How Tariff Hikes Impact The Bond Market

Table of Contents

Tariff hikes, a potent tool in international trade policy, send ripples throughout the global economy. One area significantly affected is the bond market. This article explores the multifaceted ways increased tariffs influence bond yields, investor behavior, and overall market stability. We'll delve into how these policy changes impact interest rates, inflation expectations, and ultimately, your investment portfolio.

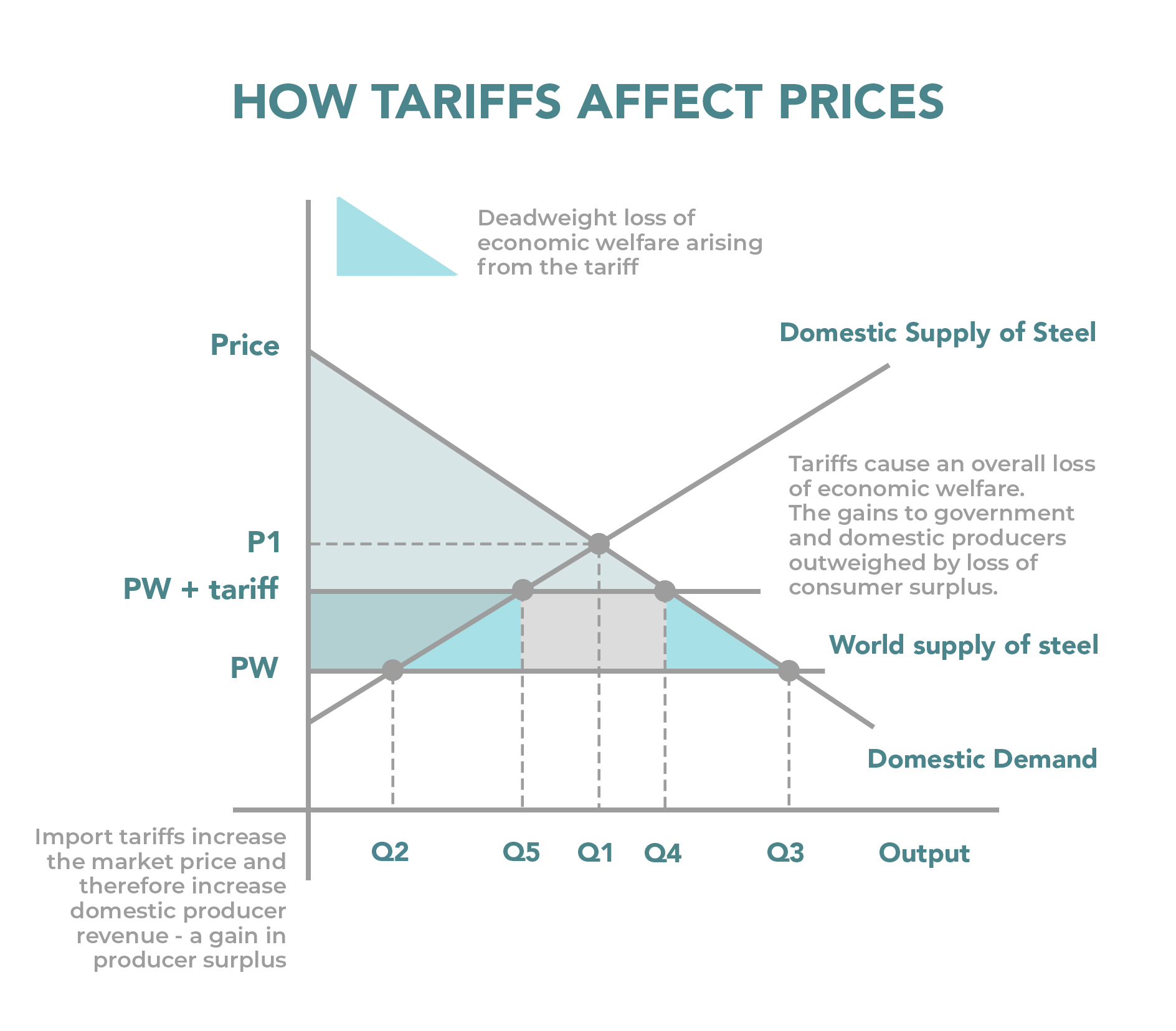

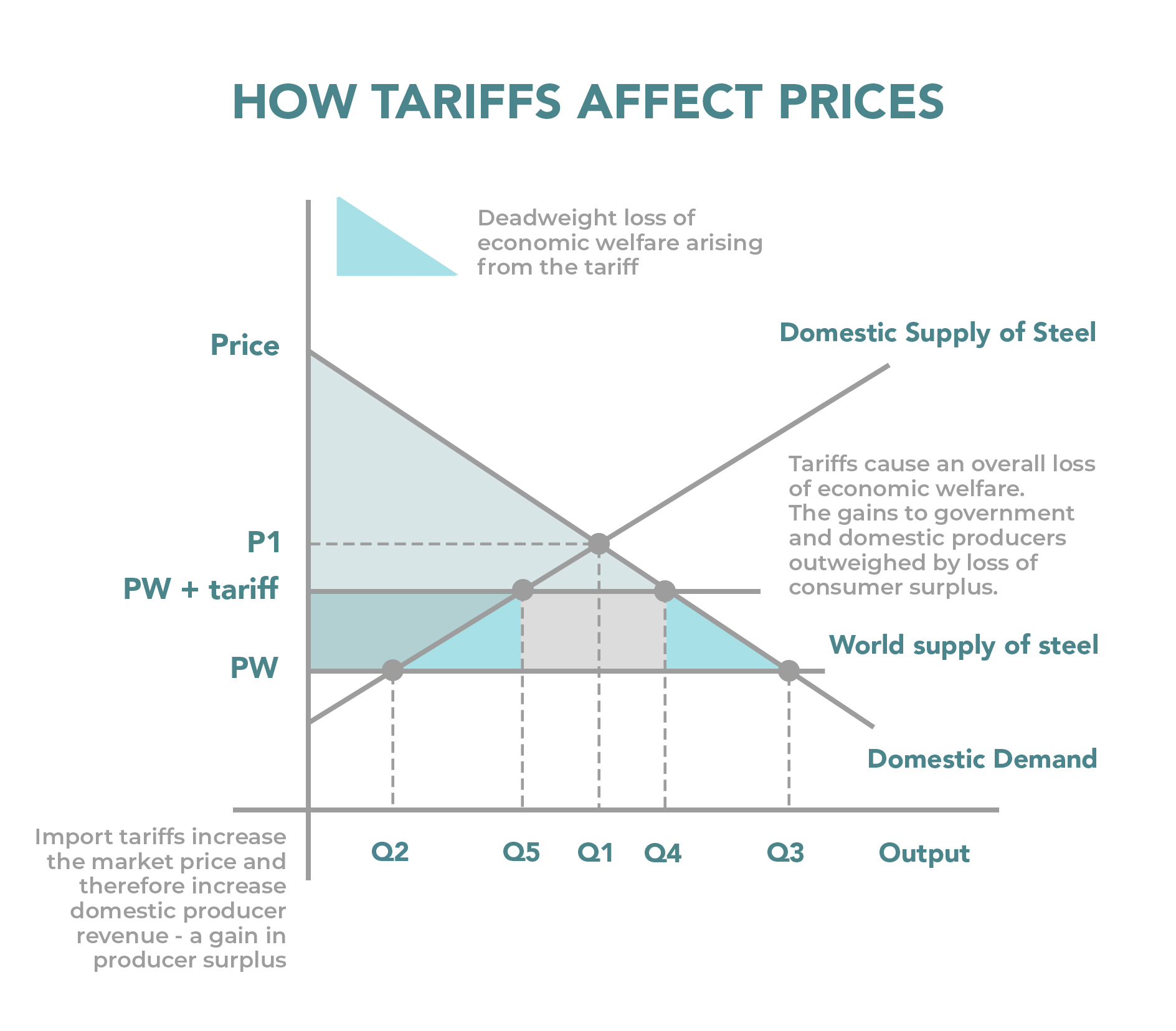

Inflationary Pressures and Bond Yields

Tariff hikes directly increase the cost of imported goods, fueling inflation. This section examines how this inflationary pressure affects bond yields and investor sentiment.

Increased Costs and Consumer Prices

Increased tariffs translate to higher prices for consumers. This is because:

- Reduced consumer spending power: Higher prices for goods reduce disposable income, impacting consumer spending and overall economic growth.

- Increased production costs for businesses relying on imports: Businesses that rely on imported materials face higher production costs, potentially leading to price increases for their products.

- Potential for a wage-price spiral: If businesses pass increased costs onto consumers through higher prices, workers may demand higher wages to maintain their purchasing power, creating a cycle of rising wages and prices.

The Impact on Central Bank Policy

Central banks often respond to rising inflation by tightening monetary policy. This typically involves:

