HMRC Savings Overdue: Are You Missing Out?

Table of Contents

Identifying Potential HMRC Savings

Finding your overdue HMRC savings requires a proactive approach. Let's explore the key areas where you might find unclaimed money.

Checking for Unclaimed Tax Refunds

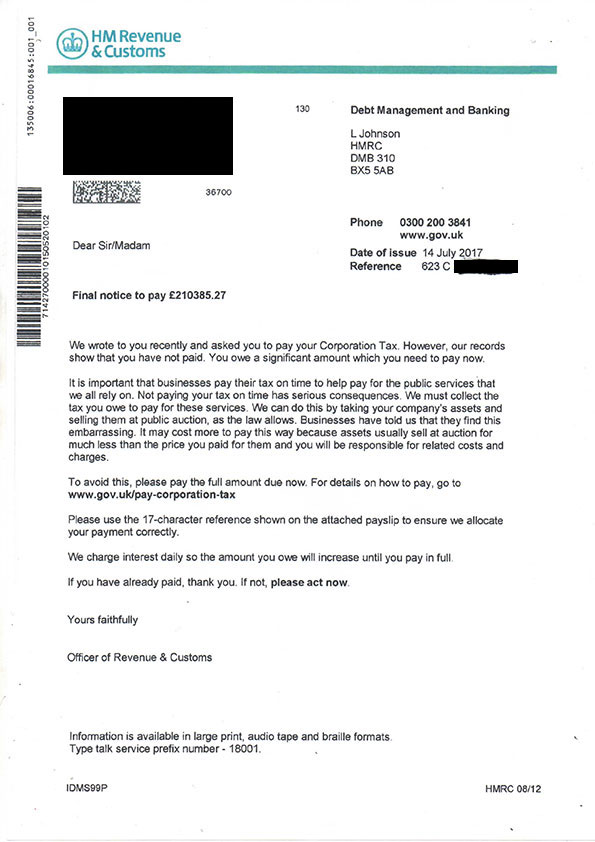

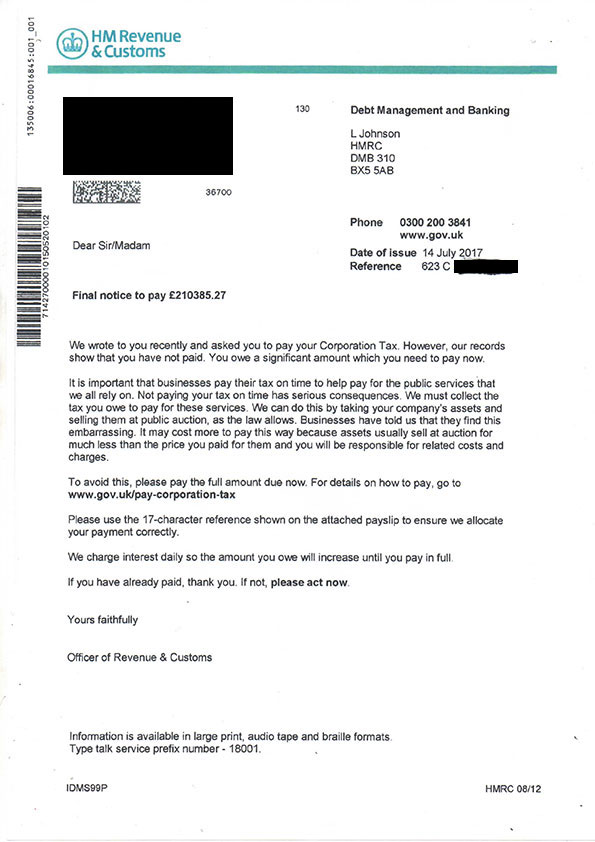

Tax refunds arise for various reasons, most commonly due to overpayment of income tax, self-assessment tax, or corporation tax. You may be owed money if you've overpaid your tax liability.

To check your tax history, visit the HMRC website. Here's how:

- Steps to check online:

- Log in to your Government Gateway account. If you don't have one, you'll need to create one first.

- Navigate to your tax history section.

- Review your tax returns for any potential overpayments.

- Documents needed: Your Government Gateway login details.

- Timeframes involved: HMRC typically processes refunds within a few weeks.

Alternatively, you can contact the HMRC helpline at 0300 200 3300 or use their online webchat service. Remember to have your National Insurance number readily available.

