India's Nifty Index: Recent Gains And Future Market Outlook

Table of Contents

Recent Gains in the Nifty Index

Factors Contributing to Recent Growth

Several factors have contributed to the Nifty Index's recent impressive performance. These include:

- Robust GDP Growth: India's consistent GDP growth, despite global headwinds, has boosted investor confidence and fueled market expansion. Strong domestic demand and government initiatives play a significant role.

- Foreign Institutional Investor (FII) Inflows: Significant inflows of foreign investment have injected liquidity into the market, pushing up stock prices across various sectors. This reflects a positive global perception of India's economic potential.

- Positive Corporate Earnings: Many companies listed on the Nifty 50 have reported strong quarterly earnings, showcasing the resilience of the Indian corporate sector and driving investor optimism.

- Government Reforms and Policies: Pro-business reforms and government initiatives aimed at improving infrastructure and ease of doing business have created a favorable environment for investment and growth. Examples include initiatives focused on digitalization and infrastructure development.

- Strong Performance in Key Sectors: The technology, pharmaceutical, and financial sectors have been particularly strong performers, significantly contributing to the Nifty Index's overall gains. This sector-specific strength demonstrates the diverse nature of India's economy.

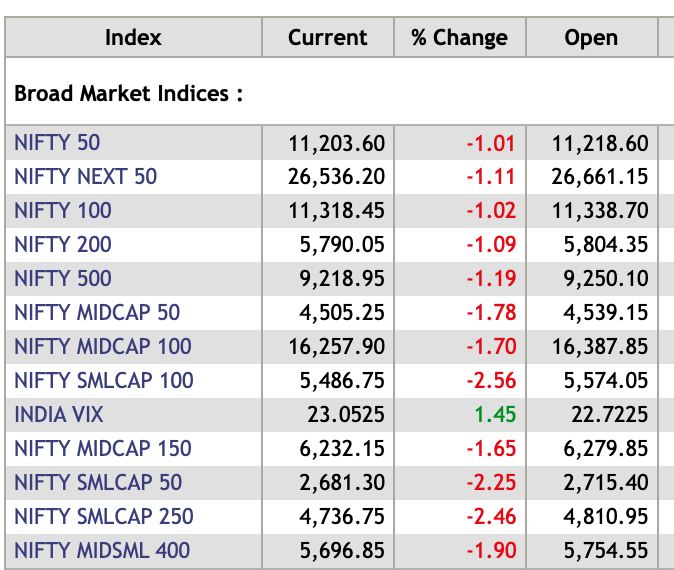

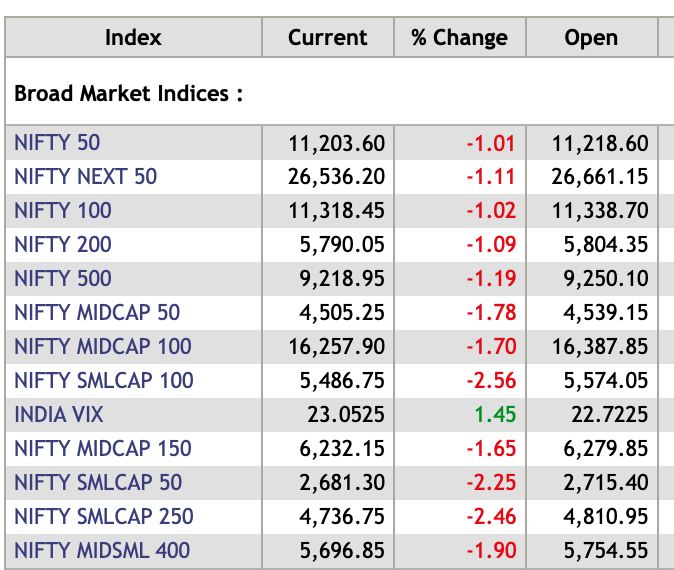

Analyzing Key Performance Indicators

Analyzing key performance indicators provides a clearer picture of the Nifty 50's recent surge.

- P/E Ratios: While P/E ratios have increased reflecting higher valuations, they remain relatively reasonable compared to global indices.

- Market Capitalization: The overall market capitalization of the Nifty 50 has significantly increased, reflecting the growth in company valuations.

- Trading Volumes: Increased trading volumes indicate heightened investor activity and participation in the market.

- Comparison with Asian Indices: Compared to other major Asian indices, the Nifty 50 has shown relatively strong performance, highlighting its resilience. (Include a relevant chart comparing Nifty 50 performance with other Asian indices here)

Challenges and Risks Facing the Nifty Index

While the recent gains are encouraging, it's essential to acknowledge potential challenges and risks.

Potential Headwinds

Several factors could potentially hinder the Nifty Index's future growth:

- Global Economic Slowdown: A global recession or significant economic slowdown could negatively impact Indian exports and foreign investment.

- Inflation and Interest Rate Hikes: Persistent inflation and subsequent interest rate hikes by the Reserve Bank of India (RBI) could curb economic growth and dampen investor sentiment.

- Geopolitical Risks: Geopolitical instability, both regionally and globally, could create uncertainty and negatively impact market performance.

- Regulatory Changes: Unforeseen regulatory changes could impact specific sectors and influence market volatility.

Sector-Specific Risks

Certain sectors within the Nifty 50 are more susceptible to market fluctuations:

- Technology Sector: Vulnerable to global tech downturns and shifts in consumer demand.

- Real Estate Sector: Subject to regulatory changes and cyclical market trends.

- Financials: Sensitive to changes in interest rates and credit risk.

Future Market Outlook for the Nifty Index

Predicting Future Trends

Predicting the future of the Nifty Index requires a balanced perspective:

- Optimistic Scenario: Continued GDP growth, sustained FII inflows, and successful government reforms could lead to further growth.

- Pessimistic Scenario: A global economic slowdown, high inflation, or unexpected geopolitical events could negatively impact the index.

- Impact of Upcoming Events: Upcoming elections and policy changes will significantly influence investor sentiment and market direction.

Investment Strategies for the Nifty Index

Investors should adopt strategies suited to their risk profiles:

- Long-Term Investment: A long-term approach is generally recommended for a stable investment in the Nifty Index, considering its potential for long-term growth.

- Short-Term Trading: Requires a higher risk tolerance and involves greater market knowledge.

- Diversification: Diversifying investments across different sectors and asset classes is crucial for risk mitigation.

- Due Diligence: Thorough research and understanding of market dynamics are essential before making any investment decisions.

Conclusion

India's Nifty Index has demonstrated significant recent gains driven by robust economic growth, foreign investment, and strong corporate earnings. However, potential headwinds like global economic slowdowns and inflation need careful consideration. A balanced outlook, understanding the various factors influencing market performance, and adopting suitable investment strategies are vital for navigating the complexities of the Indian stock market. Stay informed about the India Nifty Index and make strategic investment decisions based on thorough analysis of the market trends. (Include a link to relevant resources here)

Featured Posts

-

Bold And The Beautiful Spoilers For Thursday February 20 Steffy Liam And Finn

Apr 24, 2025

Bold And The Beautiful Spoilers For Thursday February 20 Steffy Liam And Finn

Apr 24, 2025 -

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025 -

Saudi Arabia And India Partner To Build Two New Oil Refineries

Apr 24, 2025

Saudi Arabia And India Partner To Build Two New Oil Refineries

Apr 24, 2025 -

Us Lawyers Warned Judge Abrego Garcia Demands End To Stonewalling

Apr 24, 2025

Us Lawyers Warned Judge Abrego Garcia Demands End To Stonewalling

Apr 24, 2025 -

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 24, 2025

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 24, 2025