HMRC Targeting EBay, Vinted, And Depop Users With Nudge Letters

Table of Contents

Understanding HMRC's Nudge Letter Campaign

What are HMRC Nudge Letters?

HMRC nudge letters are not tax bills or penalties; instead, they are gentle reminders aimed at encouraging tax compliance. They indicate that HMRC has information suggesting you may have undeclared income from online sales. The purpose is to prompt you to accurately declare and pay tax on your profits from selling goods on platforms such as eBay, Vinted, and Depop. Think of them as a friendly warning, urging you to get your tax affairs in order before more serious action is taken.

Why are eBay, Vinted, and Depop Users Targeted?

The ease and accessibility of selling on platforms like eBay, Vinted, and Depop have led to a significant surge in the online secondhand market. Many individuals sell items casually, sometimes overlooking their tax obligations. HMRC is actively monitoring these platforms, recognizing the potential for significant unreported income. Data sharing agreements between HMRC and these online marketplaces mean HMRC has access to considerable information regarding your sales activity.

- Ease of Use: The simplicity of listing and selling items on these platforms can lead to unintentional tax evasion.

- Market Growth: The booming secondhand market has made it a key area of focus for HMRC's tax collection efforts.

- Data Sharing: HMRC utilizes data shared by online marketplaces to identify potential tax discrepancies.

What Information is HMRC Likely to Have?

HMRC likely has access to various data points concerning your online sales, including:

- Sales Records: A detailed record of all your transactions, including dates, item descriptions, and sale prices.

- Transaction Values: The total value of all your sales on the platform.

- Customer Details: While likely anonymized, some customer details may be available to help verify sales.

It's crucial to remember that maintaining meticulous records of your own sales and expenses is vital, not just for complying with HMRC but for your own financial clarity.

What to Do if You Receive an HMRC Nudge Letter

Don't Ignore the Letter!

Ignoring an HMRC nudge letter is a serious mistake. It doesn't make the problem disappear; instead, it escalates the situation and could lead to penalties, interest charges, and even further investigation. Responding promptly shows cooperation and demonstrates your commitment to tax compliance.

Gathering Your Records

Once you receive the letter, immediately begin gathering all relevant records. This includes:

- Sales Records: Detailed records of all sales, including dates, items sold, prices, and buyer information (if available).

- Expenses: Accurate records of all business-related expenses, such as postage, packaging, materials, and any other costs directly related to your online sales. Keep receipts!

- Purchase Invoices: If you're buying and reselling items, you’ll need records of your purchases to calculate your profit.

Accurate record-keeping is essential for calculating your tax liability correctly.

Calculating Your Tax Liability

Calculating your profit from online sales involves subtracting your allowable expenses from your total sales revenue. This profit is then subject to income tax. If you’re unsure how to do this, it’s advisable to seek professional help from a tax advisor.

- Sales Revenue – Allowable Expenses = Profit

- Profit is subject to Income Tax

Responding to HMRC

Respond to the letter promptly, providing all the requested information and documentation. Be clear and concise in your communication. HMRC offers various resources and guidance on their website to assist with tax calculations and compliance.

Avoiding HMRC Nudge Letters: Best Practices for Online Sellers

Maintain Accurate Records

The best way to avoid HMRC nudge letters is to maintain meticulous and organized records from the outset. Use accounting software or spreadsheets to track your income and expenses efficiently. This will simplify the process of calculating your tax liability and ensure compliance.

- Use accounting software: Tools like Xero or FreeAgent can streamline record-keeping.

- Spreadsheet tracking: Even a simple spreadsheet can be effective for basic record-keeping.

Understand Your Tax Obligations

Familiarize yourself with HMRC's guidelines on self-assessment and the tax implications of selling goods online. Understanding your obligations is the first step to fulfilling them. HMRC provides comprehensive guidance on their website.

Consider Professional Tax Advice

If your online selling business is complex or if you’re unsure about your tax obligations, seeking professional tax advice is highly recommended. A qualified accountant can help you navigate the complexities of tax law and ensure you are fully compliant.

Conclusion: Proactive Tax Compliance is Key to Avoiding HMRC Nudge Letters

Receiving an HMRC nudge letter can be stressful, but proactive tax compliance can prevent it entirely. By meticulously keeping accurate records, understanding your tax obligations, and seeking professional advice when needed, you can avoid the hassle and potential penalties associated with undeclared income. Don't wait for an HMRC nudge letter. Take control of your tax obligations today by reviewing your online sales records and ensuring you're fully compliant. For further guidance, refer to the official HMRC website.

