How To (Not) Become A Billionaire Boy: Lessons From The Ultra-Rich

Table of Contents

The Perils of Entitlement and Lack of Drive

A sense of entitlement is perhaps the most significant threat to those inheriting substantial wealth. Growing up with unlimited resources can foster a lack of drive and an inability to appreciate the value of hard work and financial responsibility. This can lead to reckless spending, poor investment choices, and ultimately, the erosion of the family fortune.

- Examples of Failure: History is rife with examples of "trust fund kids" who squandered their inheritances on lavish lifestyles, failing to grasp the responsibility that comes with such privilege. Many end up bankrupt and deeply unhappy, despite their initial advantages.

- Cultivating a Strong Work Ethic: Regardless of your financial background, developing a robust work ethic is paramount. It fosters self-respect, provides a sense of accomplishment, and instills the crucial discipline needed for successful wealth management. Even billionaires who built their own empires often emphasize the importance of hard work.

- Beyond Inheritance: Relying solely on inherited wealth without pursuing personal goals and ambitions is a recipe for disaster. Finding purpose and passion outside of the financial realm is essential for long-term happiness and fulfillment. True financial independence requires more than just a large bank account.

The Importance of Financial Literacy and Smart Investment

Understanding personal finance and developing sophisticated investment strategies are non-negotiable for anyone inheriting significant wealth. Without this knowledge, even the largest fortune can be quickly depleted.

- Professional Guidance: Engaging a qualified financial advisor is crucial. These professionals provide expert guidance on wealth preservation, growth, and risk management, helping to navigate the complexities of the financial world.

- Diversification is Key: Diversifying investments across different asset classes (stocks, bonds, real estate, etc.) is vital to mitigate risk. Putting all your eggs in one basket is a recipe for financial disaster, even for those with vast resources.

- Long-Term Vision: Focus on long-term investment strategies rather than get-rich-quick schemes. Sustainable wealth building takes time and patience, requiring a disciplined and strategic approach. Avoid high-risk ventures that promise unrealistic returns.

Avoiding the Traps of Excessive Spending and Impulsive Purchases

Lavish spending and impulsive purchases are major threats to anyone, but particularly devastating for those with substantial wealth. The ability to control spending habits is crucial for long-term financial security.

- Understanding Spending Psychology: Understanding the psychological aspects of spending is crucial. Impulse control techniques, mindful spending habits, and an awareness of emotional triggers are vital for responsible wealth management.

- Budgeting and Financial Planning: Implementing a comprehensive budget and financial plan is essential. This involves setting clear financial goals, tracking expenses, and strategically allocating resources.

- Sticking to Goals: Set realistic financial goals and stick to them. Avoid lifestyle inflation, which is the tendency to increase spending as income rises. Remember, responsible spending is crucial for preserving your wealth and achieving your long-term aspirations.

The Value of Philanthropy and Giving Back

Philanthropy is not merely a charitable act; it offers significant personal and societal benefits. Engaging in charitable giving can enrich one's life while contributing to positive social change.

- Positive Examples: Countless ultra-rich individuals have used their wealth to make a profound impact on the world. Their legacies are built not just on financial success but also on their contributions to society.

- Psychological Rewards: The psychological rewards of philanthropy are substantial. Giving back provides a deep sense of purpose, fulfillment, and connection to the community.

- Strategic Giving: Develop a strategic approach to charitable giving to maximize your impact. Research worthy causes and align your giving with your values and passions.

Securing Your Future – Beyond the "Billionaire Boy" Stereotype

Avoiding entitlement, cultivating financial literacy, practicing responsible spending, and engaging in philanthropy are all crucial for those inheriting significant wealth. Escaping the pitfalls of the "Billionaire Boy" stereotype requires proactive steps and a long-term perspective. Becoming a responsible steward of wealth involves more than just managing money; it's about building a legacy of purpose and lasting impact. To avoid the common mistakes associated with inherited wealth, learn more about wealth management, financial planning, and responsible investment strategies. Don't let the "Billionaire Boy" label define you; instead, build a secure and fulfilling financial future. Take control of your wealth and create a legacy that extends far beyond mere financial success.

