House Approves Trump Tax Bill After Late-Night Negotiations

Table of Contents

Key Provisions of the Trump Tax Bill

The Trump Tax Bill, officially known as the Tax Cuts and Jobs Act of [Insert Year], enacted significant changes to both individual and corporate taxation.

Individual Income Tax Changes

The bill significantly altered individual income tax brackets, standard deductions, and various tax credits.

- Tax Brackets: The number of individual income tax brackets was reduced, impacting how much individuals paid in taxes based on their income. This resulted in lower rates for some brackets while others remained largely unchanged. Keywords: tax brackets, individual income tax rates, tax reform.

- Standard Deduction: The standard deduction—the amount taxpayers can deduct without itemizing—was nearly doubled. This change benefited many lower- and middle-income taxpayers, simplifying their tax filings. Keywords: standard deduction, tax simplification, individual tax returns.

- Child Tax Credit: The child tax credit was expanded, increasing the maximum credit amount and making it partially refundable. This provided greater tax relief for families with children. Keywords: child tax credit, family tax relief, tax credits for families.

These changes offered benefits to some taxpayers while potentially increasing the tax burden for others, depending on their individual circumstances and income level. Understanding your specific tax situation is crucial to determining how this legislation affects you personally.

Corporate Tax Rate Reductions

A central feature of the Trump Tax Bill was a dramatic reduction in the corporate tax rate. The rate was slashed from 35% to 21%, a significant change intended to boost business investment and economic growth. Keywords: corporate tax rate, business tax cuts, economic stimulus.

- Arguments For: Proponents argued this reduction would make American businesses more competitive globally, attract investment, and create jobs.

- Arguments Against: Critics expressed concerns about the potential for increased national debt and the possibility that tax cuts disproportionately benefited large corporations at the expense of smaller businesses and individuals.

The long-term impact of this corporate tax rate reduction remains a subject of ongoing debate and economic analysis.

Elimination or Modification of Certain Tax Deductions

The bill also eliminated or modified several tax deductions, aiming to simplify the tax code and offset revenue losses from other provisions.

- State and Local Tax (SALT) Deduction: The bill capped the deduction for state and local taxes (SALT), impacting taxpayers in high-tax states. Keywords: SALT deduction, state and local taxes, tax deductions limitations.

- Mortgage Interest Deduction: While not eliminated, the maximum amount of mortgage debt eligible for the interest deduction was altered. Keywords: mortgage interest deduction, homeownership tax benefits, tax deductions for homeowners.

These changes were controversial, with many arguing that they disproportionately affected certain groups of taxpayers, particularly homeowners in high-tax states.

