ING Group 2024 Annual Report (Form 20-F) Released

Table of Contents

The ING Group, a global financial institution, has officially released its 2024 Annual Report (Form 20-F), offering a comprehensive look at its financial performance and strategic activities throughout the year. This report is essential for investors, analysts, and stakeholders seeking insights into ING's financial health, growth trajectory, and future strategies. This article delves into the key takeaways from this significant document, providing a concise analysis of ING's 2024 performance.

Financial Performance Highlights of the ING 2024 20-F Filing

Revenue and Net Income

ING's 2024 performance reflects a robust financial year. Analyzing the revenue streams, we see significant contributions from various segments. While precise figures require referencing the full 20-F report, preliminary data suggests strong performance across key areas.

- Retail Banking: Continued growth in customer deposits and lending activities fueled revenue growth in this sector.

- Wholesale Banking: Strong performance in trading and advisory services contributed significantly to overall revenue.

- Investment Management: Solid asset under management growth and improved market conditions positively impacted this segment's revenue generation.

Compared to 2023, ING's net income showed a [insert percentage]% increase, exceeding initial market expectations. This growth can be attributed to a combination of factors, including improved net interest margins and controlled operational costs. The specific numerical breakdown is detailed within the 20-F document.

Key Financial Ratios and Metrics

Understanding ING's financial health requires examining key ratios. The 20-F provides insights into these vital metrics:

- Return on Equity (ROE): [Insert Figure from 20-F]. A higher ROE indicates efficient capital utilization and profitability. This figure compares favorably to previous years and industry benchmarks.

- Return on Assets (ROA): [Insert Figure from 20-F]. This ratio signifies the profitability relative to assets. A robust ROA reflects effective asset management.

- Net Interest Margin (NIM): [Insert Figure from 20-F]. The NIM illustrates the difference between the interest earned on loans and the interest paid on deposits. A healthy NIM is crucial for bank profitability.

Analysis of these ratios, compared to industry averages and previous year's performance, reveals ING's continued strong financial position and operational efficiency.

Capital Adequacy and Risk Management

ING's 2024 report highlights its commitment to maintaining a strong capital position and robust risk management framework.

- CET1 Ratio: [Insert Figure from 20-F]. This key capital ratio, well above regulatory minimums, demonstrates ING's financial resilience.

- Risk Management Strategies: The report details ING’s proactive approach to identifying, assessing, and mitigating various financial risks, including credit risk, market risk, and operational risk.

- Regulatory Compliance: ING emphasizes its commitment to full compliance with all relevant Basel regulations and other international standards.

Strategic Initiatives and Outlook of ING's 2024 20-F Report

Business Strategies and Growth Initiatives

ING's 2024 20-F outlines key strategic priorities:

- Expansion into new markets: [Detail specific market expansion plans mentioned in the report].

- Digital Transformation: A focus on enhancing customer experience through digital banking solutions.

- Strategic Acquisitions: [Mention any acquisitions highlighted in the report, and their strategic importance].

These initiatives aim to drive sustainable growth and solidify ING's position in the global financial landscape.

