Home Sales Plummet: Crisis Levels Hit Real Estate Market

Table of Contents

Home sales plummet, and the impact on the real estate market is undeniable. Recent data reveals a dramatic downturn, with sales figures falling to levels not seen in years. This unprecedented drop signals a potential housing market crash, creating a crisis for both buyers and sellers. Several interconnected factors contribute to this alarming situation, and understanding these is crucial for navigating the current landscape.

Rising Interest Rates and Their Impact on Home Sales

The Federal Reserve's aggressive interest rate hikes have directly impacted affordability, leading to a significant decrease in home sales. Higher rates translate to substantially increased mortgage payments, making homeownership a distant dream for many potential buyers.

- Increased mortgage payments: Even a small percentage increase in interest rates can dramatically increase monthly mortgage payments, pricing many potential homebuyers out of the market.

- Fewer buyers qualified for mortgages: Lenders tighten lending criteria in response to rising rates, resulting in fewer individuals qualifying for mortgages. Pre-approval processes become more stringent, further hindering buyer participation.

- Impact on both new and existing home sales: The effect is felt across the board, with both new construction and resales experiencing significant drops. Builders face reduced demand, impacting new housing supply.

- Data showing the relationship: A clear correlation exists between interest rate increases and the subsequent decline in home sales. For example, [Insert relevant data or link to a reputable source showing this correlation – e.g., a graph from the National Association of Realtors].

[Insert relevant graph or chart showing the correlation between interest rates and home sales]

Inflation and its Role in the Housing Market Downturn

Soaring inflation erodes purchasing power and significantly impacts consumer confidence. This decreased confidence translates to hesitation in making large purchases like homes.

- Reduced disposable income: With inflation driving up the cost of everyday necessities, potential homebuyers have less disposable income available for a down payment and ongoing mortgage payments.

- Increased building material costs: Inflation also affects the construction industry, increasing the cost of building materials and ultimately driving up the price of new homes. This further reduces affordability.

- Uncertainty in the economy: Economic uncertainty, fueled by high inflation and interest rates, leads to hesitation among consumers. Many delay major purchases, including buying a home, until the economic outlook improves.

- Data on inflation rates and their impact: [Insert relevant data or link to a reputable source showing the impact of inflation on home sales – e.g., CPI data linked to housing market statistics].

Inventory Levels and Market Dynamics

Current inventory levels play a crucial role in shaping market dynamics. A significant increase in unsold properties contributes to a buyer's market, shifting negotiating power towards buyers.

- High inventory leading to a buyer's market: An oversupply of homes for sale gives buyers more choices and leverage to negotiate lower prices.

- Increased competition among sellers leading to price reductions: Sellers are forced to compete for fewer buyers, leading to price reductions to attract offers. This further contributes to the decline in home sales prices.

- Impact of unsold properties on the overall market sentiment: A high number of unsold properties creates a negative market sentiment, making potential buyers even more hesitant to enter the market.

- Data on inventory levels and days on market: [Insert relevant data or link to a reputable source illustrating inventory levels and days on market – e.g., data from a local real estate board or national association].

Potential Consequences and Future Predictions

The current crisis in the real estate market has significant short-term and long-term consequences.

- Potential for further price drops: Depending on economic factors, further price drops are a possibility, particularly in areas with high inventory.

- Impact on the economy as a whole: The housing market downturn can have ripple effects across the broader economy, affecting related industries such as construction and finance.

- Predictions for the recovery of the housing market: Experts offer varying predictions for market recovery, with timelines ranging from several months to a few years depending on interest rate adjustments and economic stabilization.

- Expert opinions and forecasts: [Insert relevant quotes or links to expert opinions and forecasts from reputable sources].

Strategies for Buyers and Sellers in a Plummeting Market

Navigating this challenging market requires strategic planning for both buyers and sellers.

For Buyers:

- Negotiating power in a buyer’s market: Utilize the current market conditions to negotiate favorable terms and prices.

- Finding the best mortgage rates: Shop around and compare rates from multiple lenders to secure the best possible financing.

- Strategies for making competitive offers: Develop a strong offer, potentially including contingencies to protect your interests.

For Sellers:

- Pricing strategies for a competitive market: Accurately price your property to attract buyers and avoid lengthy listing periods.

- Improving property appeal to attract buyers: Make necessary repairs and upgrades to enhance your home's marketability.

- Understanding market conditions and adjusting expectations: Be realistic about pricing and the time it may take to sell your property.

