ING 2024 Annual Report (Form 20-F): A Comprehensive Overview

Table of Contents

Main Points: Key Highlights from the ING 2024 Annual Report (Form 20-F)

Financial Performance Overview: Analyzing ING's 2024 Results

Revenue and Earnings:

ING's 2024 financial performance will be detailed in the 20-F filing. This section will analyze the company's revenue streams, profit margins, and overall earnings, comparing them to previous years' results. Key data points to watch include:

- Net Income: The ultimate profit after all expenses are deducted. A year-over-year comparison will illustrate growth or decline.

- Operating Income: Profit from core operations, offering insight into the efficiency of ING's business model.

- Revenue Breakdown: A detailed breakdown by segment (Wholesale Banking, Retail Banking, Investment Management, etc.) revealing the performance of each sector and potential areas of strength or weakness. Analyzing revenue growth in each segment is crucial for understanding ING's overall financial performance.

Analyzing this data, along with contextual information such as market conditions and economic trends, will paint a clear picture of ING's 2024 earnings and overall revenue growth. Understanding the drivers of ING financial performance is crucial for evaluating the company's prospects.

Key Financial Ratios and Metrics:

The ING 2024 Annual Report (Form 20-F) will also present key financial ratios providing a deeper understanding of ING's financial health and efficiency. Analyzing these ratios is critical for assessing the company's profitability, efficiency, and risk profile. We will examine:

- Return on Equity (ROE): Measures how effectively ING utilizes shareholder investments to generate profits. A higher ROE suggests better utilization of capital.

- Return on Assets (ROA): Indicates how efficiently ING uses its assets to generate earnings.

- Net Interest Margin (NIM): Shows the difference between interest earned on assets and interest paid on liabilities, a critical metric for banks.

By examining these ING financial ratios, investors can gauge the company's financial health, understand its profitability, and assess its overall financial performance. These ING financial ratios will be a key focus in our analysis of the 20-F.

Risk Management and Compliance: Assessing ING's Risk Profile in 2024

Credit Risk:

The ING 2024 Annual Report (Form 20-F) will detail ING's approach to managing credit risk, a critical aspect for any financial institution. This section will focus on:

- Non-Performing Loans (NPLs): The percentage of loans that are in default or are unlikely to be repaid. An increase in NPLs indicates rising credit risk.

- Provisioning: The amount of money set aside to cover potential loan losses. Adequate provisioning is a sign of proactive risk management.

- Credit Risk Exposure: An overview of the overall credit risk faced by ING across various segments and geographies.

Analyzing these factors will provide insight into ING's credit risk management strategies and their effectiveness in mitigating potential losses. Understanding ING risk management strategies from the 20-F is vital for a thorough assessment of the company.

Regulatory Compliance and Governance:

The 20-F will also cover ING's adherence to regulatory requirements and its corporate governance framework. We will examine:

- Regulatory Changes: A review of significant regulatory developments and their impact on ING's operations.

- Compliance Programs: An assessment of ING's internal controls and processes aimed at ensuring regulatory compliance.

- Corporate Governance Structure: An analysis of ING's board composition, internal controls, and risk oversight mechanisms.

This analysis will provide a comprehensive view of ING regulatory filings and the effectiveness of their corporate governance. A robust regulatory compliance framework is crucial for maintaining stability and investor confidence.

Strategic Initiatives and Outlook: ING's Future Plans and Projections

Strategic Priorities:

The ING 2024 Annual Report (Form 20-F) will likely outline ING's key strategic objectives for 2024 and beyond. We will delve into:

