Hudson's Bay And Canadian Tire: Examining The Synergies And Challenges Of A Merger

Table of Contents

Potential Synergies of a Hudson's Bay and Canadian Tire Merger

A merger between these two retail behemoths could unlock significant synergies across various aspects of their operations. The combined entity could leverage its strengths to create a more efficient and profitable business.

Enhanced Supply Chain and Logistics

One significant area of synergy lies in supply chain and logistics optimization. Both companies operate extensive distribution networks across Canada. By integrating these networks, they could achieve substantial cost savings.

- Reduced transportation costs: Combining shipping routes and leveraging economies of scale could significantly reduce transportation expenses.

- Improved inventory management: A unified system would allow for better forecasting and inventory control, minimizing stockouts and reducing waste.

- Optimized warehousing: Consolidation of warehousing facilities could lead to increased efficiency and reduced overhead. This supply chain optimization is key to improving profitability.

Expanded Customer Base and Market Reach

The combined customer base of Hudson's Bay and Canadian Tire would represent a massive market opportunity. This expanded reach could translate into increased market share and revenue growth.

- Access to new demographics: HBC's focus on apparel and home goods complements Canadian Tire's strength in automotive, sporting goods, and home improvement. This allows them to reach a broader customer demographic.

- Cross-promotion opportunities: Joint marketing campaigns and loyalty program integration could expose each brand to new customers, driving sales for both.

- Enhanced customer acquisition: The combined entity could leverage data analytics to better target marketing efforts and acquire new customers more effectively. This targeted approach is crucial for market penetration.

Synergies in Real Estate and Retail Locations

Both companies possess extensive real estate portfolios. A merger could offer significant opportunities for real estate optimization and strategic location management.

- Reduced overhead costs: Consolidating overlapping store locations could significantly reduce operating expenses.

- Opportunities for co-location: Strategically positioning stores in close proximity or even co-locating them could create a one-stop shopping experience, enhancing customer convenience.

- Optimized retail footprint: A streamlined retail footprint based on a comprehensive market analysis could improve overall operational efficiency. This strategic approach is key for real estate optimization.

Challenges in a Hudson's Bay and Canadian Tire Merger

While the potential synergies are significant, a merger between Hudson's Bay and Canadian Tire would also face considerable challenges. Overcoming these hurdles would be critical to the success of any such undertaking.

Brand Overlap and Identity Conflicts

Integrating two distinct brands with significantly different target audiences and brand identities presents a substantial challenge.

- Maintaining brand equity: It's crucial to preserve the individual brand equity of both Hudson's Bay and Canadian Tire, avoiding brand dilution.

- Potential cannibalization of sales: Carefully managed product offerings are necessary to prevent one brand from negatively impacting the sales of the other.

- Managing brand messaging: Developing consistent yet distinct brand messaging for both brands will be a complex task. This brand management is essential for avoiding conflict.

Integration Difficulties and Cultural Differences

Merging two large organizations with distinct corporate cultures and management styles is inherently complex.

- Potential employee disruption: Redundancies and restructuring are likely, leading to potential employee unrest and disruption. Careful change management is necessary to mitigate these effects.

- Challenges in integrating IT systems: Combining different IT systems, databases, and supply chain management platforms is a significant technical undertaking.

- Cultural clashes: Integrating two distinct corporate cultures requires sensitive handling and a clear plan to ensure a smooth transition. This organizational integration demands a thoughtful strategy.

Regulatory Hurdles and Antitrust Concerns

Any merger of this magnitude would likely face significant regulatory scrutiny and potential antitrust concerns.

- Competition Bureau review: The Competition Bureau of Canada would thoroughly review the merger to assess its potential impact on competition in the Canadian retail market.

- Potential divestments required: To address antitrust concerns, the merged entity may be required to divest certain assets or business units.

- Regulatory approvals: Securing all necessary regulatory approvals would be a time-consuming and potentially complex process. Navigating these antitrust regulations is paramount.

Conclusion: The Future of Hudson's Bay and Canadian Tire: A Merger's Promise and Peril

The potential merger of Hudson's Bay and Canadian Tire presents both significant opportunities and considerable challenges. While potential synergies in supply chain optimization, expanded market reach, and real estate optimization are substantial, integrating two distinct brands, overcoming cultural differences, and navigating regulatory hurdles present formidable obstacles. Further analysis is needed to fully assess the viability and potential impact of this proposed union on the Canadian retail landscape. The success of a Hudson's Bay and Canadian Tire merger hinges on carefully managing these complexities to unlock the significant potential synergies while mitigating the considerable risks.

Featured Posts

-

Analyzing Michael Strahans Interview Coup Amidst Intense Competition

May 21, 2025

Analyzing Michael Strahans Interview Coup Amidst Intense Competition

May 21, 2025 -

Arda Gueler Ve Real Madrid In Yeni Teknik Direktoerue Beklentiler Ve Tahminler

May 21, 2025

Arda Gueler Ve Real Madrid In Yeni Teknik Direktoerue Beklentiler Ve Tahminler

May 21, 2025 -

The Amazing World Of Gumball Hulu Premiere Date Revealed In New Teaser

May 21, 2025

The Amazing World Of Gumball Hulu Premiere Date Revealed In New Teaser

May 21, 2025 -

Mass Layoffs At Abc News What Happens Next

May 21, 2025

Mass Layoffs At Abc News What Happens Next

May 21, 2025 -

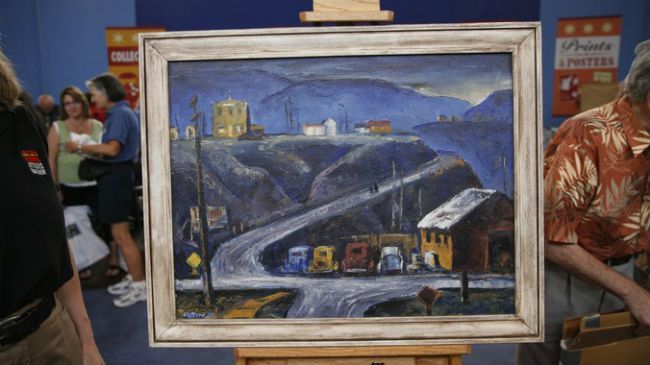

Bbc Antiques Roadshow Us Couple Arrested In Uk After Episode Appearance

May 21, 2025

Bbc Antiques Roadshow Us Couple Arrested In Uk After Episode Appearance

May 21, 2025

Latest Posts

-

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Vaikuttava Kehitys

May 21, 2025

Huuhkajat Saavat Vahvistusta Benjamin Kaellmanin Vaikuttava Kehitys

May 21, 2025 -

Glen Kamara Ja Teemu Pukki Vaihdossa Friisin Yllaetysratkaisu

May 21, 2025

Glen Kamara Ja Teemu Pukki Vaihdossa Friisin Yllaetysratkaisu

May 21, 2025 -

Kaellmanin Nousu Kentaellae Ja Sen Ulkopuolella

May 21, 2025

Kaellmanin Nousu Kentaellae Ja Sen Ulkopuolella

May 21, 2025 -

Benjamin Kaellman Huuhkajien Uusi Taehti

May 21, 2025

Benjamin Kaellman Huuhkajien Uusi Taehti

May 21, 2025 -

Jalkapallo Friis Paljasti Avauskokoonpanon Kamara Ja Pukki Sivussa

May 21, 2025

Jalkapallo Friis Paljasti Avauskokoonpanon Kamara Ja Pukki Sivussa

May 21, 2025