Home Depot Earnings: Maintaining Guidance Amidst Challenges

Table of Contents

Strong Q[Quarter Number] Results Despite Headwinds

Home Depot's Q[Quarter Number] earnings revealed a complex picture, demonstrating strength despite significant headwinds. Let's dissect the key performance indicators.

Revenue Performance and Key Drivers

Home Depot reported [insert actual revenue figures] in Q[Quarter Number], [compare to previous quarter percentage change] compared to the previous quarter and [compare to analysts' expectations percentage change] compared to analysts' expectations. While growth slowed compared to previous periods of pandemic-fueled home improvement frenzy, this performance is still noteworthy given the current economic uncertainties. Several key drivers contributed to this result:

- Professional Contractors: Spending by professional contractors remained relatively robust, indicating continued activity in new construction and renovation projects. This segment proved more resilient to economic slowdowns than DIY spending.

- Resilient DIY Segment: Despite inflation impacting consumer spending, the DIY segment showed [insert percentage change or description] compared to the previous quarter. This suggests that many homeowners are still prioritizing essential home repairs and maintenance projects.

- Strong Performance in Specific Categories: While overall growth moderated, specific product categories like [mention specific high-performing categories, e.g., appliances, paint] continued to perform well, showing resilience in the face of economic headwinds. Conversely, categories such as [mention categories affected by reduced spending, e.g., lumber] experienced a decline in sales.

Profitability and Margins

Home Depot's profitability, while impacted by inflation and supply chain disruptions, remained relatively healthy. Gross profit margin stood at [insert percentage] in Q[Quarter Number], [compare to previous quarter percentage change] compared to the previous quarter. Net income was [insert amount], reflecting [explain the change compared to the previous quarter]. Factors influencing profitability included:

- Inflationary Pressures: Rising costs for raw materials and transportation impacted margins, necessitating price adjustments to maintain profitability.

- Supply Chain Optimization: Home Depot's efforts to streamline its supply chain, improve inventory management, and secure reliable sources of goods helped mitigate some of the inflationary pressure.

- Strategic Pricing: The company carefully navigated pricing strategies, balancing the need to maintain competitiveness with the need to offset rising costs.

Maintaining Guidance: A Sign of Resilience?

Home Depot's decision to maintain its guidance for the remainder of the year is a bold statement, indicating a level of confidence in its future performance.

Factors Supporting Continued Guidance

Several factors support Home Depot's optimistic outlook:

- Strong Balance Sheet: Home Depot possesses a robust financial position, giving it the flexibility to navigate economic uncertainties.

- Market Share Dominance: Its leading position in the home improvement market allows it to capture a significant portion of overall spending.

- Strategic Initiatives: Initiatives focused on enhancing the customer experience, improving supply chain efficiency, and expanding its professional contractor base should continue to drive growth.

- Pent-up Demand: While consumer spending is slowing, there remains significant pent-up demand for home improvement projects, particularly in areas like renovations and repairs.

Potential Risks and Uncertainties

Despite the positive indicators, certain risks remain:

- Economic Downturn: A deeper-than-expected economic downturn could significantly impact consumer spending on discretionary home improvement projects.

- Interest Rate Hikes: Rising interest rates could dampen the housing market and decrease the overall demand for home improvements.

- Increased Competition: Intensified competition from other home improvement retailers could erode Home Depot's market share.

- Geopolitical Instability: Global events and supply chain disruptions could continue to exert pressure on margins and availability of goods.

Investor Reaction and Market Implications

Home Depot's Q[Quarter Number] earnings announcement elicited a mixed reaction in the market.

Stock Performance Post-Earnings

Following the earnings release, Home Depot's stock price [insert description of stock price movement - e.g., experienced a slight increase/decrease]. This reflects investor sentiment regarding the company's ability to navigate the current economic challenges. Investor sentiment is largely [positive/negative/mixed - justify with details], with some concerns remaining about the potential for a broader economic slowdown.

Implications for the Broader Home Improvement Sector

Home Depot's performance serves as a significant benchmark for the broader home improvement sector. Its ability to maintain guidance, despite headwinds, suggests a degree of resilience within the industry. However, the overall outlook remains dependent on broader macroeconomic factors and consumer confidence. The performance suggests that [positive/negative/mixed] trends are likely to continue for competitors in the near future. The market share dynamics could shift based on how effectively competitors manage inflation and supply chain issues.

Conclusion: Home Depot Earnings: A Glimpse into the Future of Home Improvement

Home Depot's Q[Quarter Number] earnings report offers a complex but ultimately positive glimpse into the future of the home improvement sector. While the company faces headwinds from inflation and economic uncertainty, its strong performance and maintained guidance demonstrate resilience. Home Depot's continued success will depend on its ability to manage costs, maintain its market leadership, and adapt to evolving consumer demands. To stay informed on how the home improvement market navigates these challenges, remain updated on future Home Depot earnings reports and related news. Follow reputable financial news sources for the latest analysis and insights into the evolving landscape of the home improvement market.