- Higher interest rates make bonds less attractive compared to higher-yielding alternatives: Increased interest rates make bonds less competitive compared to other investments offering higher returns.

- Increased demand for government bonds as a safe haven: During times of uncertainty, investors often flock to government bonds, considered a safe haven asset, driving up demand and potentially pushing prices higher.

- Potential for yield curve inversion: A yield curve inversion, where short-term yields exceed long-term yields, can be a warning sign of an impending recession, further impacting bond market performance.

Shifting Investor Sentiment

Inflationary pressures cause investors to re-evaluate the risk-return profile of their bond holdings. This leads to:

- Flight to safety into government bonds: Investors seeking safety may shift from riskier assets to government bonds perceived as less vulnerable to inflation.

- Reduced demand for corporate bonds due to increased risk: Higher inflation increases the risk of corporate defaults, leading to decreased demand for corporate bonds.

- Potential for bond price volatility: As investor sentiment shifts, bond prices can become more volatile, presenting both risks and opportunities for investors.

Economic Growth and Bond Market Performance

Tariff disputes can disrupt global trade, impacting economic growth and the bond market. Let's explore the interconnections.

Slowdown in Economic Activity

Trade wars and tariff disputes create uncertainty that can significantly hamper economic growth:

- Reduced business investment due to uncertainty: Businesses may postpone investment decisions due to uncertainty about future trade policies.

- Decreased consumer confidence: Rising prices and economic uncertainty can decrease consumer confidence, leading to reduced spending.

- Potential for a recession: In severe cases, prolonged trade disputes and economic uncertainty can lead to a recession.

Impact on Corporate Bond Yields

Slower economic growth increases the risk of corporate defaults, affecting corporate bond yields:

- Increased demand for safer government bonds: Investors may shift to safer government bonds, reducing the demand for corporate bonds.

- Reduced demand for riskier corporate bonds: The risk of default increases, leading investors to demand higher yields on corporate bonds to compensate for the added risk.

- Potential for credit rating downgrades: Credit rating agencies may downgrade the ratings of corporations facing financial distress due to the economic slowdown, further impacting bond yields.

Government Borrowing and Bond Supply

Governments may increase borrowing to stimulate the economy or address budget shortfalls resulting from trade disputes. This impacts the bond market:

- Increased government debt: Increased government borrowing leads to a larger supply of government bonds.

- Potential for higher bond yields due to increased supply: A larger supply of bonds can push bond yields higher, all else being equal.

- Impact on the yield curve: Changes in government borrowing can affect the shape and slope of the yield curve.

