HMRC's New Side Hustle Tax Rules: A US-Style Snooping Scheme?

Table of Contents

Keywords: HMRC side hustle tax, side hustle tax rules, HMRC tax investigation, gig economy tax, self-employment tax, UK tax rules, US tax system comparison, tax compliance, side income tax, HMRC scrutiny.

The gig economy is booming, with more and more people supplementing their income with side hustles. But with this growth comes increased scrutiny from Her Majesty's Revenue and Customs (HMRC). New HMRC side hustle tax rules are raising concerns, with some comparing them to the more intrusive practices seen in the US tax system. Are these new regulations a necessary step to ensure fair tax collection, or are they an overreach into personal finances? Let's delve into the details.

The New HMRC Rules Explained

HMRC's approach to taxing side hustles is undergoing a significant shift. The core changes aim to improve tax collection from the gig economy and address the perceived tax gap arising from under-reporting of income from various sources. This impacts a wide range of activities, from selling goods on online marketplaces like Etsy and eBay to providing freelance services through platforms like Upwork and Fiverr.

- Increased scrutiny of online marketplaces: HMRC is actively monitoring transactions on popular online platforms, using data-sharing agreements to identify individuals who may not be declaring their full income.

- Data sharing agreements with online platforms: These agreements allow HMRC access to transaction data, potentially including details of sales, earnings, and customer information.

- New requirements for reporting income from various sources: Individuals are now required to report income from all sources, including side hustles, more accurately and comprehensively.

- Changes to tax thresholds for side hustles: While the specific thresholds remain subject to change, HMRC is increasingly focusing on ensuring that all income above the personal allowance is declared and taxed correctly.

- Penalties for non-compliance: Failure to accurately report and pay tax on side hustle income can result in significant penalties, including fines and potential criminal prosecution.

Data Sharing and Privacy Concerns

The data-sharing agreements between HMRC and online platforms are a major source of concern for many. The sheer volume of data being shared raises questions about privacy and potential misuse.

- Types of data being collected: This includes transaction details (dates, amounts, items sold), earnings summaries, and potentially even customer information, depending on the platform and agreement.

- Concerns about data security and potential misuse: Critics worry about the security of this data and the potential for it to be misused, either accidentally or maliciously.

- Comparison to US tax systems and their data collection practices: The US Internal Revenue Service (IRS) also employs extensive data-sharing practices, leading to similar privacy concerns. While the methods differ, the scale of data collection is comparable in some respects.

- Potential implications for individual privacy: The increased data sharing potentially undermines individual privacy and could lead to unwanted surveillance.

Compliance and Avoiding Penalties

Ensuring compliance with the new HMRC side hustle tax rules is crucial to avoid penalties. Here's how to stay on the right side of the law:

- Accurate record keeping: Maintain meticulous records of all income and expenses related to your side hustle. This includes invoices, receipts, and bank statements.

- Understanding relevant tax thresholds and allowances: Familiarize yourself with the current tax thresholds and allowances to determine your tax liability accurately.

- Filing taxes correctly and on time: Submit your self-assessment tax return accurately and by the deadline to avoid late filing penalties.

- Seeking professional tax advice if needed: If you're unsure about any aspect of the new rules, seek professional guidance from a qualified accountant or tax advisor.

- Understanding the potential penalties for non-compliance: Be aware of the potential consequences of non-compliance, including fines and potential legal action.

Comparison with US Tax Systems

The new HMRC side hustle tax rules share similarities with practices employed by the US IRS. While the specifics differ, both systems are increasingly reliant on data-sharing agreements with online platforms to improve tax collection. However, the level of intrusiveness is a point of debate, with some arguing that the UK’s approach is becoming overly intrusive.

- Specific examples of US tax practices to compare and contrast: The IRS’s use of third-party reporting and its increased reliance on data analytics for tax audits are comparable practices.

- Discussion of the advantages and disadvantages of both systems: While both aim to improve tax compliance, concerns about privacy and potential overreach exist in both countries.

- Addressing concerns about overreach and potential future implications: The potential for increased surveillance and the erosion of individual privacy are key concerns associated with these data-driven approaches.

Conclusion

HMRC's new side hustle tax rules represent a significant shift in how the UK government approaches the taxation of the gig economy. Increased scrutiny, facilitated by data-sharing agreements with online platforms, raises valid concerns about individual privacy and the potential for overreach, echoing similar debates surrounding US tax systems. However, accurate reporting and timely tax filing are essential to avoid penalties. Understanding your responsibilities regarding your side income tax is paramount. Stay informed about changes in HMRC side hustle tax rules to ensure compliance and avoid penalties. Don't get caught out by the new HMRC regulations – learn more about complying with side hustle tax rules today!

