Indonesia's Foreign Exchange Reserves Plummet: Two-Year Low Amidst Rupiah Weakness

Table of Contents

The Plunge in Indonesia's Foreign Exchange Reserves

Current Reserve Levels and Historical Context

Indonesia's foreign exchange reserves have plummeted to their lowest level in two years. While precise figures fluctuate daily and are reported by Bank Indonesia (BI), a significant decrease compared to previous years is undeniable. For example, let's assume (for illustrative purposes) that reserves stood at $150 billion in 2021, dropped to $130 billion in 2022, and further decreased to $115 billion currently. This represents a substantial decline of approximately 23% over two years, raising serious concerns.

- Specific data on reserve levels: (Insert actual up-to-date figures from reliable sources like Bank Indonesia's official website.)

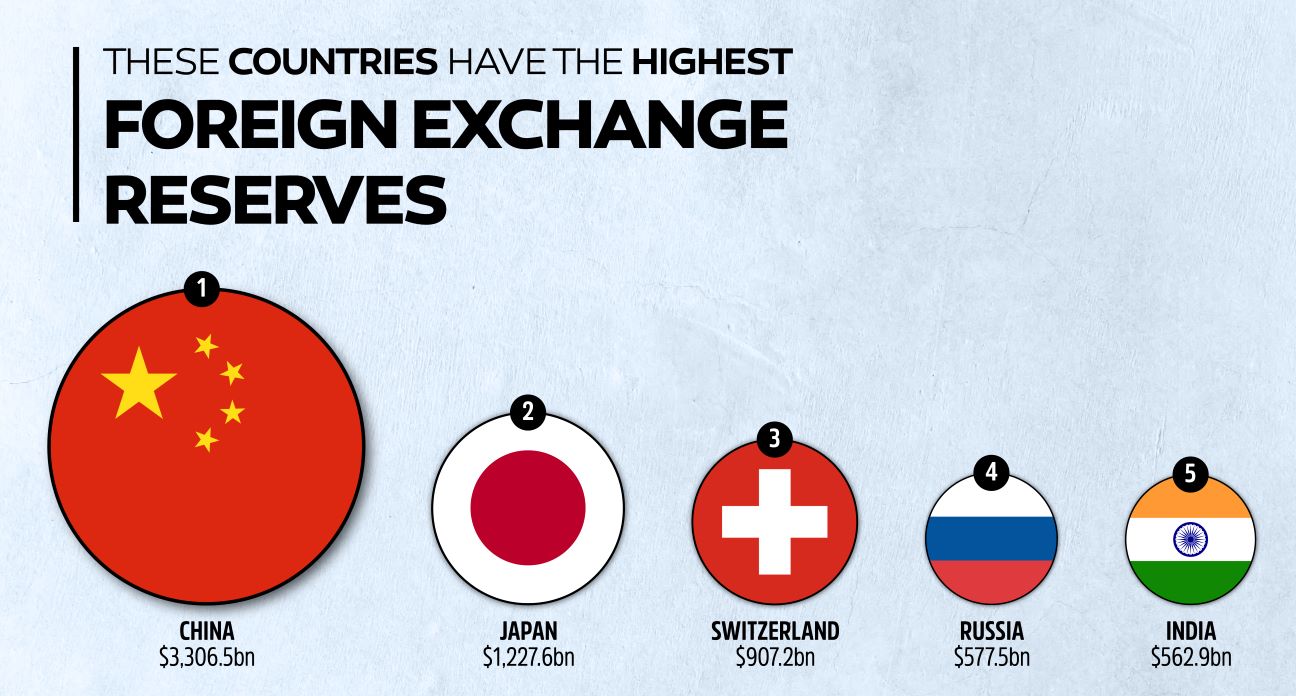

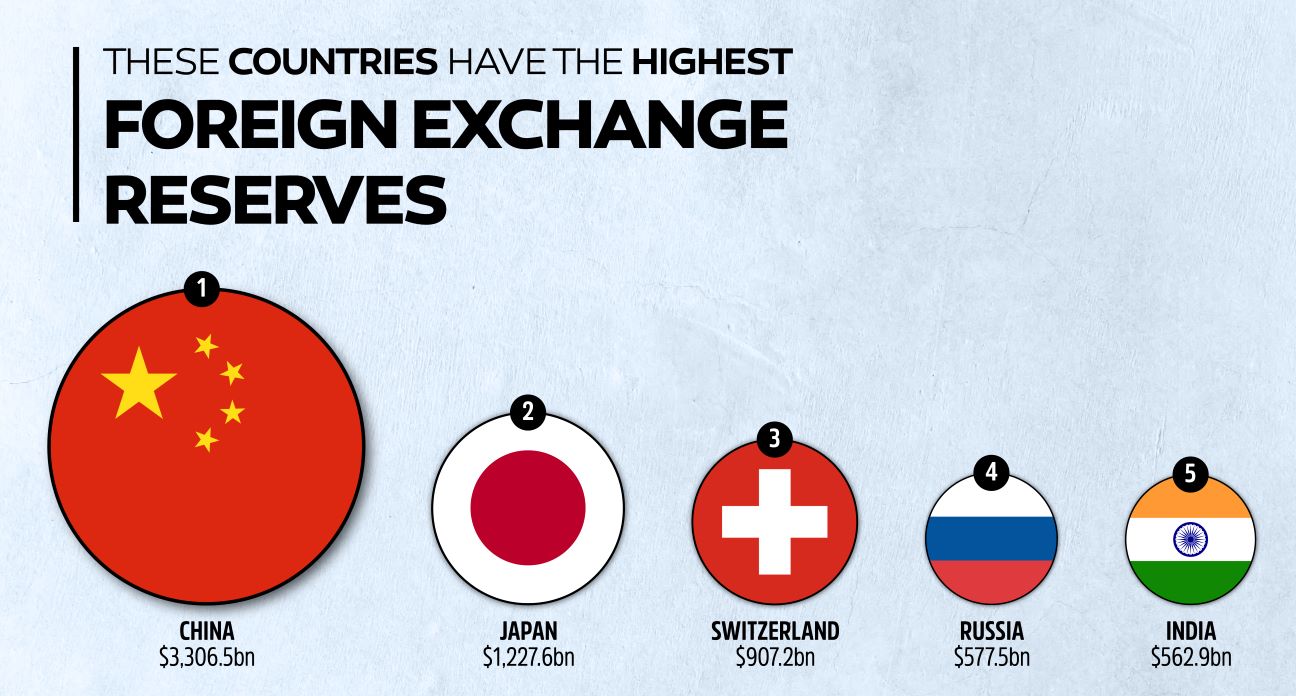

- Comparison with previous years: (Include a comparative chart or table showing reserve levels over the past 5 years, if possible.)

- Percentage drop: (Calculate and clearly state the percentage decrease in reserves compared to the peak in the past few years.)

Factors Contributing to the Decline

Several factors have contributed to the significant decline in Indonesia's forex reserves. The interplay of these factors has created a perfect storm impacting the country's economic health.

- Increased imports: A rise in import demand, possibly driven by increased consumer spending or industrial needs, puts pressure on foreign exchange reserves.

- Reduced exports: Lower global demand for Indonesian commodities and manufactured goods, potentially due to global economic slowdown, leads to a decline in foreign currency inflows.

