Impact Of Trump's Tariff Decision: 8% Stock Increase On Euronext Amsterdam

Table of Contents

Understanding the Unexpected Euronext Amsterdam Stock Increase

The initial market reaction to Trump's tariff decision was largely negative, with many global indices experiencing drops. However, Euronext Amsterdam defied this trend, registering a surprising 8% increase. This unexpected surge prompted immediate speculation and analysis.

- Specific sectors that saw the largest gains: The energy and materials sectors on Euronext Amsterdam saw disproportionately large gains. This suggests a possible connection between the tariffs and the specific composition of these sectors.

- Analysis of trading volume during the period: Trading volume on Euronext Amsterdam increased significantly during the period following the announcement of Trump's tariff decision, indicating heightened investor activity.

- Comparison to other European stock markets' performance: In contrast to Euronext Amsterdam's positive performance, other major European stock markets showed more muted or negative responses to Trump's tariff decision. This highlights the unique nature of the Amsterdam market's reaction.

One potential explanation for this positive impact lies in the unexpected benefits certain sectors might have gained. Perhaps specific Dutch companies involved in sectors less directly affected by the tariffs, or even indirectly benefiting from them, experienced a surge in demand or investor confidence.

Analyzing the Impact of Trump's Tariff Decision on Global Markets

Trump's tariff decisions have had a far-reaching impact on global markets. While Euronext Amsterdam experienced an unusual surge, other markets reacted differently.

- Impact on US markets: US markets generally exhibited a negative response to the announcement, reflecting concerns about the potential impact on domestic businesses and consumers.

- Impact on Asian markets: Asian markets also showed a predominantly negative response, underlining the interconnectedness of global financial systems and the sensitivity of these markets to trade policy changes.

- Comparison of different market reactions: This contrast underscores the complex and often unpredictable nature of global market reactions to significant economic events, emphasizing the unique position of Euronext Amsterdam in this instance.

The overall economic implications of Trump's tariff policy remain a subject of ongoing debate, with economists offering varied perspectives on its long-term effects.

Euronext Amsterdam's Position and Vulnerability to Tariff Impacts

Euronext Amsterdam's unique economic composition and the nature of its listed companies play a crucial role in understanding its reaction to Trump's tariff decision.

- Key industries listed on Euronext Amsterdam and their exposure to tariffs: While some sectors might be negatively impacted by tariffs, others could experience unexpected benefits due to changes in global supply chains or increased demand for domestically produced goods.

- Geographic diversification of companies listed on Euronext Amsterdam: The geographic reach of the companies listed on Euronext Amsterdam influences their sensitivity to global trade policies. Companies with diversified international operations may be less vulnerable than those primarily focused on domestic or US markets.

- The role of investor sentiment and speculation: Investor sentiment and speculation certainly played a role in the stock price increase. Anticipation of specific policy outcomes or perceived opportunities related to the tariff decision may have driven investor behavior.

The counter-intuitive market reaction could be attributed to a combination of factors, including specific industry composition, investor sentiment, and the inherent complexities of global trade flows.

Long-Term Implications and Future Predictions for Euronext Amsterdam

Predicting the long-term impact of Trump's tariff decisions on Euronext Amsterdam remains challenging. However, by analyzing current trends and considering potential future scenarios, we can offer some informed speculation.

- Predictions for future stock performance: The future performance of Euronext Amsterdam will likely depend on several factors, including the ongoing effects of Trump's trade policies, broader global economic conditions, and the performance of specific sectors listed on the exchange.

- Potential risks and opportunities for investors: Investors should carefully assess the potential risks and opportunities associated with investing in Euronext Amsterdam stocks, considering both the short-term and long-term implications of global trade policies.

- Recommendations for investors considering Euronext Amsterdam stocks: Investors interested in Euronext Amsterdam should conduct thorough due diligence and develop a robust investment strategy that accounts for the inherent volatility of the market.

Expert analysis suggests that while the initial surge may have been partly due to unexpected benefits, sustained growth will depend on broader economic factors.

Alternative Explanations for the Euronext Amsterdam Stock Rise

While Trump's tariff decision may have played a role, it's crucial to consider other potential factors that might have contributed to the 8% stock increase.

- Independent economic factors impacting the Netherlands or Europe: Positive economic indicators in the Netherlands or broader European Union might have contributed to investor confidence, independent of the tariff announcement.

- Specific company news affecting major players on the Euronext Amsterdam: Positive news related to individual companies listed on the exchange, unrelated to tariffs, could have also influenced the overall market trend.

- Influence of global investor sentiment unrelated to trade policy: Global investor sentiment, driven by other factors such as interest rate changes or geopolitical events, could have also independently impacted the market.

A complete analysis requires considering these alternative explanations alongside the potential effects of Trump's tariff decision.

Conclusion: Understanding the Lasting Impact of Trump's Tariff Decision on Euronext Amsterdam

The 8% surge in Euronext Amsterdam following Trump's tariff decision was an unexpected market anomaly. While the tariffs themselves might have played a role, the increase was likely influenced by a confluence of factors including specific sectoral benefits, overall investor sentiment, and independent economic conditions within the Netherlands and Europe. Understanding the precise interplay of these factors is crucial for interpreting the implications of Trump's tariff decisions.

