Indian Insurers Seek Regulatory Easing For Bond Forward Trading

Table of Contents

Current Regulatory Restrictions and Their Impact

Existing regulations governing bond forward trading for Indian insurers present significant hurdles. These limitations directly impact investment strategies and portfolio diversification capabilities within the Indian bond market. The current framework restricts insurers' ability to effectively manage risk and potentially limits returns compared to their global counterparts.

Specific restrictions create considerable challenges:

- High capital requirements for forward positions: The stringent capital adequacy requirements for holding forward contracts force insurers to allocate a larger proportion of their capital, reducing funds available for other lucrative investments.

- Restrictions on the types of bonds eligible for forward trading: This constraint limits insurers' ability to diversify their portfolios effectively and potentially exposes them to greater concentration risk.

- Limited access to sophisticated hedging strategies: The restrictions hamper insurers' ability to utilize advanced hedging techniques to mitigate interest rate risk and other market fluctuations.

- Difficulty in managing interest rate risk: The inability to effectively hedge exposes insurers to significant interest rate volatility, potentially impacting profitability and financial stability. This is a key regulatory hurdle that directly impacts risk management challenges within the Indian insurance sector.

These regulatory hurdles in the Indian bond market significantly impact the ability of insurers to optimize their investment strategies and achieve better risk-adjusted returns.

Arguments for Regulatory Easing

Indian insurers are advocating for regulatory reform to unlock the significant benefits of increased access to bond forward markets. Their arguments center on improved risk management, enhanced portfolio optimization, and ultimately, higher returns. Easing regulations would allow for greater market efficiency and participation.

The potential advantages include:

- Improved risk management through hedging instruments: Access to a wider range of hedging instruments allows insurers to mitigate risks associated with interest rate fluctuations and other market uncertainties, leading to greater stability.

- Increased investment opportunities for better portfolio diversification: Removing restrictions on eligible bonds enhances portfolio diversification, reducing overall risk and improving the risk-return profile.

- Enhanced returns due to optimized investment strategies: Greater flexibility in investment strategies directly translates to the potential for better risk-adjusted returns, boosting profitability for insurers.

- Greater participation in the bond market, boosting liquidity: Increased insurer participation would enhance the liquidity and efficiency of the Indian bond market. This is a key factor in promoting portfolio optimization and effective risk mitigation.

Potential Implications of Regulatory Changes

Easing regulations in bond forward trading for the Indian insurance sector presents both opportunities and challenges. Increased investment in the Indian bond market is a key potential positive outcome. However, careful consideration must be given to potential risks. The role of regulatory bodies like IRDAI (Insurance Regulatory and Development Authority of India) and the Reserve Bank of India (RBI) is crucial in managing these implications.

Potential Impacts:

- Increased capital flows into the bond market: Regulatory easing could attract more investment into the bond market, increasing its size and liquidity.

- Potential for increased market volatility: Greater participation might lead to increased market volatility, requiring robust monitoring and risk management frameworks.

- Need for robust risk management frameworks: As insurers adopt more sophisticated strategies, robust internal risk management frameworks become essential.

- Importance of effective regulatory supervision: Effective regulatory oversight is crucial to ensure the stability and integrity of the market while fostering growth.

Comparison with International Practices

A comparison with international best practices reveals significant differences in regulatory approaches to bond forward trading for insurance companies. The regulatory frameworks in the US and UK, for example, generally offer greater flexibility than India's current regime. Studying these international benchmarks provides valuable lessons in managing risk and fostering market growth.

- Regulatory framework in the US and UK: These jurisdictions typically allow insurers greater latitude in engaging in derivatives and bond forward trading.

- Key differences and similarities with Indian regulations: A key difference lies in the level of restrictions on eligible bonds and the capital requirements for forward positions. Similarities exist in the general goal of maintaining market stability and protecting policyholders.

- Best practices for managing risk in bond forward trading: International best practices highlight the importance of robust risk management frameworks, including stress testing, scenario analysis, and effective internal controls.

Conclusion: The Future of Bond Forward Trading for Indian Insurers

Regulatory easing for bond forward trading presents a significant opportunity for the Indian insurance sector. While the potential benefits of increased investment, improved risk management, and enhanced returns are undeniable, it is crucial to address potential risks through robust regulatory oversight and effective risk management frameworks. The IRDAI and RBI play a vital role in facilitating balanced regulatory reform to promote growth while mitigating systemic risk.

To ensure a healthy and dynamic bond market, it's crucial to stay informed about the evolving regulatory landscape. Engage in discussions about the future of Indian insurer participation in bond forward trading and advocate for policies that promote responsible growth and market efficiency. This proactive approach will pave the way for a more robust and dynamic Indian insurance sector, allowing insurers to better leverage bond market opportunities while maintaining financial stability.

