HMRC Website Crash: Hundreds Unable To Access Accounts Across UK

Table of Contents

Extent of the HMRC Website Outage

The HMRC website outage, beginning at approximately [Insert Time] on [Insert Date], lasted for [Insert Duration]. While the precise number of affected users remains unconfirmed, reports suggest that hundreds, possibly thousands, were unable to access crucial services. This widespread disruption impacted various critical functions, including:

- Tax return submissions: Many individuals attempting to file their self-assessment tax returns were met with error messages, delaying their compliance and potentially incurring penalties.

- Tax payment processing: Businesses and individuals were unable to make online tax payments, creating uncertainty and potential financial repercussions.

- Account access and information retrieval: Simple tasks like checking tax balances or viewing payment history became impossible for many users.

Specific user-reported issues included:

- "Error 500" and other server error messages.

- Inability to log in, despite using correct credentials.

- Website unresponsiveness and prolonged loading times.

The impact spanned various user groups and geographical locations, with reports suggesting particularly heavy disruption in [mention specific regions if available].

Potential Causes of the HMRC Website Crash

The reasons behind this significant HMRC website crash remain under investigation. However, several potential causes warrant consideration:

- High traffic volume: The period leading up to the outage might have coincided with a peak in online activity, potentially exceeding the website's capacity. Tax deadlines often result in surges of website traffic.

- Technical malfunction: Internal server errors or database issues could have caused the crash. This could stem from planned or unplanned maintenance, software bugs, or hardware failures.

- Cyberattack (unlikely but possible): Although less likely without official confirmation, a Distributed Denial of Service (DDoS) attack or other cyber security incident couldn't be entirely ruled out.

Possible explanations for each cause:

- High traffic could overload the servers, leading to slowdowns and eventual crashes.

- A technical malfunction might involve software glitches or hardware failures within HMRC's IT infrastructure.

- A successful cyberattack would disrupt service availability by flooding the system with illegitimate requests.

While speculation is rampant, responsible reporting avoids unfounded accusations until a full investigation is complete. Comparing this incident to previous HMRC website incidents could provide valuable insights, but information remains scarce at this time.

HMRC's Response to the Website Crash

HMRC has yet to issue a comprehensive statement detailing the exact cause and extent of the outage. However, they have acknowledged the issue through their social media channels:

- “[Insert quote from HMRC’s official Twitter or press release, if available]”.

The agency has also indicated that they are working to resolve the problem and restore full service as quickly as possible. They have not yet detailed the specific steps taken to remedy the situation, nor have they commented on any potential compensation for affected users due to the inconvenience. We will update this article as further information becomes available. You can find updates on the official HMRC website at [Insert link to relevant page].

Impact on Taxpayers and Businesses

The consequences of this HMRC website crash are far-reaching and potentially severe for both individuals and businesses.

Impacts on individuals:

- Missed tax return deadlines, resulting in potential penalties and interest charges.

- Inability to access crucial financial information related to tax payments and refunds.

- Significant stress and inconvenience caused by the disruption.

Impacts on businesses:

- Delays in submitting tax returns and VAT payments, leading to late payment penalties.

- Disruptions to cash flow and financial planning due to delayed payments and refunds.

- Potential reputational damage from inability to meet tax obligations promptly.

The legal ramifications for late submissions vary depending on individual circumstances and the type of tax filing affected.

Tips for Dealing with Future HMRC Website Issues

To mitigate the impact of future HMRC website problems, taxpayers and businesses should take proactive steps:

- Regularly check the HMRC website: Look for service updates, announcements, and planned maintenance notices.

- Utilize alternative communication channels: Contact HMRC through their helpline or utilize their online contact forms.

- Enable email alerts or notifications: Sign up for email alerts from HMRC to stay updated on service disruptions or important announcements.

By being prepared and proactive, individuals and businesses can minimize the disruption caused by potential future HMRC website outages.

Conclusion: Staying Informed About HMRC Website Availability

The HMRC website crash highlighted the vulnerability of relying solely on online services for crucial tax-related matters. The widespread disruption, affecting hundreds of users across the UK, underscored the importance of alternative communication channels and proactive preparation. While the cause of the crash remains under investigation, its impact on individuals and businesses highlights the need for robust system resilience and transparent communication from HMRC. Staying informed about potential future HMRC website crashes or HMRC system outages is crucial. Bookmark the official HMRC website and regularly check for service updates to minimize disruption to your tax affairs. Share this article to raise awareness about the importance of preparedness and to encourage others to be vigilant.

