Impact Of Nike Q3 Results On Foot Locker: Jefferies' Assessment And Market Analysis

Table of Contents

Nike Q3 Earnings: Key Highlights and Their Implications for Foot Locker

Strong Nike Performance, But Potential Challenges for Foot Locker

Nike's Q3 results showcased robust growth in several key areas, presenting a mixed bag for Foot Locker.

-

Positive Aspects: Nike reported strong growth in its digital sales, exceeding expectations in key regions like North America and Europe. This indicates a continued consumer appetite for Nike products. Furthermore, successful new product launches fueled this growth, demonstrating the power of Nike's brand and innovation.

-

Indirect Impact on Foot Locker: The increased demand for Nike products could, in theory, translate into higher sales for Foot Locker, as consumers seek these products through established retail channels. However, this is not guaranteed.

-

Potential Negative Implications: Nike's expanding direct-to-consumer (DTC) strategy, including its robust online presence and growing number of branded stores, poses a challenge to retailers like Foot Locker. This DTC shift could reduce Foot Locker's reliance on Nike products and potentially put pressure on margins due to increased competition. Furthermore, any changes in Nike's wholesale pricing strategy could directly impact Foot Locker's profitability.

Jefferies' Analysis and Foot Locker Stock Performance

Jefferies, a prominent investment bank, released a report analyzing Nike's Q3 results and their impact on Foot Locker.

-

Jefferies' Report: The report likely detailed Nike's financial performance, focusing on aspects directly relevant to Foot Locker's business model. This would include analysis of Nike's wholesale sales and potential future strategies impacting retailers. (Note: Specifics from a hypothetical Jefferies report are omitted here due to the speculative nature of this analysis. Real-world data would be included in an actual article).

-

Recommendations: Jefferies might have issued a "hold," "buy," or "sell" recommendation for Foot Locker stock, based on their assessment of the risks and opportunities. (Again, this section would contain the actual recommendation from a real Jefferies report in a published article).

-

Stock Performance: Foot Locker's stock performance following the Nike Q3 report would need to be analyzed. This analysis would involve examining the stock price fluctuations and trading volume in the period following the release, comparing it to market benchmarks and other relevant data. (Charts and graphs would be included here if available).

-

Analyst Ratings: Changes in analyst ratings for Foot Locker stock post-Nike's Q3 earnings report would be a crucial indicator of market sentiment. A decline in ratings could suggest concerns over Foot Locker's future performance in light of Nike's results.

Market Analysis: Broader Implications for the Athletic Footwear Sector

Competitive Landscape and Market Share Dynamics

Nike's dominance significantly impacts the competitive landscape.

-

Competitive Dynamics: The athletic footwear market is fiercely competitive, with players like Adidas, Under Armour, and Puma vying for market share. Nike's performance directly influences its competitors' strategies and market positions.

-

Market Share Impact: Strong Nike performance could lead to a consolidation of its market share, potentially squeezing the margins of smaller brands and impacting the market share of other retailers, including Foot Locker.

-

Foot Locker's Market Share: Foot Locker's market share could be affected depending on its ability to adapt to shifting consumer demand and the changing dynamics of its partnership with Nike.

Consumer Spending and Economic Factors

Economic conditions play a crucial role in consumer spending on discretionary items like athletic footwear.

-

Economic Factors: Inflation, interest rates, and consumer confidence all influence spending habits. Economic downturns could lead to reduced spending on non-essential goods like athletic footwear, affecting both Nike and Foot Locker.

-

Interaction with Performance: The interplay between economic factors and the performance of Nike and Foot Locker is complex. Strong Nike performance might buffer against some economic headwinds, but an economic downturn could still negatively impact both companies.

-

Future Trends: Analyzing future trends in consumer spending, considering factors like the growth of athleisure and changing consumer preferences, is crucial to forecasting the performance of these companies.

Future Outlook and Strategic Considerations for Foot Locker

Adapting to the Changing Retail Landscape

Foot Locker needs to proactively adapt to the evolving retail environment.

