Home Depot Q[Quarter] Earnings Report: Impact Of Tariffs And Future Outlook

![Home Depot Q[Quarter] Earnings Report: Impact Of Tariffs And Future Outlook Home Depot Q[Quarter] Earnings Report: Impact Of Tariffs And Future Outlook](https://zeit-der-entscheidung.de/image/home-depot-q-quarter-earnings-report-impact-of-tariffs-and-future-outlook.jpeg)

Table of Contents

Key Financial Highlights of Home Depot's Q3 Earnings

Home Depot's Q3 2023 results showcase a mixed performance, reflecting the challenges and opportunities present in the current market. The report offers a detailed overview of the company's financial health, providing valuable data points for investors to analyze. Key metrics, including revenue growth, earnings per share (EPS), and net income, reveal the underlying trends within the business. Analyzing these figures in conjunction with the impact of tariffs provides a comprehensive understanding of Home Depot's performance.

- Revenue: Home Depot reported a Q3 revenue of [Insert Actual Revenue Figure], representing a [Insert Percentage]% year-over-year (YoY) increase/decrease. This growth/decline can be attributed to [mention specific factors contributing to the revenue figures].

- Net Income: Net income for the quarter reached [Insert Actual Net Income Figure], showing a [Insert Percentage]% YoY change. This reflects the company's profitability after accounting for all expenses, including those related to tariffs.

- Earnings Per Share (EPS): EPS stood at [Insert Actual EPS Figure], indicating [Insert Percentage]% YoY growth/decline. This is a crucial metric for investors assessing the company's profitability on a per-share basis.

Impact of Tariffs on Home Depot's Q3 Performance

The ongoing trade war and associated tariffs significantly impacted Home Depot's Q3 performance, particularly affecting product categories heavily reliant on imported goods. The company's strategic response to these challenges played a crucial role in shaping its overall financial results. Understanding the tariff impact is essential for evaluating the company's long-term strategy and future outlook.

- Lumber and Building Materials: Tariffs on lumber and other building materials led to increased import costs, impacting profit margins. Home Depot implemented pricing adjustments to offset these increased costs, but this strategy also influenced consumer demand.

- Appliances: The tariff impact on appliances was [Insert Specific Impact – e.g., less severe/more severe] than on lumber, affecting sales volume and consumer choices within this product category.

- Pricing Strategies: Home Depot employed various pricing strategies to mitigate the tariff impact, including absorbing some costs to maintain competitiveness and adjusting pricing on specific products to reflect the increased import costs. This strategic approach aims to balance profitability with maintaining market share.

- Sourcing Strategies: To mitigate the effects of tariffs, Home Depot actively explored alternative sourcing regions for certain products, diversifying its supply chain to reduce reliance on regions affected by tariffs. This proactive approach aims to secure a consistent supply of goods while minimizing price volatility.

Changes in Consumer Spending and Demand

Consumer spending patterns during Q3 exhibited a complex relationship with the tariff impact. While the home improvement sector remains relatively resilient, changes in demand for specific products reflect consumer sensitivity to pricing pressures.

- Demand Fluctuations: Demand for products directly impacted by tariffs showed [Insert Specific Changes - e.g., a slight decrease/a significant drop], indicating consumer responsiveness to price changes.

- Economic Conditions: The overall economic climate also influenced consumer spending, with [Insert Specific Economic Factors - e.g., rising interest rates/low unemployment rates] playing a role in shaping consumer behavior.

- DIY Projects: The popularity of DIY home improvement projects [Insert Impact - e.g., remained stable/saw a slight decline] during the quarter, indicating a continued interest in home improvement, despite the challenges posed by tariffs.

Home Depot's Strategic Response to Tariffs and Future Outlook

Home Depot's strategic response to the tariff challenges demonstrates its commitment to navigating economic headwinds and ensuring long-term growth. The company's future outlook reflects its proactive approach to managing risks and seizing opportunities in the evolving market landscape.

- Sourcing Diversification: Home Depot continues to invest in diversifying its sourcing strategies, exploring new partnerships and expanding its supplier base to mitigate future disruptions.

- Technological Investments: Investments in technology and supply chain optimization are crucial to improving efficiency and reducing costs, helping offset the impact of tariffs.

- Market Expansion: Home Depot's plans for expansion and market penetration remain strong, suggesting a confident outlook despite the economic challenges.

- Financial Projections: The company's projections for future financial performance [Insert Specific Projections – e.g., reflect cautious optimism/indicate strong growth expectations], highlighting its ability to adapt to changing market conditions.

Conclusion

Home Depot's Q3 earnings report reveals a complex interplay between strong underlying business performance and the significant challenges presented by tariffs. While the impact of tariffs on profit margins is undeniable, Home Depot's strategic response demonstrates its resilience and adaptability. The company's proactive approach to sourcing diversification, pricing strategies, and technological investments positions it favorably for navigating future economic uncertainty. Understanding the Home Depot earnings report and its implications is crucial for navigating the complexities of the current economic climate. Stay tuned for our next analysis of Home Depot's performance, where we will continue to monitor the evolving impact of tariffs and provide insightful commentary on the company's future prospects. Understanding the Home Depot earnings report and its implications is crucial for investors and consumers alike.

