How Lack Of Funds Impacts Your Goals And What To Do

Table of Contents

The Ripple Effect of Insufficient Funds on Goal Achievement

Lack of funds doesn't just mean you can't afford something today; it creates a ripple effect that impacts your future significantly. The consequences extend far beyond a simple inability to purchase a desired item.

Delayed Gratification and Lost Opportunities

Limited finances often lead to postponed gratification, pushing significant life goals further into the future. This delay can have profound consequences.

- Educational pursuits: Delaying higher education can limit future earning potential and career opportunities.

- Homeownership: Insufficient funds can prevent you from purchasing a home, potentially leading to increased rent costs and missed opportunities for building equity.

- Business ventures: A lack of start-up capital can stifle entrepreneurial dreams before they even begin, potentially missing out on lucrative business opportunities.

- Investment opportunities: Missing out on key investment windows due to insufficient funds can significantly reduce long-term wealth accumulation.

Statistics show a strong correlation between financial insecurity and difficulty achieving life goals. A recent study by [insert credible source and statistics here] found that [insert specific statistic highlighting the impact of financial constraints on goal achievement]. These lost opportunities represent not only financial setbacks but also missed personal milestones.

Increased Stress and Mental Health Impact

The constant worry about finances and the inability to achieve desired goals creates significant stress, impacting mental and physical well-being.

- Increased anxiety and depression: The pressure of financial strain can lead to overwhelming anxiety and depression, affecting daily life and relationships.

- Strained relationships: Financial struggles often put a strain on personal relationships, leading to conflict and resentment.

- Compromised overall well-being: Chronic stress from financial insecurity weakens the immune system and increases the risk of various health problems.

As Dr. [Name of financial advisor or therapist], a leading expert in financial psychology, states: “[Insert quote about the mental health consequences of financial stress].” Addressing financial challenges is crucial not only for financial security but also for mental and emotional well-being.

Identifying Your Financial Gaps and Setting Realistic Goals

The first step to overcoming financial constraints is gaining a clear understanding of your current financial situation and setting realistic, achievable goals.

Honest Financial Assessment

Creating a realistic budget is paramount. This involves honestly tracking your income and expenses to identify areas where you can save or reduce spending.

- Use budgeting apps: Apps like Mint, YNAB (You Need A Budget), and Personal Capital can automate the process and provide insightful visualizations of your spending habits.

- Categorize your expenses: Divide your spending into essential (housing, food, utilities) and non-essential categories (entertainment, dining out) to identify areas for potential savings.

- Track your spending meticulously: Keep accurate records of every transaction, whether it’s a large purchase or a small coffee.

Prioritizing Goals and Creating a Financial Plan

Once you have a clear picture of your finances, prioritize your goals based on their importance and urgency. Use the SMART goal-setting framework:

- Specific: Clearly define your goal. Instead of "save money," aim for "save $10,000 for a down payment within two years."

- Measurable: Track your progress regularly.

- Achievable: Ensure your goals are realistic given your current financial situation.

- Relevant: Make sure your goals align with your overall life plan and values.

- Time-bound: Set a deadline for achieving your goals.

For instance, paying off high-interest debt might be a higher priority than saving for a vacation. Creating a step-by-step financial plan that outlines how you’ll reach each goal is vital.

Strategies to Overcome Financial Constraints and Achieve Your Goals

Overcoming financial constraints requires a multifaceted approach that combines securing funds with responsible financial management.

Exploring Funding Options

Several options exist to secure the funds needed to achieve your goals:

- Savings plans: Regularly contributing to savings accounts and high-yield savings accounts is crucial.

- Loans: Personal loans, student loans, and business loans can provide immediate access to funds but come with interest payments.

- Grants: Explore government grants or non-profit grants related to your goals (education, business, etc.).

- Crowdfunding: Platforms like Kickstarter and GoFundMe allow you to raise funds from a large pool of individuals.

- Investments: Investing in stocks, bonds, or real estate can generate returns over time, but involves risk.

Each option has its own pros and cons; careful consideration is needed before making a decision.

Building Good Financial Habits

Responsible financial management is essential for long-term goal achievement.

- Save consistently: Aim to save a certain percentage of your income each month, regardless of how small it may seem.

- Reduce unnecessary expenses: Identify areas where you can cut back on spending without compromising your well-being.

