Impact Of US-China Relations And Economic Data On Chinese Stocks

Table of Contents

The Geopolitical Rollercoaster: US-China Relations and Market Sentiment

Escalating tensions between the US and China, whether through trade wars, technological disputes, or political disagreements, significantly influence investor sentiment and create market volatility. Negative news and heightened uncertainty often lead to capital flight and sell-offs in Chinese stocks. Conversely, periods of improved relations, marked by trade deals or diplomatic breakthroughs, can boost investor confidence, triggering market rallies and increased investment in Chinese equities.

-

Examples of impact: The 2018-2020 trade war significantly impacted Chinese stock indices, with periods of sharp decline followed by periods of recovery as trade negotiations progressed. Conversely, positive diplomatic signals often lead to short-term gains in the Shanghai Composite Index and the Hang Seng Index.

-

Media and public perception: Media coverage plays a crucial role in shaping market reactions. Negative headlines about US-China relations can exacerbate sell-offs, while positive narratives can fuel investor optimism. Understanding the narrative surrounding US-China relations is crucial for assessing market sentiment.

-

Sector-specific impact: The technology sector, in particular, has been highly sensitive to US-China tensions, experiencing significant volatility due to export restrictions and regulatory uncertainty. Manufacturing and other export-oriented sectors are also highly susceptible to the ebb and flow of geopolitical relations.

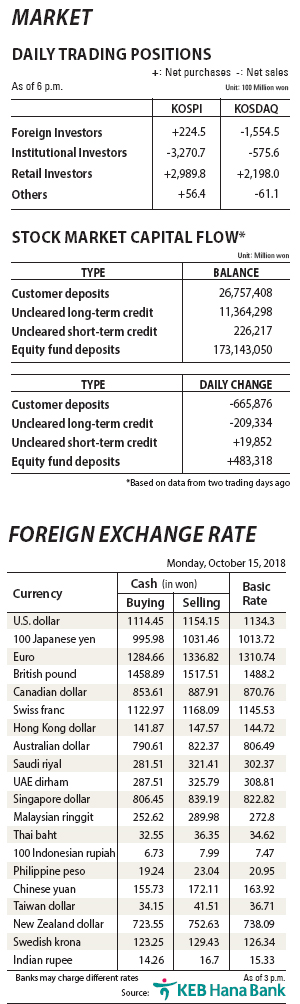

Decoding the Numbers: Key Economic Indicators and Their Influence

Monitoring macroeconomic data is essential for understanding the health of the Chinese economy and its implications for Chinese stocks. Key indicators such as GDP growth, inflation (CPI), consumer spending, industrial production (PMI), and employment data provide valuable insights into the country's economic trajectory. Positive data releases generally boost stock prices, reflecting investor confidence in the economy's growth potential. Conversely, negative data often triggers sell-offs as investors react to signs of economic slowdown or weakness.

-

Specific indicators and relevance: The Purchasing Managers' Index (PMI) provides insights into manufacturing activity, while CPI reveals inflationary pressures. Strong PMI readings and controlled inflation are generally positive for Chinese stocks. Employment data reveals the health of the labor market, a key indicator of consumer spending and overall economic strength.

-

Impact of unexpected data: Unexpectedly strong or weak data releases can have a significant and immediate impact on market reactions. Positive surprises tend to lead to short-term gains, while negative surprises can trigger sell-offs.

-

Data comparison: It’s crucial to compare current economic data to expectations and previous periods to gauge the true significance of the release. A small increase in inflation that aligns with expectations might have minimal market impact, while an unexpected surge could trigger significant volatility.

Sector-Specific Impacts: Identifying Opportunities and Risks

Different sectors within the Chinese economy exhibit varying sensitivities to US-China relations and economic data. Understanding these sector-specific impacts is key to identifying opportunities and mitigating risks.

-

Geopolitically sensitive sectors: The technology sector, due to its reliance on international supply chains and its strategic importance, is highly sensitive to US-China tensions. Certain manufacturing sectors heavily reliant on US exports also face significant risks.

