India's Yes Bank: Potential Investment From SMFG

Table of Contents

SMFG's Potential Investment in Yes Bank: A Detailed Look

The potential investment by SMFG in Yes Bank represents a significant development in the Indian financial landscape. While the exact details remain subject to ongoing negotiations and regulatory approvals, the potential implications are far-reaching. SMFG's motivation likely stems from a desire to expand its presence in a rapidly growing market like India, leveraging Yes Bank's existing infrastructure and customer base. The investment could unlock substantial growth opportunities for SMFG, providing access to a vast and increasingly affluent Indian consumer market.

- Potential capital infusion amount: While the exact figure remains undisclosed, reports suggest a substantial investment capable of significantly bolstering Yes Bank's capital reserves.

- Type of investment: The investment could potentially involve a mix of equity and debt instruments, providing both capital and strategic support.

- Expected timeline for the investment: The timeline for the investment is contingent upon successful negotiations, regulatory approvals, and completion of due diligence.

- Strategic partnerships with Indian companies facilitated by SMFG: SMFG's global network and expertise could lead to valuable partnerships between Yes Bank and other Indian companies, enhancing business opportunities and technological capabilities.

Impact on Yes Bank's Financial Health and Future Growth

An SMFG investment could be a game-changer for Yes Bank. The infusion of capital would likely bolster its capital adequacy ratio (CAR), improving its financial stability and reducing risk. This improved financial health would translate into enhanced lending capabilities, allowing Yes Bank to expand its loan portfolio and support the growth of Indian businesses. A stronger balance sheet should also lead to improved credit ratings, attracting more investors and boosting investor confidence, which would likely result in a positive impact on the bank's share price.

- Improved financial stability for Yes Bank: Increased capital reserves will enhance the bank's resilience against economic shocks and market volatility.

- Enhanced credit rating prospects: A stronger capital base will positively influence credit rating agencies' assessments of Yes Bank's creditworthiness.

- Increased lending capacity to support Indian businesses: This would stimulate economic activity and contribute to India's overall growth.

- Potential for new product and service offerings: Access to SMFG's expertise could enable Yes Bank to launch innovative financial products and services.

Implications for the Indian Banking Sector

The potential SMFG investment in Yes Bank could have significant implications for the broader Indian banking sector. It could signal increased interest from foreign investors seeking opportunities in India's rapidly growing economy. This influx of foreign capital could intensify competition, potentially leading to improved banking services, enhanced technology, and more competitive interest rates for both borrowers and depositors. However, increased foreign investment might also lead to heightened regulatory scrutiny and necessitate policy adjustments to ensure a level playing field and protect the interests of domestic banks.

- Increased foreign participation in the Indian financial sector: This influx of capital could inject much-needed liquidity and boost competition within the banking sector.

- Potential for improved banking services and technology: SMFG's expertise in advanced banking technologies could benefit the Indian banking landscape.

- Impact on interest rates and lending policies: Increased competition could lead to more competitive interest rates and flexible lending policies.

- Potential regulatory scrutiny of foreign investments: The Reserve Bank of India (RBI) will likely carefully scrutinize the investment to ensure compliance with regulations.

Potential Challenges and Risks Associated with the Investment

While the potential benefits are substantial, several challenges and risks are associated with the SMFG investment. Securing necessary regulatory approvals from Indian authorities could prove time-consuming and complex. Thorough due diligence is crucial to ensure a successful integration between Yes Bank and SMFG. Furthermore, macroeconomic factors, such as an economic downturn in India or global geopolitical uncertainties, could negatively impact the investment's success. Cultural differences and potential conflicts of interest between the two entities also need careful management.

- Regulatory hurdles and approval timelines: Obtaining necessary approvals from the RBI and other regulatory bodies could delay or even derail the investment.

- Geopolitical risks and economic uncertainties in India: External factors could influence the investment's overall performance.

