Indonesia's Falling Reserves: Impact Of Rupiah Weakness On Economic Stability

Table of Contents

The Declining Trend of Indonesia's Foreign Exchange Reserves

Indonesia's foreign exchange reserves have been on a downward trajectory in recent years, raising concerns about the country's economic resilience. This decline needs to be viewed within its historical context; while reserves have historically fluctuated, the current rate of decrease is significant and warrants careful analysis.

- Data points showcasing the decline: Between 2020 and 2023, Indonesia's foreign exchange reserves decreased by approximately X%, falling from [Insert Figure] billion USD to [Insert Figure] billion USD. This represents a substantial drop compared to previous years.

- Comparison with regional economies: Compared to other Southeast Asian economies like Singapore and Malaysia, Indonesia's foreign exchange reserves show a comparatively weaker position, further highlighting the gravity of the situation. A detailed comparison of reserve levels per capita would provide a more nuanced understanding.

- Potential reasons behind the decline: Several factors contribute to this decline, including increased import costs driven by global commodity price increases, a widening current account deficit, and potential capital outflows due to global economic uncertainty and investor sentiment towards emerging markets.

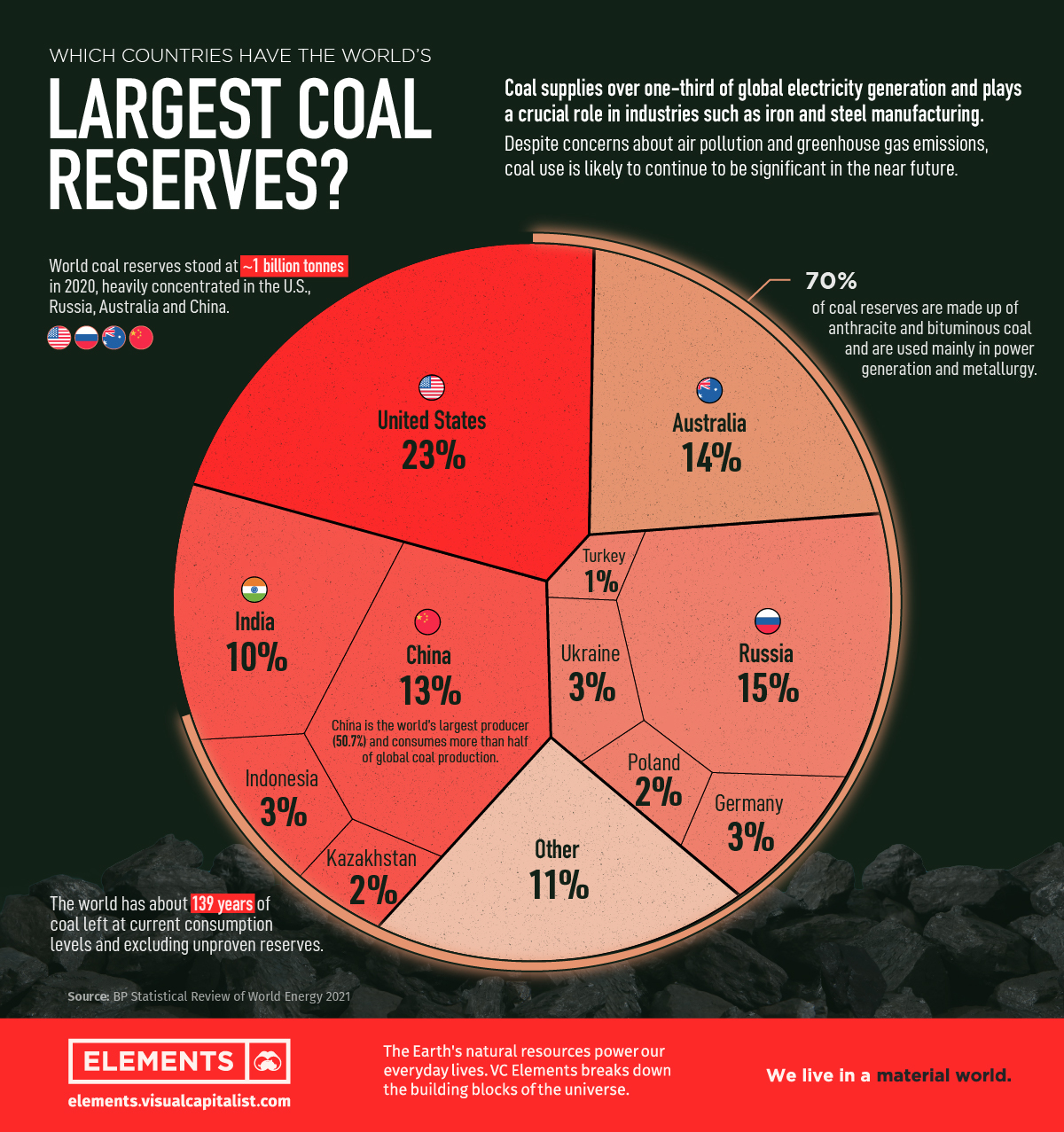

- Illustrative chart or graph: [Insert a chart or graph visually representing the decline in Indonesia's foreign exchange reserves over the specified period].