Tracing Forgotten Pension Contributions

Lost or overlooked pension contributions are a surprisingly common source of unclaimed savings. Many people change jobs throughout their careers, leading to multiple pension pots that can easily be forgotten.

The government's Pension Tracing Service can help locate these lost pension pots.

- Steps to trace pensions: Visit the government's Pension Tracing Service website and follow the instructions. You will likely need personal information such as your name, date of birth, and previous employers.

- Websites to use: gov.uk/find-pension-contact-details

- Relevant contact information: The Pension Tracing Service provides contact details for the relevant pension providers once they locate your lost pension pots.

Investigating Other Potential Overdue Payments

Beyond tax refunds and pensions, other less common sources of overdue HMRC savings exist. This could include:

- Unclaimed benefits: Check if you're entitled to benefits you haven't claimed.

- Grants: Research whether you've been eligible for any grants or schemes in the past.

You can often find information about these less common sources via the HMRC website or by contacting their helpline.

Claiming Your HMRC Savings Overdue

Once you've identified potential overdue savings, claiming your money is relatively straightforward.

The Online Claim Process

The easiest and most efficient method is to submit an online claim through the HMRC website.

- Specific links to relevant HMRC pages: (Insert direct links to the relevant claim pages on the HMRC website here)

- Required documents: You might need supporting documentation, depending on the type of claim (e.g., payslips, tax statements).

- Tips for a successful application: Ensure all information is accurate and complete. Keep a copy of your claim for your records.

Alternative Claiming Methods (Phone, Post)

If online access isn't feasible, you can claim via phone or post.

- Contact details: (Insert HMRC phone number and postal address here)

- Necessary forms: (Insert links or descriptions of relevant forms here)

- Expected processing times: Processing times can vary, but typically take several weeks.

Dealing with Delays and Complications

If your claim is delayed or rejected, don't panic.

- Contact information for further assistance: Contact HMRC directly via phone or webchat for assistance.

- Potential reasons for delays: Incomplete information, missing documentation, or complex cases can all contribute to delays.

Avoiding HMRC Savings Overdue in the Future

Proactive measures can help prevent future overdue savings.

Keeping Accurate Records

Maintaining detailed financial records is crucial.

- Tips for record-keeping: Use a digital filing system, or keep all paper documents organized.

- Recommended software or apps: (Suggest appropriate software or apps for managing finances here).

Regular HMRC Account Checks

Regularly checking your HMRC online account allows for early detection of any issues or potential refunds.

- Frequency of checks: Aim to check your account at least once a year.

- Features to look out for: Pay attention to any updates, notices, or discrepancies in your tax information.

Conclusion: Don't Let Your HMRC Savings Overdue Go Unclaimed!

Claiming your overdue HMRC savings can significantly boost your finances. By following the steps outlined above, you can effectively identify and claim any money owed to you. Don't delay! Check for your HMRC savings overdue now! Claim your HMRC savings today! Visit the HMRC website to start your claim. [Insert link to HMRC website here].

Featured Posts

-

Plyuschenko Sikharulidze Kuznetsova Chem Esche Vladeyut Figuristy Pomimo Lda

May 20, 2025

Plyuschenko Sikharulidze Kuznetsova Chem Esche Vladeyut Figuristy Pomimo Lda

May 20, 2025 -

Cote D Ivoire Operation De La Bcr Dans Les Marches D Abidjan

May 20, 2025

Cote D Ivoire Operation De La Bcr Dans Les Marches D Abidjan

May 20, 2025 -

Offerta Lampo Hercule Poirot Su Play Station 5 A Prezzo Scontato Meno Di 10 E

May 20, 2025

Offerta Lampo Hercule Poirot Su Play Station 5 A Prezzo Scontato Meno Di 10 E

May 20, 2025 -

Huuhkajat Saavat Vahvistuksen Benjamin Kaellmanin Maalintekotaidot

May 20, 2025

Huuhkajat Saavat Vahvistuksen Benjamin Kaellmanin Maalintekotaidot

May 20, 2025 -

Efimeries Giatron Stin Patra Savvatokyriako 12 13 Aprilioy

May 20, 2025

Efimeries Giatron Stin Patra Savvatokyriako 12 13 Aprilioy

May 20, 2025