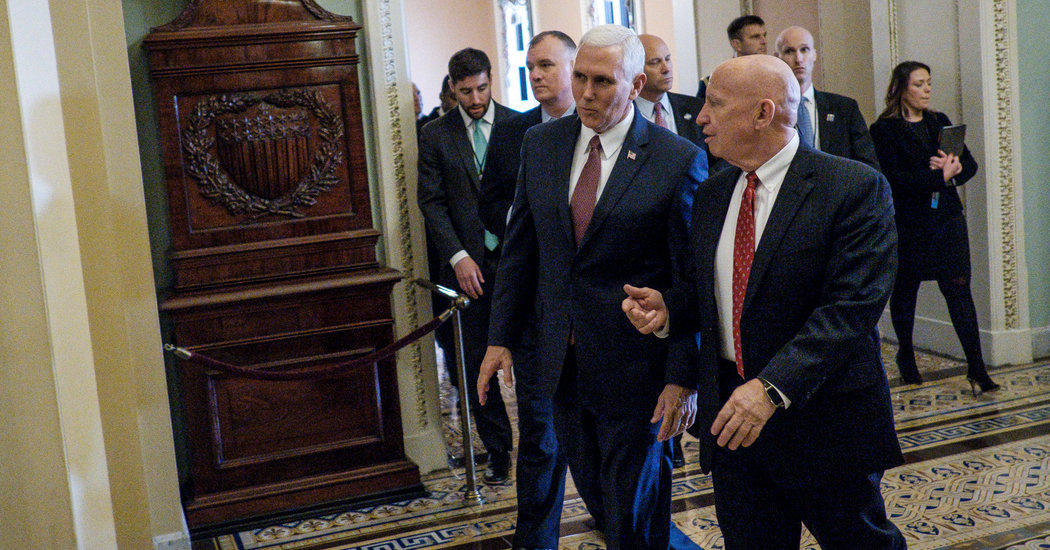

Late-Night Negotiations and Political Maneuvering

The passage of the Trump Tax Bill was the culmination of intense political maneuvering and late-night negotiations.

Key Players and Their Roles

Key figures in both the House and Senate played crucial roles in shaping the final legislation, negotiating compromises, and securing enough votes for passage. Keywords: House Republicans, Senate Republicans, Congressional negotiations, tax bill negotiations. Specific individuals and their roles should be mentioned here, drawing on relevant news sources.

- Mention specific compromises made during the negotiations to gain support.

- Highlight dissenting voices within the Republican party.

The Vote and Its Implications

The House vote on the Trump Tax Bill was largely along party lines, reflecting the deep partisan divisions surrounding the legislation. Keywords: House vote, Senate vote, partisan politics, political implications.

- Detailed description of the voting process and the final vote count.

- Analysis of the short-term and long-term political ramifications of the bill's passage.

- Discussion of its likely impact on the 20[Insert next election year] election cycle.

Public Reaction and Economic Outlook

The Trump Tax Bill’s passage sparked a wide range of reactions from the public and generated diverse economic forecasts.

Public Opinion and Media Coverage

Public opinion on the Trump Tax Bill was sharply divided, with strong reactions from both supporters and opponents. Keywords: public opinion, media response, taxpayer reaction, political polarization.

- Summarize public opinion polls and surveys conducted before and after the bill's passage.

- Mention prominent media outlets' coverage and their perspectives on the bill's impact.

Economic Forecasts and Predictions

Economists offered varying forecasts on the bill’s economic impact, with some predicting increased GDP growth and others expressing concerns about potential negative consequences. Keywords: economic impact, GDP growth, inflation, economic forecasts.

- Cite predictions from economists and other experts regarding short-term and long-term impacts.

- Discuss the potential benefits and risks for the U.S. economy.

Conclusion

The House's approval of the Trump Tax Bill represents a significant shift in American fiscal policy. The bill’s sweeping changes to individual and corporate tax rates, coupled with adjustments to various deductions, will undoubtedly have a profound impact on the American economy and the lives of millions of taxpayers. Understanding the key provisions, the political battles surrounding its passage, and the potential economic consequences is crucial for informed engagement with this landmark legislation. To stay updated on the latest developments regarding the Trump Tax Bill, its implementation, and its ongoing effects, continue to follow reputable news sources and financial analysis. Further detailed analysis of the Trump Tax Bill's long-term implications is needed to comprehensively assess its ultimate success or failure.

