Indian Stock Market: BSE Shares Poised For Growth Following Earnings Announcement

Table of Contents

Positive Earnings Reports Fueling BSE Share Growth

Strong earnings reports are the primary catalyst for the current bullish sentiment surrounding BSE shares. Several blue-chip companies have significantly exceeded expectations in their recent announcements, boosting investor confidence and driving up the BSE Index.

- Exceptional Q3 Results: Many prominent companies showcased robust Q3 (October-December) 2023 results, reflecting strong economic activity and healthy consumer spending within India. This indicates a resilient domestic market, unaffected by global headwinds to the same extent as other major markets.

- Increased Profitability Across Sectors: Increased profitability isn't limited to a single sector. We're seeing strong performances across diverse areas, suggesting a broad-based economic upturn. This translates to a positive trend for the overall BSE market performance.

- Positive Financial Indicators: Analysis of key financial indicators, such as Earnings Per Share (EPS) and revenue growth, demonstrates a healthy upward trajectory for many listed companies. This data-driven analysis supports the optimistic outlook.

For example, Reliance Industries' impressive Q3 results significantly impacted the BSE Sensex. Similarly, strong performances from IT giants like Infosys and TCS have further fueled the positive market sentiment. (Note: This section would ideally include links to relevant financial news articles supporting these claims). The impact of these positive earnings reports is clearly visible in the upward trend of both the BSE Sensex and the Nifty indices.

Government Policies and Initiatives Boosting Investor Confidence

Government policies and initiatives are playing a crucial role in bolstering investor confidence and attracting foreign investment into the Indian stock market. Several factors contribute to this positive environment.

- Focus on Infrastructure Development: Massive infrastructure development projects are stimulating growth across various sectors, creating a ripple effect that benefits numerous BSE-listed companies.

- Attracting Foreign Investment: The government's consistent efforts to attract foreign direct investment (FDI) are injecting much-needed capital into the economy, further strengthening the market.

- Pro-business Reforms: Regulatory reforms and streamlining of business processes have significantly improved the ease of doing business in India, encouraging both domestic and international investments.

These initiatives have a direct and indirect impact on the BSE. For instance, policies promoting renewable energy have led to significant growth in the renewable energy sector listed on the BSE. Data on FDI inflows and GDP growth can further substantiate the positive impact of these government policies. (Again, linking to relevant government reports would strengthen this section).

Sector-Specific Growth Drivers in the BSE

Specific sectors within the BSE are experiencing particularly robust growth, further contributing to the overall positive outlook.

- IT Sector Boom: The IT sector continues to be a significant growth driver, fueled by global demand for technology services and India's position as a leading IT services provider.

- Pharmaceutical Sector Expansion: The pharmaceutical sector is also witnessing strong growth, driven by increasing healthcare expenditure and the rise of generic drug manufacturers.

- FMCG Sector Resilience: The fast-moving consumer goods (FMCG) sector remains resilient, showcasing consistent growth despite economic fluctuations.

This sector-specific analysis reveals a diverse and dynamic market. However, it's important to note that while some sectors are thriving, others may face challenges. (A chart comparing the performance of these sectors would be a valuable visual aid here).

Potential Risks and Challenges for BSE Shares

While the outlook is positive, it’s crucial to acknowledge potential risks and challenges that could impact the growth trajectory of BSE shares.

- Global Economic Uncertainty: Global economic uncertainty, including inflation and potential recessions in major economies, could negatively affect investor sentiment and impact the Indian market.

- Inflationary Pressures: Persistent inflationary pressures could erode corporate profits and dampen consumer spending, thereby affecting the performance of BSE-listed companies.

- Geopolitical Risks: Geopolitical tensions and global events can create market volatility and impact investor confidence.

These risks, while real, should be viewed within the context of India's relatively strong economic fundamentals and its potential for long-term growth. Effective risk mitigation strategies, such as diversification and careful portfolio management, can help investors navigate these challenges.

Conclusion

Strong earnings announcements, supportive government policies, and robust sector-specific growth drivers paint a largely positive picture for BSE shares. While potential risks exist, the overall sentiment points towards substantial growth. This presents an opportune time to explore investment opportunities in the Indian stock market. However, it's vital to conduct thorough research and consider consulting with a qualified financial advisor before making any investment decisions related to BSE shares or any investments in the broader Indian Stock Market. Remember to carefully analyze your risk tolerance and diversify your portfolio accordingly.