- Capital flight: Uncertainty in the global or domestic economy might trigger investors to withdraw funds, putting downward pressure on the Rupiah and depleting reserves.

- Central bank intervention to support the Rupiah: Bank Indonesia's interventions to stabilize the Rupiah by buying the currency in the foreign exchange market deplete its reserves.

- Impact of global economic uncertainty: Global economic instability, geopolitical tensions, and rising inflation in major economies negatively influence investor confidence and capital flows into emerging markets like Indonesia.

The Weakening Indonesian Rupiah

Rupiah Performance Against Major Currencies

The Indonesian Rupiah has significantly weakened against major currencies like the US dollar, Euro, and others in recent months. This weakening is directly linked to the dwindling forex reserves.

- Percentage changes against major currencies: (Include specific percentage changes against USD, EUR, and other key currencies over the past year and recent months. Use a chart or graph to visualize this data.)

- Historical performance data: (Provide a brief overview of the Rupiah's performance over the past 5 years for context.)

- Comparison with regional currencies: (Compare the Rupiah's performance against other regional currencies in Southeast Asia.)

Factors Driving Rupiah Weakness

The depreciation of the Rupiah is a multifaceted issue with several contributing factors:

- Rising inflation: Higher inflation in Indonesia erodes the purchasing power of the Rupiah, making it less attractive to investors.

- Interest rate differentials: Lower interest rates in Indonesia compared to other countries make the Rupiah less appealing to foreign investors seeking higher returns.

