Impact Of Trump Administration's $3 Billion Loan Rejection On Sunnova Energy

Table of Contents

Sunnova's Business Model and the Importance of the Loan

Sunnova Energy International Inc. operates primarily in the residential solar energy sector. Its business model centers on providing solar panel systems to homeowners, often through lease or power purchase agreements (PPAs). Securing the $3 billion loan from the Department of Energy (DOE) was crucial for Sunnova's ambitious expansion plans. The loan would have significantly fueled their growth trajectory, allowing them to:

- Increased Installation Capacity: Substantially increase the number of residential solar installations across the US.

- Expansion into New Markets: Expand operations into new geographic regions, reaching a wider customer base and strengthening market presence.

- Job Creation: Create numerous jobs in the solar installation, manufacturing, and maintenance sectors.

- Technological Advancements: Invest in research and development to improve solar technology and efficiency.

The loan represented a pivotal opportunity for Sunnova to solidify its position as a major player in the rapidly expanding renewable energy market. The rejection dramatically altered the company's short-term and long-term prospects.

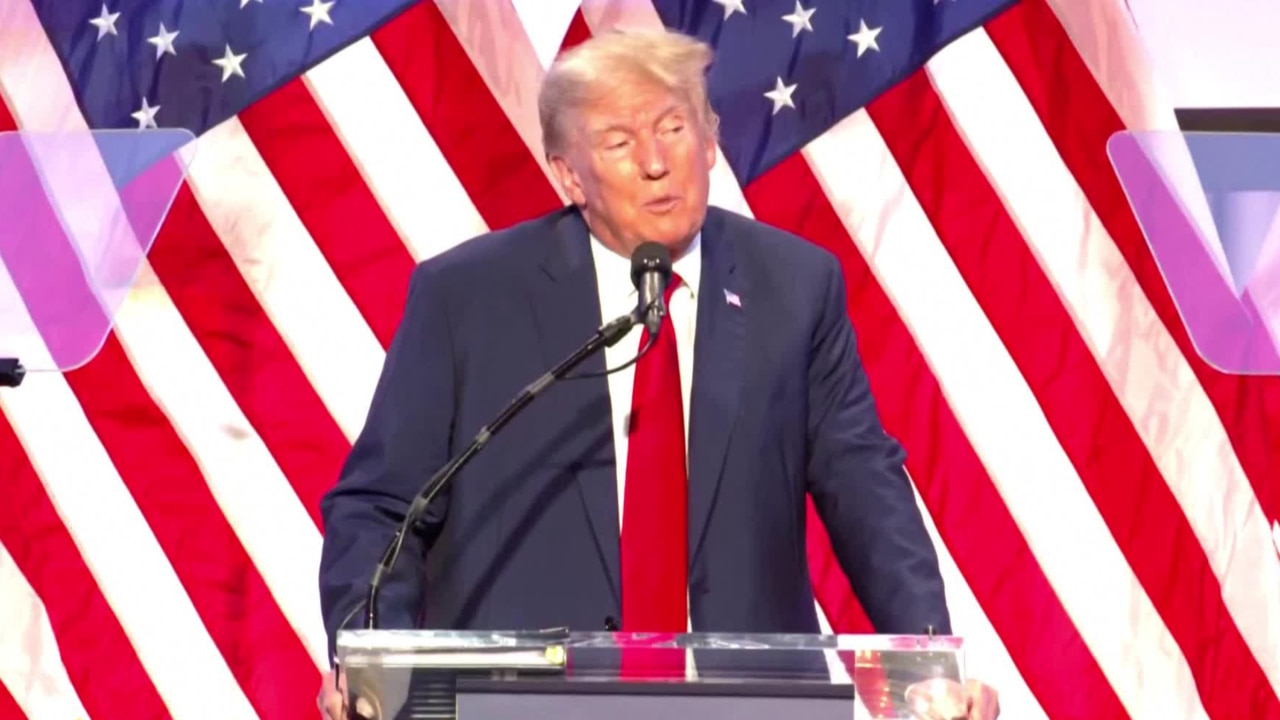

The Trump Administration's Rationale for Rejection

The Trump Administration never publicly provided a clear, concise explanation for rejecting Sunnova's loan application. While official statements from the Department of Energy were scant, speculation centered on several possible factors:

- Concerns about Financial Stability: Potential doubts about Sunnova's financial health and long-term viability may have influenced the decision.