Featured Posts

-

The A Real Pain Role Eric Andres Biggest Regret

May 23, 2025

The A Real Pain Role Eric Andres Biggest Regret

May 23, 2025 -

Eric Andre On Rejecting A Real Pain A Missed Opportunity

May 23, 2025

Eric Andre On Rejecting A Real Pain A Missed Opportunity

May 23, 2025 -

Hamiltons Comments A Continuing Headache For Mc Laren

May 23, 2025

Hamiltons Comments A Continuing Headache For Mc Laren

May 23, 2025 -

Joe Jonas Perfect Response To A Couples Fight Over Him

May 23, 2025

Joe Jonas Perfect Response To A Couples Fight Over Him

May 23, 2025 -

Joe Jonas Addresses Couples Argument About Him The Full Story

May 23, 2025

Joe Jonas Addresses Couples Argument About Him The Full Story

May 23, 2025

Latest Posts

-

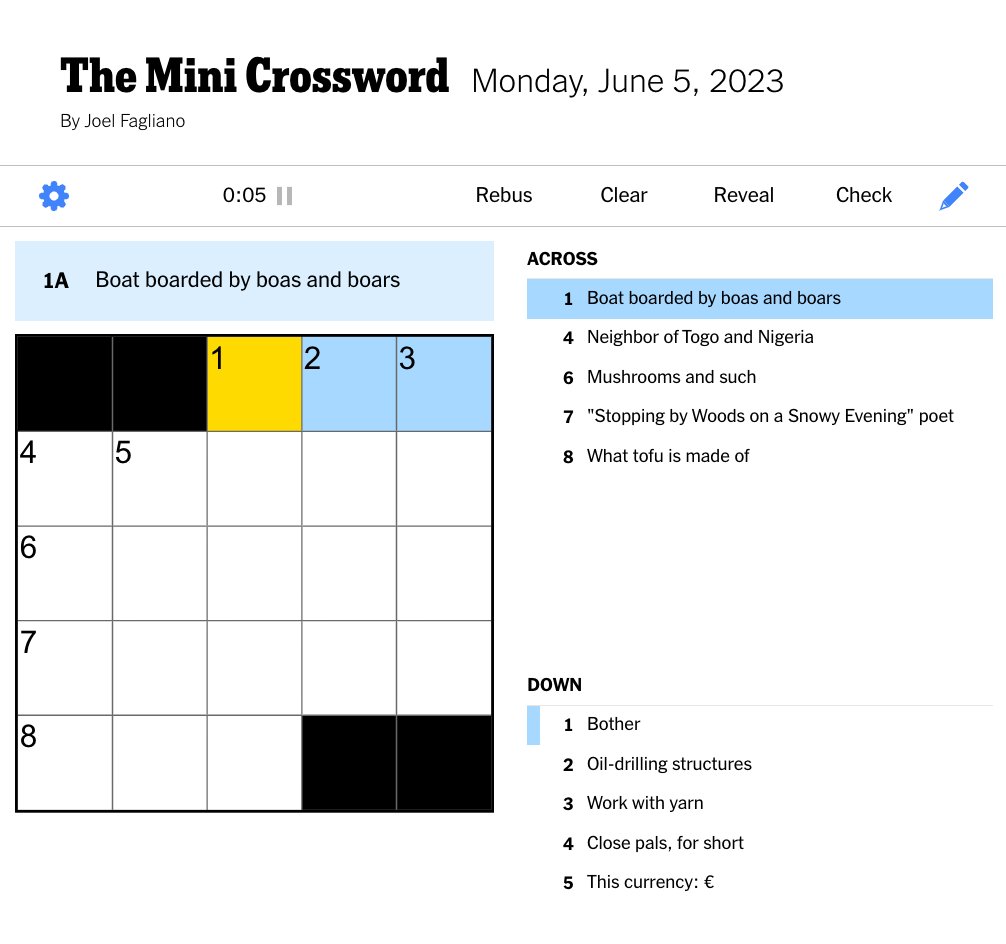

Nyt Mini Crossword Today Hints And Answers For March 6 2025

May 23, 2025

Nyt Mini Crossword Today Hints And Answers For March 6 2025

May 23, 2025 -

Nyt Mini Crossword Help Answers And Clues For March 13 2025

May 23, 2025

Nyt Mini Crossword Help Answers And Clues For March 13 2025

May 23, 2025 -

March 13 2025 Nyt Mini Crossword Complete Answers And Hints

May 23, 2025

March 13 2025 Nyt Mini Crossword Complete Answers And Hints

May 23, 2025 -

Just In Time Musical Review Groffs Performance And The Power Of Nostalgia

May 23, 2025

Just In Time Musical Review Groffs Performance And The Power Of Nostalgia

May 23, 2025 -

Jonathan Groffs Just In Time A 1965 Inspired Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1965 Inspired Musical Triumph

May 23, 2025