HMRC Tax Codes: Understanding Your New Savings-Related Code

Table of Contents

What are Savings-Related HMRC Tax Codes?

In the UK, savings income, such as interest from bank accounts and dividends from shares, is subject to income tax. HMRC uses tax codes to determine how much income tax is deducted from your savings income at source. Savings-related tax codes are specifically designed to manage the tax on your savings and investments. These codes ensure the correct amount of tax is deducted, taking into account your overall income and any tax-free allowances you might be entitled to.

Examples of common savings-related tax codes include:

- BR: Basic rate tax code for savings.

- K: Indicates a specific tax adjustment related to savings. The exact meaning depends on the accompanying numbers.

- Other codes: HMRC may use other codes to reflect individual circumstances and tax reliefs.

Here's how different tax codes affect taxable savings income:

- Illustrative Example 1: With a BR tax code, basic-rate tax (20%) is deducted from your savings interest.

- Illustrative Example 2: A higher-rate tax code (e.g., a code reflecting higher-rate tax liability from other income sources) will result in a higher rate of tax (40%) being deducted from your savings interest.

- Personal Savings Allowance: Remember the Personal Savings Allowance, which allows you to earn a certain amount of savings interest tax-free. This allowance reduces the amount of tax deducted.

How to Find Your HMRC Tax Code

Accessing your HMRC tax code is straightforward. You can easily find it online through your personal HMRC account:

- Step 1: Go to the GOV.UK website and log in to your HMRC online account.

- Step 2: Navigate to your tax details.

- Step 3: Your current tax code will be clearly displayed.

If you don't have an online account, you can contact HMRC directly via phone or post. Remember to always keep your tax code details up-to-date to prevent errors. It's crucial to check your code regularly for accuracy, ensuring it reflects your current financial situation.

- Contacting HMRC: You can find contact details on the GOV.UK website.

- If you can't find your tax code: Contact HMRC immediately for assistance.

Understanding Your Savings Income and Tax Implications

Understanding the different types of savings income and how they are taxed is crucial. This includes:

- Savings Interest: Interest earned on savings accounts, bonds, etc.

- Dividends: Payments received from shares held in companies.

The tax implications depend on the type of savings vehicle used:

- ISAs (Individual Savings Accounts): Offer tax-free growth and withdrawals.

- Premium Bonds: Interest is paid as prize draws, and winnings are generally tax-free.

Maintaining accurate records of all your savings income and tax paid is vital for tax compliance.

- Tax Rates: The tax rate applicable to your savings income depends on your overall income and tax band.

- Tax-Free Allowances: Take full advantage of allowances like the Personal Savings Allowance.

- Record Keeping: Keep detailed records of all savings transactions and tax deducted.

What to Do if Your HMRC Tax Code is Incorrect

If you suspect your HMRC tax code is wrong, take immediate action:

- Gather your documentation: Collect bank statements, payslips, and any other relevant information.

- Contact HMRC: Use the official channels to report the discrepancy.

- Explain the situation clearly: Provide details of your savings income and your believed correct tax code.

An incorrect tax code can lead to either overpayment or underpayment of tax, causing complications later on. HMRC will investigate and adjust your tax accordingly.

Frequently Asked Questions (FAQs) about HMRC Tax Codes

Q: What happens if I don't have a savings-related tax code? A: HMRC will likely use your standard tax code, which may not accurately reflect your savings income. Contact HMRC to clarify this.

Q: Can my savings-related tax code change? A: Yes, it can change based on changes to your income or circumstances. Regular checks are recommended.

Q: Where can I find more information about HMRC tax codes? A: Visit the official GOV.UK website for comprehensive guidance and resources.

Conclusion

Understanding your HMRC tax code, especially its implications for your savings, is vital for responsible financial management. By carefully reviewing your code and understanding how it affects your savings income, you can ensure accurate tax payments and avoid potential issues. If you're still unsure about your new savings-related HMRC tax code, don't hesitate to contact HMRC for clarification or seek professional financial advice. Take control of your finances today and ensure you're paying the correct amount of tax on your savings. Learn more about your HMRC tax codes and optimize your savings strategy.

Featured Posts

-

Clean Energys Fight For Survival Thriving In Hostile Environments

May 20, 2025

Clean Energys Fight For Survival Thriving In Hostile Environments

May 20, 2025 -

The Ultimate Sandylands U Tv Guide

May 20, 2025

The Ultimate Sandylands U Tv Guide

May 20, 2025 -

Yllaetyskokoonpano Glen Kamara Ja Teemu Pukki Vaihtopenkillae

May 20, 2025

Yllaetyskokoonpano Glen Kamara Ja Teemu Pukki Vaihtopenkillae

May 20, 2025 -

Escape The Us Election A Guide To Obtaining European Citizenship For Americans

May 20, 2025

Escape The Us Election A Guide To Obtaining European Citizenship For Americans

May 20, 2025 -

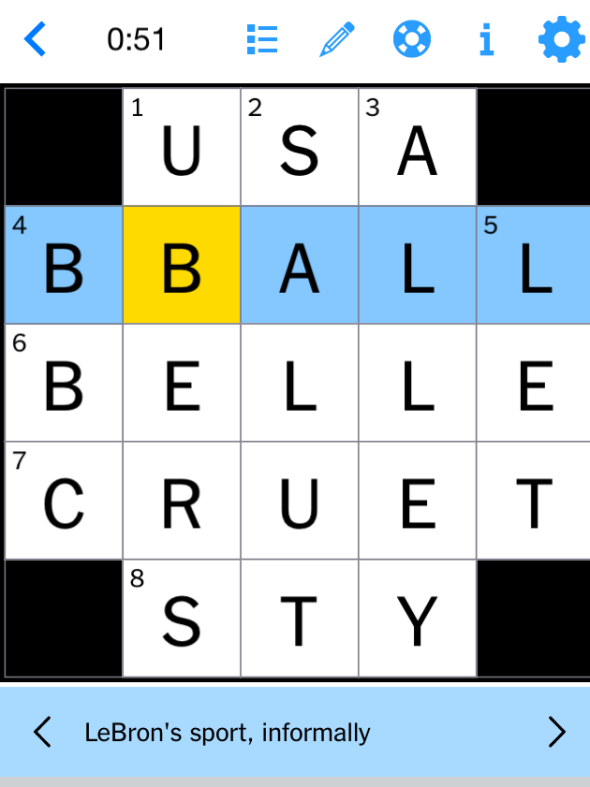

Get The Answers Nyt Mini Crossword March 13 2025

May 20, 2025

Get The Answers Nyt Mini Crossword March 13 2025

May 20, 2025