Conclusion

The plummeting home sales are creating a significant crisis in the real estate market, driven by rising interest rates, inflation, and high inventory levels. This situation has significant consequences, potentially leading to further price drops and broader economic impacts. Understanding these factors is critical for making informed decisions. To navigate the plummeting home sales market effectively, stay informed about changing market conditions and consult with real estate professionals and financial advisors before making any major real estate decisions. Understanding the current real estate crisis and making informed decisions in a falling home sales market is crucial for success. [Link to a relevant resource, e.g., a mortgage calculator or market analysis].

Featured Posts

-

Canadas Measles Elimination Status At Risk Fall 2024 A Critical Point

May 30, 2025

Canadas Measles Elimination Status At Risk Fall 2024 A Critical Point

May 30, 2025 -

Han Skal Erstatte Dolberg Tipsbladets Bedste Bud

May 30, 2025

Han Skal Erstatte Dolberg Tipsbladets Bedste Bud

May 30, 2025 -

The Bts Reunion Teaser A Deep Dive Into Comeback Clues

May 30, 2025

The Bts Reunion Teaser A Deep Dive Into Comeback Clues

May 30, 2025 -

Ruuds French Open Loss Knee Problem Hinders Borges Match

May 30, 2025

Ruuds French Open Loss Knee Problem Hinders Borges Match

May 30, 2025 -

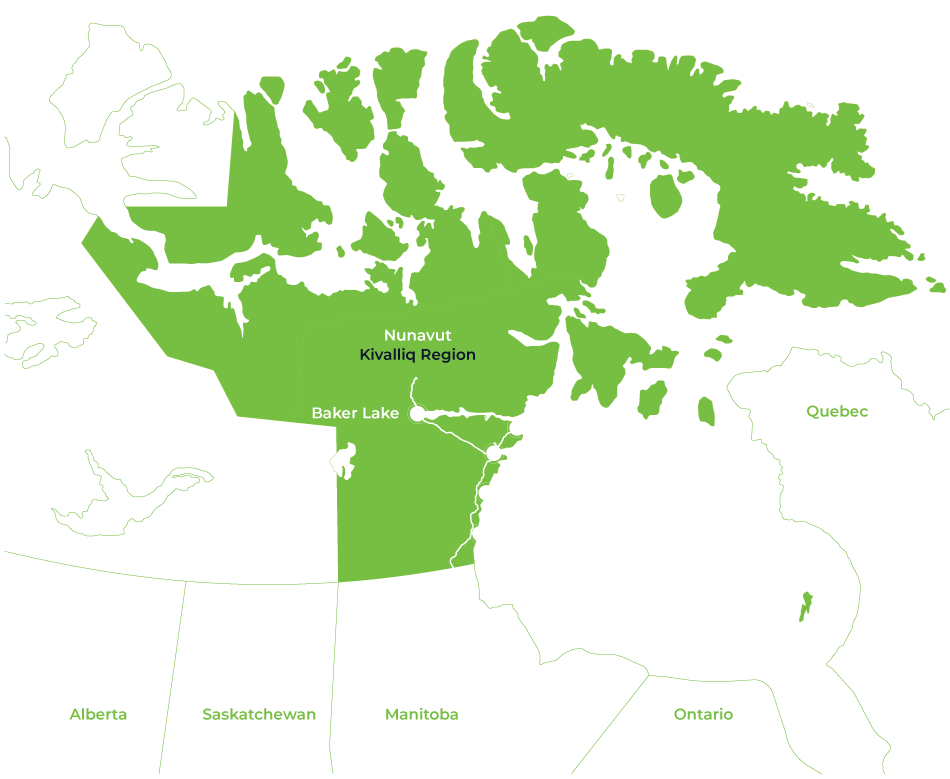

Manitoba Nunavut Partnership Kivalliq Hydro Fibre Link Fuels Economic Growth

May 30, 2025

Manitoba Nunavut Partnership Kivalliq Hydro Fibre Link Fuels Economic Growth

May 30, 2025

Latest Posts

-

Griekspoor Stuns Zverev In Indian Wells Second Round

May 31, 2025

Griekspoor Stuns Zverev In Indian Wells Second Round

May 31, 2025 -

Griekspoor Pulls Off Major Upset Against Zverev At Indian Wells

May 31, 2025

Griekspoor Pulls Off Major Upset Against Zverev At Indian Wells

May 31, 2025 -

Zverev Loses To Griekspoor In Indian Wells Shock

May 31, 2025

Zverev Loses To Griekspoor In Indian Wells Shock

May 31, 2025 -

Zverevs Road To The Munich Semifinals A Comeback Story

May 31, 2025

Zverevs Road To The Munich Semifinals A Comeback Story

May 31, 2025 -

Tallon Griekspoor Defeats Alexander Zverev At Indian Wells

May 31, 2025

Tallon Griekspoor Defeats Alexander Zverev At Indian Wells

May 31, 2025