Featured Posts

-

Mayor Ras Baraka Faces Arrest During Ice Detention Center Demonstration

May 10, 2025

Mayor Ras Baraka Faces Arrest During Ice Detention Center Demonstration

May 10, 2025 -

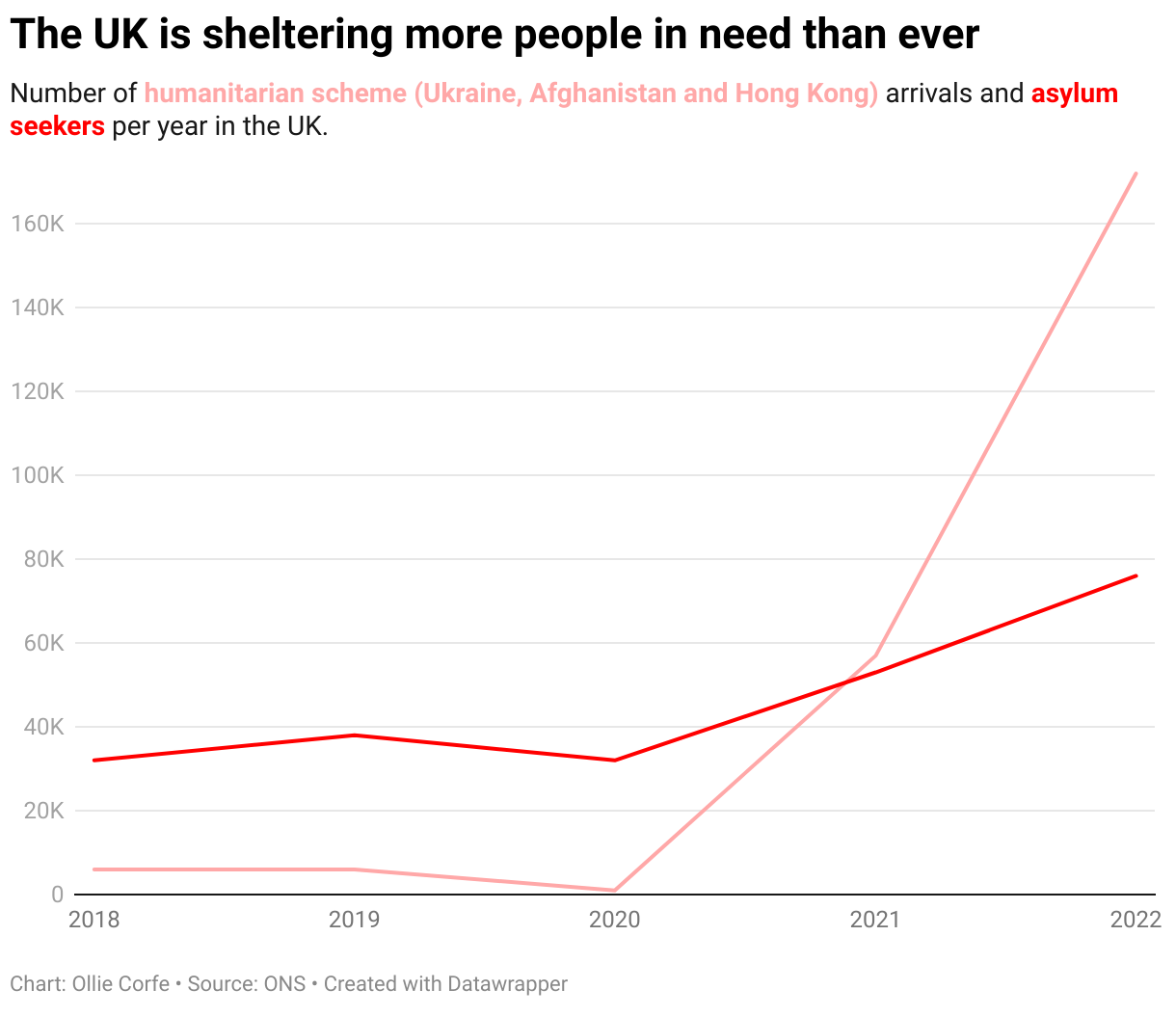

Uk Student Visas New Restrictions For Pakistani Applicants And Asylum Seekers

May 10, 2025

Uk Student Visas New Restrictions For Pakistani Applicants And Asylum Seekers

May 10, 2025 -

Analysis Of Broadcoms Extreme Price Increase On V Mware Costs

May 10, 2025

Analysis Of Broadcoms Extreme Price Increase On V Mware Costs

May 10, 2025 -

The End Of Ryujinx Nintendos Action And The Impact On Switch Emulation

May 10, 2025

The End Of Ryujinx Nintendos Action And The Impact On Switch Emulation

May 10, 2025 -

Accident A Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 10, 2025

Accident A Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Constitue Prisonnier

May 10, 2025