To fully grasp the lasting impact of Trump's tariff decisions, it's essential to monitor Trump's tariff decisions closely, track Euronext Amsterdam stock performance, and understand the impact of global trade policies on various market sectors. Further research into the specific industry compositions of Euronext Amsterdam and a detailed analysis of investor behavior during this period would yield more comprehensive insights. Stay informed to navigate the complexities of global trade and its impact on your investments.

Featured Posts

-

Find Your Dream Car Pts Riviera Blue Porsche 911 S T

May 24, 2025

Find Your Dream Car Pts Riviera Blue Porsche 911 S T

May 24, 2025 -

Significant Delays On M6 Southbound Following Accident

May 24, 2025

Significant Delays On M6 Southbound Following Accident

May 24, 2025 -

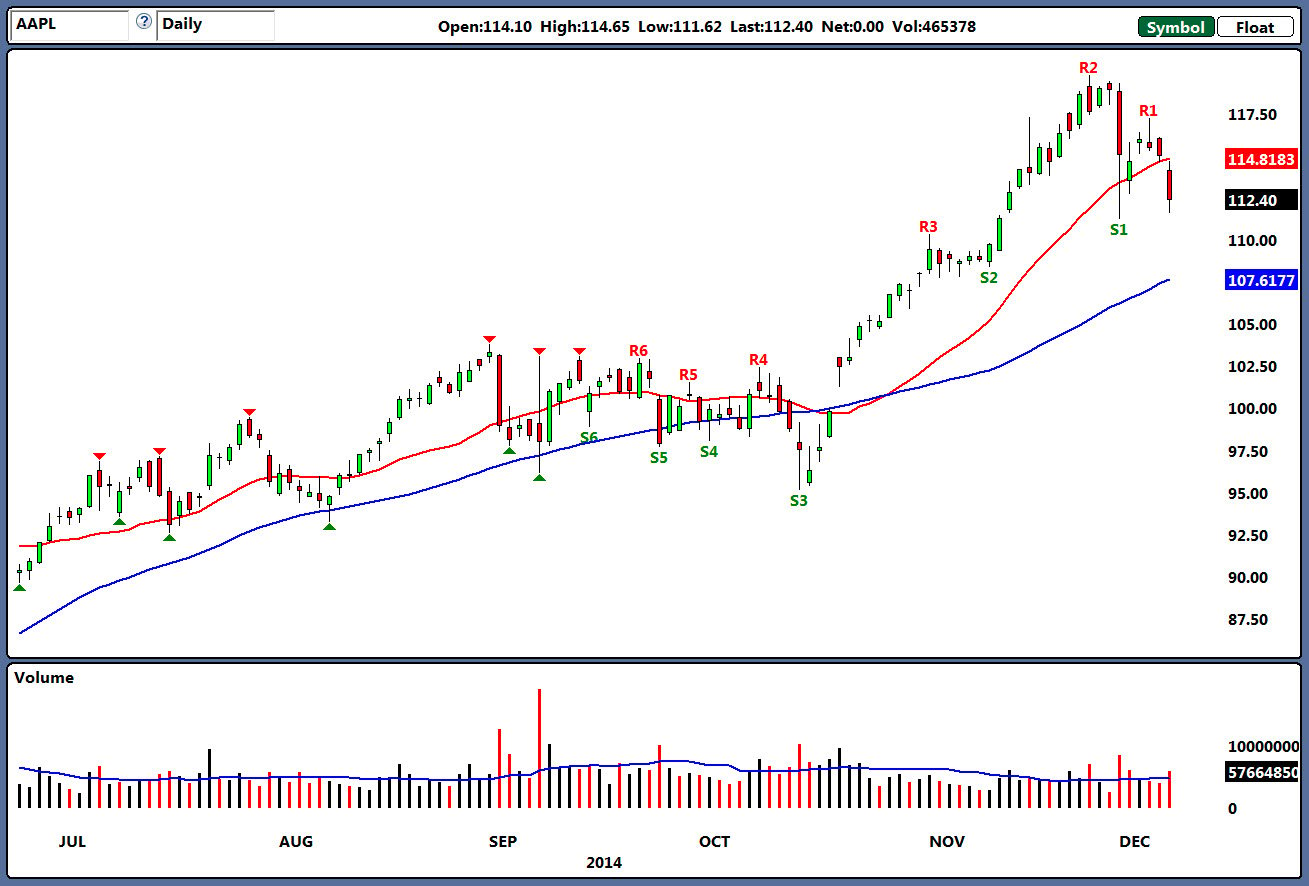

Apple Stock Aapl Key Price Levels To Watch

May 24, 2025

Apple Stock Aapl Key Price Levels To Watch

May 24, 2025 -

Michael Caines Unexpected On Set Visit During Mia Farrow Sex Scene Filming

May 24, 2025

Michael Caines Unexpected On Set Visit During Mia Farrow Sex Scene Filming

May 24, 2025 -

The Impact Of Trump Era Funding Cuts On Museum Programs

May 24, 2025

The Impact Of Trump Era Funding Cuts On Museum Programs

May 24, 2025

Latest Posts

-

Covid 19 Pandemic Lab Owners Guilty Plea For False Test Results

May 24, 2025

Covid 19 Pandemic Lab Owners Guilty Plea For False Test Results

May 24, 2025 -

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025

Investigating The Consequences Of Trumps Museum Funding Cuts

May 24, 2025 -

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025

Funding Crisis Trumps Cuts And The Fate Of Museum Programs

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025 -

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025

The Potential Of Orbital Space Crystals In Pharmaceutical Research

May 24, 2025