- Cultural differences and integration challenges: Merging two entities with different corporate cultures requires careful planning and execution.

- Potential for conflicts of interest: Potential conflicts need to be identified and addressed proactively.

Conclusion: Analyzing the Future of Yes Bank with Potential SMFG Investment

The potential investment by Sumitomo Mitsui Financial Group (SMFG) in Yes Bank holds significant promise for both the bank and the Indian banking sector. It has the potential to revitalize Yes Bank's financial health, enhance its competitiveness, and stimulate economic growth. However, it is crucial to address the potential challenges and risks associated with this partnership. The successful integration of SMFG's expertise and capital could represent a pivotal moment in reshaping India's financial landscape. To stay informed about the latest developments regarding this potentially transformative investment, follow updates on Yes Bank’s and SMFG’s potential investment for further insights. Stay tuned for further developments regarding this significant potential investment!

Featured Posts

-

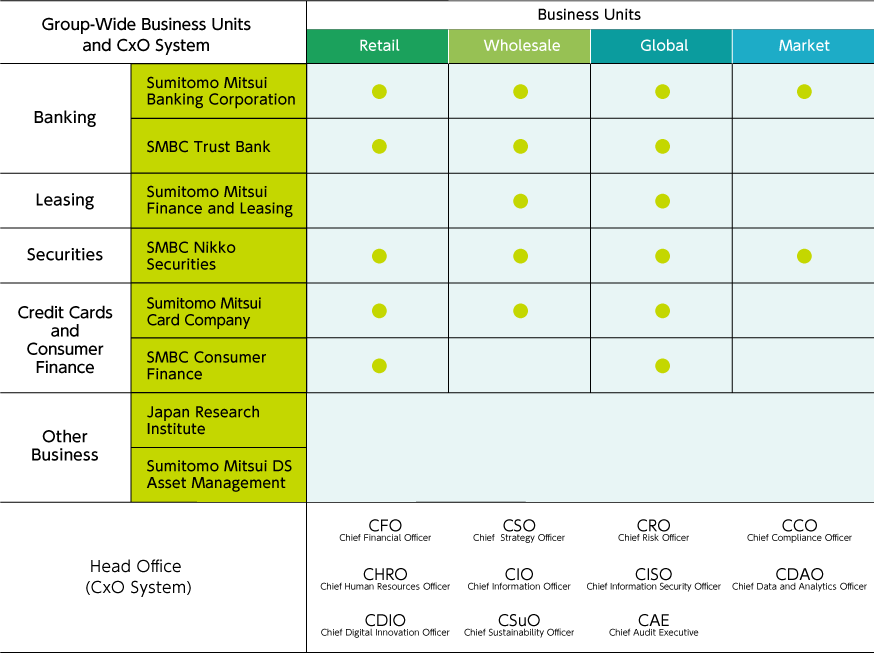

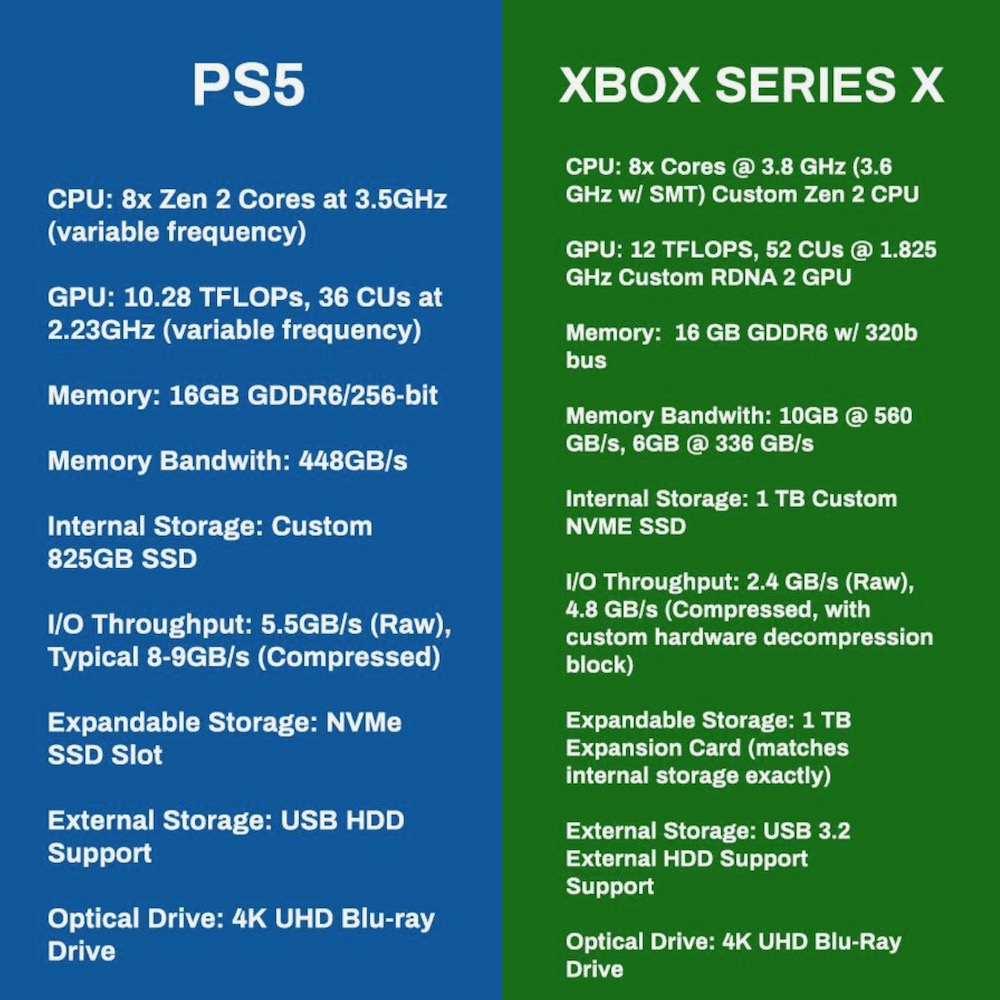

Experience Enhanced Gaming Top Ps 5 Pro Exclusive Titles

May 07, 2025

Experience Enhanced Gaming Top Ps 5 Pro Exclusive Titles

May 07, 2025 -

John Wick The One True Appearance Of The Legendary Assassin

May 07, 2025

John Wick The One True Appearance Of The Legendary Assassin

May 07, 2025 -

Nhl 25 Arcade Mode Everything You Need To Know

May 07, 2025

Nhl 25 Arcade Mode Everything You Need To Know

May 07, 2025 -

Will Trumps Xrp Support Drive Mainstream Acceptance

May 07, 2025

Will Trumps Xrp Support Drive Mainstream Acceptance

May 07, 2025 -

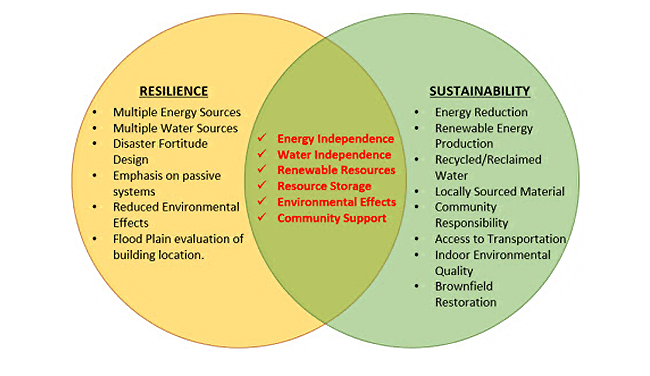

Resilience Building In Least Developed Countries Strategies For Sustainable Development

May 07, 2025

Resilience Building In Least Developed Countries Strategies For Sustainable Development

May 07, 2025