India Market Buzz: Nifty's Bullish Run Fueled By Positive Trends

Table of Contents

Robust Economic Fundamentals Driving the Nifty Bullish Run

India's strong economic fundamentals are a primary driver of the current Nifty bullish run. This positive momentum is not a fleeting trend but is rooted in solid, sustainable growth.

Strong GDP Growth

India's consistent GDP growth, exceeding expectations in recent quarters, is a major contributor to investor confidence. This robust growth is fueled by several key factors:

- Increased consumer spending: A burgeoning middle class and rising disposable incomes are driving significant consumer spending, boosting domestic demand.

- Government infrastructure investments: Massive government investments in infrastructure projects, including roads, railways, and energy, are stimulating economic activity and creating jobs. This includes initiatives like the Bharatmala Project and the ambitious plans for renewable energy expansion.

- Growth in key sectors like IT and manufacturing: The IT sector continues to thrive, attracting global clients and generating substantial revenue. Simultaneously, the manufacturing sector is experiencing a revival, driven by government initiatives like "Make in India."

- Positive forecasts from international organizations: Leading international organizations like the IMF and World Bank have issued positive growth forecasts for the Indian economy, further bolstering investor confidence.

Improving Corporate Earnings

Companies listed on the Nifty are reporting strong earnings, a key indicator of a healthy and growing economy. This improved profitability is translating into higher stock prices, further fueling the Nifty bullish run.

- Increased profitability across various sectors: Companies across diverse sectors, from banking and finance to consumer goods and pharmaceuticals, are reporting increased profitability.

- Strong balance sheets among leading companies: Many Nifty-listed companies boast strong balance sheets, providing them with the financial resilience to navigate economic uncertainties.

- Positive future earnings guidance from corporations: A significant number of companies are providing positive guidance for future earnings, indicating continued optimism and growth prospects.

- Expansion into new markets and product lines: Many Indian companies are aggressively expanding into new markets, both domestically and internationally, and are diversifying their product lines to fuel further growth.

Positive Global Sentiment and Foreign Institutional Investor (FII) Flows

The positive global sentiment towards emerging markets and strong FII flows are significantly contributing to the India Market's upward trajectory.

Global Economic Recovery

While the global economic recovery is uneven, the overall trend is positive, boosting investor sentiment towards emerging markets like India.

- Reduced global uncertainty: Decreased geopolitical uncertainties and a relatively stable global economic outlook are attracting foreign investment.

- Increased foreign direct investment (FDI): India is witnessing a significant increase in FDI, driven by its large and growing market, and the government's pro-business policies.

- Improved global trade relations: Improved global trade relations are facilitating increased exports and economic activity in India.

Strong FII Investments

Significant inflows from Foreign Institutional Investors (FIIs) are injecting liquidity into the Indian market, significantly contributing to the Nifty bullish run.

- Increased FII confidence in the Indian economy: FIIs are increasingly confident in the long-term growth prospects of the Indian economy.

- Attractive valuations compared to other markets: Compared to other major markets, Indian equities are often perceived as attractively valued, making them a desirable investment destination.

- Positive outlook for long-term growth in India: The long-term growth potential of India, driven by its young and growing population, makes it an attractive investment proposition for FIIs.

Government Policies and Reforms Supporting Market Growth

Supportive government policies and reforms are creating a conducive environment for investment and growth, playing a crucial role in the current market momentum.

Pro-business Reforms

The Indian government has implemented several pro-business reforms aimed at simplifying regulations and boosting ease of doing business.

- Tax reforms and incentives for businesses: Tax reforms and various incentives offered to businesses are attracting both domestic and foreign investment. The Goods and Services Tax (GST) has streamlined taxation, making business operations more efficient.

- Infrastructure development projects: Massive investments in infrastructure are creating a more robust environment for business growth and attracting investment.

- Initiatives to improve digital infrastructure: Initiatives to improve digital infrastructure, including the Digital India program, are improving connectivity and promoting digitalization across the economy.

- Focus on attracting foreign investment: The government's consistent focus on attracting foreign investment is yielding positive results, contributing to the current growth.

Focus on Infrastructure Development

Increased investment in infrastructure development is expected to generate significant economic activity and employment, further fueling the positive sentiment.

