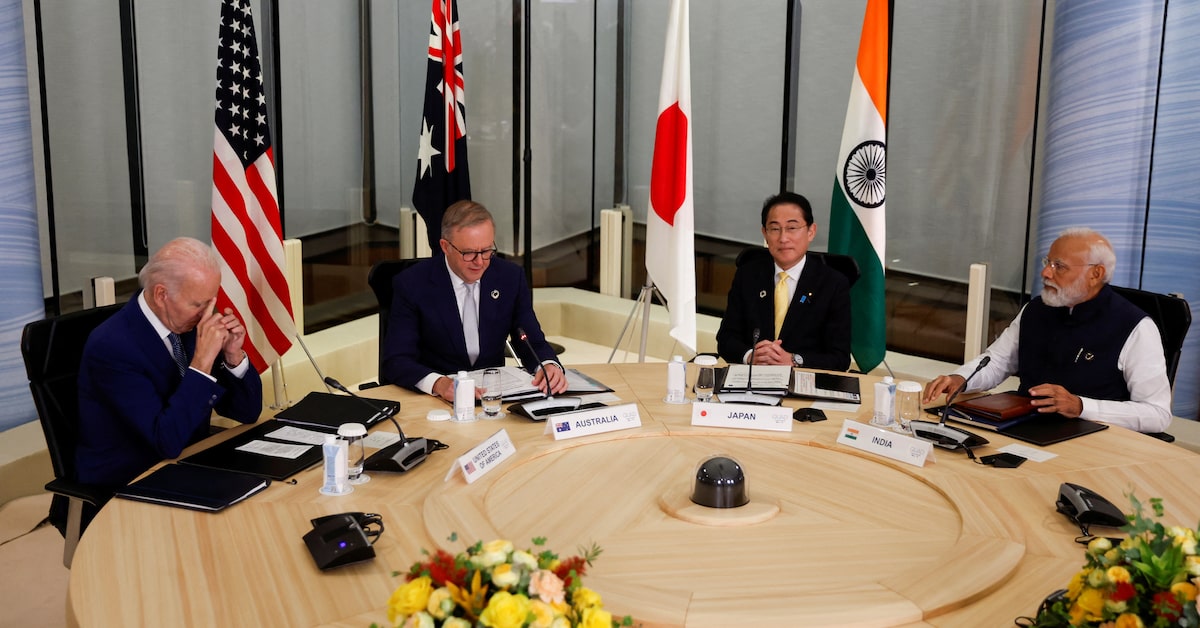

Impact Of G-7 De Minimis Tariff Discussions On Chinese-Made Products

Table of Contents

Current De Minimis Value and its Impact on Chinese Imports

Understanding the implications of the G-7's deliberations requires a grasp of the concept of "de minimis" itself. In the context of import tariffs, "de minimis" refers to the value threshold below which goods are exempt from tariffs. Currently, de minimis values vary considerably across G-7 nations, leading to inconsistencies in import regulations.

Defining "De Minimis":

The de minimis value acts as a crucial determinant of whether imported goods will be subject to tariffs. For example, a low de minimis value means that even small shipments of goods will face tariffs, while a higher threshold allows for a larger volume of imports to enter duty-free. These variations across G-7 countries create complexities for businesses dealing with international trade. The discrepancies in de minimis values directly influence the competitiveness of different importers and the overall flow of goods.

The Volume of Chinese Goods Affected:

A substantial volume of Chinese-made products currently benefits from the existing de minimis thresholds. These goods range from small consumer electronics and clothing items to various components used in manufacturing. Precise figures are difficult to obtain due to the complexity of global trade data, but anecdotal evidence and industry reports suggest that a significant portion of low-value Chinese imports falls under these exemptions.

- Current de minimis values for various G7 countries: These vary considerably, ranging from as low as $800 in some countries to significantly higher values in others. This disparity creates uneven playing fields for importers.

- Statistics on Chinese imports falling under the current de minimis thresholds: Obtaining precise figures requires extensive data analysis, but estimates suggest a substantial portion of Chinese imports benefit from the current thresholds.

