How Did Donald Trump's First 100 Days Affect Elon Musk's Wealth?

Table of Contents

The intertwined fates of two of the world's most recognizable figures, Donald Trump and Elon Musk, offer a fascinating case study in the unpredictable intersection of politics and business. This article explores the question: How did Donald Trump's first 100 days in office affect Elon Musk's wealth? We'll delve into the economic policies implemented during that period and analyze their potential influence on the performance of Musk's companies, SpaceX and Tesla, ultimately impacting his net worth. We will examine how Trump's policies, from tax cuts to trade wars, potentially shaped the trajectory of these businesses and the resulting financial implications for Elon Musk.

The Economic Climate of Trump's First 100 Days:

Tax Cuts and Their Impact on Tesla:

The Trump administration's proposed tax cuts, a cornerstone of its early economic agenda, significantly impacted corporate America. Analyzing how these cuts affected Tesla's profitability and stock price is crucial to understanding their influence on Elon Musk's wealth.

- The Tax Cuts and Jobs Act of 2017: This legislation reduced the corporate tax rate from 35% to 21%, a substantial decrease.

- Impact on Corporate Profits: Lower taxes increased Tesla's after-tax profits, potentially boosting its stock value.

- Tesla's Stock Performance: While Tesla's stock price fluctuated during this period, the overall trend showed positive growth, partially attributed to improved profit margins due to the tax cuts. (Include a relevant chart showing Tesla's stock performance during Trump's first 100 days here.)

Deregulation and its Effect on SpaceX:

Simultaneously, the Trump administration pursued a policy of deregulation across various sectors. Let's examine how this affected SpaceX’s operations and funding opportunities.

- Reduced Environmental Regulations: Easing environmental regulations might have streamlined the approval process for SpaceX's launch activities.

- Increased Access to Funding: A less regulated environment could have potentially made it easier for SpaceX to secure private and government contracts.

- Impact on Space Exploration: While the direct impact is difficult to quantify, the overall pro-business stance of the administration likely contributed to a more favorable climate for private space exploration initiatives like SpaceX. (Cite relevant SpaceX press releases and government reports here.)

Trump's Trade Policies and Their Influence on Tesla and SpaceX:

Tariffs and the Global Supply Chain:

Trump's "America First" trade policy, characterized by the imposition of tariffs on imported goods, had a significant impact on global supply chains. This section examines how it affected Tesla's production costs and profitability.

- Tariffs on Raw Materials: Tariffs on steel, aluminum, and other materials used in Tesla's vehicle production increased the company's input costs.

- Price Fluctuations: These increased costs could have led to price fluctuations for Tesla vehicles and reduced profit margins. (Include relevant import/export data and Tesla financial reports here.)

- Supply Chain Disruptions: Tariffs potentially disrupted Tesla's global supply chain, creating uncertainty and delays.

International Relations and SpaceX's Ambitions:

Trump's foreign policy decisions also had implications for SpaceX's international collaborations and market access.

- Geopolitical Tensions: Increased tensions with certain countries could have impacted SpaceX's ability to secure launch sites or international partnerships.

- Space Cooperation: Trump's stance on international space cooperation might have affected SpaceX's opportunities for collaborative projects. (Include relevant SpaceX press releases and government statements here.)

- Access to Markets: Trade disputes and sanctions could have hindered SpaceX's ability to access certain markets for its services and technology.

The Stock Market and Investor Sentiment During Trump's Initial Term:

Overall Market Trends and Their Correlation with Tesla's Stock Price:

Trump's first 100 days coincided with a period of overall market growth, fueled partly by expectations surrounding his economic policies. Understanding the broader market trends is essential to fully assess the impact on Tesla's stock price and, consequently, Elon Musk's wealth.

- Market Indices: Analyze the performance of major market indices (e.g., Dow Jones, S&P 500) during this period.

- Investor Confidence: Assess investor confidence levels and how they influenced investment decisions concerning Tesla. (Include relevant stock market data and news articles analyzing market sentiment here.)

- Correlation Analysis: Establish a correlation between overall market trends and Tesla's stock performance.

Media Coverage and its Influence on Musk's Net Worth:

The media's portrayal of the Trump administration significantly influenced investor perceptions of Tesla and SpaceX, thereby impacting Musk's net worth.