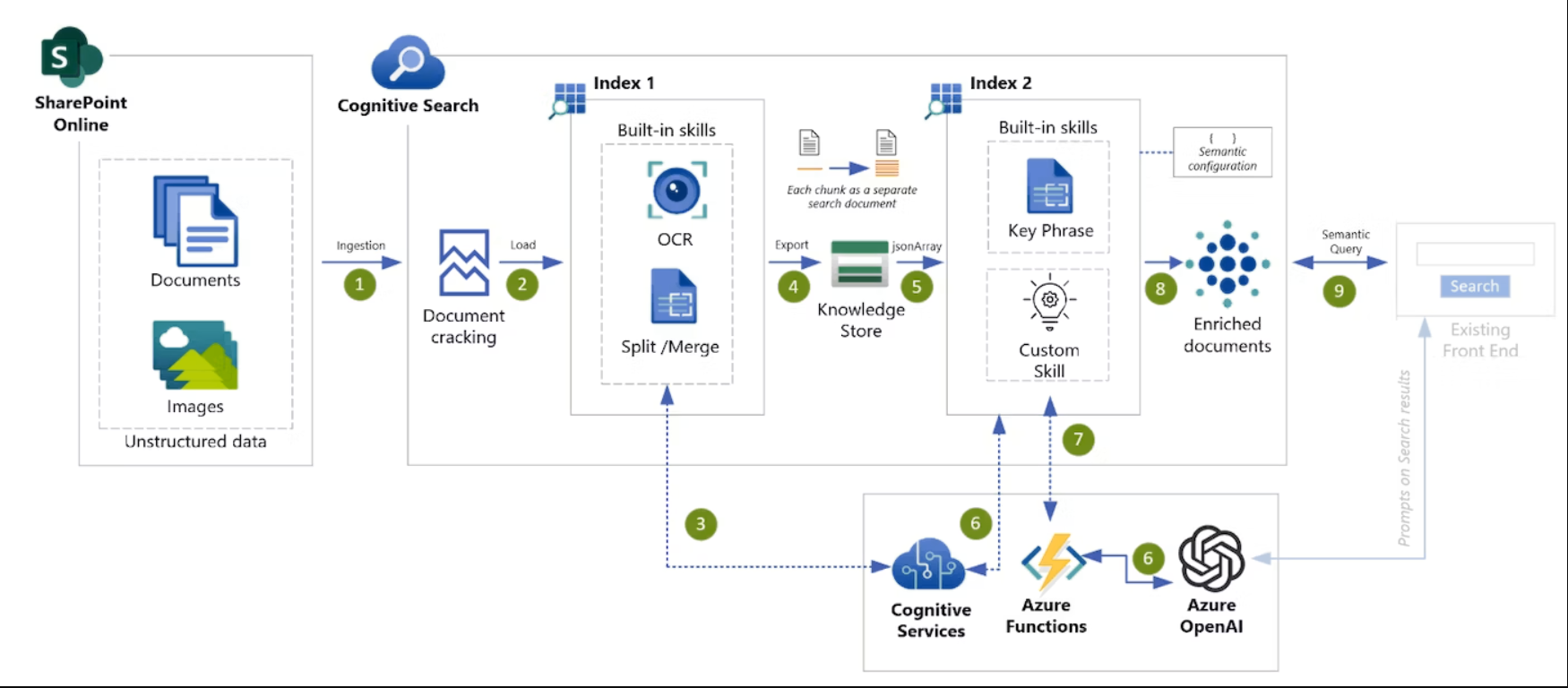

- Digital Transformation: ING's ongoing efforts to modernize its operations and enhance customer experience through technology.

- Sustainability Goals: ING's commitment to environmental, social, and governance (ESG) factors and its related targets.

- Geographic Expansion Plans: Any planned expansion into new markets or strengthening of existing market positions.

Understanding these ING strategic plan initiatives will provide insights into the company's long-term vision and its ability to adapt to evolving market conditions. Assessing the progress towards sustainability and digital transformation is crucial for understanding ING's future trajectory.

Financial Projections and Guidance:

The 20-F will also provide insight into ING's financial projections and guidance for the coming periods. Key areas include:

- Revenue Projections: Forecasts of future revenue based on the current strategic plans and market outlook.

- Earnings Guidance: Estimates of future earnings, providing a roadmap for potential growth and profitability.

- Capital Allocation Plans: How ING intends to deploy its capital to support growth and shareholder returns.

These ING financial projections and earnings guidance will offer a valuable perspective on the company's anticipated future financial performance.

Conclusion: Key Takeaways and Call to Action: Understanding the ING 2024 Annual Report (Form 20-F)

This analysis of the ING 2024 Annual Report (Form 20-F) highlights ING's financial performance, its risk management approach, and its strategic direction. Understanding these key elements is vital for anyone interested in assessing ING's financial health and future prospects. A thorough review of the financial statements, risk factors, and management's discussion and analysis within the 20-F is recommended.

We encourage you to access the complete ING 2024 Annual Report (Form 20-F) from the official ING investor relations website for a comprehensive understanding of the company's financial position and future plans. A detailed review of this document will allow for a more complete evaluation of the company's ING 20-F report and its overall prospects. Don’t miss the opportunity to gain a deeper understanding of ING’s financial strategy by reviewing the complete ING annual report analysis of this vital document. Use this analysis to aid in your own detailed understanding of ING's financials.

Featured Posts

-

Cassidy Hutchinsons Memoir Key Jan 6th Hearing Witness To Tell All This Fall

May 21, 2025

Cassidy Hutchinsons Memoir Key Jan 6th Hearing Witness To Tell All This Fall

May 21, 2025 -

Nuffy On Touring With Vybz Kartel A Dream Fulfilled

May 21, 2025

Nuffy On Touring With Vybz Kartel A Dream Fulfilled

May 21, 2025 -

Switzerland Issues Strong Statement Against Chinese Military Actions

May 21, 2025

Switzerland Issues Strong Statement Against Chinese Military Actions

May 21, 2025 -

Record Breaking Run Man Achieves Fastest Australian Foot Crossing

May 21, 2025

Record Breaking Run Man Achieves Fastest Australian Foot Crossing

May 21, 2025 -

Jail Sentence And Homelessness For Mother Following Southport Stabbing Tweet

May 21, 2025

Jail Sentence And Homelessness For Mother Following Southport Stabbing Tweet

May 21, 2025

Latest Posts

-

T Mobile To Pay 16 Million Following Three Years Of Data Security Issues

May 21, 2025

T Mobile To Pay 16 Million Following Three Years Of Data Security Issues

May 21, 2025 -

T Mobile Hit With 16 Million Fine For Data Breaches Spanning Three Years

May 21, 2025

T Mobile Hit With 16 Million Fine For Data Breaches Spanning Three Years

May 21, 2025 -

Revolutionizing Voice Assistant Development Open Ais New Tools

May 21, 2025

Revolutionizing Voice Assistant Development Open Ais New Tools

May 21, 2025 -

Exec Office365 Breach Nets Millions For Hacker Fbi Says

May 21, 2025

Exec Office365 Breach Nets Millions For Hacker Fbi Says

May 21, 2025 -

Podcast Revolution Ais Role In Transforming Repetitive Scatological Text

May 21, 2025

Podcast Revolution Ais Role In Transforming Repetitive Scatological Text

May 21, 2025