- Examples of product categories: Clothing, small electronics, toys, certain types of household goods, and numerous components used in larger manufacturing processes are commonly affected.

Proposed Changes and their Potential Consequences

The G-7 is currently exploring adjustments to its de minimis thresholds. These proposals are driven by various factors, including concerns about fairness, revenue generation, and the potential for protectionist measures.

G-7's Proposed Adjustments:

The specific proposals under discussion vary, but many involve raising the de minimis threshold, potentially reducing the volume of goods that enter duty-free. This could lead to a significant increase in the cost of some imported goods. Other proposals focus on standardizing the de minimis values across G7 nations to create a more level playing field.

Impact on Chinese Exporters:

The proposed changes could have a substantial negative impact on Chinese exporters, particularly those specializing in low-value goods. Raising the de minimis value would mean more goods become subject to tariffs, increasing costs and reducing competitiveness in international markets. This could lead to:

- Potential increase or decrease in tariffs for Chinese goods: Depending on the final decision, the impact will vary. A higher threshold could lead to a significant increase in tariffs on previously duty-free goods.

- Impact on Chinese export volumes and profitability: Reduced competitiveness could lead to lower export volumes and decreased profitability for numerous Chinese businesses.

- Potential for retaliatory measures from China: Significant changes to import tariffs could trigger retaliatory measures from China, further escalating trade tensions.

Implications for Consumers and Businesses in G-7 Countries

Changes to de minimis tariffs will undeniably ripple through G-7 economies, affecting both consumers and businesses.

Price Changes for Consumers:

Higher tariffs on Chinese-made products will almost certainly translate into higher prices for consumers. The extent of these price increases will depend on the magnitude of the tariff changes and the elasticity of demand for the affected goods. Some consumers might shift to alternative, possibly more expensive, products.

Business Adjustments and Supply Chain Restructuring:

Businesses in G-7 nations, especially importers and retailers, will need to adapt to the changing tariff landscape. This might involve:

- Potential price increases for specific product categories: Consumers can expect to see price increases across a wide array of goods, especially those currently benefiting from low de minimis thresholds.

- Impact on consumer spending and purchasing power: Higher prices could lead to decreased consumer spending and reduced purchasing power.

- Challenges for businesses adapting to tariff changes: Businesses will need to adjust pricing strategies, explore alternative supply chains, and potentially absorb some of the increased costs.

- Potential shift in sourcing from China to other countries: Some businesses might explore sourcing goods from other countries to mitigate the increased cost of Chinese imports.

Conclusion

The G-7 de minimis tariff discussions carry significant implications for Chinese-made products and the global trade landscape. Proposed changes to de minimis values could lead to increased tariffs, impacting Chinese exporters, raising consumer prices in G-7 countries, and forcing businesses to adapt their supply chains. The potential economic and political ramifications are substantial, making it crucial to stay abreast of these developments. It is vital to monitor the ongoing negotiations and their eventual outcome.

Call to Action: Stay informed about the evolving situation regarding G-7 de minimis tariff discussions and their effects on Chinese-made products. Further research into the specific proposals and their potential impacts is crucial for businesses and consumers alike. Subscribe to our newsletter or follow reputable news sources for updates on G-7 de minimis tariff discussions and their impact on Chinese-made products.

