Home Sales In Crisis: A Realtor's Perspective On The Current Market

Table of Contents

The Impact of Rising Interest Rates on Home Sales

Higher interest rates are arguably the most significant factor driving the current home sales crisis. This has created a ripple effect throughout the market, impacting affordability, demand, and overall market activity.

Affordability Crisis

Higher interest rates dramatically reduce the purchasing power of potential homebuyers. A seemingly small increase in the interest rate can significantly inflate monthly mortgage payments, making homeownership unattainable for many.

- Example: A $300,000 mortgage at 3% interest results in a significantly lower monthly payment than the same mortgage at 7%. This difference can easily be hundreds of dollars per month.

- Impact on First-Time Homebuyers: First-time homebuyers, often relying on smaller down payments and tighter budgets, are disproportionately affected by rising interest rates, shrinking the pool of eligible buyers.

- Affordability Indices: Major indices tracking housing affordability are showing alarming declines, reflecting the difficulty many face in affording a home in the current market. This creates a significant barrier to entry for many prospective buyers.

Reduced Buyer Demand

The increased cost of borrowing, directly linked to higher interest rates, has led to a considerable decrease in buyer demand. Fewer buyers translate to fewer offers, longer selling times, and a shift in market power from buyers to sellers.

- Market Data Comparison: Comparing current sales figures with those from the previous two years reveals a stark decline in transactions across many regions.

- Slowdown in New Listings: The slowdown in new listings reflects sellers' hesitation to enter a market perceived as less favorable. This decreased supply further exacerbates the challenges faced by buyers.

- Implications for Sellers: Sellers are finding it more challenging to secure quick sales at their desired price points, leading to price adjustments and longer market times.

Inflation's Role in the Home Sales Crisis

Inflation plays a crucial role in the current home sales crisis, impacting both the supply and the demand sides of the equation.

Increased Construction Costs

Inflation significantly increases the cost of building new homes. Rising prices for materials like lumber, concrete, and labor contribute to higher construction costs, impacting the supply of new homes and driving up prices for existing properties.

- Impact on New Construction: Builders face increased costs, potentially leading to delays, reduced profitability, and a decrease in new home construction.

- Ripple Effect: This increased cost is not isolated to new homes; it influences the prices of existing homes as well, as sellers factor in the increased costs associated with renovations and improvements.

- Rising Material Costs: Specific examples of rising material costs, such as lumber prices doubling or tripling in certain periods, showcase the significant impact of inflation on the construction industry.

Impact on Consumer Spending

Beyond construction costs, inflation impacts consumers’ overall spending power. Even if home prices were to decline, the reduced disposable income due to inflation makes it difficult for many to afford a home.

- Reduced Discretionary Income: Rising energy and food costs significantly reduce consumer discretionary income, leaving less money available for major purchases like homes.

- Impact of Rising Energy and Food Costs: The increased cost of daily necessities forces many households to prioritize essential expenses over non-essential purchases, including housing.

Navigating the Current Market: Strategies for Buyers and Sellers

While the market presents challenges, effective strategies can help both buyers and sellers navigate the current crisis.

Strategies for Buyers

- Consider Adjustable-Rate Mortgages (ARMs): ARMs may offer lower initial interest rates, although it’s crucial to understand the risks involved.

- Focus on Lower-Priced Properties: Focusing on more affordable price ranges can increase the chances of finding a suitable property.

- Negotiate Aggressively: Buyers have more leverage in a buyer's market, providing opportunities to negotiate terms and prices.

- Secure Pre-Approval: Demonstrating financial readiness to sellers strengthens your offer’s competitiveness.

- Be Prepared for a Competitive Market: Even in a challenging market, desirable properties may still attract multiple offers.

Strategies for Sellers

- Price Strategically: Pricing your home competitively is crucial to attract buyers in a slower market.

- Improve Curb Appeal: First impressions matter; investing in minor improvements to your home’s exterior can significantly enhance its appeal.

- Stage Your Home: Presenting a well-staged home can enhance its appeal and attract potential buyers.

- Be Prepared for a Longer Selling Time: Expect the selling process to take longer than in a more active market.

