How Will QBTS Stock Perform After The Next Earnings Announcement?

Table of Contents

Analyzing QBTS's Recent Financial Performance

To predict QBTS stock performance after the next earnings announcement, we need to carefully analyze the company's recent financial performance. This includes examining revenue growth, profitability, and key performance indicators (KPIs).

Revenue Growth and Trends

QBTS's revenue growth is a critical indicator of its overall health and future potential. We need to examine the year-over-year (YoY) revenue growth percentage, identifying the primary drivers of growth or any areas of concern.

- Revenue growth percentage YoY: A consistent upward trend indicates strong performance, while a decline warrants closer scrutiny. (Insert actual data here if available, for example: "QBTS showed a 15% YoY revenue growth in Q3 2023").

- Breakdown of revenue streams: Analyzing the contribution of different revenue streams (e.g., subscription services, product sales) helps assess diversification and reliance on specific markets.

- Impact of new product launches or market expansion: New product launches or successful expansions into new markets can significantly impact revenue growth. (For example: "The successful launch of Product X contributed significantly to the revenue growth in Q3.")

- Comparison to industry competitors: Benchmarking QBTS's revenue growth against its key competitors provides context and highlights its relative performance within the industry.

Profitability and Margins

Profitability is another crucial aspect to consider when evaluating QBTS's performance. Key metrics include:

- Gross profit margin trend analysis: Analyzing trends in gross profit margin reveals the efficiency of QBTS's operations and its ability to manage costs.

- Operating expense management: Efficient management of operating expenses is critical for profitability. Any significant changes in operating expenses should be examined.

- Impact of cost-cutting measures: If QBTS implemented cost-cutting measures, their impact on profitability should be evaluated.

- Net income growth (or decline): Net income is the ultimate measure of profitability, indicating the company's bottom-line performance.

Key Performance Indicators (KPIs)

Specific KPIs relevant to QBTS's business model provide valuable insights into its operational efficiency and market position. These might include:

- Customer acquisition cost (CAC): A lower CAC indicates efficient marketing and customer acquisition strategies.

- Customer lifetime value (CLTV): A high CLTV shows that customers are loyal and profitable over time.

- User engagement metrics: Strong user engagement metrics suggest a high level of customer satisfaction and product stickiness.

- Market share data: Tracking market share helps assess QBTS's competitive position.

Factors Influencing QBTS Stock After Earnings

Several factors beyond QBTS's financial results will influence its stock price after the earnings announcement.

Market Sentiment and Investor Expectations

Market sentiment and investor expectations play a crucial role in shaping QBTS stock performance.

- Consensus earnings estimates: How do QBTS's actual earnings compare to analyst expectations? Beating estimates generally leads to positive market reaction.

- Analyst ratings and price targets: Analyst ratings and price targets reflect expert opinions on QBTS's future prospects.

- Overall market trends (bullish or bearish): Broader market trends can influence the performance of individual stocks, including QBTS.

- Impact of broader economic factors: Economic factors such as inflation, interest rates, and recessionary fears can also affect investor sentiment towards QBTS.

Competitive Landscape

QBTS operates within a competitive landscape, and its performance relative to competitors significantly impacts its stock price.

- Major competitors and their recent performance: How does QBTS compare to its competitors in terms of revenue growth, profitability, and market share?

- Market share dynamics: Is QBTS gaining or losing market share? This is a key indicator of its competitive strength.

- Technological advancements and disruptions: Technological disruptions can drastically alter the competitive landscape, posing both opportunities and threats for QBTS.

- Strategic partnerships and alliances: Strategic alliances and partnerships can strengthen QBTS's position in the market.

Management Guidance and Future Outlook

Management's guidance for future quarters is crucial in shaping investor expectations.

- Management's commentary on future revenue and earnings: Management's outlook on future performance influences investor confidence.

- Planned strategic initiatives: New strategic initiatives can impact future growth.

- Potential risks and challenges: Management should identify potential risks and challenges impacting future performance.

- Long-term growth prospects: The company's long-term vision and growth strategy are also important factors.

Predicting QBTS Stock Movement Post-Earnings

Predicting QBTS stock movement is challenging, but we can use various tools and analyses.

