Indonesia Reserve Levels Fall: Analysis Of The Rupiah's Impact

Table of Contents

Indonesia's dwindling foreign exchange reserves have sparked considerable concern regarding the stability of the Rupiah, Indonesia's national currency. This decline presents a significant challenge to the Indonesian economy, demanding a thorough understanding of its causes and potential consequences. This article analyzes the factors contributing to this fall, explores the impact on the Rupiah's performance in the global market, and examines potential solutions to address this critical issue. We will delve into the interplay between reserve levels and the Rupiah's vulnerability, providing insights for businesses, investors, and policymakers alike.

Factors Contributing to the Fall in Indonesia's Foreign Exchange Reserves

Several interconnected factors contribute to the recent decline in Indonesia's foreign exchange reserves. Understanding these underlying causes is crucial for formulating effective strategies to mitigate the risks.

Increased Import Spending

Rising global commodity prices, particularly for energy imports like oil and gas, significantly impact Indonesia's trade balance. Indonesia, being a net importer of energy, experiences a widening trade deficit as import costs surge. This increased import bill puts immense pressure on foreign exchange reserves.

- Rising Global Commodity Prices: The global energy crisis has driven up the cost of crucial imports, increasing the demand for foreign currency.

- Increased Demand for Imported Goods: Strong domestic consumption, fueled by a growing middle class, further contributes to increased demand for imported goods, including consumer electronics, machinery, and raw materials.

- Specific Import Categories: A significant portion of the increased import spending stems from fuel imports (petroleum products), capital goods (machinery for infrastructure projects), and various consumer goods.

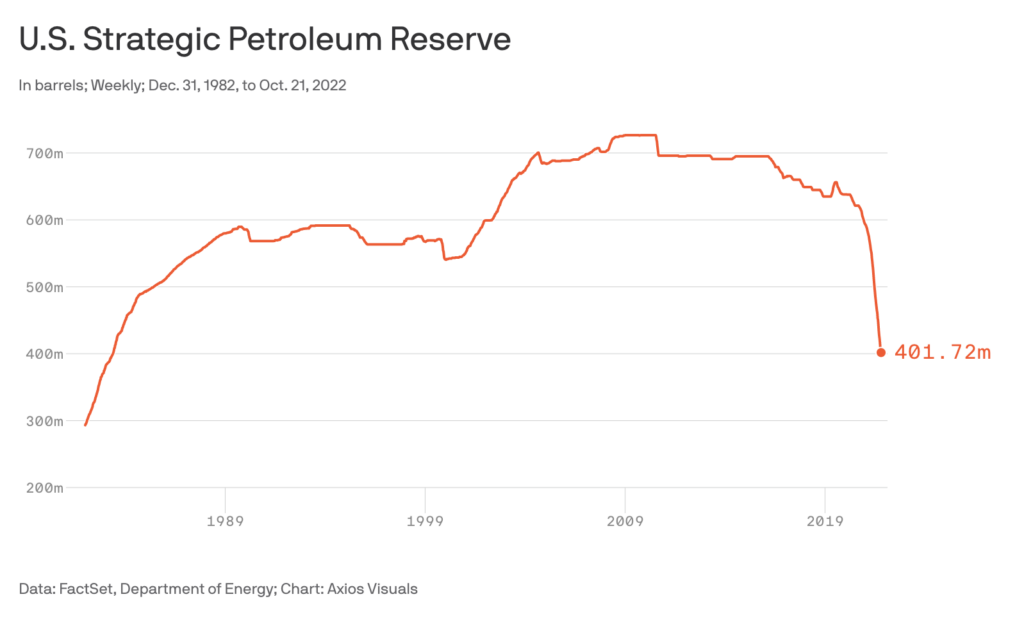

- Statistical Data: Data from Bank Indonesia (BI) reveals a substantial increase in import spending compared to previous years, showcasing a clear trend of rising import costs impacting reserve levels. (Insert relevant statistical data here, citing the source).

Capital Outflows

Global economic uncertainty often leads to capital flight from emerging markets, including Indonesia. Investors, seeking safer havens, withdraw funds, putting downward pressure on the Rupiah and depleting foreign exchange reserves.

- Global Economic Uncertainty: Geopolitical instability and fears of a global recession drive investors towards perceived safer assets in developed economies.

- Rising US Interest Rates: Higher interest rates in the US make dollar-denominated assets more attractive, incentivizing capital outflow from Indonesia.

- Other Potential Factors: Other potential reasons for capital outflows include concerns about domestic political risks, changes in government policies, and shifts in investor sentiment.

- Net Capital Outflow Figures: Data illustrating net capital outflow figures from Indonesia (sourced from reputable financial institutions) should be included here.

Government Spending and Debt Servicing

Government expenditure on infrastructure projects and social programs, while essential for economic development, can also contribute to pressure on foreign exchange reserves. Moreover, increasing government debt servicing costs require significant foreign currency outlays.

- Infrastructure Projects and Social Programs: Government investment in crucial infrastructure and social welfare programs requires substantial funding, impacting reserve levels.