![Home Depot Q[Quarter] Earnings Report: Impact Of Tariffs And Future Outlook Home Depot Q[Quarter] Earnings Report: Impact Of Tariffs And Future Outlook](https://zeit-der-entscheidung.de/image/home-depot-q-quarter-earnings-report-impact-of-tariffs-and-future-outlook.jpeg)

Featured Posts

-

Significant Zebra Mussel Population Found In Casper

May 22, 2025

Significant Zebra Mussel Population Found In Casper

May 22, 2025 -

Blake Livelys Alleged Behavior Context And Implications

May 22, 2025

Blake Livelys Alleged Behavior Context And Implications

May 22, 2025 -

Los 5 Mejores Podcasts De Misterio Suspenso Y Terror En Espanol

May 22, 2025

Los 5 Mejores Podcasts De Misterio Suspenso Y Terror En Espanol

May 22, 2025 -

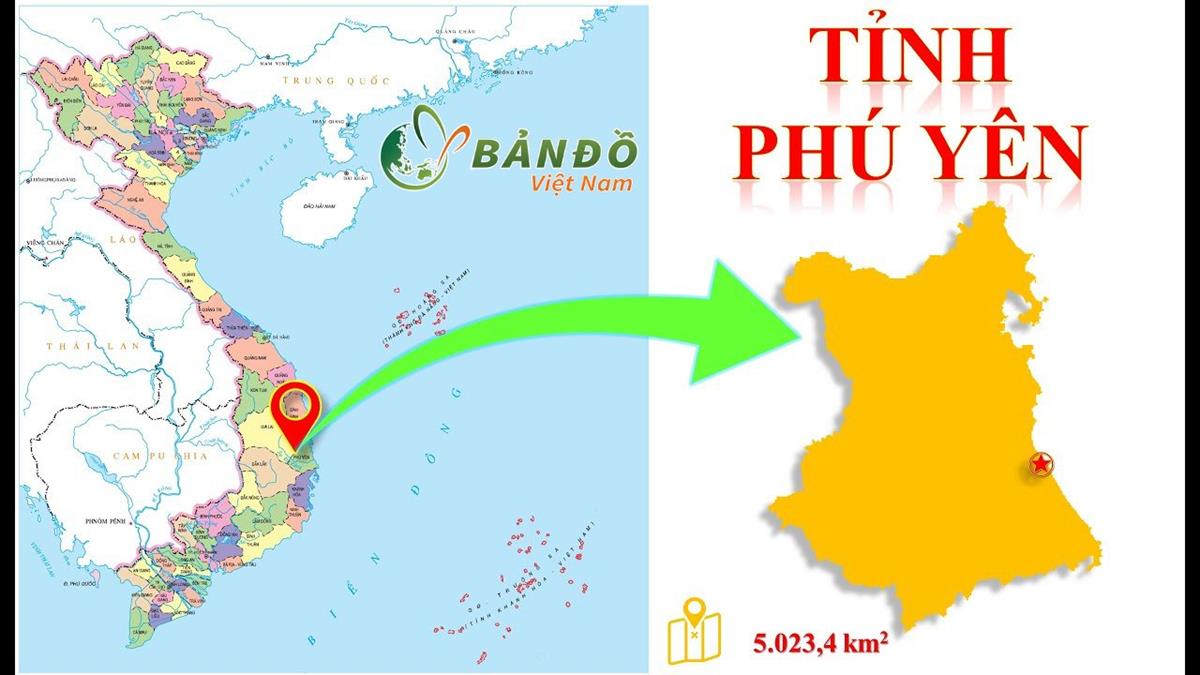

Hon 200 Nguoi Chay Bo Ket Noi Dak Lak Va Phu Yen Mot Cuoc Hanh Trinh The Thao

May 22, 2025

Hon 200 Nguoi Chay Bo Ket Noi Dak Lak Va Phu Yen Mot Cuoc Hanh Trinh The Thao

May 22, 2025 -

Wordle Answer Today April 3 2025 Hints And Solution For Wordle 1384

May 22, 2025

Wordle Answer Today April 3 2025 Hints And Solution For Wordle 1384

May 22, 2025

Latest Posts

-

Adam Ramey Of Dropout Kings Dead At 32 A Tragic Loss

May 22, 2025

Adam Ramey Of Dropout Kings Dead At 32 A Tragic Loss

May 22, 2025 -

Death Of Adam Ramey Dropout Kings Vocalist Passes Away At 32

May 22, 2025

Death Of Adam Ramey Dropout Kings Vocalist Passes Away At 32

May 22, 2025 -

Dropout Kings Vocalist Adam Ramey Dies At 32

May 22, 2025

Dropout Kings Vocalist Adam Ramey Dies At 32

May 22, 2025 -

Dropout Kings Lose Vocalist Adam Ramey At 32

May 22, 2025

Dropout Kings Lose Vocalist Adam Ramey At 32

May 22, 2025 -

Adam Ramey Dropout Kings Vocalist Dead At 32

May 22, 2025

Adam Ramey Dropout Kings Vocalist Dead At 32

May 22, 2025