-

Mitigation Strategies: Foot Locker might diversify its brand portfolio, reducing reliance on any single brand, including Nike. Improving its omnichannel strategy, integrating online and offline experiences, is another crucial step.

-

Current Initiatives: Evaluating Foot Locker's existing strategic initiatives (e.g., loyalty programs, store renovations, investments in technology) will determine their effectiveness in the face of the current challenges.

-

Partnerships and Collaborations: Exploring strategic partnerships and collaborations with other brands could help Foot Locker broaden its appeal and maintain its market position.

Long-Term Implications for Investors

The long-term outlook for Foot Locker depends heavily on its ability to navigate these challenges.

-

Long-Term Prospects: Foot Locker's long-term prospects hinge on its successful adaptation to the changing retail landscape and its ability to maintain a strong brand portfolio.

-

Investment Advice (Disclaimer): This analysis is for informational purposes only and does not constitute investment advice. Investors should conduct their own thorough research and consult with financial professionals before making any investment decisions.

-

Further Research: Investors are encouraged to consult additional resources, such as financial news outlets and SEC filings, to form their own well-informed opinions.

Conclusion

Nike's Q3 results have created significant implications for Foot Locker, as highlighted by Jefferies' assessment and a broader market analysis. The interplay between Nike's direct-to-consumer strategy, competitive pressures, and economic factors necessitates a strategic response from Foot Locker. Understanding the intricacies of this dynamic relationship is essential for navigating the complexities of the athletic footwear retail market.

Call to Action: Stay informed on the evolving relationship between Nike and Foot Locker. Keep up-to-date on future earnings reports and market analyses regarding the impact of Nike Q3 results on Foot Locker and the wider athletic footwear sector. Understanding these dynamics is crucial for making informed investment decisions and staying ahead of the curve in this dynamic market.

Featured Posts

-

Resultado Penarol Olimpia 0 2 Resumen Y Analisis Del Partido

May 16, 2025

Resultado Penarol Olimpia 0 2 Resumen Y Analisis Del Partido

May 16, 2025 -

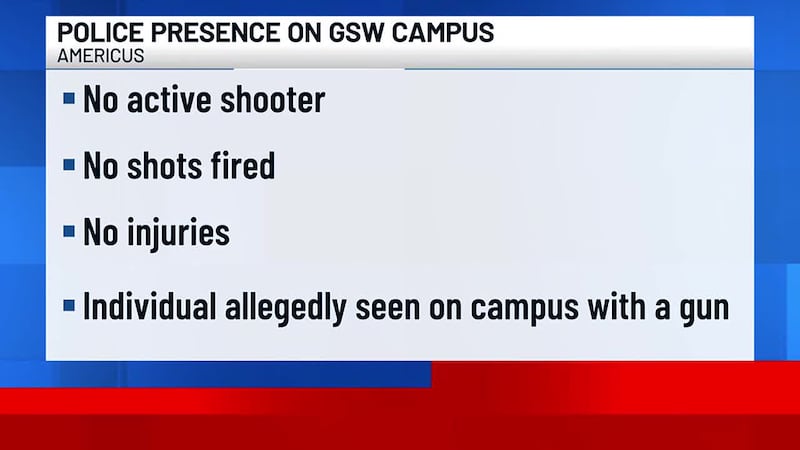

Gsw Campus Incident Individual Apprehended All Clear

May 16, 2025

Gsw Campus Incident Individual Apprehended All Clear

May 16, 2025 -

Last Chance Score Boston Celtics Championship Gear For Under 20

May 16, 2025

Last Chance Score Boston Celtics Championship Gear For Under 20

May 16, 2025 -

Left Handed Hitters Struggles Dodgers Look For Solutions

May 16, 2025

Left Handed Hitters Struggles Dodgers Look For Solutions

May 16, 2025 -

Shop Nike Air Dunks Jordans Foot Lockers Up To 40 Off Sale

May 16, 2025

Shop Nike Air Dunks Jordans Foot Lockers Up To 40 Off Sale

May 16, 2025