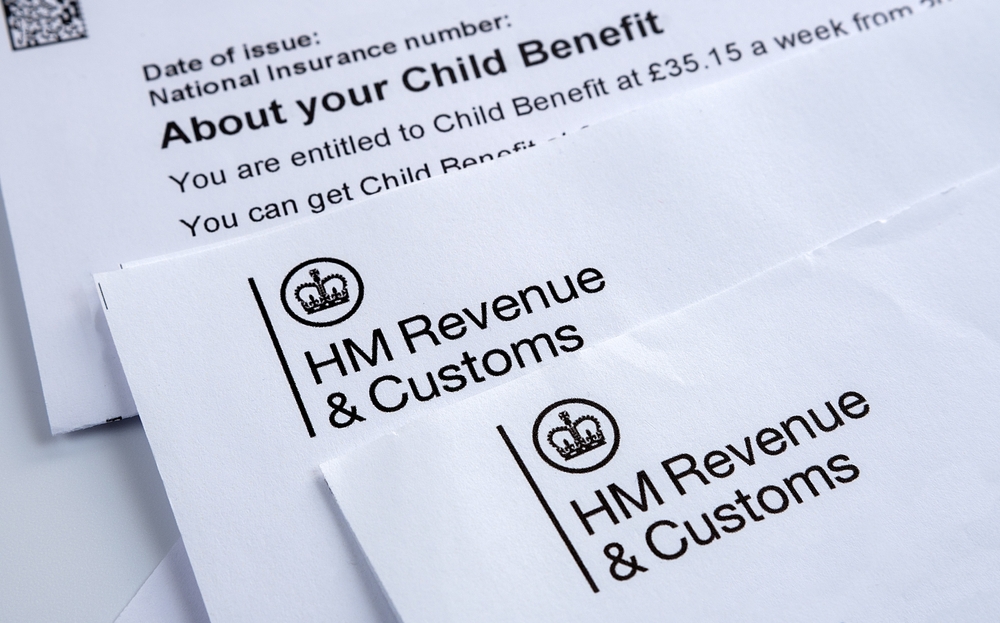

Important HMRC Communication: Check Your Child Benefit Status Now

Table of Contents

Understanding Your Child Benefit Entitlement

Child Benefit is a significant financial support offered by the UK government to help families with the costs of raising children. However, your eligibility for Child Benefit, and the amount you receive, depends on several factors.

Eligibility criteria for Child Benefit include:

- Residency: You must be ordinarily resident in the UK.

- Child's Age: Child Benefit is payable for each child under 16, or under 20 if they are in approved further or higher education.

- National Insurance Number: You'll need a valid National Insurance number for each child.

High Income Child Benefit Charge: It's important to understand the High Income Child Benefit Charge. If one partner earns over £50,000 per year, you might need to pay back some of the Child Benefit you receive. This is not a penalty; it's a tax charge. The amount you repay depends on your combined income.

Common reasons for changes in your Child Benefit payments include:

- Changes in family income: A significant increase or decrease in income can impact your entitlement and potentially trigger the High Income Child Benefit Charge.

- Changes in family circumstances: Events like the birth of a child, a child turning 16 or leaving full-time education, or a change of address all need to be reported to HMRC.

- Changes in childcare arrangements: Certain childcare costs might affect your entitlement.

For more detailed information on Child Benefit eligibility, visit the official HMRC website: [Insert HMRC Child Benefit Eligibility Link Here]

How to Check Your Child Benefit Status Online

Accessing your Child Benefit information online is quick and easy. Here's a step-by-step guide:

- Visit the HMRC website: Go to the official HMRC website and navigate to the Child Benefit section.

- Sign in: Use your Government Gateway user ID and password to log in to your online account. If you don't have an account, you'll need to register.

- Navigate to your Child Benefit information: Once logged in, locate the section dedicated to your Child Benefit claim. The layout may vary slightly depending on updates to the HMRC website, but the information should be easily accessible.

- Verify your details: Check that all your personal details, including your address and bank account information, are accurate and up to date. This is crucial for ensuring your payments are made correctly.

Troubleshooting common login issues:

- Forgotten Password: Use the password reset function on the HMRC website.

- Account locked: Contact the HMRC helpline if your account is locked.

The information available in your online Child Benefit account includes:

- Payment history: View past Child Benefit payments.

- Upcoming payments: See when your next payment is scheduled.

- Contact details: Ensure your contact information is correct.

- Claim details: Review details of your Child Benefit claim, including the number of children claimed for.

What to Do If There's a Problem with Your Child Benefit

If you notice any discrepancies, such as an incorrect payment amount or missing payments, it's important to act quickly.

- Report discrepancies: Contact the HMRC Child Benefit helpline immediately to report any issues.

- Missing Payments: If you haven't received a payment, check your bank statements and then contact HMRC.

- Appealing a decision: If you disagree with a decision made by HMRC regarding your Child Benefit, you have the right to appeal. The HMRC website provides information on the appeals process.

Potential issues and solutions:

- Incorrect payment amount: Contact HMRC to report the error and provide supporting documentation.

- Missing payments: Contact HMRC immediately to investigate the delay.

- Changes to your claim: Report any changes to your circumstances promptly to avoid delays or potential penalties.

- Updating contact details: Update your address and other contact information online through your HMRC account.

Key Dates and Deadlines for Child Benefit

Staying informed about key dates and deadlines is essential to avoid any potential penalties. HMRC provides regular updates on their website. Always check for any announcements regarding changes in policy or payment schedules. Late reporting of changes to your circumstances can result in penalties. Regularly monitoring your Child Benefit status is highly recommended.

Act Now – Check Your Child Benefit Status

Checking your Child Benefit status is a simple yet crucial step to ensure your family receives the financial support they're entitled to. Remember to regularly review your Child Benefit information to confirm accuracy and report any changes in your circumstances promptly. Don't delay! Check your Child Benefit status today and ensure your family receives the support they are entitled to. Visit the HMRC website or contact the helpline to address any concerns regarding your Child Benefit status. [Insert HMRC Child Benefit Website Link Here]

Featured Posts

-

Billionaire Boy A Deep Dive Into Wealth And Privilege

May 20, 2025

Billionaire Boy A Deep Dive Into Wealth And Privilege

May 20, 2025 -

Former F1 World Champion Advocates For Mick Schumachers Cadillac Seat

May 20, 2025

Former F1 World Champion Advocates For Mick Schumachers Cadillac Seat

May 20, 2025 -

Wwe Mitb Rhea Ripley And Roxanne Perez Secure Qualifying Wins

May 20, 2025

Wwe Mitb Rhea Ripley And Roxanne Perez Secure Qualifying Wins

May 20, 2025 -

Jennifer Lawrence A Jej Rodina Nove Prirastky

May 20, 2025

Jennifer Lawrence A Jej Rodina Nove Prirastky

May 20, 2025 -

F1 Drama Hamilton Och Leclerc Diskningen Och Dess Konsekvenser

May 20, 2025

F1 Drama Hamilton Och Leclerc Diskningen Och Dess Konsekvenser

May 20, 2025