Indian Stock Market Update: Sensex & Nifty Rally - Detailed Market Analysis

Table of Contents

Sensex & Nifty Performance: A Closer Look

Sensex's Upward Trajectory

The Sensex has demonstrated a robust upward trajectory in recent weeks. For instance, over the past month, the index has seen a remarkable 10% increase, fueled by strong performance across multiple sectors. This surge is a significant indicator of investor confidence in the Indian economy.

- Specific sector gains within the Sensex: The IT sector has been a significant contributor, showing a 15% increase, followed by the FMCG sector with an 8% rise. Financials also saw notable growth.

- Significant contributing stocks: Reliance Industries, Infosys, and HDFC Bank have been key drivers of the Sensex's upward movement, showcasing strong individual performances. These companies' positive financial results and outlook have boosted investor sentiment.

- Sensex gains visualization: (Insert chart/graph showing Sensex performance over the specified period)

Nifty's Parallel Growth

Mirroring the Sensex, the Nifty index has also experienced substantial growth, exhibiting a parallel upward trend. Over the same month, the Nifty 50 index has shown a 9% increase, highlighting a broad-based market rally.

- Sector-wise analysis for Nifty: Similar to the Sensex, the IT and FMCG sectors have been key contributors to the Nifty's growth, reflecting positive industry trends. The banking sector also registered significant gains.

- Key contributing stocks: TCS, HCL Technologies, and Bajaj Finance were among the top performers within the Nifty 50 index, contributing significantly to its overall gains.

- Nifty gains visualization: (Insert chart/graph showing Nifty performance over the specified period)

Comparison of Sensex and Nifty Performance

The correlation between Sensex and Nifty movements is generally strong, and this recent rally exemplifies this. Both indices have shown nearly identical percentage gains, reflecting a broad-based market optimism rather than sector-specific exuberance. Any minor divergence can usually be attributed to the different composition of the indices and the weighting of individual stocks.

Underlying Factors Driving the Rally

Positive Economic Indicators

Several positive economic indicators are contributing to the current market rally.

- Indian GDP growth: The recent projection of strong GDP growth for the fiscal year has instilled confidence among investors, indicating a healthy economic outlook.

- Inflation rates: A relatively stable inflation rate, within the Reserve Bank of India's target range, is reducing uncertainty and promoting investment.

- Foreign Institutional Investment (FII) and Domestic Institutional Investment (DII): Increased FII and DII flows are injecting significant capital into the Indian stock market, driving prices higher.

Government Policies and Initiatives

Recent government initiatives and policies have also played a crucial role in boosting market sentiment.

- Economic reforms: The government's focus on infrastructure development and ease of doing business has improved investor confidence.

- Market regulations: Clear and consistent regulatory frameworks are attracting both domestic and foreign investment, encouraging market stability.

Global Market Trends

While the Indian market shows strength, global market trends also have an impact.

- International investment: Positive global economic indicators and favorable international investment flows have added to the positive sentiment in the Indian market.

- Global economic outlook: A relatively stable global economic outlook, despite some uncertainties, has contributed to the current market optimism.

Sector-Specific Analysis

Top Performing Sectors

Several sectors have significantly outperformed the market during this rally.

- IT sector: Strong growth in the IT sector, fueled by increasing demand for technology services globally, has driven substantial gains.

- Pharma sector: The pharma sector has shown resilience, benefitting from robust domestic and international demand.

- FMCG sector: The FMCG sector's consistent performance reflects strong consumer demand and stable growth prospects.

Underperforming Sectors

Despite the overall positive market sentiment, some sectors have underperformed.

- Reasons for underperformance: Factors like cyclical downturns, specific company challenges, or regulatory headwinds can lead to underperformance in certain sectors. A careful analysis is needed for each underperforming sector.

- Future prospects: Understanding the reasons for underperformance is crucial for long-term investors to assess the future prospects of individual sectors.

Future Outlook and Investment Strategies

Expert Opinions

Financial experts have expressed differing opinions on the future market trajectory. While some anticipate continued growth, others suggest caution, anticipating potential market corrections.

- Stock market predictions: The consensus leans towards moderate growth, but the pace of the rally is subject to various macroeconomic and geopolitical factors.

- Market outlook: Maintaining a diversified portfolio and a long-term investment strategy is recommended, irrespective of short-term market fluctuations.

Potential Risks and Challenges

Despite the current positive trend, several potential risks and challenges could impact the market's future performance.

- Market risks: Geopolitical instability, unexpected economic downturns, and regulatory changes could negatively impact the market.

- Investment risks: Investors should carefully assess their risk tolerance before making any investment decisions.

Conclusion

The recent rally in the Indian stock market, reflected in the significant gains of the Sensex and Nifty, is a result of positive economic indicators, supportive government policies, and favorable global trends. While sectors like IT, Pharma, and FMCG have shown exceptional performance, others have underperformed. Experts predict continued growth, but investors should be mindful of potential risks and maintain a balanced, long-term investment strategy. Understanding the dynamics of the Indian stock market is crucial for informed investment decisions. To stay updated on the latest trends and analysis of the Indian stock market, regularly check for updated reports and consider subscribing to reputable financial news sources for insightful market analysis and investment advice. Stay informed about Indian equities and their ongoing performance to make well-informed investment decisions.