The Weakening Rupiah and its Correlation with Falling Reserves

The weakening Rupiah and the decline in foreign exchange reserves are intrinsically linked. The relationship is cyclical and mutually reinforcing: falling reserves reduce the central bank's ability to intervene in the foreign exchange market, leading to further depreciation of the Rupiah.

- Impact of reduced reserves on central bank intervention: A smaller pool of foreign exchange reserves limits Bank Indonesia's capacity to support the Rupiah by buying it in the foreign exchange market, thus exacerbating the downward pressure on the currency.

- Impact of a weaker Rupiah on import costs and inflation: A weaker Rupiah increases the cost of imported goods, directly contributing to inflationary pressures within Indonesia. As Indonesia relies heavily on imports for various goods, this effect is significantly amplified.

- Impact of the weakening Rupiah on investor confidence: Currency volatility deters foreign investment, as investors seek stability and predictability. The weakening Rupiah increases the risk associated with investments in Indonesia, potentially leading to capital flight.

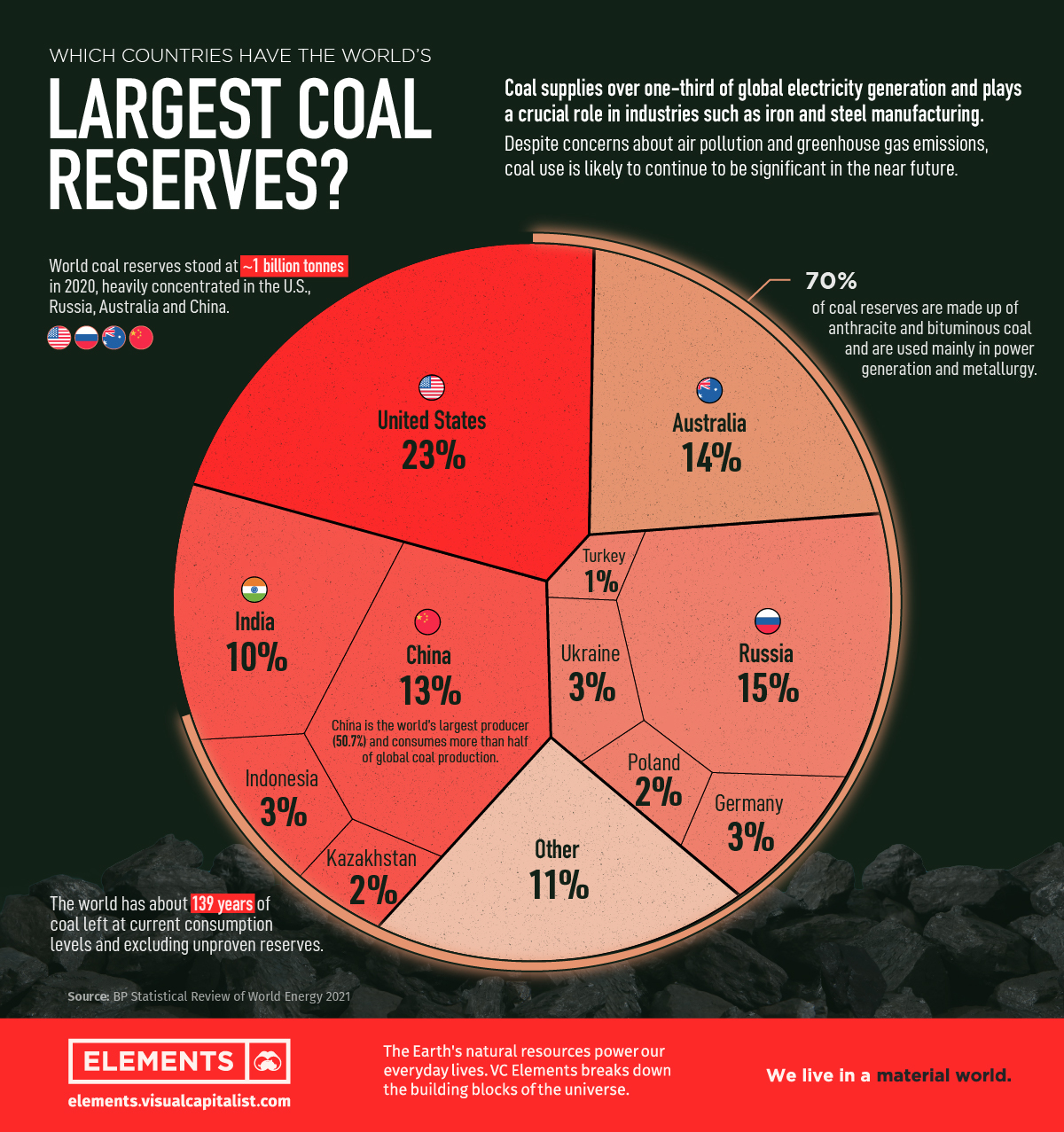

- Correlation between Rupiah exchange rate and foreign exchange reserves: [Insert a chart or graph illustrating the correlation between the Rupiah's exchange rate and the level of foreign exchange reserves].

