Inflation Report Impacts BOE Rate Cut Bets: Pound's Response

Table of Contents

The Inflation Report's Key Findings and Market Reaction

The recently released inflation report revealed key figures that significantly deviated from market expectations. The Consumer Price Index (CPI) reached X%, while the Retail Price Index (RPI) registered at Y%. These figures represent a Z% increase/decrease compared to the previous month and a W% change year-on-year. This unexpected data sparked immediate market volatility.

- CPI: X% (compared to previous month's Y% and last year's Z%)

- RPI: Y% (compared to previous month's W% and last year's V%)

- Market Reaction: The immediate response was a sharp GBP depreciation against major currencies like the USD and EUR. Analyst predictions for future inflation were revised upwards, contributing to increased uncertainty.

- Investor Sentiment: Investor confidence took a hit, with many reassessing their investment strategies in light of the higher-than-anticipated inflation figures. This uncertainty fuelled speculation about the future direction of BOE monetary policy.

BOE Rate Cut Bets Before and After the Report

Before the inflation report, market analysts widely anticipated a BOE rate cut, with the probability priced in at approximately A%. The prevailing belief was that easing monetary policy was necessary to combat slowing economic growth. However, the higher-than-expected inflation figures significantly altered these expectations. The probability of a rate cut immediately plummeted to B% post-report.

- Rate Cut Probability: A% before the report, B% after the report.

- Market Pricing of Future Interest Rates: The yield curve, reflecting market expectations for future interest rates, steepened following the report, indicating a reduced likelihood of near-term rate cuts.

- Influencing Factors: The BOE's decision-making process is complex, considering various factors beyond inflation, including employment data, GDP growth forecasts, and global economic conditions. The unexpected inflation figures have significantly shifted the balance of these factors.

Impact on the UK Economy

The inflation report and the subsequent shift in BOE rate cut expectations carry significant implications for the UK economy. Higher-than-anticipated inflation could stifle consumer spending, impacting GDP growth. Furthermore, the BOE's response, whether a rate cut or maintaining current interest rates, will influence economic growth, employment rates, and investment decisions.

- Economic Growth: Higher inflation might lead to slower economic growth due to reduced consumer spending and business investment.

- Unemployment: The BOE's actions will directly affect employment levels, with potential implications for job creation or potential job losses.

- Fiscal Policy: Government fiscal policies may also need to adjust to mitigate the impact of high inflation and fluctuating interest rates.

The Pound's Response to the Inflation Report and BOE Expectations

The Pound Sterling's response to the inflation report and revised BOE expectations was immediate and significant. Following the report's release, GBP experienced a sharp decline against the USD and EUR, reflecting market concerns about higher inflation and reduced likelihood of a rate cut.

- GBP Exchange Rate Fluctuations: Specific figures showing GBP's movements against USD and EUR pre and post-report.

- Comparison to Other Major Currencies: Analysis of GBP performance relative to other major currencies such as the Yen (JPY) and Canadian dollar (CAD).

- Factors Driving GBP Movement: The primary drivers of GBP volatility include inflation data, BOE policy decisions, global economic uncertainty, and investor sentiment.

Conclusion

The recent inflation report significantly impacted market expectations for a BOE rate cut, leading to a noticeable response from the Pound Sterling. Higher-than-anticipated inflation figures reduced the likelihood of a rate cut and triggered a GBP depreciation against major currencies. The BOE's decisions regarding monetary policy will play a crucial role in shaping the UK's economic trajectory in the coming months. Understanding the interplay between inflation reports, BOE rate cut bets, and the Pound's response is vital for effective investment management. Stay informed about future inflation reports and BOE announcements to effectively navigate this dynamic economic landscape and manage your investments accordingly. Consider utilizing financial news sources and economic data websites to monitor these important indicators.

Featured Posts

-

Annie Kilners Diamond Ring Confirmation Of Engagement After Kyle Walker Spotting

May 25, 2025

Annie Kilners Diamond Ring Confirmation Of Engagement After Kyle Walker Spotting

May 25, 2025 -

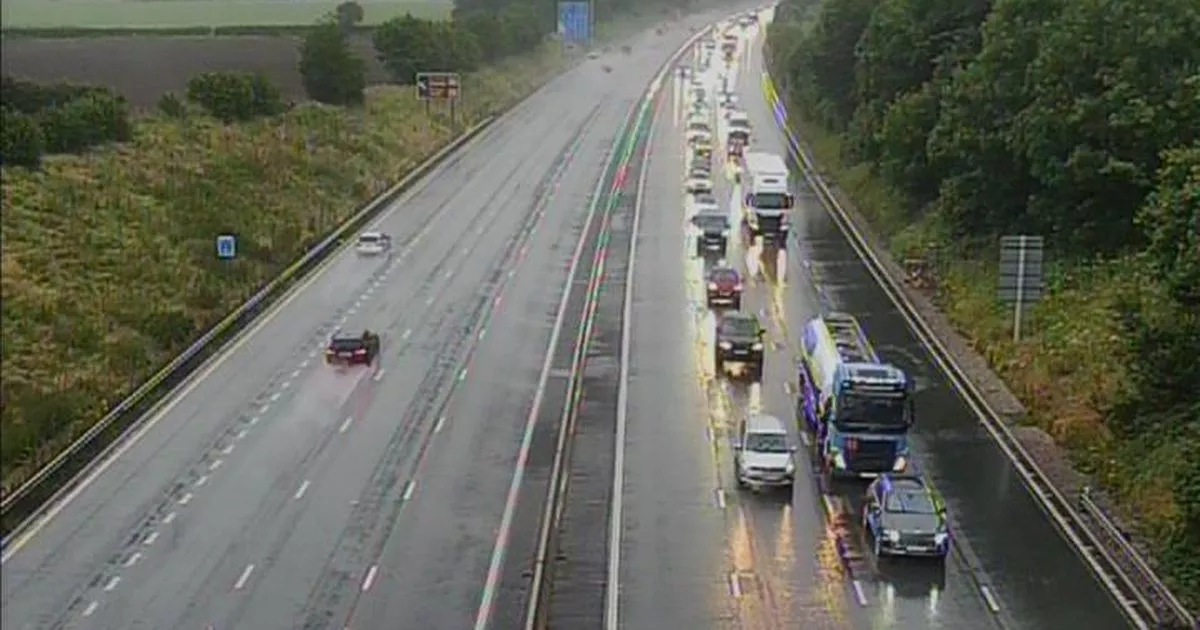

Live Updates M56 Traffic Disruption After Serious Crash

May 25, 2025

Live Updates M56 Traffic Disruption After Serious Crash

May 25, 2025 -

Porsche 956 Nin Tavan Asili Sergilenme Nedeni

May 25, 2025

Porsche 956 Nin Tavan Asili Sergilenme Nedeni

May 25, 2025 -

Sean Penn Casts Doubt On Woody Allens Sexual Abuse Accusation

May 25, 2025

Sean Penn Casts Doubt On Woody Allens Sexual Abuse Accusation

May 25, 2025 -

Buffetts Apple Investment Impact Of Trump Tariffs And Future Outlook

May 25, 2025

Buffetts Apple Investment Impact Of Trump Tariffs And Future Outlook

May 25, 2025