- Improved transportation networks: Investments in roads, railways, and ports are improving connectivity and logistics, boosting trade and commerce.

- Enhanced energy infrastructure: Investments in renewable energy and power generation are improving the reliability and affordability of energy, supporting industrial growth.

- Development of smart cities: Initiatives to develop smart cities are creating modern infrastructure and promoting sustainable development.

Conclusion

The Nifty's bullish run is a testament to the strong fundamentals of the Indian economy and the positive investor sentiment. Robust economic growth, improving corporate earnings, positive global sentiment, and supportive government policies are all contributing factors to this upward trajectory. While market volatility is always a possibility, the current trends suggest a promising outlook for the Indian stock market. Stay informed about the latest developments and consider diversifying your investment portfolio to capitalize on this exciting period of growth in the Indian market. Continue monitoring the Nifty bullish run for further insights and informed decision-making. Understanding the driving forces behind this India Market surge is crucial for any investor looking to participate in this positive trend. Don't miss out on the opportunities presented by this Nifty Bullish Run – stay updated!

Featured Posts

-

Canadian Auto Industry Fights Back A Five Point Plan To Counter Us Trade War

Apr 24, 2025

Canadian Auto Industry Fights Back A Five Point Plan To Counter Us Trade War

Apr 24, 2025 -

Trump Lawsuit Prompts 60 Minutes Executive Producer To Resign

Apr 24, 2025

Trump Lawsuit Prompts 60 Minutes Executive Producer To Resign

Apr 24, 2025 -

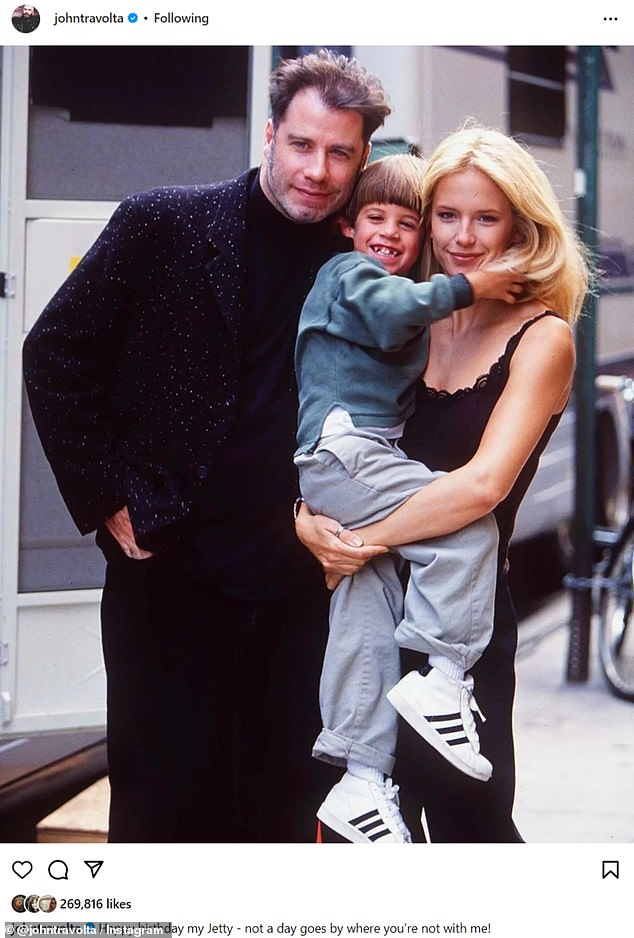

John Travoltas Heartfelt Tribute Photo Marks Late Sons Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute Photo Marks Late Sons Birthday

Apr 24, 2025 -

Child Actor Sophie Nyweide Known For Mammoth And Noah Passes Away At 24

Apr 24, 2025

Child Actor Sophie Nyweide Known For Mammoth And Noah Passes Away At 24

Apr 24, 2025 -

Usd Surges Shift In Trumps Rhetoric Fuels Dollar Appreciation Against Major Peers

Apr 24, 2025

Usd Surges Shift In Trumps Rhetoric Fuels Dollar Appreciation Against Major Peers

Apr 24, 2025