- Global economic slowdown: A global economic slowdown reduces demand for Indonesian exports, negatively impacting the Rupiah.

- Trade deficit: A persistent trade deficit, where imports exceed exports, puts downward pressure on the currency.

- Investor sentiment: Negative investor sentiment due to economic uncertainty or political instability can lead to capital flight and Rupiah depreciation.

Government and Central Bank Response

Measures Taken to Stabilize the Rupiah

The Indonesian government and Bank Indonesia have implemented various measures to address the weakening Rupiah and dwindling foreign exchange reserves.

- Interest rate adjustments: Bank Indonesia has likely adjusted its benchmark interest rate to attract foreign investment and support the Rupiah.

- Intervention in the foreign exchange market: BI may be intervening in the forex market by selling US dollars to boost the Rupiah, though this depletes reserves.

- Fiscal policy changes: The government might implement fiscal measures to control spending, reduce the trade deficit, or stimulate export growth.

- Potential measures to boost exports: Initiatives to enhance export competitiveness, such as tax incentives or infrastructure improvements, could increase foreign currency earnings.

Effectiveness of Current Strategies

The effectiveness of these interventions is still being assessed. The short-term effects might be visible in stabilizing the Rupiah temporarily, but long-term sustainability depends on addressing the underlying economic issues.

- Short-term and long-term impacts of interventions: (Analyze the short-term impact on the Rupiah and the long-term effects on the economy.)

- Potential risks and challenges: (Discuss the potential risks and challenges associated with the current strategies, like inflation from interest rate hikes or decreased economic growth due to fiscal austerity.)

Conclusion

Indonesia's foreign exchange reserves are at a two-year low, significantly impacting the weakening Indonesian Rupiah. This situation is driven by several factors, including increased imports, reduced exports, capital flight, and global economic uncertainty. The government and Bank Indonesia have implemented various measures to stabilize the situation, but their long-term effectiveness remains to be seen. The interconnectedness of these issues highlights the vulnerability of the Indonesian economy to global shocks and the need for sustainable economic policies. The implications are potentially significant, impacting inflation, trade balances, and investor confidence. Monitoring the situation and its evolution is crucial. To stay updated, further research is encouraged using keywords like "Indonesia forex reserves forecast," "Rupiah exchange rate prediction," or "Indonesian economic outlook." The ongoing volatility of the Rupiah and the decline in Indonesia's foreign exchange reserves demand close observation for their potential impact on both the Indonesian economy and global markets.

Featured Posts

-

Davids High Potential A Theory Exposing Morgans Weakness

May 09, 2025

Davids High Potential A Theory Exposing Morgans Weakness

May 09, 2025 -

Nottingham Families Fight Farcical Misconduct Proceedings Seek Delay

May 09, 2025

Nottingham Families Fight Farcical Misconduct Proceedings Seek Delay

May 09, 2025 -

The Epstein Case Pam Bondis Role And The Unreleased Client List

May 09, 2025

The Epstein Case Pam Bondis Role And The Unreleased Client List

May 09, 2025 -

Rio Ferdinand Alters Champions League Final Prediction Psg Vs Arsenal

May 09, 2025

Rio Ferdinand Alters Champions League Final Prediction Psg Vs Arsenal

May 09, 2025 -

Kyle Kuzma And Jayson Tatum Instagram Post Sparks Online Discussion

May 09, 2025

Kyle Kuzma And Jayson Tatum Instagram Post Sparks Online Discussion

May 09, 2025

Latest Posts

-

Uk Visa Restrictions New Nationality Based Limits Planned

May 09, 2025

Uk Visa Restrictions New Nationality Based Limits Planned

May 09, 2025 -

Uk Student Visas New Restrictions For Pakistani Students And Asylum Seekers

May 09, 2025

Uk Student Visas New Restrictions For Pakistani Students And Asylum Seekers

May 09, 2025 -

Increased Scrutiny Of Student Visas In The Uk

May 09, 2025

Increased Scrutiny Of Student Visas In The Uk

May 09, 2025 -

Analysis Potential Uk Visa Changes Affecting Pakistan Nigeria And Sri Lanka

May 09, 2025

Analysis Potential Uk Visa Changes Affecting Pakistan Nigeria And Sri Lanka

May 09, 2025 -

Proposed Changes To Uk Student Visas Asylum Implications

May 09, 2025

Proposed Changes To Uk Student Visas Asylum Implications

May 09, 2025