Honeywell And Johnson Matthey Near £1.8B Deal

Table of Contents

Deal Details and Structure

The proposed acquisition centers around a significant portion of Johnson Matthey's business, details of which are still emerging. The exact assets included in the Honeywell Johnson Matthey merger are subject to ongoing negotiations and final agreements. However, reports suggest it involves specific technologies and potentially entire divisions focused on high-growth sectors. Understanding the precise nature of this acquisition is crucial for assessing its full impact.

- Specifics of the proposed acquisition: While complete transparency awaits official announcements, it’s expected to involve key technologies and operational units central to Johnson Matthey's portfolio. Further details regarding the specific technologies and divisions will be released as the deal progresses.

- Financial terms: The headline figure is a proposed £1.8 billion, representing a substantial investment for Honeywell. The final acquisition price might be subject to adjustments based on due diligence findings. Funding mechanisms, whether through debt financing, equity issuance, or a combination, remain to be confirmed. This significant £1.8 billion deal will undoubtedly impact both companies’ balance sheets.

- Timeline and regulatory approvals: The deal’s timeline is contingent upon successful completion of due diligence, regulatory approvals, and satisfaction of other closing conditions. Antitrust reviews and other regulatory hurdles are expected, potentially delaying the finalization of the transaction. We expect updates on the deal completion and the final timeline to emerge in the coming months.

Implications for Honeywell

This acquisition presents several strategic advantages for Honeywell. This strategic acquisition positions Honeywell to capitalize on significant synergies and strengthen its presence in high-growth markets.

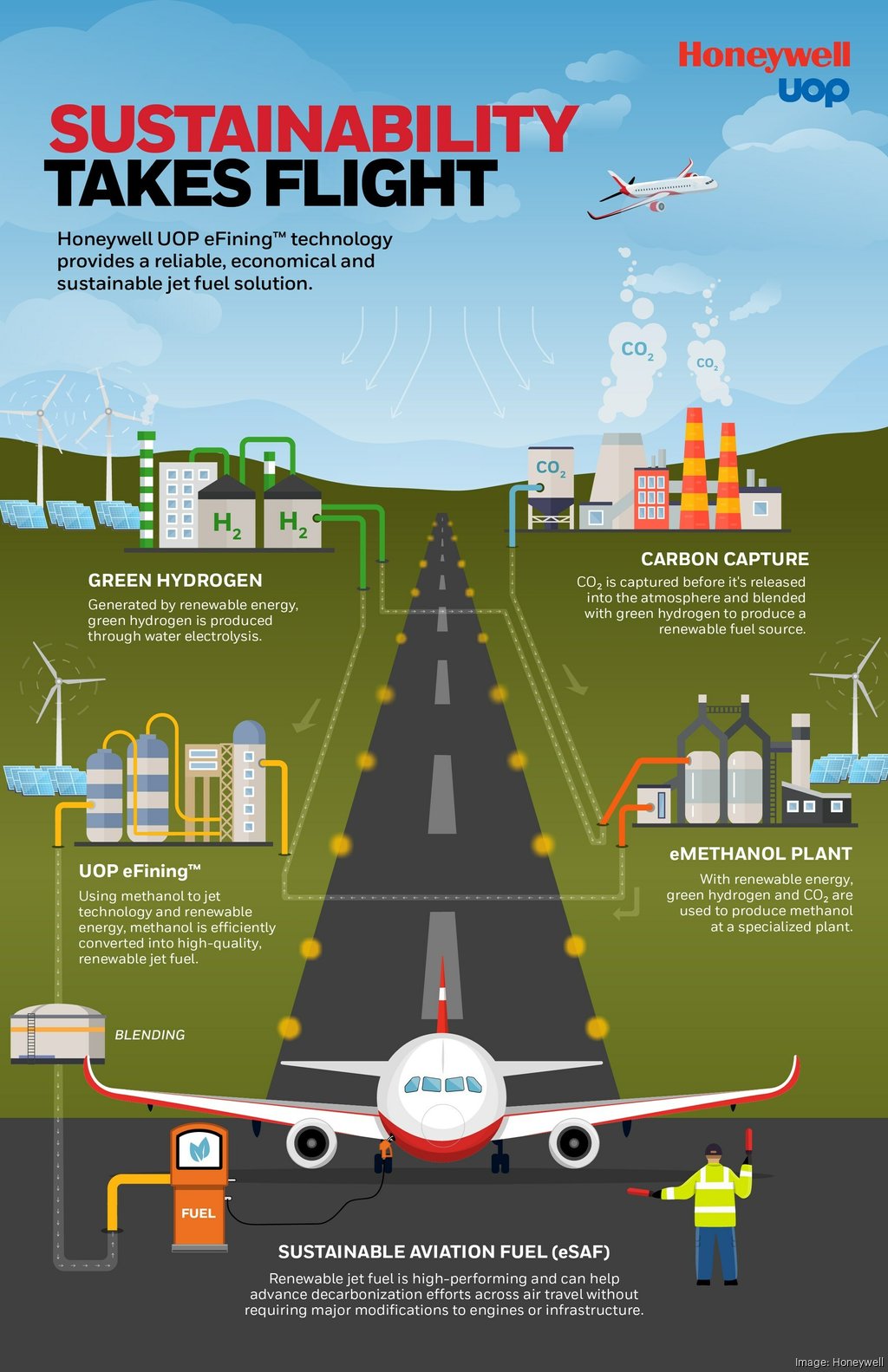

- Strategic benefits: The acquisition is likely to align perfectly with Honeywell’s strategic focus on sustainable technologies and high-value materials. It's expected to unlock synergies and boost Honeywell's market share in target sectors. The deal represents a significant step towards market expansion and solidifying Honeywell's position as a leader in advanced materials.