- Policy Disagreements: The Trump Administration's generally skeptical stance toward renewable energy investment, favoring fossil fuels instead, likely played a role. This was reflected in broader policy decisions and cuts to renewable energy programs within the DOE.

- Political Motivations: Some analysts suggest the rejection may have been politically motivated, aligning with the administration's broader energy policy objectives.

Short-Term and Long-Term Impacts on Sunnova

The rejection of the $3 billion loan had immediate and significant repercussions for Sunnova:

- Stock Price Decline: Sunnova's stock price experienced a noticeable dip following the news.

- Reduced Investment: The company faced challenges in securing alternative funding at favorable terms.

- Operational Adjustments: Sunnova had to revise its expansion plans and potentially scale back on certain initiatives.

The long-term consequences could include:

- Slower Growth Rate: A hampered ability to compete effectively with other solar companies.

- Reduced Market Share: Loss of market share to competitors who were able to secure funding.

- Difficulty in attracting investors: A damaged reputation and a diminished ability to attract future investments.

- Potential job losses: The possibility of needing to lay off employees to adjust to reduced operational capacity.

The Broader Implications for the Renewable Energy Sector

The Trump Administration's decision had a chilling effect on investor confidence within the renewable energy sector. The rejection signaled a potential reluctance from the government to support large-scale renewable energy projects, potentially discouraging other companies from pursuing similar endeavors. This, in turn, could impede the overall development and deployment of solar energy technologies in the United States, hindering progress toward cleaner energy goals. The incident raised concerns about the stability and predictability of government support for renewable energy initiatives, potentially impacting future loan applications seeking similar funding.

Alternative Funding Sources and Sunnova's Response

Following the rejection, Sunnova had to adapt its strategy, focusing on securing alternative funding sources. This included exploring private investment opportunities, partnerships, and potentially restructuring its financial operations. Sunnova's subsequent financial performance and adjustments to their business plans offer a compelling case study in navigating unexpected challenges within the renewable energy landscape. Their successful pivoting, or lack thereof, serves as a crucial lesson for other companies operating within the volatile world of government funding and renewable energy.

Assessing the Lasting Impact of the Trump Administration's $3 Billion Loan Rejection on Sunnova Energy

The Trump Administration's rejection of Sunnova's $3 billion loan application had profound and lasting effects on the company, impacting its financial stability, growth trajectory, and market position. The decision also sent a significant signal to the broader renewable energy sector, raising concerns about the reliability of government support for such projects. This case study underscores the complexities and inherent risks involved in securing large-scale funding for renewable energy projects and the critical importance of navigating the political and economic landscape. Learn more about the impact of the Trump Administration's $3 billion loan rejection on Sunnova Energy and understand the challenges faced by companies striving to secure funding for vital renewable energy projects.