Featured Posts

-

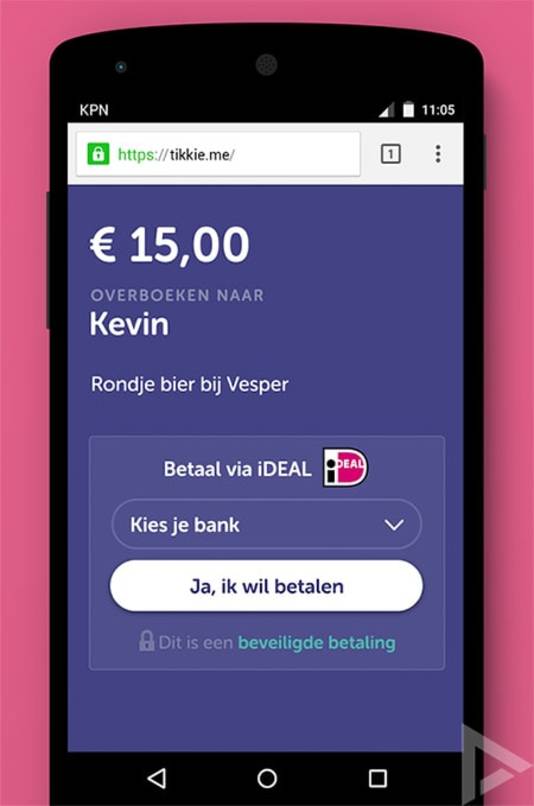

Begrijpen Van Tikkie Uw Gids Voor Het Nederlandse Betalingssysteem

May 22, 2025

Begrijpen Van Tikkie Uw Gids Voor Het Nederlandse Betalingssysteem

May 22, 2025 -

The Viral Reddit Story That Became A Movie Starring Sydney Sweeney A Deep Dive

May 22, 2025

The Viral Reddit Story That Became A Movie Starring Sydney Sweeney A Deep Dive

May 22, 2025 -

A Critical Look At Trumps Proposed Golden Dome Missile Defense System

May 22, 2025

A Critical Look At Trumps Proposed Golden Dome Missile Defense System

May 22, 2025 -

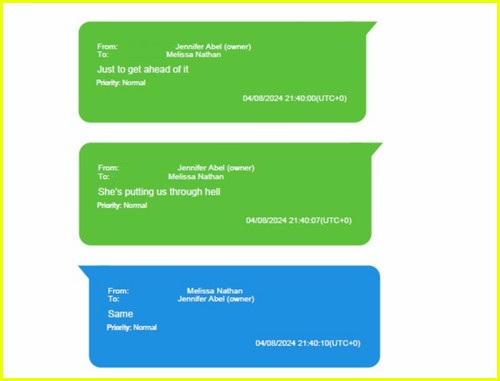

Blake Lively Allegedly Examining Recent News And Reports

May 22, 2025

Blake Lively Allegedly Examining Recent News And Reports

May 22, 2025 -

Antiques Roadshow Appearance Leads To Us Couples Arrest In The Uk

May 22, 2025

Antiques Roadshow Appearance Leads To Us Couples Arrest In The Uk

May 22, 2025

Latest Posts

-

Tuyen Duong Huyet Mach Tp Hcm Ba Ria Vung Tau Diem Danh Cac Lua Chon

May 22, 2025

Tuyen Duong Huyet Mach Tp Hcm Ba Ria Vung Tau Diem Danh Cac Lua Chon

May 22, 2025 -

200 Van Dong Vien Tham Gia Chay Bo Lien Tinh Dak Lak Phu Yen

May 22, 2025

200 Van Dong Vien Tham Gia Chay Bo Lien Tinh Dak Lak Phu Yen

May 22, 2025 -

Hanh Trinh Chay Bo 200 Nguoi Kham Pha Ve Dep Dak Lak Va Phu Yen

May 22, 2025

Hanh Trinh Chay Bo 200 Nguoi Kham Pha Ve Dep Dak Lak Va Phu Yen

May 22, 2025 -

Ket Noi Giao Thong Tp Hcm Va Ba Ria Vung Tau Nhung Tuyen Duong Chinh

May 22, 2025

Ket Noi Giao Thong Tp Hcm Va Ba Ria Vung Tau Nhung Tuyen Duong Chinh

May 22, 2025 -

Cau Ma Da Noi Dong Nai Binh Phuoc Du Kien Khoi Cong Thang 6

May 22, 2025

Cau Ma Da Noi Dong Nai Binh Phuoc Du Kien Khoi Cong Thang 6

May 22, 2025