How Will QBTS Earnings Impact Stock Performance?

Table of Contents

<p><strong>Meta Description:</strong> Analyze the potential impact of QBTS earnings reports on its stock price. Learn how to interpret financial results and predict future stock movements. Discover key metrics and factors influencing QBTS's market performance.</p>

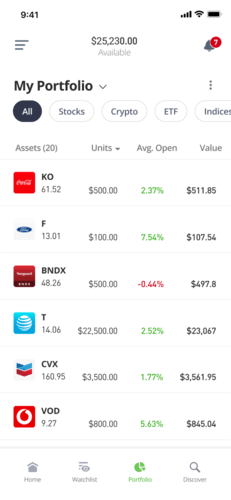

<p>Quarterly earnings reports are crucial events for publicly traded companies like QBTS. These reports provide insights into the company's financial health and future prospects, directly influencing investor sentiment and, consequently, the stock price. This article explores how upcoming and past QBTS earnings announcements are likely to affect its stock performance, examining key metrics and market factors. Understanding how QBTS earnings impact stock performance is key to successful investing.</p>

<h2>Understanding QBTS's Business Model and Key Performance Indicators (KPIs)</h2>

<p>To understand how QBTS earnings impact its stock price, we must first grasp its core business operations. [Insert a brief, clear explanation of QBTS's business model here – e.g., "QBTS is a technology company specializing in [specific area], targeting the [target market] segment."]. Their revenue streams primarily come from [explain QBTS's revenue sources, e.g., software licenses, subscription fees, advertising revenue].</p>

<p>Investors closely monitor several key performance indicators (KPIs) to gauge QBTS's financial health and growth potential. These include:</p>

<ul> <li><strong>Revenue Growth (YoY and QoQ):</strong> Year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth rates indicate the company's ability to expand its sales and market share.</li> <li><strong>EPS (Earnings Per Share):</strong> EPS reflects the company's profitability on a per-share basis, a crucial metric for valuing the stock.</li> <li><strong>Net Income Margin:</strong> This metric shows the percentage of revenue remaining as profit after deducting all expenses. A higher margin generally suggests better operational efficiency.</li> <li><strong>Debt-to-Equity Ratio:</strong> This ratio reveals the company's financial leverage, indicating its reliance on debt financing. A high ratio might signal increased financial risk.</li> <li><strong>Customer Acquisition Cost (CAC):</strong> The cost of acquiring a new customer is vital for understanding the company's growth strategy and profitability.</li> <li><strong>Customer Lifetime Value (CLTV):</strong> This metric measures the total revenue expected from a single customer over their relationship with the company.</li> </ul>

<h2>Analyzing Past QBTS Earnings Reports to Predict Future Trends</h2>

<p>Analyzing QBTS's historical earnings reports offers valuable insights into potential future performance. By examining past trends, we can identify patterns and predict potential outcomes following upcoming earnings announcements.</p>

<p>We need to look at:</p> <ul> <li><strong>Comparison of past quarters' performance:</strong> Identify periods of strong growth versus periods of underperformance. What factors contributed to these variances?</li> <li><strong>Identification of consistent trends or anomalies:</strong> Are there recurring patterns in revenue growth, EPS, or other KPIs? Any significant deviations from these trends warrant closer scrutiny.</li> <li><strong>Correlation between earnings and stock price changes:</strong> How has the market reacted to past earnings surprises (both positive and negative)? This analysis can help anticipate the market's response to future results.</li> </ul> <p>For example, if QBTS consistently exceeds earnings expectations, the stock price might react positively. Conversely, consistently missing expectations could lead to negative price movements. Specific examples from past reports should be included here.</p>

<h2>External Factors Influencing QBTS Stock Performance After Earnings</h2>

<p>Even with strong earnings, external factors can significantly impact QBTS's stock performance. These factors operate independently of the company's internal performance.</p>

<ul> <li><strong>Overall market sentiment:</strong> A positive or negative market outlook can influence investor behavior regardless of QBTS's specific earnings.</li> <li><strong>Competitor performance and announcements:</strong> Strong performance by competitors could overshadow QBTS's positive earnings, while poor performance might boost its stock price relatively.</li> <li><strong>Economic indicators (GDP, inflation, etc.):</strong> Macroeconomic conditions like GDP growth, inflation rates, and interest rates greatly influence investor confidence and stock valuations.</li> <li><strong>Regulatory changes affecting the industry:</strong> New regulations or policy changes within QBTS's industry can significantly affect its operations and profitability.</li> </ul>

<h2>Interpreting QBTS's Earnings Guidance and Management Commentary</h2>

<p>Management's outlook for future quarters, typically included in earnings releases, is crucial. This guidance shapes investor expectations and influences stock price movements. The tone and confidence level expressed by management during conference calls and investor presentations are particularly insightful.</p>

<ul> <li><strong>Analysis of management's tone and confidence level:</strong> Is management optimistic about future growth? Are they cautious or concerned about potential challenges?</li> <li><strong>Focus on key guidance metrics and their implications:</strong> Pay close attention to specific projections for revenue growth, EPS, and other KPIs provided by management.</li> <li><strong>Importance of listening to the Q&A session:</strong> The Q&A portion of earnings calls often reveals valuable information and insights that aren't explicitly stated in the financial statements.</li> </ul>

<h2>Conclusion</h2>

<p>QBTS earnings reports are a critical factor influencing its stock price. Analyzing past performance, considering external market factors, and carefully reviewing management's guidance are all essential for investors trying to predict the impact of future earnings announcements. Understanding key performance indicators and their trends allows for a more informed assessment of the company's prospects. Successfully navigating the complexities of QBTS's stock performance requires a comprehensive understanding of both its internal performance and external market influences.</p>

<p><strong>Call to Action:</strong> Stay informed about upcoming QBTS earnings releases and thoroughly analyze the results to make informed decisions regarding your investment in QBTS stock. Understanding how QBTS earnings impact stock performance is crucial for successful investing.</p>

Featured Posts

-

Tony Hinchcliffes Wwe Segment A Behind The Scenes Look At A Failed Appearance

May 20, 2025

Tony Hinchcliffes Wwe Segment A Behind The Scenes Look At A Failed Appearance

May 20, 2025 -

A Forever Mouse From Logitech A Realistic Expectation

May 20, 2025

A Forever Mouse From Logitech A Realistic Expectation

May 20, 2025 -

Is Gangsta Granny Suitable For Young Readers A Parents Guide

May 20, 2025

Is Gangsta Granny Suitable For Young Readers A Parents Guide

May 20, 2025 -

Journee Internationale Des Droits Des Femmes Echanges A Biarritz

May 20, 2025

Journee Internationale Des Droits Des Femmes Echanges A Biarritz

May 20, 2025 -

Fridays D Wave Quantum Qbts Stock Price Rise A Detailed Look

May 20, 2025

Fridays D Wave Quantum Qbts Stock Price Rise A Detailed Look

May 20, 2025