Featured Posts

-

The Devastating Impact Of Invasive Seaweed On Australian Marine Fauna

May 30, 2025

The Devastating Impact Of Invasive Seaweed On Australian Marine Fauna

May 30, 2025 -

Czy Odra Jest Bezpieczna Analiza Ryzyka Powtorki Katastrofy Ekologicznej

May 30, 2025

Czy Odra Jest Bezpieczna Analiza Ryzyka Powtorki Katastrofy Ekologicznej

May 30, 2025 -

Gazze Den Kanser Hastasi Cocuklarin Uerduen De Tedavi Goermesi

May 30, 2025

Gazze Den Kanser Hastasi Cocuklarin Uerduen De Tedavi Goermesi

May 30, 2025 -

Emergency Red Tide Warning Cape Cod Beaches Closed

May 30, 2025

Emergency Red Tide Warning Cape Cod Beaches Closed

May 30, 2025 -

Preduprezhdenie Mada Anomalnaya Zhara Pokholodanie I Silniy Shtorm V Izraile

May 30, 2025

Preduprezhdenie Mada Anomalnaya Zhara Pokholodanie I Silniy Shtorm V Izraile

May 30, 2025

Latest Posts

-

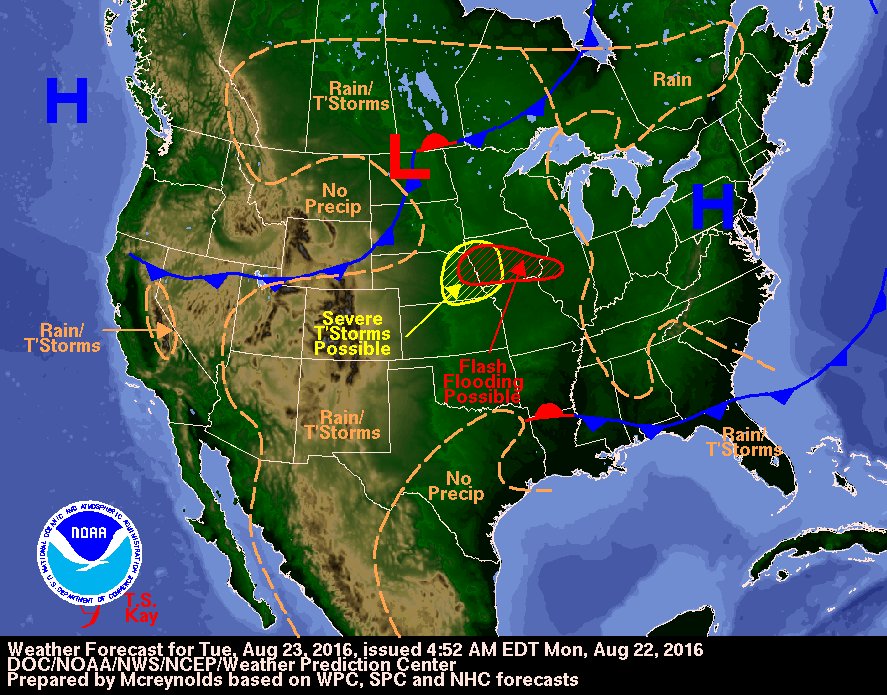

Clear Skies And Dry Weather Predicted For Northeast Ohio On Tuesday

May 31, 2025

Clear Skies And Dry Weather Predicted For Northeast Ohio On Tuesday

May 31, 2025 -

Northeast Ohio Weather Tuesday Brings Sunshine And Dry Conditions

May 31, 2025

Northeast Ohio Weather Tuesday Brings Sunshine And Dry Conditions

May 31, 2025 -

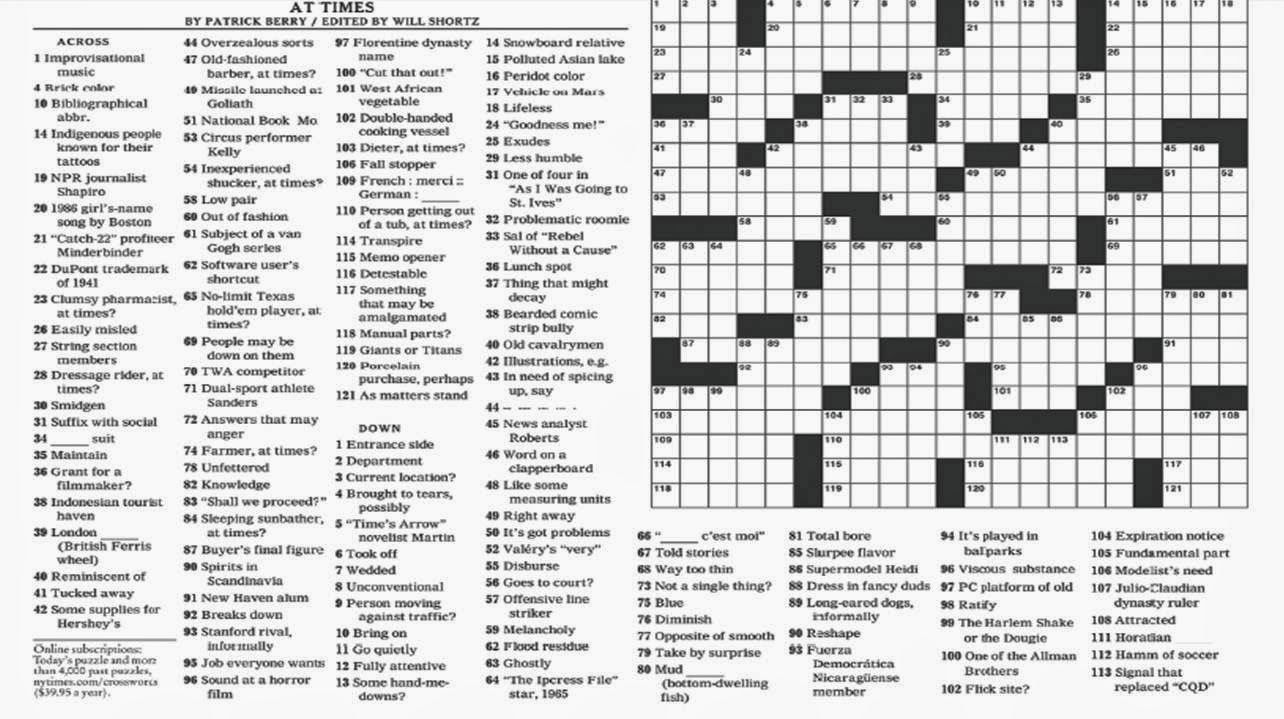

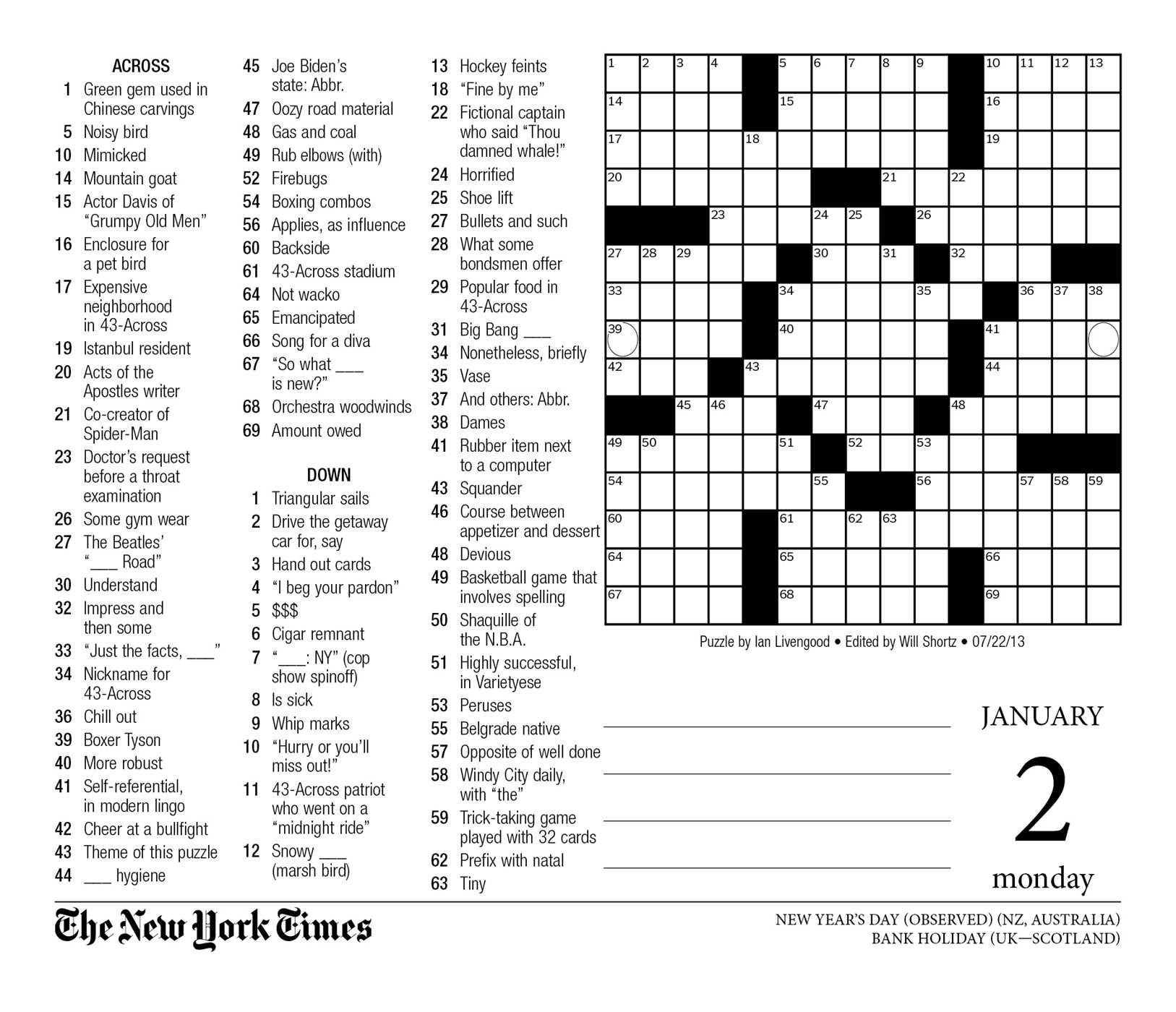

Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025 -

Saturday May 3rd Nyt Mini Crossword Solutions

May 31, 2025

Saturday May 3rd Nyt Mini Crossword Solutions

May 31, 2025 -

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025