How Canada's Economic Climate Affects Car Security

Table of Contents

Unemployment and Car Theft

A strong correlation exists between high unemployment rates and increased car theft in Canada. When job opportunities dwindle and financial hardship increases, some individuals may resort to criminal activities, including vehicle theft, to survive. This isn't simply about stealing for resale; it often involves opportunistic thefts targeting unlocked vehicles or those left in less secure areas.

- Desperate Measures: High unemployment leads to desperation, pushing individuals to commit crimes for financial survival.

- Strained Resources: Increased crime rates place a heavier burden on already strained law enforcement resources, potentially hindering effective crime prevention and investigation.

- Opportunistic Thefts: Unlocked vehicles and those parked in poorly lit areas become easy targets for opportunistic thieves.

- Insurance Claims Surge: During economic downturns, a higher incidence of vehicle-related insurance claims is typically observed, reflecting the increased rate of car thefts and related crimes.

Statistics Canada data consistently demonstrates a link between periods of high unemployment and a subsequent increase in reported vehicle thefts across the country. Analyzing this data provides a clear picture of the socio-economic factors driving this criminal activity.

Inflation and the Value of Vehicles

Inflation significantly impacts the value of used cars, directly influencing car theft rates. As inflation rises, the value of older vehicles may increase, making them more attractive targets for thieves. This is particularly true for vehicles with high resale value, even if they are several years old.

- Increased Value, Increased Risk: Higher inflation can lead to an increased value of older vehicles, making them more attractive targets for theft.

- Insurance Affordability: Inflation makes car insurance more expensive, potentially leading some individuals to forgo coverage, increasing the risk for both the owner and the insurance company.

- Repair Costs: Inflation increases the cost of car parts and repairs, making the financial consequences of vehicle theft even more significant.

- Chop Shop Activity: The higher demand for used parts, driven by inflation and increased car thefts, can lead to a rise in the number and activity of chop shops across the country.

Reports from Canadian automotive associations and economic analyses consistently demonstrate the relationship between inflation rates and vehicle theft trends. The increased value of used cars during inflationary periods makes them lucrative targets, fueling the problem.

Government Policies and Car Security

Government economic policies significantly influence car security trends in Canada. For example, incentives for purchasing new, fuel-efficient vehicles, such as government subsidies for electric vehicles, can indirectly impact car theft rates by decreasing the desirability of older vehicles.

- EV Subsidies and Theft: Government subsidies for electric vehicles may decrease the theft of older gasoline-powered vehicles, as people opt for newer, subsidized alternatives.

- Law Enforcement Budgets: Changes in law enforcement budgets directly affect the resources available for crime prevention and investigation, impacting vehicle theft rates.

- Tax Policies on Security Systems: Tax policies influencing the affordability of vehicle security systems can impact the number of vehicles equipped with such technologies.

- Government Initiatives: Government initiatives aimed at combating vehicle theft, such as public awareness campaigns or improved tracking technologies, can significantly affect car security.

Impact on Insurance Premiums

The economic climate directly affects car insurance premiums in Canada. Increased crime rates, driven by economic factors, inevitably lead to higher insurance premiums to cover the increased risk.

- Crime Rates and Premiums: Higher car theft rates directly translate into higher insurance premiums for consumers.

- Insurance Company Solvency: Economic downturns can impact the financial stability of insurance companies, potentially affecting their ability to offer competitive rates.

- Coverage Options: Changes in insurance coverage options, influenced by economic factors, may affect consumer choices and the overall cost of car insurance.

Conclusion

Canada's economic climate demonstrably affects car security. Unemployment drives opportunistic crime, inflation boosts the value of targets, and government policies shape both prevention efforts and the overall cost to consumers. Understanding this complex interplay is crucial for both individuals and policymakers. To protect yourself, invest in advanced security systems, such as GPS trackers and alarms, and practice safe parking habits. Stay informed about the impact of Canada's economic climate on car security and take appropriate precautions to safeguard your vehicle. For further resources on car security and related information, visit [link to relevant resource 1] and [link to relevant resource 2]. Remember, proactive measures are key to improving car security regardless of the economic climate.

