Hudson Bay's Creditor Protection Extended To July 31st

Table of Contents

Reasons for the Extension of Creditor Protection

HBC's initial creditor protection filing stemmed from a confluence of significant financial challenges. The company has been struggling to adapt to the rapidly evolving retail landscape, facing intense competition from online retailers and experiencing declining sales in its brick-and-mortar stores. This situation has been exacerbated by several factors:

- Declining retail sales and increased competition: The rise of e-commerce giants has significantly impacted HBC's traditional retail model, leading to a drop in foot traffic and sales. The increased competition for consumer spending has further squeezed profit margins.

- High debt levels and interest payments: HBC carries a substantial debt burden, resulting in significant interest payments that strain its cash flow and limit its ability to invest in growth initiatives or weather economic downturns. This high debt-to-equity ratio has made it vulnerable.

- Impact of the COVID-19 pandemic on retail operations: The pandemic severely disrupted retail operations globally, forcing temporary closures and impacting consumer spending. HBC, like many other retailers, faced significant challenges in adapting to the new realities of the pandemic and recovering lost revenue.

- Ineffective restructuring strategies: Previous attempts at restructuring and cost-cutting measures have not proven sufficient to address HBC's underlying financial issues, necessitating the extension of creditor protection to allow for a more comprehensive restructuring plan.

HBC's rationale for the extension centers on the need for additional time to finalize its comprehensive restructuring plan, aiming to address the company’s debt and reposition itself for long-term viability in the competitive retail market.

Implications for Shareholders

The extended creditor protection period significantly impacts HBC shareholders. The ongoing restructuring process introduces considerable uncertainty, impacting shareholder equity and potentially leading to dilution.

- Potential for further share price decline: The uncertainty surrounding HBC's future and the potential for further losses could lead to a continued decline in the company's share price.

- Uncertainty regarding future dividends: With the company focusing on debt reduction and restructuring, the payment of dividends to shareholders is highly unlikely in the near future.

- The possibility of a restructuring plan impacting shareholder ownership: The restructuring plan may involve actions like share buybacks, rights issues, or other measures that could dilute existing shareholders' ownership or even result in a complete loss of investment.

Shareholders should brace for potential losses and carefully monitor the progress of the restructuring plan. The value of their investment is significantly at risk during this period of creditor protection.

Implications for Creditors

The extension of creditor protection directly affects the recovery prospects of HBC's creditors. The outcome remains uncertain, with potential scenarios ranging from partial recovery to complete loss of debt.

- Potential for partial debt recovery: Creditors may only recover a portion of their outstanding debt, depending on the success of the restructuring plan and the assets available for distribution.

- The possibility of a negotiated settlement with HBC: Creditors may be involved in negotiations with HBC to agree on a restructuring plan that balances their interests with the company’s need for financial stability. This could involve extending repayment terms or accepting a reduced payout.

- The timeline for creditor payments under the restructuring plan: The timeline for creditor payments will depend on the specifics of the approved restructuring plan. Payments may be spread over an extended period, or some creditors might receive priority over others.

Ongoing negotiations between HBC and its creditors are crucial to determining the final outcome for all parties involved. The success of these negotiations will be key in ensuring a degree of recovery for creditors.

The Proposed Restructuring Plan and its Timeline

HBC's proposed restructuring plan aims to address its financial woes and pave the way for its emergence from creditor protection. The plan likely includes several key components:

- Store closures or sales: Non-performing stores or underperforming retail locations may be closed or sold to generate cash and reduce operating costs.

- Debt reduction strategies: The plan may involve negotiating with creditors to reduce the overall debt burden, potentially through debt-for-equity swaps or other debt restructuring mechanisms.

- Refinancing options: HBC may seek to refinance its existing debt at more favorable terms, securing new financing to support its operations.

- Cost-cutting measures: Further cost-cutting measures, such as streamlining operations and reducing workforce, are likely to be part of the plan to improve profitability.

The July 31st deadline is critical. Failure to finalize and implement a viable restructuring plan by this date could lead to more drastic measures, potentially including liquidation.

Potential Outcomes and Future of HBC

Several scenarios could unfold after July 31st:

- Successful emergence from creditor protection: If the restructuring plan is successful, HBC could emerge from creditor protection with a reduced debt burden and a clearer path towards profitability.

- Chapter 7 bankruptcy filing (liquidation): If the restructuring efforts fail, HBC could file for Chapter 7 bankruptcy, leading to liquidation of its assets and potential closure of its operations.

- Acquisition by another company: A potential outcome is the acquisition of HBC or parts of its business by another company, offering a path to survival and restructuring under new ownership.

Conclusion

The extension of Hudson Bay's creditor protection to July 31st creates significant uncertainty for shareholders and creditors alike. The success of the proposed restructuring plan is pivotal in determining the long-term viability of HBC. The company faces significant challenges in adapting to a changing retail environment and managing its high debt levels. The next few weeks are critical in shaping the future of this iconic retailer.

Call to Action: Stay informed about the ongoing developments surrounding Hudson Bay's creditor protection. Regularly check for updates on the company's restructuring efforts and their implications for stakeholders. Understanding the details of this extended period of creditor protection is crucial for making informed decisions regarding your investments and business dealings with HBC. Monitor news releases, financial reports, and analyst commentary to stay abreast of the latest developments concerning this important business restructuring.

Featured Posts

-

The Trump Biden Presidency A Look At Their Leadership Styles

May 16, 2025

The Trump Biden Presidency A Look At Their Leadership Styles

May 16, 2025 -

Mavs Future Was Losing Brunson More Damaging Than The Doncic Trade

May 16, 2025

Mavs Future Was Losing Brunson More Damaging Than The Doncic Trade

May 16, 2025 -

Wilson And Muncys Highly Anticipated 2025 Opening Day Reunion

May 16, 2025

Wilson And Muncys Highly Anticipated 2025 Opening Day Reunion

May 16, 2025 -

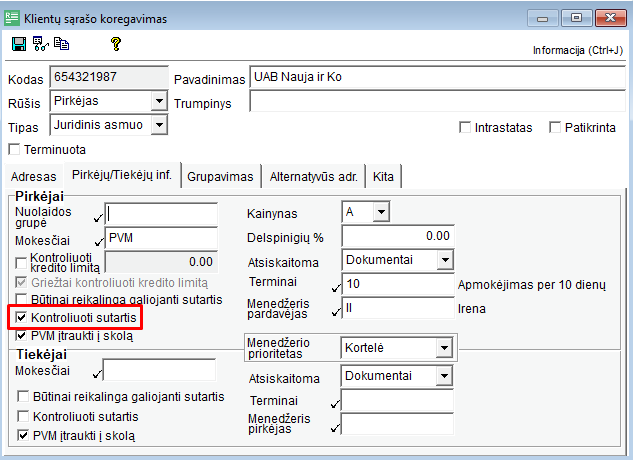

Rekordine Boston Celtics Pardavimo Kaina Lietuviai Tarp Pirkeju Nebuvo

May 16, 2025

Rekordine Boston Celtics Pardavimo Kaina Lietuviai Tarp Pirkeju Nebuvo

May 16, 2025 -

Bahia Derrota A Paysandu 0 1 Goles Y Cronica Del Partido

May 16, 2025

Bahia Derrota A Paysandu 0 1 Goles Y Cronica Del Partido

May 16, 2025