India's Greenko: Founders Explore Deal To Purchase Orix Stake

Table of Contents

Greenko's Current Market Position and Growth Trajectory

Greenko Energy Holdings has firmly established itself as a leader in India's renewable energy landscape. The company boasts a substantial portfolio of wind, solar, and hydro power projects, contributing significantly to India's ambitious renewable energy targets. Greenko's strategic expansion plans, coupled with a strong financial performance, position it for continued growth.

- Market share in renewable energy: Greenko holds a significant market share in the Indian renewable energy sector, consistently ranking among the top players. Precise figures vary depending on the source and year, but estimates consistently place them within the top three.

- Key projects undertaken: Greenko has successfully completed numerous large-scale renewable energy projects across India, showcasing its expertise in project development and execution. These include both wind and solar farms, contributing significantly to the country's renewable energy capacity.

- Financial performance (revenue, profit): Greenko has demonstrated consistent revenue and profit growth, attracting significant investments and highlighting its financial stability. Detailed financial data can be found in their annual reports.

- Future growth projections: Greenko's future growth projections are optimistic, driven by India's increasing demand for renewable energy and the company's ongoing expansion plans. They are actively pursuing new projects and exploring innovative technologies to further enhance their market position. These projections indicate a strong future for the company.

Orix Corporation's Stake and its Strategic Importance

Orix Corporation, a significant Japanese financial services group, holds a substantial stake in Greenko. The exact percentage of this stake is currently undisclosed, but reports indicate it's a significant minority holding. Orix's investment in Greenko reflects its long-term strategic interest in the growth of India's renewable energy sector.

- Percentage of stake held by Orix: While the precise percentage remains unconfirmed publicly, sources suggest it represents a considerable investment for Orix.

- Orix's investment timeline in Greenko: Orix's investment in Greenko spans several years, showcasing its confidence in the company's long-term prospects and its commitment to the Indian renewable energy market.

- Potential reasons for Orix's planned divestment: While the precise reasons for Orix's potential divestment are speculative, industry analysts point to various possibilities, such as portfolio restructuring or a focus on other investment opportunities.

- Impact of the stake sale on Orix's portfolio: The divestment from Greenko will undoubtedly reshape Orix's investment portfolio, potentially creating opportunities for further investment in other sectors or geographic regions.

Potential Implications of the Acquisition for Greenko

The potential acquisition of Orix's stake by Greenko's founders could have significant implications for the company's future. While it promises increased control and potentially improved financial performance, it also introduces risks.

- Increased control for founders: A successful acquisition would grant the founders greater control over Greenko's strategic direction and operational decisions.

- Potential for improved financial performance: The acquisition might lead to streamlined decision-making and more focused strategies, potentially boosting financial performance.

- Risks associated with increased debt or leverage: Funding the acquisition might require significant debt financing, potentially increasing financial risk and vulnerability to market fluctuations.

- Impact on Greenko's relationships with other investors: The acquisition could impact relationships with existing investors, requiring careful management to maintain stability and confidence.

Market Reaction and Expert Opinions on the Proposed Deal

News of the potential Greenko-Orix deal has generated considerable interest within the financial and renewable energy markets. Early reactions are mixed, with analysts expressing both optimism and caution.

- Stock market reaction: The stock market reaction to the news has been closely watched, with shares demonstrating some volatility.

- Analyst comments and predictions: Industry analysts have offered varying perspectives, some predicting positive outcomes due to increased founder control, while others express concerns about the potential financial burden.

- Impact on investor confidence: The deal's impact on investor confidence will depend largely on how it is structured and executed, and how transparently it is communicated.

- Comparison with similar acquisitions in the industry: Analysts are drawing comparisons to similar acquisitions within the renewable energy sector, offering insights into potential outcomes and challenges.

Greenko's Future: Founders' Stake Acquisition and the Path Ahead

The potential acquisition of Orix's stake represents a pivotal moment for Greenko Energy Holdings. The successful completion of this deal could solidify the founders' control, potentially unlocking new growth opportunities. However, careful management of financial risks and investor relations will be crucial for long-term success. The deal's outcome will significantly shape Greenko's future and its position within the dynamic Indian renewable energy market. Stay informed about the latest developments in the Greenko-Orix stake acquisition and the future of Greenko's renewable energy initiatives in India. Follow [link to relevant news source or Greenko’s website].