- Consider Flexible Terms: Offering flexible closing dates or other concessions can enhance the attractiveness of your property to potential buyers.

The Future of Home Sales: Predictions and Outlook

Predicting the future of the home sales market is challenging, but several factors influence the outlook.

Market Predictions

Experts offer varied opinions on the future of the housing market, with potential scenarios including interest rate stabilization, inflation reduction, or a prolonged period of uncertainty.

- Potential Scenarios: Interest rate stabilization could lead to a market recovery, while sustained inflation may prolong the current challenges.

- Market Recovery Likelihood and Timeline: The timing and strength of any market recovery remain highly uncertain, influenced by various economic and policy factors.

- Influence of Policy Changes: Government policies targeting inflation or interest rates could significantly influence the trajectory of the housing market.

Conclusion:

The current "home sales in crisis" situation is a complex interplay of rising interest rates, persistent inflation, and decreased buyer demand, creating significant challenges for both buyers and sellers. Successfully navigating this market requires understanding these factors and employing appropriate strategies. Don't navigate this crisis alone. Consult a real estate expert for guidance on home sales. Let us help you navigate the complexities of the current home sales market and achieve your real estate goals.

Featured Posts

-

Fog Rolling In San Diego County Weather Update With Cooler Temps And Showers

May 30, 2025

Fog Rolling In San Diego County Weather Update With Cooler Temps And Showers

May 30, 2025 -

Krizis Zdravookhraneniya V Mongolii Iz Za Vspyshki Kori

May 30, 2025

Krizis Zdravookhraneniya V Mongolii Iz Za Vspyshki Kori

May 30, 2025 -

Review Of Sparks Mad Album A Comprehensive Assessment

May 30, 2025

Review Of Sparks Mad Album A Comprehensive Assessment

May 30, 2025 -

Mongoliya Massovaya Vaktsinatsiya V Otvet Na Epidemiyu Kori

May 30, 2025

Mongoliya Massovaya Vaktsinatsiya V Otvet Na Epidemiyu Kori

May 30, 2025 -

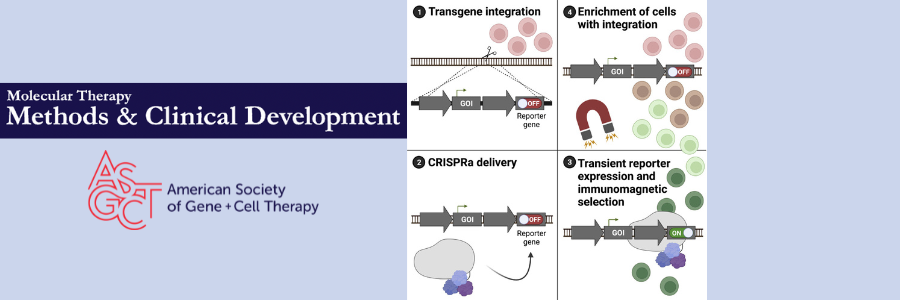

Crispr Gene Editing Enhanced Accuracy And Efficiency With New Modification

May 30, 2025

Crispr Gene Editing Enhanced Accuracy And Efficiency With New Modification

May 30, 2025

Latest Posts

-

Shelton Beats Darderi In Munich Sets Up Semifinal Clash

May 31, 2025

Shelton Beats Darderi In Munich Sets Up Semifinal Clash

May 31, 2025 -

Thompsons Struggle In Monte Carlo Key Factors And Future Outlook

May 31, 2025

Thompsons Struggle In Monte Carlo Key Factors And Future Outlook

May 31, 2025 -

Ben Sheltons Munich Semifinal Berth Darderi Overpowered

May 31, 2025

Ben Sheltons Munich Semifinal Berth Darderi Overpowered

May 31, 2025 -

A Detailed Look At Thompsons Unfortunate Monte Carlo Results

May 31, 2025

A Detailed Look At Thompsons Unfortunate Monte Carlo Results

May 31, 2025 -

Shelton Through To Munich Semis After Darderi Win

May 31, 2025

Shelton Through To Munich Semis After Darderi Win

May 31, 2025