Featured Posts

-

Aghatha Krysty Fy Esr Aldhkae Alastnaey Frs Wthdyat

May 20, 2025

Aghatha Krysty Fy Esr Aldhkae Alastnaey Frs Wthdyat

May 20, 2025 -

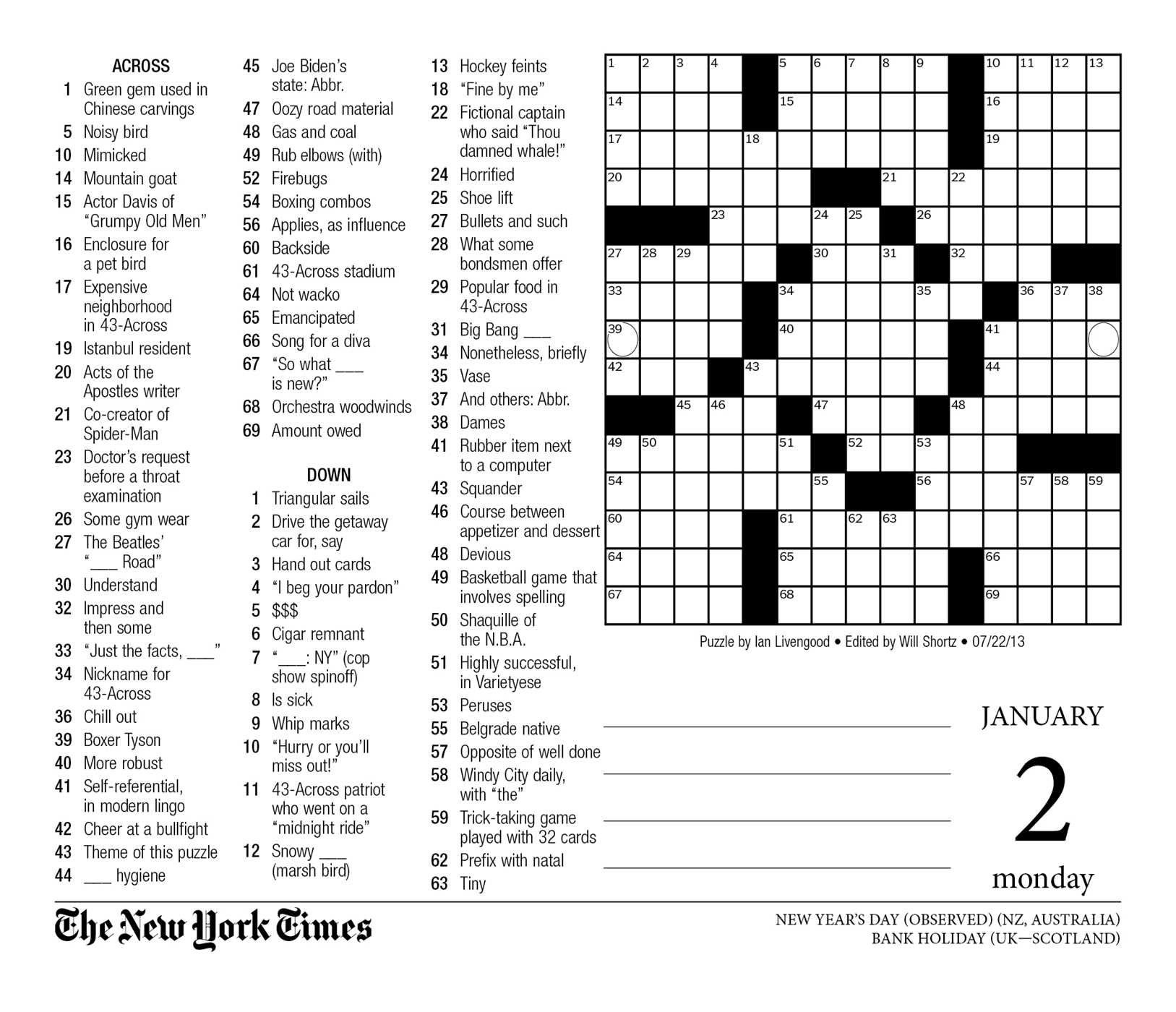

Nyt Mini Crossword Solution April 13 2024

May 20, 2025

Nyt Mini Crossword Solution April 13 2024

May 20, 2025 -

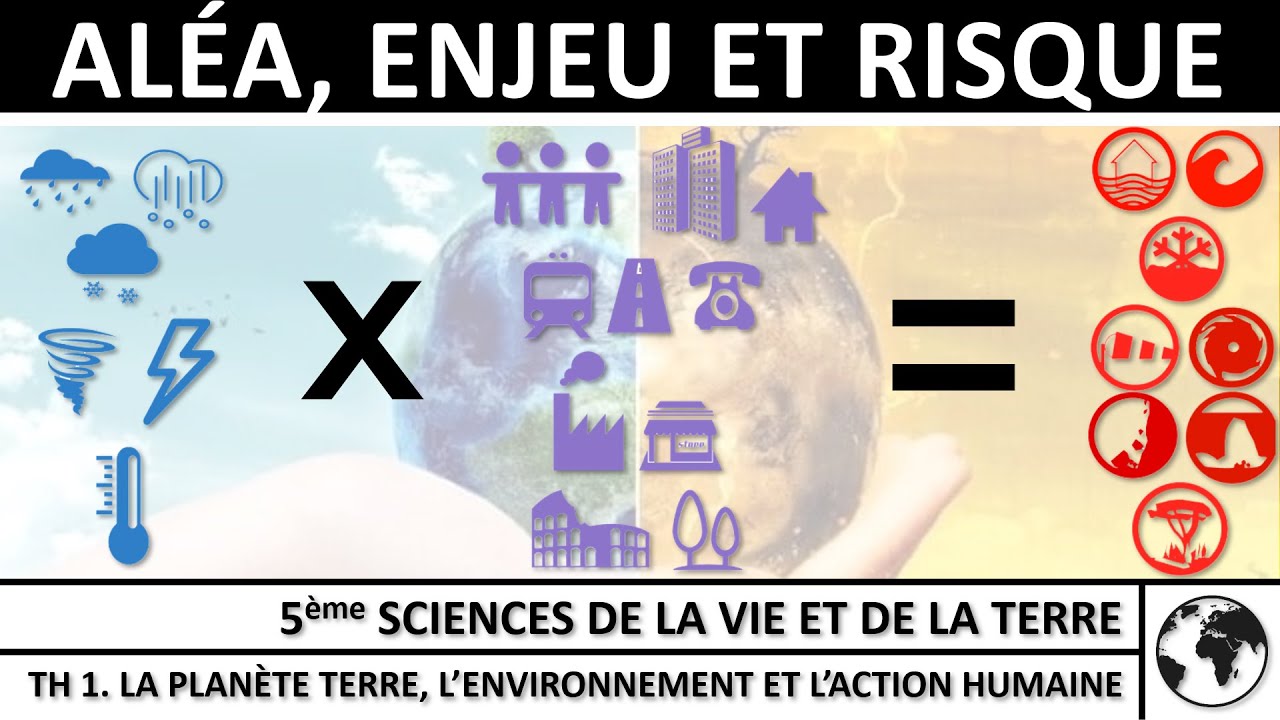

Colomiers Oyonnax Et Montauban Brive Pronostics Et Enjeux De La Pro D2

May 20, 2025

Colomiers Oyonnax Et Montauban Brive Pronostics Et Enjeux De La Pro D2

May 20, 2025 -

Cadillac F1 Seat A Champions Voice Adds Weight To Schumachers Candidacy

May 20, 2025

Cadillac F1 Seat A Champions Voice Adds Weight To Schumachers Candidacy

May 20, 2025 -

China Urges Philippines To Remove Missiles From South China Sea

May 20, 2025

China Urges Philippines To Remove Missiles From South China Sea

May 20, 2025

Latest Posts

-

6 Billion Investment Public Works Ministry Awards Sea And River Defence Contracts

May 20, 2025

6 Billion Investment Public Works Ministry Awards Sea And River Defence Contracts

May 20, 2025 -

Louane Chanson Eurovision 2024 Pour La France Details Officiels

May 20, 2025

Louane Chanson Eurovision 2024 Pour La France Details Officiels

May 20, 2025 -

The Potential Negative Impacts Of The Philippines Typhon Missile System

May 20, 2025

The Potential Negative Impacts Of The Philippines Typhon Missile System

May 20, 2025 -

France Eurovision 2024 Devoilement De La Chanson De Louane

May 20, 2025

France Eurovision 2024 Devoilement De La Chanson De Louane

May 20, 2025 -

Philippine Typhon Missile Deployment Weighing The Costs And Benefits

May 20, 2025

Philippine Typhon Missile Deployment Weighing The Costs And Benefits

May 20, 2025