Featured Posts

-

Protomagia Sto Oropedio Evdomos Idees Gia Ekdromi

May 21, 2025

Protomagia Sto Oropedio Evdomos Idees Gia Ekdromi

May 21, 2025 -

Mntkhb Amryka Thlathy Jdyd Fy Qaymt Bwtshytynw

May 21, 2025

Mntkhb Amryka Thlathy Jdyd Fy Qaymt Bwtshytynw

May 21, 2025 -

Record Breaking Run Man Achieves Fastest Australian Foot Crossing

May 21, 2025

Record Breaking Run Man Achieves Fastest Australian Foot Crossing

May 21, 2025 -

A Practical Guide To A Screen Free Week For Families

May 21, 2025

A Practical Guide To A Screen Free Week For Families

May 21, 2025 -

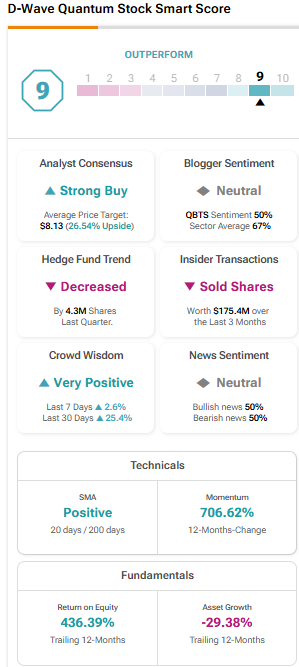

Recent Developments Driving D Wave Quantum Qbts Stock Higher

May 21, 2025

Recent Developments Driving D Wave Quantum Qbts Stock Higher

May 21, 2025

Latest Posts

-

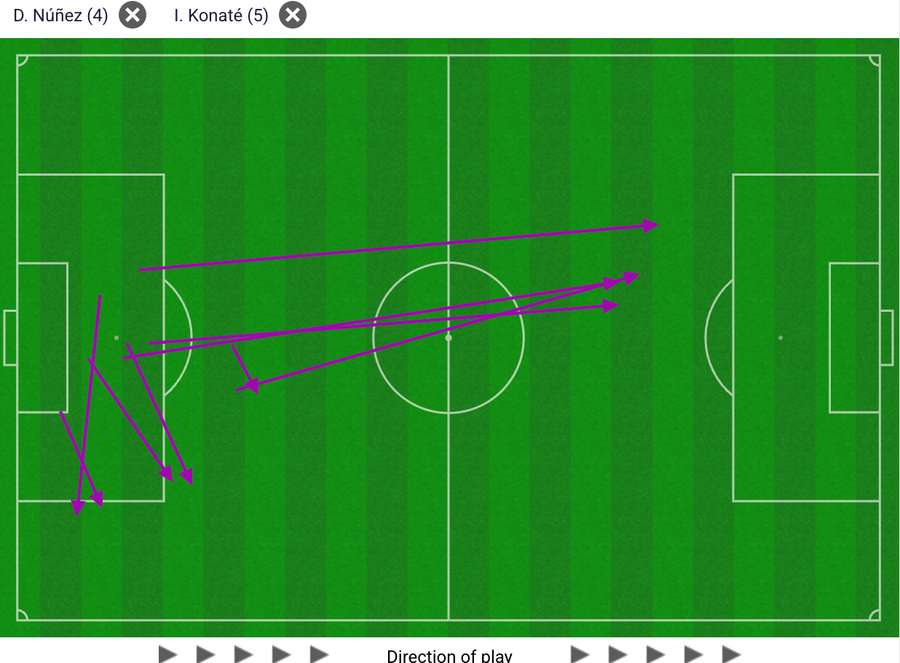

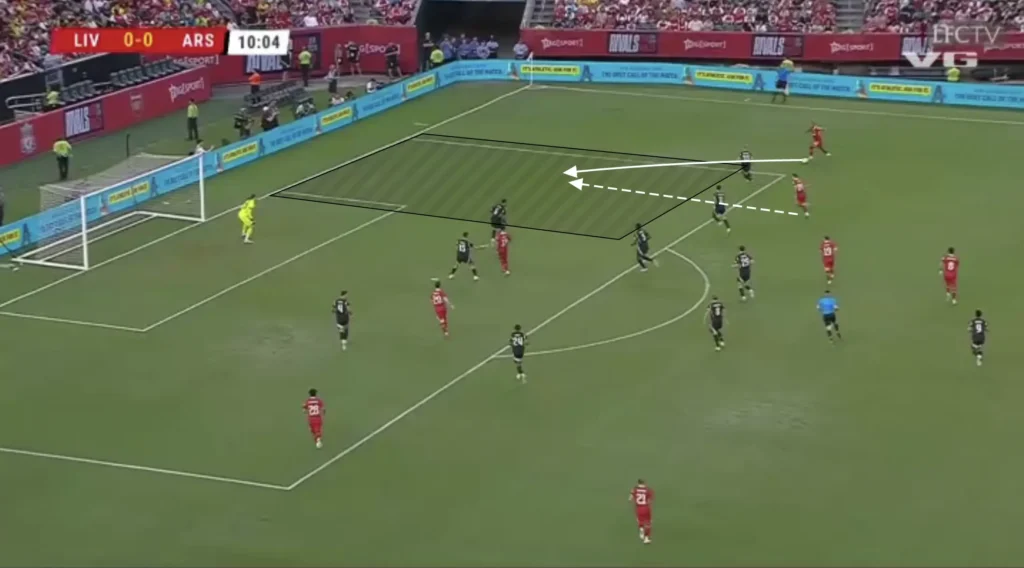

Analyzing Liverpools Win Against Psg Arne Slots View On Alisson Beckers Performance

May 22, 2025

Analyzing Liverpools Win Against Psg Arne Slots View On Alisson Beckers Performance

May 22, 2025 -

Arne Slot On Liverpools Victory Over Psg Alisson Beckers Crucial Role

May 22, 2025

Arne Slot On Liverpools Victory Over Psg Alisson Beckers Crucial Role

May 22, 2025 -

Was Liverpool Lucky To Beat Psg Arne Slots Perspective On Alisson Becker

May 22, 2025

Was Liverpool Lucky To Beat Psg Arne Slots Perspective On Alisson Becker

May 22, 2025 -

Arne Slot Liverpools Lucky Win Against Psg And The Worlds Best Goalkeeper

May 22, 2025

Arne Slot Liverpools Lucky Win Against Psg And The Worlds Best Goalkeeper

May 22, 2025 -

1 1

May 22, 2025

1 1

May 22, 2025