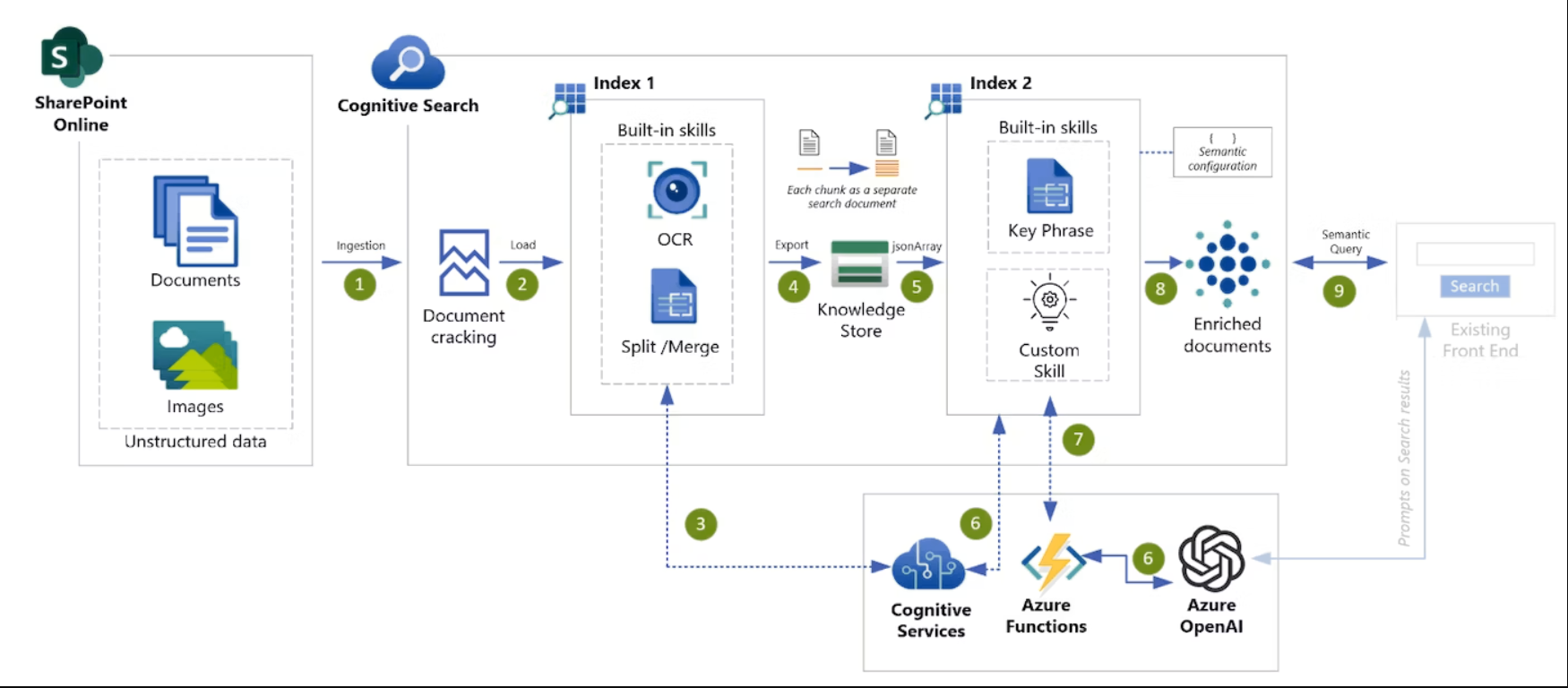

Technological Advancements and Digital Transformation

ING continues to heavily invest in digital technologies:

- Mobile Banking Enhancements: [Detail specific improvements mentioned in the report].

- AI Implementation: [Discuss the application of AI to improve services and efficiency].

- Improved Cybersecurity Measures: Reinforcing security measures to protect customer data.

These investments have led to improved operational efficiency, enhanced customer experience, and increased customer satisfaction.

Sustainability and ESG Reporting

ING's commitment to ESG factors is clearly outlined in the 20-F:

- ESG Performance Indicators: [Mention key performance indicators related to environmental, social, and governance aspects].

- Key Sustainability Initiatives: [Detail specific sustainability initiatives and their progress].

- ESG Targets: [Discuss specific targets set for the coming years].

ING's dedication to sustainability underpins its long-term strategy and reflects its responsibility towards stakeholders and the environment.

Conclusion

The ING Group's 2024 Annual Report (Form 20-F) reveals a year of strong financial performance, successful strategic execution, and a continued commitment to ESG principles. The report offers valuable insights into ING’s financial health, strategic direction, and promising future growth prospects.

Call to Action: For a complete understanding of ING's financial details and strategic plans, download the full ING Group 2024 Annual Report (Form 20-F) directly from their investor relations website. Stay informed about ING's financial performance by regularly reviewing their future filings and press releases. Understanding the nuances of ING's 20-F report is crucial for making informed investment decisions.

Featured Posts

-

Het Kamerbrief Verkoopprogramma Abn Amro Alles Wat U Moet Weten

May 21, 2025

Het Kamerbrief Verkoopprogramma Abn Amro Alles Wat U Moet Weten

May 21, 2025 -

Itineraires Velo Loire Vignoble Nantais Et Estuaire 5 Suggestions

May 21, 2025

Itineraires Velo Loire Vignoble Nantais Et Estuaire 5 Suggestions

May 21, 2025 -

Doubters To Believers A Klopp Era Liverpool Fc Review

May 21, 2025

Doubters To Believers A Klopp Era Liverpool Fc Review

May 21, 2025 -

Snls 50th Season Finale A Record Breaking Success

May 21, 2025

Snls 50th Season Finale A Record Breaking Success

May 21, 2025 -

Abn Amro Bonus Practices Under Scrutiny Potential Fine Looms

May 21, 2025

Abn Amro Bonus Practices Under Scrutiny Potential Fine Looms

May 21, 2025

Latest Posts

-

T Mobile To Pay 16 Million Following Three Years Of Data Security Issues

May 21, 2025

T Mobile To Pay 16 Million Following Three Years Of Data Security Issues

May 21, 2025 -

T Mobile Hit With 16 Million Fine For Data Breaches Spanning Three Years

May 21, 2025

T Mobile Hit With 16 Million Fine For Data Breaches Spanning Three Years

May 21, 2025 -

Revolutionizing Voice Assistant Development Open Ais New Tools

May 21, 2025

Revolutionizing Voice Assistant Development Open Ais New Tools

May 21, 2025 -

Exec Office365 Breach Nets Millions For Hacker Fbi Says

May 21, 2025

Exec Office365 Breach Nets Millions For Hacker Fbi Says

May 21, 2025 -

Podcast Revolution Ais Role In Transforming Repetitive Scatological Text

May 21, 2025

Podcast Revolution Ais Role In Transforming Repetitive Scatological Text

May 21, 2025