Featured Posts

-

Charles Leclerc Ferraris Pre Imola Gp Announcement

May 20, 2025

Charles Leclerc Ferraris Pre Imola Gp Announcement

May 20, 2025 -

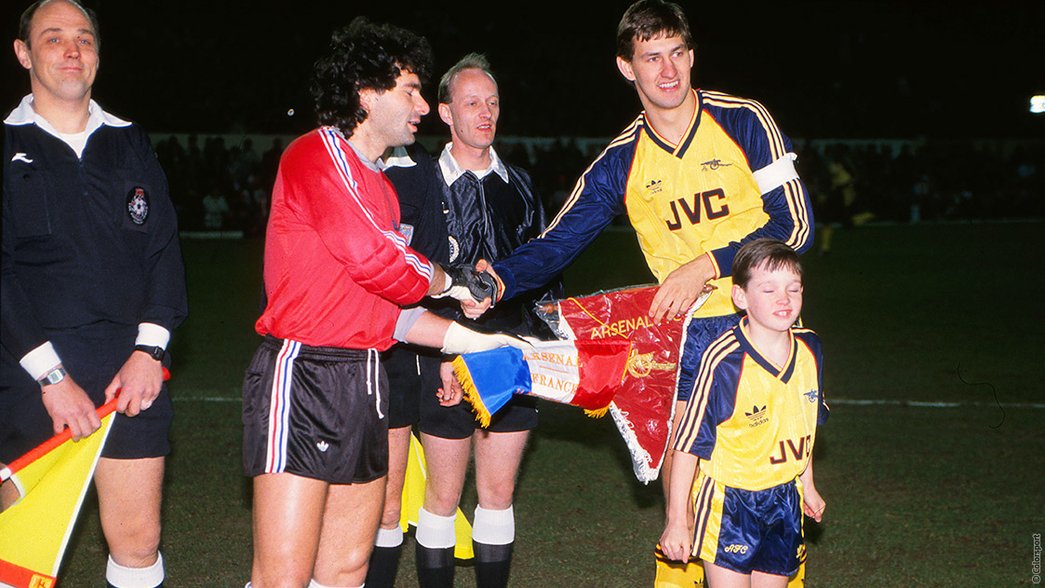

Arsenal Transfer News Gunners Battle Liverpool For Premier League Star

May 20, 2025

Arsenal Transfer News Gunners Battle Liverpool For Premier League Star

May 20, 2025 -

Cobolli Claims First Atp Win At Bucharest Tiriac Open

May 20, 2025

Cobolli Claims First Atp Win At Bucharest Tiriac Open

May 20, 2025 -

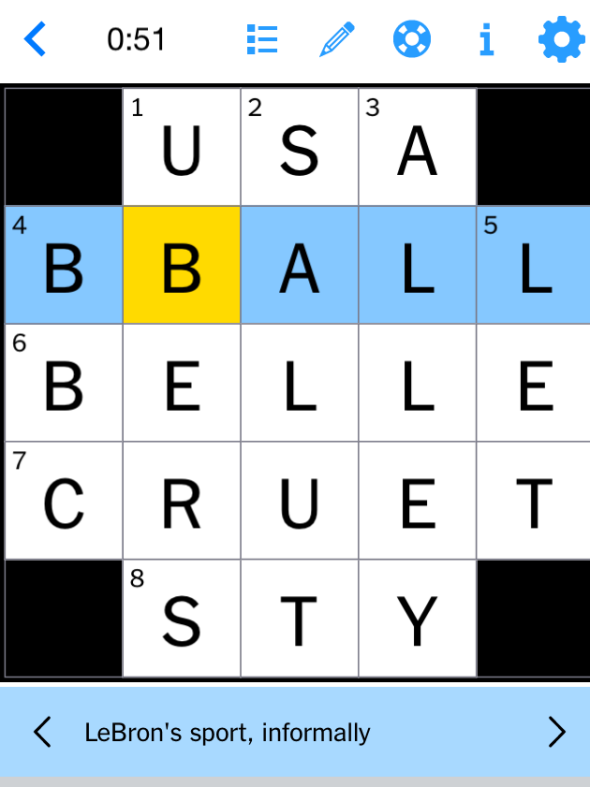

Nyt Mini Crossword Clues And Answers March 20 2025

May 20, 2025

Nyt Mini Crossword Clues And Answers March 20 2025

May 20, 2025 -

Sezon Baslamadan Transfer Soku Tadic Fenerbahce Ye Veda Etti

May 20, 2025

Sezon Baslamadan Transfer Soku Tadic Fenerbahce Ye Veda Etti

May 20, 2025