Featured Posts

-

The Hollywood Strike Understanding The Actors And Writers Demands

May 25, 2025

The Hollywood Strike Understanding The Actors And Writers Demands

May 25, 2025 -

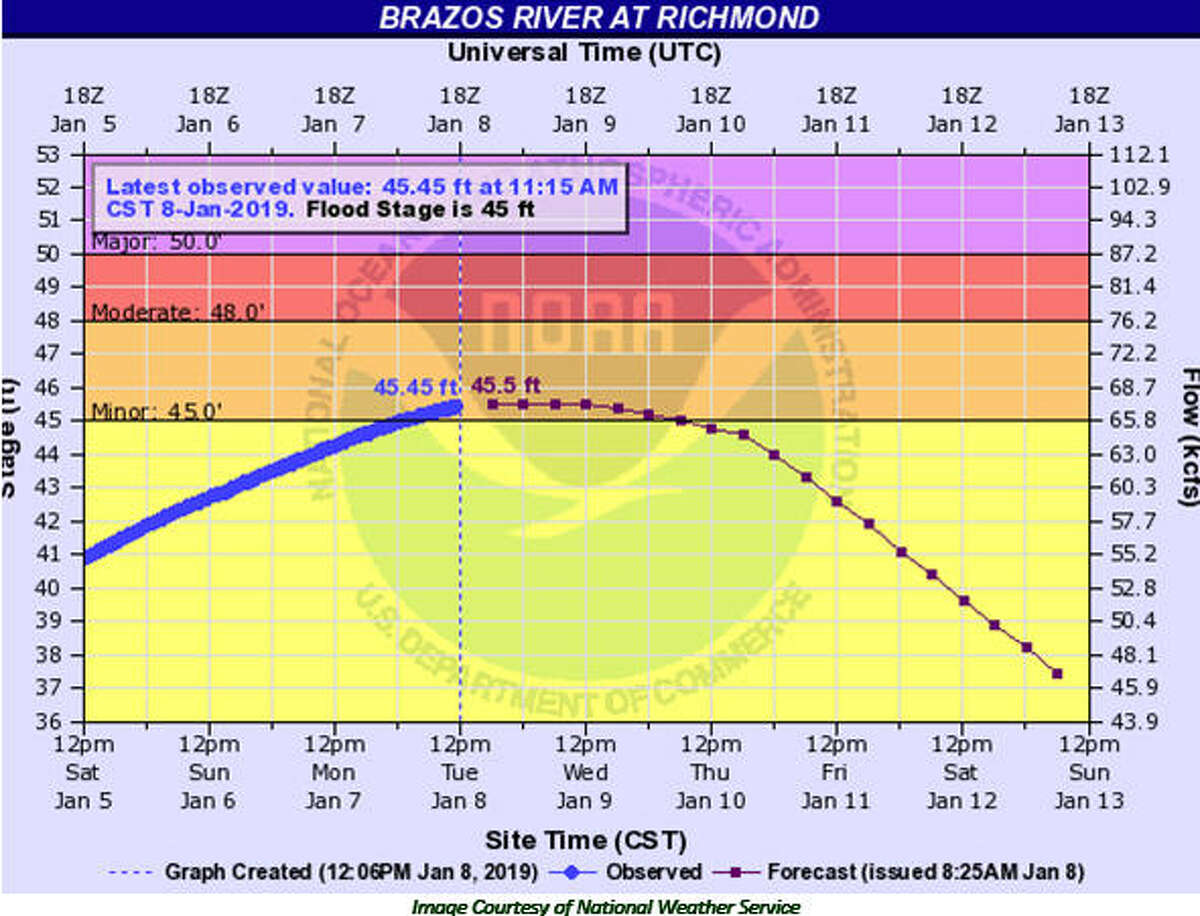

Severe Weather Alert Flash Flood Warning For Pennsylvania Until Thursday

May 25, 2025

Severe Weather Alert Flash Flood Warning For Pennsylvania Until Thursday

May 25, 2025 -

Sse Announces 3 Billion Reduction In Spending Due To Slowing Growth

May 25, 2025

Sse Announces 3 Billion Reduction In Spending Due To Slowing Growth

May 25, 2025 -

Aex Index Trotseert Onrust Op Amerikaanse Beurs Een Dieper Duik In De Markttrends

May 25, 2025

Aex Index Trotseert Onrust Op Amerikaanse Beurs Een Dieper Duik In De Markttrends

May 25, 2025 -

Hsv Aufstieg Zwischen Hafengeburtstag Und Roland Kaiser Konzert

May 25, 2025

Hsv Aufstieg Zwischen Hafengeburtstag Und Roland Kaiser Konzert

May 25, 2025