Navigating the Bond Market During Tariff Hikes

This section offers strategies for navigating the bond market amidst tariff uncertainties.

Diversification Strategies

Diversification is key to mitigating risks associated with tariff hikes:

- Consider investing in inflation-protected securities (TIPS): TIPS are designed to protect investors from inflation.

- Diversify across government and corporate bonds: Don't put all your eggs in one basket. Diversify your holdings across different issuers and types of bonds.

- Adjust your portfolio based on your risk tolerance and investment horizon: Tailor your investment strategy to your specific financial goals and risk tolerance.

Active vs. Passive Management

Choosing between active and passive management depends on your investment approach:

- Active management can involve adjusting your bond holdings based on market predictions: Active managers try to outperform the market by anticipating changes and making timely adjustments to their portfolio.

- Passive management involves holding a diversified portfolio without frequent adjustments: Passive strategies aim to match the return of a specific market index.

Consult with a Financial Advisor

Seeking professional financial advice is highly recommended:

- Personalized investment recommendations based on your financial goals: A financial advisor will help you create a portfolio tailored to your needs.

- Guidance on navigating market volatility: They can provide insights and strategies to manage risk during uncertain times.

- Assistance with portfolio diversification and risk management: They offer expertise in constructing a well-diversified portfolio and managing risk effectively.

Conclusion

Tariff hikes pose significant challenges to bond market investors. Understanding their influence on inflation, economic growth, and investor sentiment is critical for making sound investment decisions. By diversifying your portfolio, using appropriate management strategies (active or passive), and seeking professional guidance, you can effectively manage your bond investments during periods of tariff uncertainty. Stay informed about trade policy changes to proactively manage your bond portfolio and mitigate the effects of tariff hikes. Learn more about how tariff hikes impact the bond market by researching current economic data and consulting with a financial advisor.

Featured Posts

-

Carrie And The Creatures Boris Johnsons Animal Related Controversies

May 12, 2025

Carrie And The Creatures Boris Johnsons Animal Related Controversies

May 12, 2025 -

Foreign Airlines Acquire West Jet Stake Onex Investment Fully Recovered

May 12, 2025

Foreign Airlines Acquire West Jet Stake Onex Investment Fully Recovered

May 12, 2025 -

10 Year Agreement A New Era Of Collaboration Between Ottawa And Indigenous Capital Group

May 12, 2025

10 Year Agreement A New Era Of Collaboration Between Ottawa And Indigenous Capital Group

May 12, 2025 -

Mundial De Karate Full Contact Equipo Uruguayo Solicita Apoyo

May 12, 2025

Mundial De Karate Full Contact Equipo Uruguayo Solicita Apoyo

May 12, 2025 -

Ksiaze Andrzej I Masazystka Szczegoly Kontrowersyjnego Zabiegu

May 12, 2025

Ksiaze Andrzej I Masazystka Szczegoly Kontrowersyjnego Zabiegu

May 12, 2025

Latest Posts

-

Bombendrohung Entwarnung Nach Erneuter Evakuierung Braunschweiger Grundschule

May 13, 2025

Bombendrohung Entwarnung Nach Erneuter Evakuierung Braunschweiger Grundschule

May 13, 2025 -

Braunschweiger Grundschule Entwarnung Nach Erneuten Schulalarm

May 13, 2025

Braunschweiger Grundschule Entwarnung Nach Erneuten Schulalarm

May 13, 2025 -

Sabalenkas Miami Open Win A Dominant Performance Against Pegula

May 13, 2025

Sabalenkas Miami Open Win A Dominant Performance Against Pegula

May 13, 2025 -

Aryna Sabalenka Wins Through To Italian Open Round Of 32

May 13, 2025

Aryna Sabalenka Wins Through To Italian Open Round Of 32

May 13, 2025 -

Italian Open Sabalenka Through To Round Of 32

May 13, 2025

Italian Open Sabalenka Through To Round Of 32

May 13, 2025