- Positive and Negative Coverage: Analyze the tone and content of media coverage during this period, differentiating between positive and negative portrayals of Trump's policies and their potential effects on Tesla and SpaceX.

- Impact on Investor Sentiment: Discuss how the media's narrative influenced investor sentiment and subsequent investment decisions regarding Tesla and SpaceX. (Include examples of news articles, social media analysis, and financial news reports here.)

- Direct Impact on Net Worth: Quantify, where possible, the correlation between positive or negative media coverage and the fluctuation of Musk's net worth.

Conclusion: Unraveling the Complex Relationship Between Trump's Presidency and Elon Musk's Fortune

In conclusion, determining the precise impact of Donald Trump's first 100 days on Elon Musk's wealth is a complex undertaking. While the tax cuts likely contributed positively to Tesla's profitability, the effects of trade policies and broader market trends were more nuanced and varied. Media coverage played a significant role in shaping investor sentiment, further influencing Musk's net worth. Analyzing these intertwined factors reveals a complex relationship, where the effects are not easily isolated. Further research into the long-term consequences of Trump's policies on Tesla, SpaceX, and other comparable companies is warranted. We encourage you to explore related resources and continue the discussion on how Donald Trump's policies affected Elon Musk's wealth, and consider the broader implications of political decisions on the business world.

Featured Posts

-

Vstrecha Zelenskogo I Trampa Makron Raskryvaet Rezultaty Peregovorov V Vatikane

May 09, 2025

Vstrecha Zelenskogo I Trampa Makron Raskryvaet Rezultaty Peregovorov V Vatikane

May 09, 2025 -

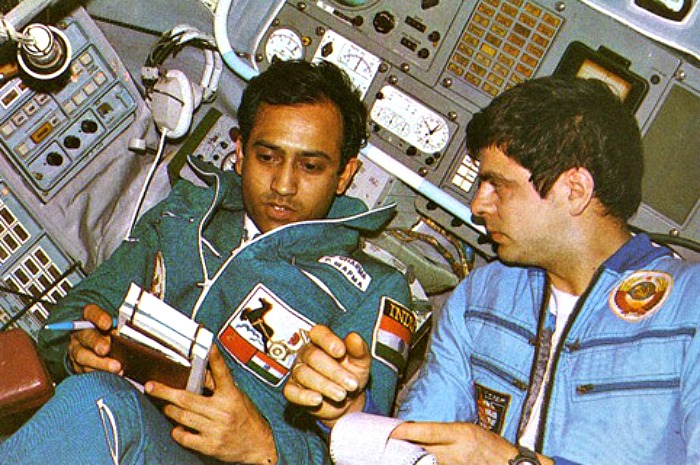

Where Is Rakesh Sharma Now Indias First Astronauts Life After Space

May 09, 2025

Where Is Rakesh Sharma Now Indias First Astronauts Life After Space

May 09, 2025 -

Elon Musks Financial Empire From Pay Pal To Space X And Tesla

May 09, 2025

Elon Musks Financial Empire From Pay Pal To Space X And Tesla

May 09, 2025 -

Best Show To Watch Instead Of Roman Fate Season 2 Spoiler Free Streaming Option

May 09, 2025

Best Show To Watch Instead Of Roman Fate Season 2 Spoiler Free Streaming Option

May 09, 2025 -

Doohans F1 Future Palmers Insights Following Alpines Reserve Driver Change

May 09, 2025

Doohans F1 Future Palmers Insights Following Alpines Reserve Driver Change

May 09, 2025

Latest Posts

-

Increased Eu Response To Us Tariffs A French Ministers Plea

May 09, 2025

Increased Eu Response To Us Tariffs A French Ministers Plea

May 09, 2025 -

Further Eu Action Needed On Us Tariffs Says French Minister

May 09, 2025

Further Eu Action Needed On Us Tariffs Says French Minister

May 09, 2025 -

A French Ministers Call For Increased European Nuclear Cooperation

May 09, 2025

A French Ministers Call For Increased European Nuclear Cooperation

May 09, 2025 -

French Minister Highlights Importance Of Shared Nuclear Power For Europe

May 09, 2025

French Minister Highlights Importance Of Shared Nuclear Power For Europe

May 09, 2025 -

French Minister Demands Further Eu Action Against Us Tariffs

May 09, 2025

French Minister Demands Further Eu Action Against Us Tariffs

May 09, 2025