Featured Posts

-

Xrp Whales Massive 20 M Token Buy A Big Bet On Ripple

May 07, 2025

Xrp Whales Massive 20 M Token Buy A Big Bet On Ripple

May 07, 2025 -

Lotto Plus And Lotto Results For Saturday April 12 2025

May 07, 2025

Lotto Plus And Lotto Results For Saturday April 12 2025

May 07, 2025 -

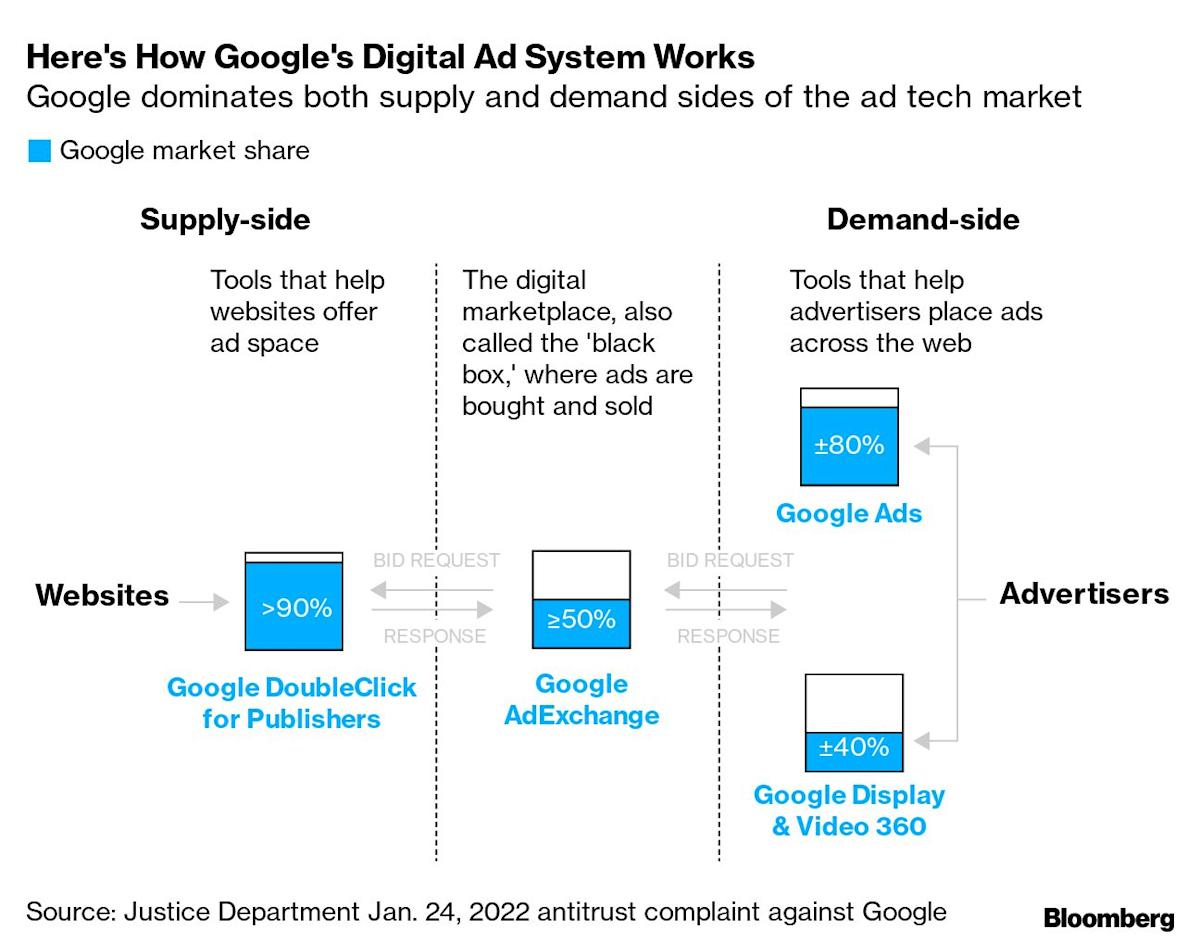

Us Antitrust Action Googles Ad Tech Empire Under Threat Of Forced Sale

May 07, 2025

Us Antitrust Action Googles Ad Tech Empire Under Threat Of Forced Sale

May 07, 2025 -

Saturday Lotto Results April 12th Winning Numbers

May 07, 2025

Saturday Lotto Results April 12th Winning Numbers

May 07, 2025 -

Savage X Fenty Rihannas New Lingerie Line For The Bride To Be

May 07, 2025

Savage X Fenty Rihannas New Lingerie Line For The Bride To Be

May 07, 2025