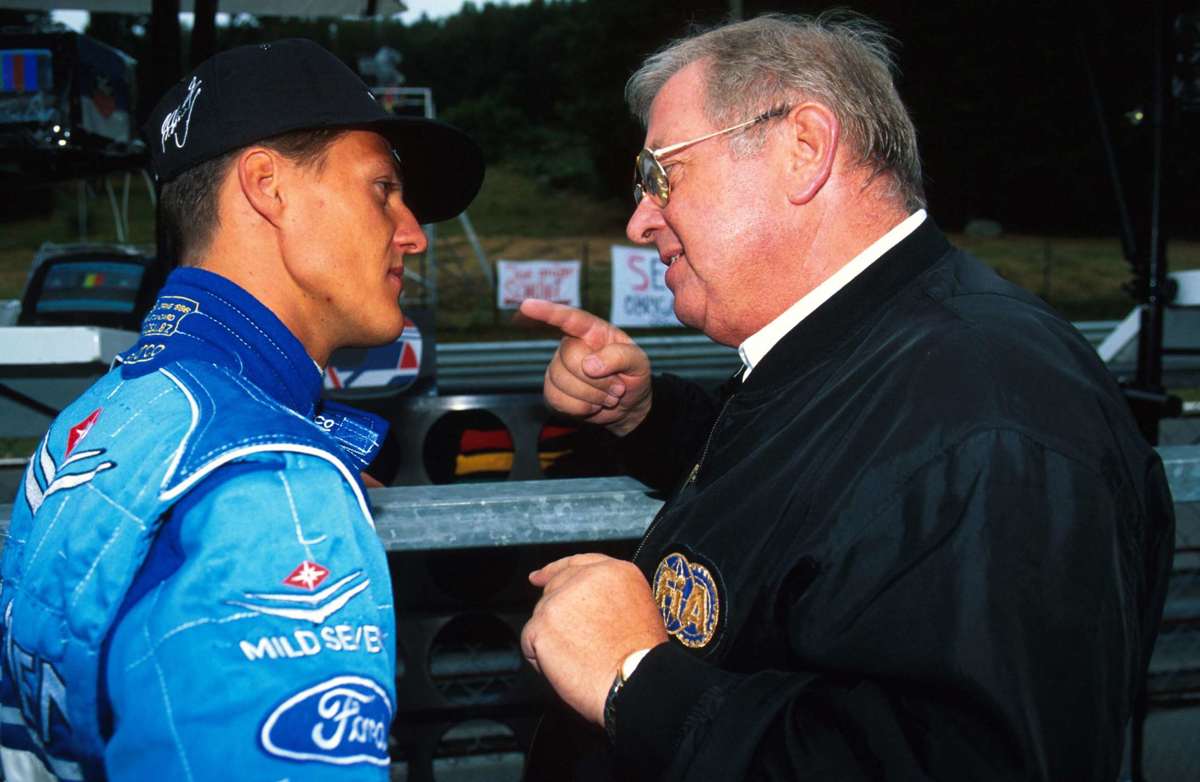

The Schumacher Comeback Fiasco Ignoring Red Bulls Warnings

May 20, 2025

The Schumacher Comeback Fiasco Ignoring Red Bulls Warnings

May 20, 2025 -

Former F1 World Champion Advocates For Mick Schumachers Cadillac Seat

May 20, 2025

Former F1 World Champion Advocates For Mick Schumachers Cadillac Seat

May 20, 2025 -

Retired Admirals Bribery Conviction A Four Count Guilty Verdict

May 20, 2025

Retired Admirals Bribery Conviction A Four Count Guilty Verdict

May 20, 2025 -

Office365 Breach Nets Millions Federal Charges Filed Against Hacker

May 20, 2025

Office365 Breach Nets Millions Federal Charges Filed Against Hacker

May 20, 2025 -

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025

Chinas Demand Philippines Withdraw Typhon Missiles To Maintain Peace

May 20, 2025