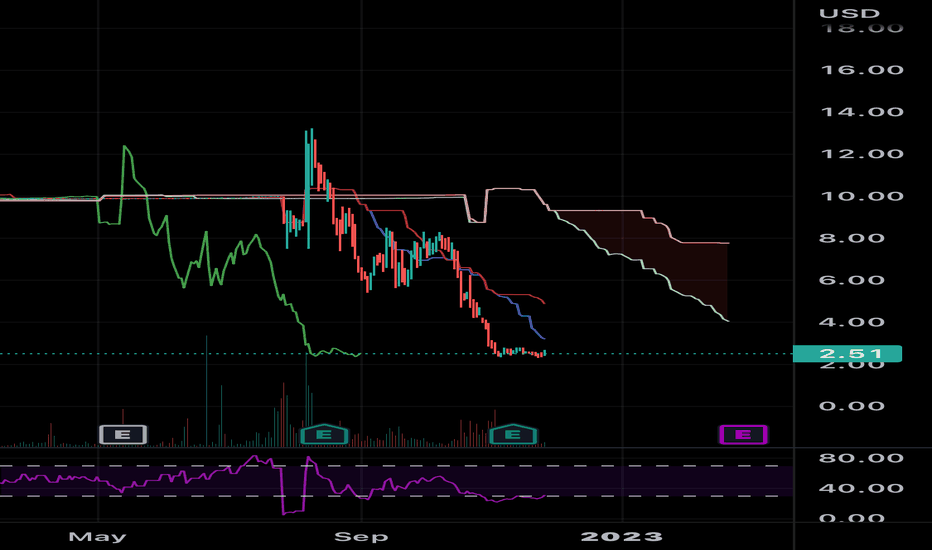

Technical Analysis

Technical analysis uses chart patterns, moving averages, and other indicators to predict short-term price movements. Disclaimer: Technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

Fundamental Analysis

Fundamental analysis evaluates QBTS's intrinsic value based on its financial performance, competitive position, and growth prospects. This provides a more long-term perspective on the stock's valuation.

Risk Assessment

It's crucial to identify potential risks affecting QBTS stock performance: positive surprises (e.g., unexpected product success) or negative surprises (e.g., supply chain disruptions).

Conclusion

Predicting QBTS stock performance after the next earnings announcement requires a careful analysis of its recent financial performance, the competitive landscape, market sentiment, and management guidance. Both fundamental and technical analyses offer valuable insights, but it's vital to understand their limitations. While this analysis provides insights into potential QBTS stock performance after the next earnings announcement, remember to conduct your own comprehensive research and consider your individual risk tolerance before investing. Understanding QBTS earnings and their impact on QBTS stock price is key to making informed investment decisions. Remember, all investments carry risk.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Featured Posts

-

Impact Of Abc News Layoffs On Programming

May 21, 2025

Impact Of Abc News Layoffs On Programming

May 21, 2025 -

Britons Epic Australian Run Pain Pests And Controversy

May 21, 2025

Britons Epic Australian Run Pain Pests And Controversy

May 21, 2025 -

Upgraded Wireless Headphones Whats New And Improved

May 21, 2025

Upgraded Wireless Headphones Whats New And Improved

May 21, 2025 -

The Heartwarming Story Behind Peppa Pigs Baby Sisters Name

May 21, 2025

The Heartwarming Story Behind Peppa Pigs Baby Sisters Name

May 21, 2025 -

Navigating The Love Monster Practical Strategies For Healthy Relationships

May 21, 2025

Navigating The Love Monster Practical Strategies For Healthy Relationships

May 21, 2025

Latest Posts

-

Mkhalfat Malyt Jsymt Albrlman Yetmd Tqryry Dywan Almhasbt 2022 2023

May 21, 2025

Mkhalfat Malyt Jsymt Albrlman Yetmd Tqryry Dywan Almhasbt 2022 2023

May 21, 2025 -

Trumps Legacy A Boost For Ai Companies Yet Concerns Persist

May 21, 2025

Trumps Legacy A Boost For Ai Companies Yet Concerns Persist

May 21, 2025 -

May 9 2025 Your Old North State Report

May 21, 2025

May 9 2025 Your Old North State Report

May 21, 2025 -

Rozhodovanie Medzi Home Office A Kancelariou Prakticky Sprievodca

May 21, 2025

Rozhodovanie Medzi Home Office A Kancelariou Prakticky Sprievodca

May 21, 2025 -

Ai Companies Celebrate Legislative Win But Challenges Loom

May 21, 2025

Ai Companies Celebrate Legislative Win But Challenges Loom

May 21, 2025