- Government Debt Servicing Costs: A large portion of foreign exchange reserves is used to service government debt, particularly external debt denominated in foreign currencies.

- Breakdown of Government Spending: A detailed breakdown of government spending and its effect on foreign currency reserves needs to be included.

- Relevant Statistics: Statistics on government debt, interest payments, and the proportion allocated to foreign currency servicing are essential for a complete analysis.

Impact of Falling Reserves on the Rupiah Exchange Rate

The decline in Indonesia's foreign exchange reserves directly impacts the Rupiah's exchange rate, leading to various economic consequences.

Depreciation of the Rupiah

Falling reserves weaken the Rupiah against major currencies like the US dollar and Euro. This depreciation makes imports more expensive and exacerbates inflationary pressures.

- Correlation Between Reserves and Rupiah: A clear correlation exists between falling reserves and a weakening Rupiah, impacting purchasing power.

- Impact on Import Costs: Depreciation increases the cost of imports, impacting businesses and consumers alike.

- Effect on Various Sectors: Different sectors of the Indonesian economy are differentially affected by Rupiah depreciation (e.g., import-dependent industries versus export-oriented ones).

- Rupiah Exchange Rate Fluctuations: Charts illustrating the Rupiah's exchange rate fluctuations against major currencies are necessary for visualization.

Increased Inflationary Pressure

The higher import costs resulting from Rupiah depreciation contribute significantly to inflation, eroding consumer purchasing power and slowing economic growth.

- Higher Import Costs and Inflation: Depreciation directly translates into higher prices for imported goods, feeding into overall inflation.

- Impact on Economic Growth: Persistent inflation can negatively impact economic growth and social stability.

- Government Measures to Combat Inflation: The government's efforts to combat inflation (e.g., monetary policy adjustments, subsidies) should be discussed.

- Inflation Rates in Indonesia: Relevant statistics illustrating Indonesia's inflation rates are crucial for providing context.

Central Bank Intervention

Bank Indonesia (BI), the central bank of Indonesia, intervenes in the foreign exchange market to manage the Rupiah's exchange rate and mitigate the effects of falling reserves.

- BI's Intervention Strategies: BI employs various strategies, including adjusting interest rates and directly intervening in the foreign exchange market to stabilize the Rupiah.

- Effectiveness of Interventions: The effectiveness of these interventions needs to be evaluated, considering their limitations.

- Limitations and Risks: Central bank interventions carry inherent limitations and potential risks, which should be addressed.

- Analysis of Past Interventions: An analysis of the success or failure of past interventions can offer valuable lessons for future strategies.

Potential Solutions and Outlook

Addressing the decline in Indonesia's foreign exchange reserves requires a multi-pronged approach involving both short-term and long-term strategies.

- Diversification of Export Markets: Indonesia needs to diversify its export markets and promote non-commodity exports to reduce reliance on volatile commodity prices.

- Fiscal Reforms: Implementing fiscal reforms to manage government spending and debt more efficiently is crucial.

- Attracting Foreign Direct Investment: Improving the investment climate and infrastructure will attract much-needed foreign direct investment.

- Strengthening the Financial Regulatory Framework: A robust regulatory framework improves market confidence and stability.

- Long-Term Strategies: Long-term strategies to improve Indonesia's economic resilience and reduce vulnerability to external shocks are needed.

Conclusion

The decline in Indonesia's foreign exchange reserves poses significant challenges to the stability of the Rupiah and the overall Indonesian economy. Understanding the contributing factors—increased import spending, capital outflows, and government spending—is crucial for developing effective countermeasures. While central bank intervention plays a vital role, long-term strategies focused on export diversification, fiscal discipline, and attracting foreign investment are essential for ensuring the long-term resilience of the Rupiah and the Indonesian economy. Continuous monitoring of Indonesia's foreign exchange reserves and their impact on the Rupiah exchange rate is vital for businesses, investors, and policymakers to navigate the evolving economic landscape. Stay informed on the latest developments concerning Indonesia foreign exchange reserves and their implications for the Rupiah exchange rate to make informed decisions.

Featured Posts

-

Hkayat Mdkhnyn Krt Alqdm Mn Alnjwm Ila Alaetzal

May 10, 2025

Hkayat Mdkhnyn Krt Alqdm Mn Alnjwm Ila Alaetzal

May 10, 2025 -

The Closure Of Anchor Brewing Company What Happens Next

May 10, 2025

The Closure Of Anchor Brewing Company What Happens Next

May 10, 2025 -

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025

Millions Lost Office365 Executive Account Hacks Investigated

May 10, 2025 -

Bangkok Post Reports Increased Demand For Transgender Rights And Equality

May 10, 2025

Bangkok Post Reports Increased Demand For Transgender Rights And Equality

May 10, 2025 -

Strands Nyt Puzzle Solutions Wednesday March 12 Game 374

May 10, 2025

Strands Nyt Puzzle Solutions Wednesday March 12 Game 374

May 10, 2025