Featured Posts

-

The Bangkok Posts Coverage Of The Transgender Equality Movement In Thailand

May 10, 2025

The Bangkok Posts Coverage Of The Transgender Equality Movement In Thailand

May 10, 2025 -

New Deals Team At Deutsche Bank Targets Growth In Defense Finance Sector

May 10, 2025

New Deals Team At Deutsche Bank Targets Growth In Defense Finance Sector

May 10, 2025 -

Strands Nyt Crossword Solutions And Clues For February 15th Game 349

May 10, 2025

Strands Nyt Crossword Solutions And Clues For February 15th Game 349

May 10, 2025 -

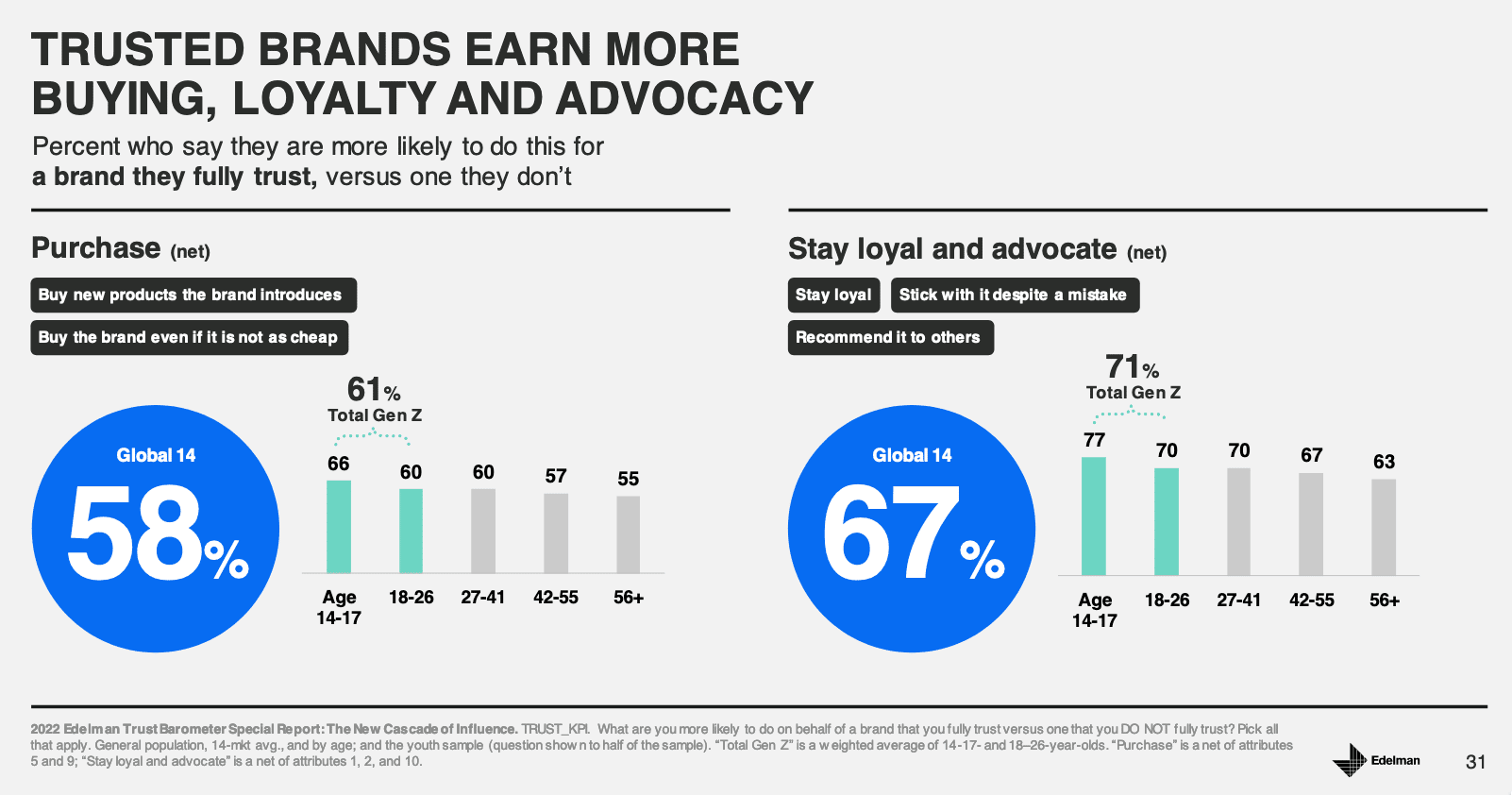

Android Vs I Phone Analyzing Gen Zs Smartphone Preferences

May 10, 2025

Android Vs I Phone Analyzing Gen Zs Smartphone Preferences

May 10, 2025 -

Thailands Transgender Community A Fight For Equality In The Spotlight Bangkok Post

May 10, 2025

Thailands Transgender Community A Fight For Equality In The Spotlight Bangkok Post

May 10, 2025