Impact on Key Economic Indicators

The interplay between falling reserves and the weakening Rupiah significantly impacts several key economic indicators:

Inflation

The weaker Rupiah fuels inflation primarily through higher import costs.

- Impact of rising global prices and a weaker currency: Indonesia's reliance on imported goods makes it particularly vulnerable to global price increases. A weaker Rupiah exacerbates this vulnerability, making imports considerably more expensive.

- Potential for increased consumer prices and its impact on the population: Rising import costs translate into higher consumer prices, impacting the purchasing power of Indonesian households, particularly those with lower incomes.

- Government measures to control inflation: The Indonesian government may employ various measures, such as interest rate adjustments and subsidies, to mitigate inflationary pressures. The effectiveness of these measures will depend on various internal and external factors.

Investment

The instability in the foreign exchange market significantly impacts both foreign direct investment (FDI) and domestic investment.

- Risk aversion of investors due to currency volatility: Currency fluctuations create uncertainty and risk, deterring both foreign and domestic investors who seek stable investment environments.

- Impact on capital flows into Indonesia: A weaker Rupiah and falling reserves discourage capital inflows, hindering economic growth. This is further aggravated by the global economic uncertainty.

- Potential consequences for economic growth: Reduced investment leads to slower economic growth, impacting job creation and overall economic development.

Trade Deficit

The weakening Rupiah has a double-edged effect on Indonesia's trade balance.

- Impact of a weaker Rupiah on exports and imports: While a weaker Rupiah makes Indonesian exports more competitive in the global market, it simultaneously increases the cost of imports.

- Net impact on the trade balance: The net impact on the trade balance depends on the elasticity of demand for Indonesian exports and imports. If the increase in export demand outweighs the rise in import costs, the trade deficit might improve, but the opposite is also plausible.

- Government policies to address the trade deficit: The Indonesian government may implement policies to diversify exports, promote import substitution, and improve trade competitiveness to address the trade deficit.

Government Response and Monetary Policy

The Indonesian government and Bank Indonesia have implemented various measures to address the falling reserves and weakening Rupiah.

- Policy interventions (e.g., interest rate hikes, foreign exchange interventions): Bank Indonesia has adjusted its monetary policy, including raising interest rates to attract foreign investment and stabilize the Rupiah. Interventions in the foreign exchange market may also be employed.

- Effectiveness of these policies: The effectiveness of these policies depends on various factors, including global economic conditions and investor sentiment. A comprehensive assessment requires detailed analysis of the impact of each measure.

- Potential future policy adjustments: Depending on the effectiveness of current policies and evolving economic conditions, the government and Bank Indonesia may need to further adjust their strategies. This may involve structural reforms to enhance economic competitiveness and resilience.

Conclusion

The declining trend of Indonesia's foreign exchange reserves and the concomitant weakening of the Rupiah pose significant challenges to Indonesia's economic stability. This has led to increased inflationary pressures, negatively impacting investment and potentially widening the trade deficit. The Indonesian government and Bank Indonesia's response through monetary policy adjustments is crucial, but the effectiveness of these measures remains to be fully assessed. The situation underscores the need for proactive measures to stabilize the Rupiah, bolster foreign exchange reserves, and improve Indonesia's overall economic resilience. Further research into the effectiveness of various policy interventions and the long-term implications of the current economic trends is essential for informed decision-making. Staying informed about developments related to Indonesia's falling foreign exchange reserves and the weakening Rupiah is vital for understanding the country's economic future.

Featured Posts

-

Kjoreforhold I Fjellet Sikkerhet Og Forberedelser I Sor Norge

May 09, 2025

Kjoreforhold I Fjellet Sikkerhet Og Forberedelser I Sor Norge

May 09, 2025 -

Sensex Live Market Rebounds Nifty Climbs Above 17 950

May 09, 2025

Sensex Live Market Rebounds Nifty Climbs Above 17 950

May 09, 2025 -

Madeleine Mc Cann Case Polish Woman Faces Stalking Charges

May 09, 2025

Madeleine Mc Cann Case Polish Woman Faces Stalking Charges

May 09, 2025 -

Asias Leading Bitcoin Conference Bitcoin Seoul 2025

May 09, 2025

Asias Leading Bitcoin Conference Bitcoin Seoul 2025

May 09, 2025 -

Benson Boone Responds To Harry Styles Plagiarism Accusations

May 09, 2025

Benson Boone Responds To Harry Styles Plagiarism Accusations

May 09, 2025

Latest Posts

-

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025

The Experiences Of Transgender People Under Trumps Executive Orders

May 10, 2025 -

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025

Trumps Legacy The Transgender Communitys Perspective

May 10, 2025 -

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025

Bangkok Post Highlights Growing Movement For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025

The Impact Of Trumps Transgender Military Ban A Critical Analysis

May 10, 2025 -

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025

The Trump Presidency And Its Impact On The Transgender Community

May 10, 2025