Featured Posts

-

Major Reddit Outage In Us Users Encounter Page Not Found Errors

May 17, 2025

Major Reddit Outage In Us Users Encounter Page Not Found Errors

May 17, 2025 -

Travel With Pets On Uber In Mumbai A Complete Guide

May 17, 2025

Travel With Pets On Uber In Mumbai A Complete Guide

May 17, 2025 -

7 Bit Casino A Top Rated No Kyc Casino With Fast Withdrawals In 2025

May 17, 2025

7 Bit Casino A Top Rated No Kyc Casino With Fast Withdrawals In 2025

May 17, 2025 -

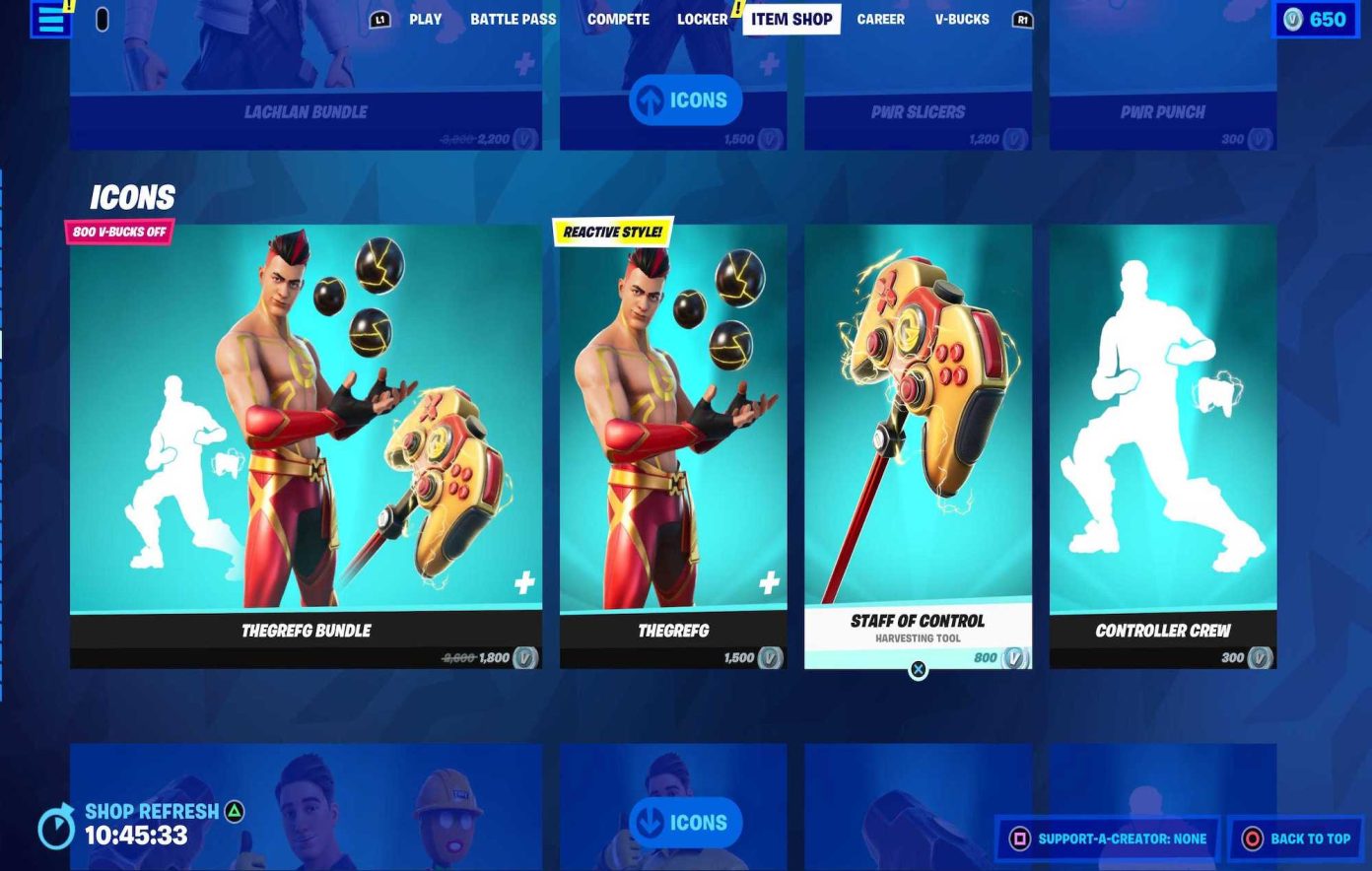

Highly Requested Fortnite Skins Returning To The Item Shop

May 17, 2025

Highly Requested Fortnite Skins Returning To The Item Shop

May 17, 2025 -

Apenas 4 Cursos Superam A Nota Maxima Do Mec Na Regiao Veja Quais

May 17, 2025

Apenas 4 Cursos Superam A Nota Maxima Do Mec Na Regiao Veja Quais

May 17, 2025