HMRC Tax Investigation: Over £23,000 Earners Targeted

Table of Contents

Who is Targeted by HMRC Tax Investigations?

While anyone can be subject to an HMRC tax investigation, individuals earning over £23,000 are statistically more likely to be targeted. This is simply because higher income levels generally translate into larger tax liabilities, making them a more attractive focus for HMRC's resources. HMRC employs sophisticated data analytics and risk assessment techniques to identify potential discrepancies and non-compliance.

- High-Income Earners: The higher your income, the greater the scrutiny. This includes salaried employees, but especially those with complex financial situations.

- Self-Employed Individuals and Contractors: These groups often face greater complexities in their tax returns, increasing the likelihood of errors or omissions. Accurate record-keeping is paramount.

- Business Owners: Businesses, regardless of size, are subject to rigorous tax compliance requirements. Any inconsistencies or inaccuracies can trigger an investigation.

- Specific Professions: Certain professions, such as those in finance, property, and the digital economy, may be more susceptible to investigation due to the nature of their income streams and potential for tax avoidance.

HMRC's sophisticated risk assessment models analyze various data points, including declared income, lifestyle indicators, and comparisons against industry benchmarks, to identify potential tax evasion or avoidance. Understanding how this risk assessment works is crucial in mitigating your own risk.

Common Triggers for an HMRC Tax Investigation

Several factors can trigger an HMRC tax enquiry, which can escalate into a full-blown tax investigation. These include:

- Discrepancies between declared income and lifestyle: A significant mismatch between reported income and your lifestyle (e.g., owning multiple properties, expensive cars, or frequent foreign travel) can raise red flags.

- Inconsistent or incomplete records: Poor record-keeping is a major contributor to tax investigations. HMRC expects thorough and accurate documentation of all financial transactions.

- Suspicious transactions or offshore accounts: Transactions involving offshore accounts or complex financial structures necessitate meticulous record-keeping and clear explanations.

- Tips and whistleblowers: Information provided by whistleblowers or anonymous tips can lead to investigations.

- Failure to file tax returns: Failing to file tax returns on time or at all is a serious offense that automatically triggers an HMRC investigation.

It's vital to understand the difference between an HMRC tax enquiry and a full investigation. An enquiry is a preliminary review, while a full investigation involves a more in-depth examination of your financial affairs, potentially leading to significant penalties.

Navigating an HMRC Tax Investigation: What to Expect

Navigating an HMRC tax investigation can be daunting, but understanding the process is crucial. Here's a typical timeline:

- Initial Contact and Request for Information: HMRC will typically initiate contact via letter, requesting specific information and documentation.

- Gathering and Providing Evidence: This is a critical stage. Accurate and complete documentation is paramount.

- Meetings with HMRC Investigators: You may be required to attend meetings with HMRC investigators to discuss your financial affairs.

- Potential Penalties and Settlement Negotiations: If HMRC finds discrepancies, you may face penalties and be involved in settlement negotiations.

The importance of seeking professional advice from a qualified tax advisor immediately cannot be overstated. A tax specialist can guide you through the process, represent you in meetings with HMRC, and help negotiate a favorable settlement.

Mitigating the Risk of an HMRC Tax Investigation

Proactive steps can significantly reduce your risk of facing an HMRC tax investigation:

- Maintaining accurate and detailed financial records: Keep meticulous records of all income, expenses, and transactions. Use reliable accounting software.

- Seeking professional tax advice regularly: Regular consultations with a tax advisor can help identify potential compliance issues and ensure your tax affairs are in order.

- Understanding your tax obligations thoroughly: Familiarize yourself with all relevant tax legislation and regulations.

- Using reputable tax software and accounting services: Utilize trusted software and services to help manage your finances accurately.

- Regularly reviewing your tax return before submission: Double-check all figures and ensure accuracy before submitting your return.

Proactive tax planning offers significant long-term benefits, minimizing the likelihood of future problems and fostering a strong relationship with HMRC.

Conclusion: Protect Yourself from an HMRC Tax Investigation

Higher earners, especially those earning over £23,000, face increased scrutiny from HMRC. Understanding the common triggers for tax investigations, the investigation process, and the importance of proactive tax planning is crucial for safeguarding your financial future. Ignoring potential issues can lead to significant penalties, stress, and financial hardship.

Seeking professional advice from a qualified tax advisor is the most effective way to mitigate the risk of an HMRC tax investigation and ensure full tax compliance. Don't wait until you're facing an investigation; take proactive steps today. Contact us for a free consultation to discuss your tax affairs and develop a robust tax planning strategy. Protect your finances and avoid the potentially devastating consequences of an HMRC tax investigation.

Featured Posts

-

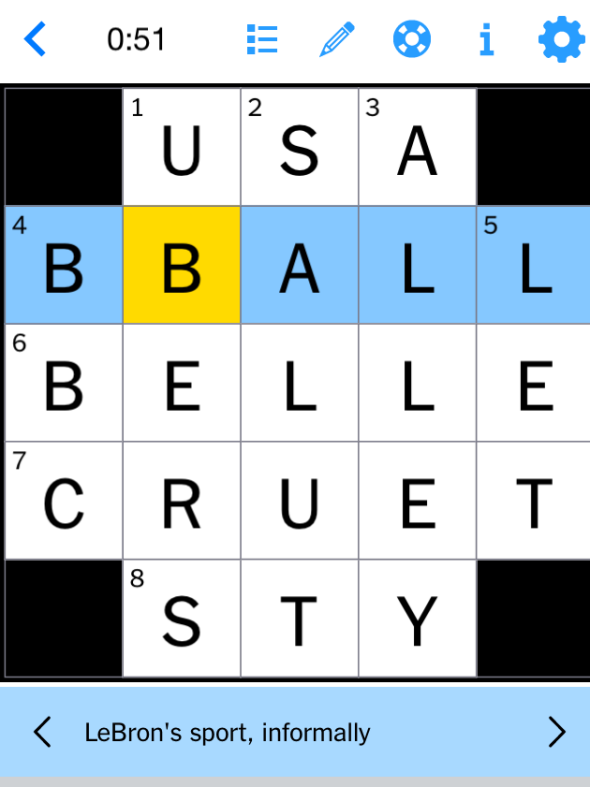

Nyt Mini Crossword Solutions May 13 2025 Complete Guide

May 20, 2025

Nyt Mini Crossword Solutions May 13 2025 Complete Guide

May 20, 2025 -

Big E Engaged Ronda Rousey Logan Paul And Jey Uso Wwe Updates

May 20, 2025

Big E Engaged Ronda Rousey Logan Paul And Jey Uso Wwe Updates

May 20, 2025 -

584 Million Ipo Dubai Holding Expands Reit Offering

May 20, 2025

584 Million Ipo Dubai Holding Expands Reit Offering

May 20, 2025 -

Are La Landlords Exploiting Fire Victims A Selling Sunset Star Weighs In

May 20, 2025

Are La Landlords Exploiting Fire Victims A Selling Sunset Star Weighs In

May 20, 2025 -

Hmrc Cracks Down On Side Hustle Tax Evasion With Us Inspired Measures

May 20, 2025

Hmrc Cracks Down On Side Hustle Tax Evasion With Us Inspired Measures

May 20, 2025