- Market share and competitiveness: The acquisition of these assets is expected to considerably bolster Honeywell's market share within the relevant sectors, enhancing its competitiveness. By integrating Johnson Matthey's technologies and expertise, Honeywell will achieve greater industry leadership and potentially attain market dominance in certain niches.

- Technological advancements: The potential acquisition of cutting-edge technologies and intellectual property from Johnson Matthey will significantly enhance Honeywell's R&D capabilities and accelerate innovation. This infusion of advanced technologies represents a vital catalyst for future technology acquisition and product development.

Implications for Johnson Matthey

For Johnson Matthey, this move represents a strategic portfolio adjustment, potentially driven by a need for financial restructuring or a sharper focus on core competencies.

- Reasons for the sale: The divestiture might reflect Johnson Matthey's strategic decision to streamline operations, focusing resources on its core businesses. This strategic restructuring allows the company to optimize its portfolio and improve overall financial performance.

- Future plans: Following the sale, Johnson Matthey will likely refocus its energies on its remaining core business areas, potentially involving further investments in R&D and expansion into other strategic sectors. Their future strategic direction will be keenly observed by industry analysts. This portfolio optimization strategy reflects a proactive response to market dynamics.

- Impact on employees: While the precise impact on employment is yet to be determined, Johnson Matthey is likely to have a transition plan in place to support impacted employees. The company is expected to address employee impact and job security concerns transparently. A well-structured transition plan will help minimize disruption.

Industry Analysis and Future Outlook

This deal reflects larger trends in the chemical and materials industries, particularly the increasing demand for sustainable and high-performance materials.

- Market trends: The deal is a reflection of ongoing consolidation within the chemical and materials sectors. Growing demand for sustainable and advanced materials, coupled with increasing regulatory scrutiny, is driving mergers and acquisitions like this one. This market analysis highlights the industry’s proactive response to emerging trends. The chemical industry and materials science sectors will be closely watching this precedent.

- Competitive landscape: The deal is expected to significantly reshape the competitive landscape, leading to increased market consolidation. Other players in the sector will need to adapt to this changed dynamic, potentially accelerating further mergers or acquisitions in the future. The industry dynamics are likely to shift considerably following this significant transaction.

- Potential future developments: The long-term impact of this Honeywell and Johnson Matthey £1.8B deal remains to be seen. However, it is likely to inspire further consolidation within the sector and increase investment in sustainable and high-performance materials. We can anticipate more such mergers and acquisitions. The future outlook appears bullish for players who can strategically adapt to this changing landscape.

Conclusion: The Honeywell and Johnson Matthey £1.8 Billion Deal – A Defining Moment

The proposed Honeywell and Johnson Matthey £1.8 billion deal represents a significant transaction with far-reaching implications for both companies and the broader chemical and materials industry. The financial terms, strategic motivations, and potential industry impacts are all significant and warrant close attention. This landmark acquisition highlights the increasing importance of sustainable technologies and innovative materials in shaping the future of these sectors. To stay informed on the progress of this major acquisition and other significant developments in the industry, be sure to follow the Honeywell and Johnson Matthey £1.8B deal closely. Stay updated on this major acquisition by following industry news and subscribing to relevant newsletters. Learn more about this significant industry merger and its ongoing impact.

Featured Posts

-

Hulu Movie Departures This Month A Full List

May 23, 2025

Hulu Movie Departures This Month A Full List

May 23, 2025 -

Swiss Mountain Municipality Partially Evacuated Landslide Threat

May 23, 2025

Swiss Mountain Municipality Partially Evacuated Landslide Threat

May 23, 2025 -

What To Watch Before Its Gone Hulus Removing These Movies This Month

May 23, 2025

What To Watch Before Its Gone Hulus Removing These Movies This Month

May 23, 2025 -

Zimbabwe Secures Thrilling Test Victory In Sylhet

May 23, 2025

Zimbabwe Secures Thrilling Test Victory In Sylhet

May 23, 2025 -

Kartels Restrictions A Necessary Safety Measure Trinidad And Tobago Newsday

May 23, 2025

Kartels Restrictions A Necessary Safety Measure Trinidad And Tobago Newsday

May 23, 2025

Latest Posts

-

Emissary Reveals Hamas Deception In Witkoff Deal

May 23, 2025

Emissary Reveals Hamas Deception In Witkoff Deal

May 23, 2025 -

Mbarat Qtr Walkhwr Khsart Thqylt Bmsharkt Ebd Alqadr

May 23, 2025

Mbarat Qtr Walkhwr Khsart Thqylt Bmsharkt Ebd Alqadr

May 23, 2025 -

Witkoff An Emissarys Account Of Hamas Deception

May 23, 2025

Witkoff An Emissarys Account Of Hamas Deception

May 23, 2025 -

Witkoff Representative Alleges Hamas Fraud

May 23, 2025

Witkoff Representative Alleges Hamas Fraud

May 23, 2025 -

Aldhhb Fy Qtr Alywm Alithnyn 24 Mars Asear Wtghyrat

May 23, 2025

Aldhhb Fy Qtr Alywm Alithnyn 24 Mars Asear Wtghyrat

May 23, 2025