-

Resilient sectors: Sectors focused on domestic consumption, such as consumer goods and certain parts of the healthcare sector, tend to exhibit greater resilience during periods of economic uncertainty or geopolitical tension.

-

Diversification strategies: Diversification across different sectors is crucial for mitigating risk. Investing in a mix of sectors less sensitive to geopolitical risks can help to stabilize portfolios during periods of market uncertainty.

Investment Strategies in a Complex Landscape: Mitigating Risk and Capitalizing on Opportunities

Investing in Chinese stocks requires a sophisticated approach that acknowledges the complexities of the geopolitical and economic landscape. Thorough due diligence and fundamental analysis are paramount.

-

Due diligence and fundamental analysis: Investors should thoroughly research individual companies, assessing their financial health, competitive landscape, and growth potential before investing.

-

Diversification: Diversification across sectors and asset classes helps to mitigate risk. Holding a diversified portfolio reduces exposure to any single sector or geopolitical event.

-

Hedging strategies: Employing hedging strategies, such as using derivatives, can help mitigate risks associated with currency fluctuations or market downturns.

-

Staying updated: Staying informed about the latest news and developments concerning US-China relations and key economic indicators is crucial for making timely and informed investment decisions.

Conclusion: Charting a Course Through Volatility: Making Informed Decisions on Chinese Stocks

The performance of Chinese stocks is inextricably linked to the dynamics of US-China relations and the release of key economic data. Understanding these factors is vital for informed investment decisions. By carefully monitoring geopolitical developments, analyzing economic indicators, and employing sound risk management techniques, investors can navigate the complexities of this market and potentially capitalize on opportunities while mitigating risks. Continue your research by exploring reputable financial news sources and conducting thorough due diligence before making any investment decisions in Chinese stocks. Understanding the impact of US-China relations and economic data is crucial for success in this dynamic market.

Featured Posts

-

Confirmation Rihanna Pregnant With Third Child At Met Gala

May 07, 2025

Confirmation Rihanna Pregnant With Third Child At Met Gala

May 07, 2025 -

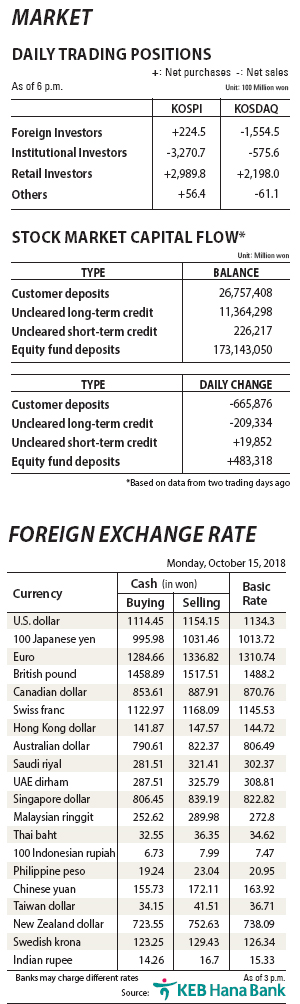

A List Stars Dazzle At The Met Gala Red Carpet

May 07, 2025

A List Stars Dazzle At The Met Gala Red Carpet

May 07, 2025 -

Future Russian Nhl Stars Learning From Alex Ovechkins Success

May 07, 2025

Future Russian Nhl Stars Learning From Alex Ovechkins Success

May 07, 2025 -

John Wick 5 Making The Keanu Reeves Team Up A Reality

May 07, 2025

John Wick 5 Making The Keanu Reeves Team Up A Reality

May 07, 2025 -

Khokkey Rekordsmen Po Silovym Priemam Obyavlyaet O Zavershenii Karery

May 07, 2025

Khokkey Rekordsmen Po Silovym Priemam Obyavlyaet O Zavershenii Karery

May 07, 2025