How To Interpret A Proxy Statement (Form DEF 14A) Effectively

Table of Contents

Understanding the Key Sections of a DEF 14A

The DEF 14A, or proxy statement, is a formal document that companies send to their shareholders before a shareholder meeting. It outlines proposals for votes, including elections of directors, executive compensation plans, and shareholder resolutions. Let's break down the key sections:

The Company's Narrative and Business Overview

This section provides a snapshot of the company's current state and future direction. It's crucial to carefully review the company's description of its business, recent performance, and future plans. This context is vital for understanding the proposals outlined later in the document. Look for key metrics such as:

- Revenue growth: Year-over-year and quarter-over-quarter comparisons.

- Profitability: Net income, operating margins, and return on equity (ROE).

- Market share: The company's position within its industry.

- Key risks and challenges: Potential obstacles to future growth and profitability.

By understanding the company's narrative, you can better assess the rationale behind the proposals presented in the proxy statement and evaluate their potential impact on the company's future performance.

Executive Compensation and Director Compensation

Analyzing executive and director compensation packages is crucial for assessing corporate governance and potential conflicts of interest. This section usually includes details on:

- Salaries: Base compensation for executives and directors.

- Bonuses: Performance-based incentives.

- Stock options: Grants of the right to purchase company stock at a predetermined price.

- Other compensation: Benefits, perks, and other forms of remuneration.

To effectively evaluate compensation, compare it to industry benchmarks and analyze its correlation with company performance. Look for excessive payouts unrelated to company success, which may indicate poor governance. Key metrics to consider include:

- Compensation ratio: The ratio of CEO pay to the median worker's pay.

- Performance-based pay: The percentage of compensation tied to performance metrics.

- Stock option grants: The number and value of stock options granted.

Identifying potential misalignments between executive compensation and shareholder value is a vital step in interpreting the proxy statement.

Shareholder Proposals

This section details proposals submitted by shareholders for consideration at the upcoming meeting. These proposals cover a wide range of topics, including:

- Social responsibility: Environmental, social, and governance (ESG) issues.

- Corporate governance: Board composition, executive compensation, and shareholder rights.

- Strategic initiatives: Mergers and acquisitions, divestitures, and other strategic decisions.

Understanding the arguments for and against each proposal is crucial for making an informed voting decision. Pay close attention to the company's response to each proposal, as it often provides valuable insight into management's priorities and strategic thinking. Examples of common shareholder proposal topics include:

- Climate change initiatives

- Diversity and inclusion policies

- Political contributions

Election of Directors

This section outlines the process for electing members to the company's board of directors. For each nominee, the proxy statement will provide biographical information, including:

- Background and experience: Professional history and relevant expertise.

- Qualifications: Skills and experience relevant to the board's responsibilities.

- Committees: Board committees to which the nominee is assigned (e.g., audit, compensation, nominating).

Thoroughly reviewing this information is crucial for assessing the independence and qualifications of the board members. Look for potential conflicts of interest and ensure the board possesses the necessary diversity of skills and experience to effectively oversee the company.

Analyzing the Information Critically: Advanced Techniques for Interpreting a Proxy Statement

Interpreting a proxy statement goes beyond simply reading the information; it involves critical analysis and comparison.

Identifying Potential Conflicts of Interest

Scrutinize the relationships between directors, executives, and significant shareholders. Look for any transactions that may benefit certain individuals at the expense of other shareholders.

Comparing Compensation to Industry Benchmarks

Utilize online resources such as compensation databases and industry reports to compare executive compensation to that of peer companies. This provides context and helps determine if compensation is reasonable.

Understanding Voting Procedures and Deadlines

Familiarize yourself with the voting process and deadlines for submitting your vote. Understanding how to vote and by when is critical to participating in corporate governance.

Utilizing Online Resources

Several websites offer helpful resources and tools for researching companies and interpreting proxy statements. Examples include the SEC's EDGAR database and financial news websites.

Conclusion: Making Informed Decisions with Proxy Statements

Effectively interpreting a proxy statement (Form DEF 14A) involves understanding its key sections, analyzing the information critically, and utilizing available resources. By actively engaging with this crucial document, you can make more informed investment decisions and participate effectively in corporate governance. Master the art of interpreting proxy statements (Form DEF 14A) today! Become a savvy investor by effectively interpreting your next proxy statement and influencing the direction of the companies in which you invest.

Featured Posts

-

Angel Reeses New Reebok Collection A Look At Ss 25

May 17, 2025

Angel Reeses New Reebok Collection A Look At Ss 25

May 17, 2025 -

Should You Invest In Uber Technologies Uber A Comprehensive Guide

May 17, 2025

Should You Invest In Uber Technologies Uber A Comprehensive Guide

May 17, 2025 -

Rare Earth Minerals Fueling A New Geopolitical Cold War

May 17, 2025

Rare Earth Minerals Fueling A New Geopolitical Cold War

May 17, 2025 -

Djokovic Va Alcaraz Chung Nhanh Ban Ket Miami Open 2025

May 17, 2025

Djokovic Va Alcaraz Chung Nhanh Ban Ket Miami Open 2025

May 17, 2025 -

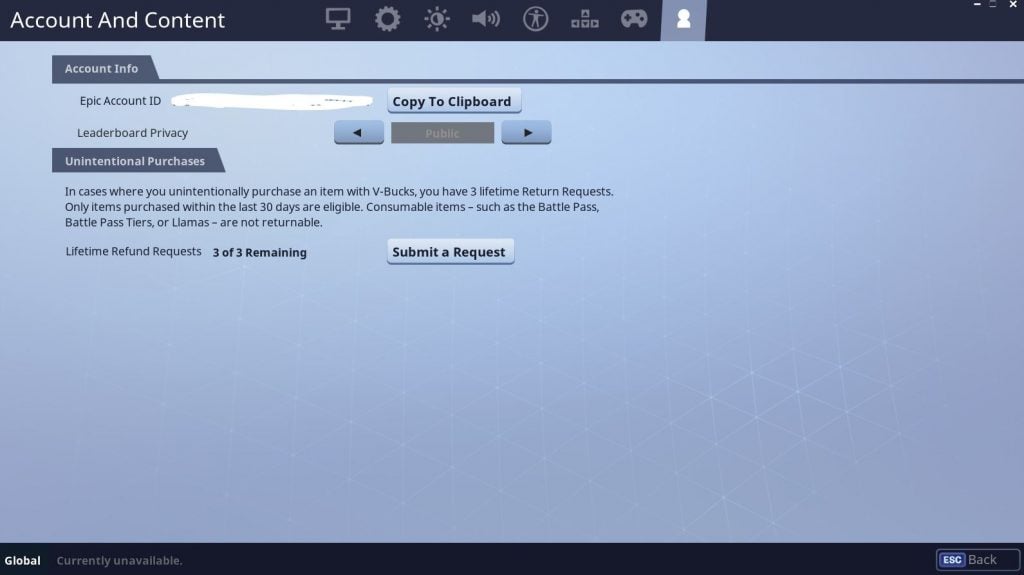

Fortnite Refund Indicates Possible Changes To In Game Cosmetics

May 17, 2025

Fortnite Refund Indicates Possible Changes To In Game Cosmetics

May 17, 2025