- Avoid unnecessary debt: High-interest debt can significantly hinder your progress towards financial goals.

- Invest wisely: Learn about different investment options and choose strategies that align with your risk tolerance and financial goals.

Seeking Professional Financial Advice

Consulting a financial advisor can provide personalized guidance and support.

- Tailored financial plan: A financial advisor can create a customized plan to help you achieve your goals.

- Debt management strategies: They can help you develop effective strategies to manage and reduce your debt.

- Investment guidance: They can advise you on investment options that align with your risk tolerance and financial goals.

Finding a reputable financial advisor is crucial. Resources like the [insert relevant financial planning association or website] can help you find qualified professionals in your area.

Conclusion

Lack of funds significantly impacts the ability to achieve personal and professional goals, creating a ripple effect that extends beyond simple financial limitations to affect mental and emotional well-being. By honestly assessing your finances, creating a realistic budget, setting SMART goals, exploring diverse funding options, building responsible financial habits, and seeking professional guidance where needed, you can effectively manage financial constraints and make significant progress toward achieving your aspirations. Start planning your financial future today by creating a realistic budget and exploring funding options. Overcoming a lack of funds is achievable with careful planning, determination, and effective management of your finances.

Featured Posts

-

Experience The Manhattan Forgotten Foods Festival A Culinary Journey

May 22, 2025

Experience The Manhattan Forgotten Foods Festival A Culinary Journey

May 22, 2025 -

Betalbaarheid Woningen Nederland Analyse Geen Stijl En Abn Amro Rapport

May 22, 2025

Betalbaarheid Woningen Nederland Analyse Geen Stijl En Abn Amro Rapport

May 22, 2025 -

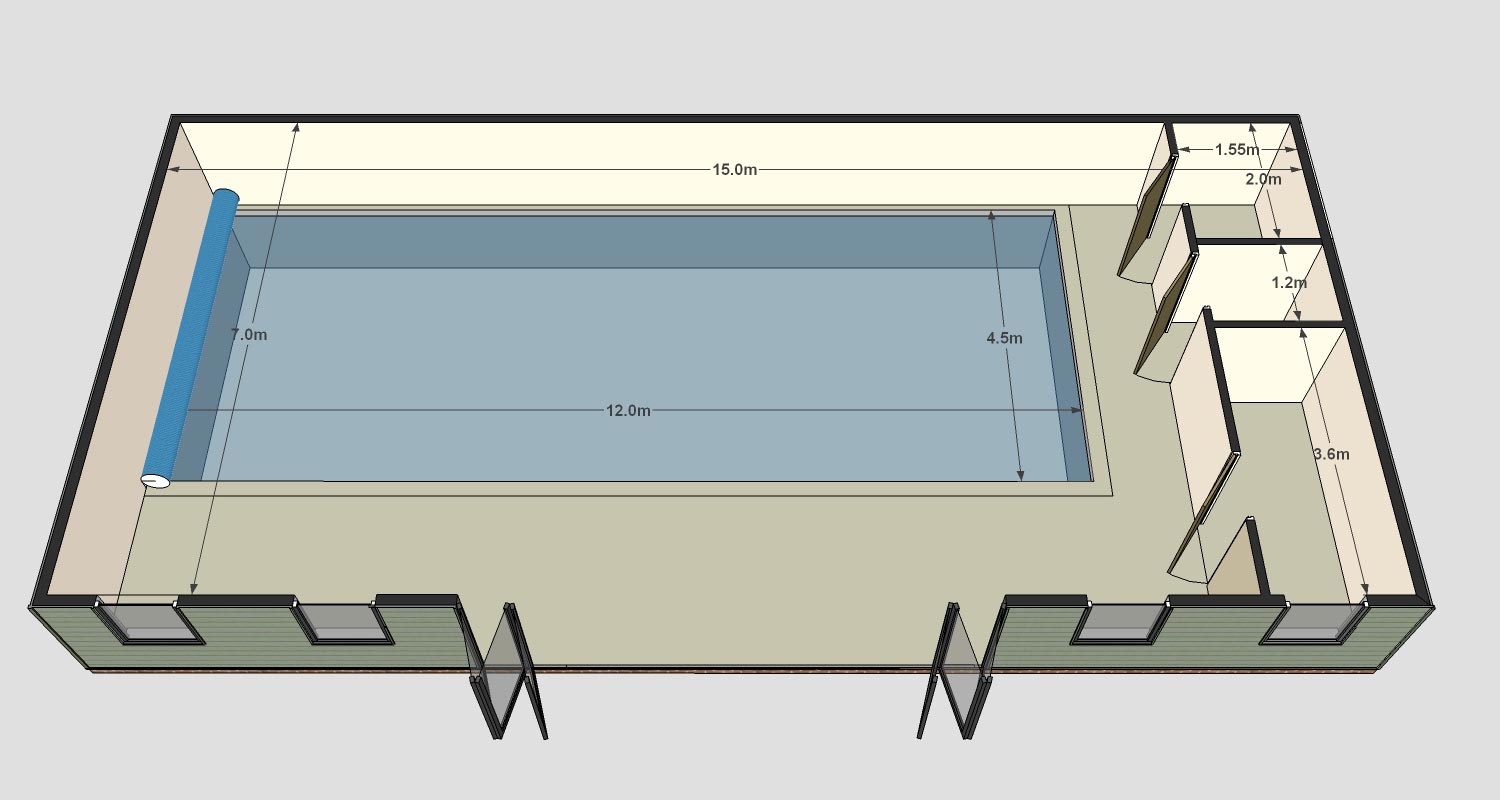

Nice Unveils Plans For New Olympic Sized Swimming Pool Complex

May 22, 2025

Nice Unveils Plans For New Olympic Sized Swimming Pool Complex

May 22, 2025 -

Liverpool Raih Liga Inggris 2024 2025 Analisis Peran Pelatih

May 22, 2025

Liverpool Raih Liga Inggris 2024 2025 Analisis Peran Pelatih

May 22, 2025 -

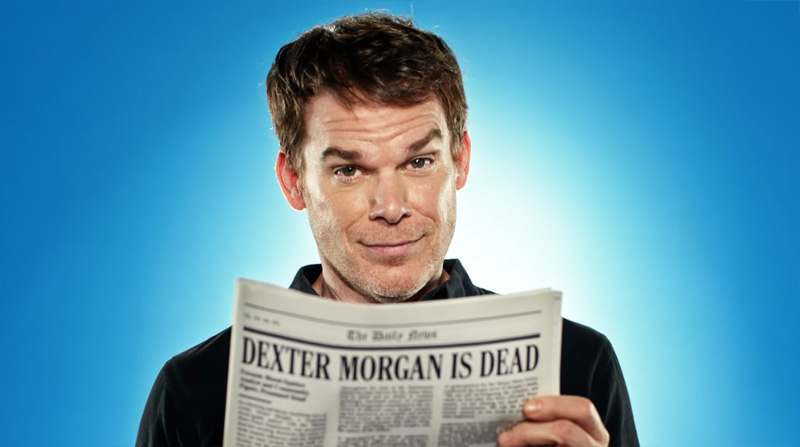

Die Rueckkehr Von Lithgow Und Smits In Dexter Resurrection

May 22, 2025

Die Rueckkehr Von Lithgow Und Smits In Dexter Resurrection

May 22, 2025

Latest Posts

-

Remont Pivdennogo Mostu Pidryadniki Termini Ta Byudzhet

May 22, 2025

Remont Pivdennogo Mostu Pidryadniki Termini Ta Byudzhet

May 22, 2025 -

Pivdenniy Mist Analiz Remontno Budivelnikh Robit

May 22, 2025

Pivdenniy Mist Analiz Remontno Budivelnikh Robit

May 22, 2025 -

Pivdenniy Mist Detali Remontu Pidryadniki Ta Finansuvannya

May 22, 2025

Pivdenniy Mist Detali Remontu Pidryadniki Ta Finansuvannya

May 22, 2025 -

Leiderschap Bij Abn Amro Florius En Moneyou Karin Polman Benoemd Als Directeur Hypotheken

May 22, 2025

Leiderschap Bij Abn Amro Florius En Moneyou Karin Polman Benoemd Als Directeur Hypotheken

May 22, 2025 -

Uw Gids Voor Het Verkoopprogramma Van Abn Amro Kamerbrief Certificaten

May 22, 2025

Uw Gids Voor Het Verkoopprogramma Van Abn Amro Kamerbrief Certificaten

May 22, 2025