Featured Posts

-

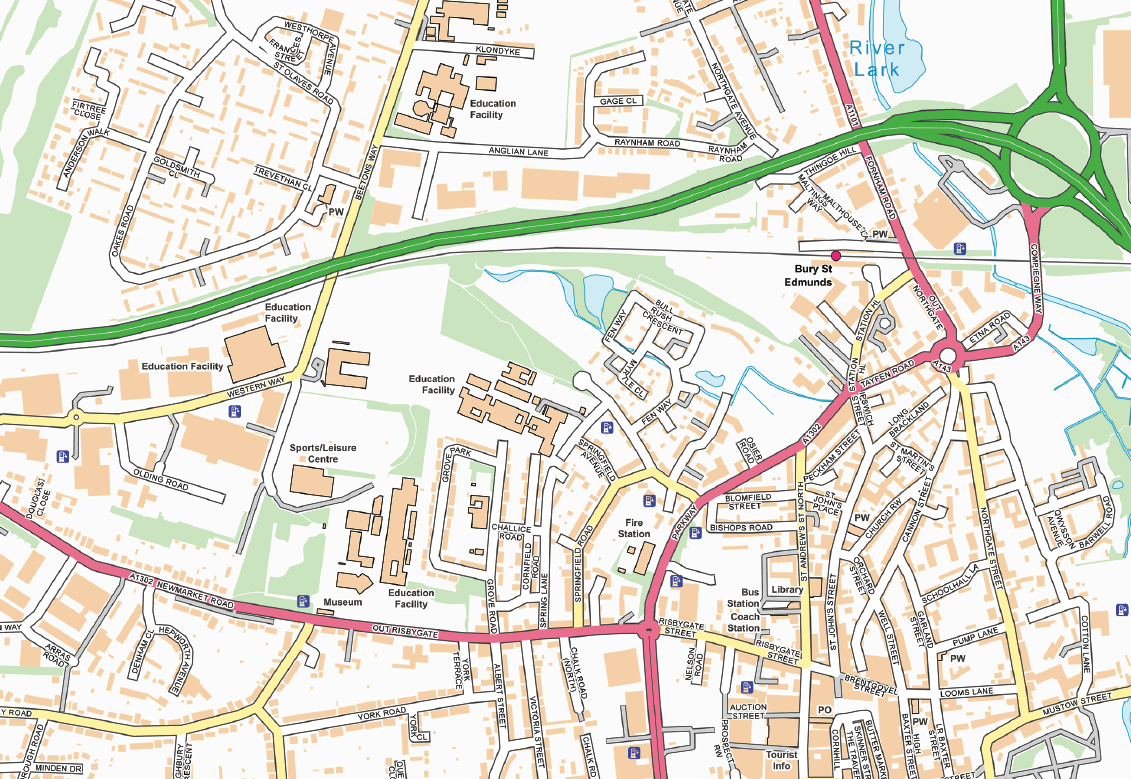

The Bury M62 Relief Road A Forgotten Plan

May 24, 2025

The Bury M62 Relief Road A Forgotten Plan

May 24, 2025 -

Faiz Indiriminin Avrupa Borsalari Uezerindeki Etkisi

May 24, 2025

Faiz Indiriminin Avrupa Borsalari Uezerindeki Etkisi

May 24, 2025 -

Is Kyle Walker Peters Joining West Ham Latest Transfer News

May 24, 2025

Is Kyle Walker Peters Joining West Ham Latest Transfer News

May 24, 2025 -

Joy Crookes Releases New Song I Know You D Kill

May 24, 2025

Joy Crookes Releases New Song I Know You D Kill

May 24, 2025 -

Royal Philips 2025 Agm Agenda And Important Dates For Shareholders

May 24, 2025

Royal Philips 2025 Agm Agenda And Important Dates For Shareholders

May 24, 2025

Latest Posts

-

Review Jonathan Groffs Just In Time A 1965 Inspired Triumph

May 24, 2025

Review Jonathan Groffs Just In Time A 1965 Inspired Triumph

May 24, 2025 -

Just In Time Musical Review Groffs Captivating Bobby Darin Portrayal

May 24, 2025

Just In Time Musical Review Groffs Captivating Bobby Darin Portrayal

May 24, 2025 -

Jonathan Groffs Just In Time A Stellar 1965 Style Performance

May 24, 2025

Jonathan Groffs Just In Time A Stellar 1965 Style Performance

May 24, 2025 -

Jonathan Groff Discusses His Past And Asexuality

May 24, 2025

Jonathan Groff Discusses His Past And Asexuality

May 24, 2025 -

How Jonathan Groff Brought Bobby Darin To Life In Just In Time

May 24, 2025

How Jonathan Groff Brought Bobby Darin To Life In Just In Time

May 24, 2025