Featured Posts

-

Bbai Stock Market Reaction To Disappointing First Quarter Earnings

May 20, 2025

Bbai Stock Market Reaction To Disappointing First Quarter Earnings

May 20, 2025 -

Angely I Restorany Biznes Imperii Plyuschenko Sikharulidze I Kuznetsovoy

May 20, 2025

Angely I Restorany Biznes Imperii Plyuschenko Sikharulidze I Kuznetsovoy

May 20, 2025 -

Rodina Jennifer Lawrence Sa Rozrastla Herecka Ma Druhe Dieta

May 20, 2025

Rodina Jennifer Lawrence Sa Rozrastla Herecka Ma Druhe Dieta

May 20, 2025 -

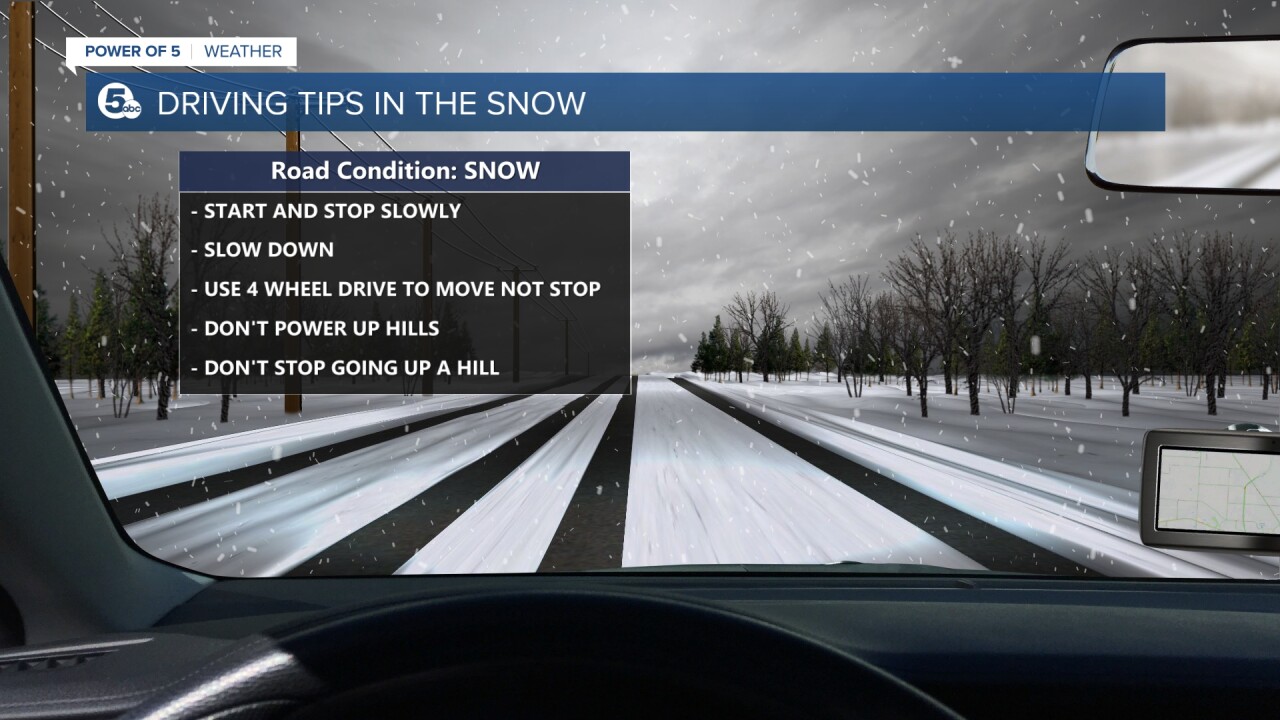

Driving Safely During A Wintry Mix Of Rain And Snow

May 20, 2025

Driving Safely During A Wintry Mix Of Rain And Snow

May 20, 2025 -

D Wave Quantum Qbts Stock Performance Thursday Factors Contributing To The Fall

May 20, 2025

D Wave Quantum Qbts Stock Performance Thursday Factors Contributing To The Fall

May 20, 2025