ING Group's Form 20-F: 2024 Annual Report And Financial Statements

Table of Contents

Key Highlights from ING Group's 2024 Form 20-F

Revenue and Profitability

ING Group's revenue streams are diverse, spanning retail banking, wholesale banking, and investment management. Analyzing the Form 20-F reveals the performance of each segment, highlighting strengths and areas for improvement. The 2024 Annual Report will detail the total revenue generated, broken down by these key business units. This allows for a granular understanding of ING Group's revenue generation capabilities.

- Retail Banking: Examine revenue growth from mortgages, personal loans, and deposit accounts.

- Wholesale Banking: Analyze income from corporate lending, trade finance, and capital markets activities.

- Investment Management: Assess performance of assets under management and related fees.

Crucially, the Form 20-F will also present key profitability metrics:

- Net Profit: The overall profit after all expenses are deducted. Expect a detailed breakdown in the 20-F.

- Return on Equity (ROE): A measure of how effectively ING Group uses shareholder investments to generate profit. A higher ROE generally indicates better performance.

- Return on Assets (ROA): Shows how efficiently ING Group uses its assets to generate earnings. Comparing the 2024 ROA to previous years and industry benchmarks is vital for assessing performance.

Analyzing percentage changes in these key metrics from 2023 to 2024, as presented in the Form 20-F, will provide critical insights into ING Group's financial performance and trends. Look for detailed tables and graphs illustrating this data within the filing.

Assets, Liabilities, and Capital Structure

The Form 20-F's balance sheet provides a snapshot of ING Group's assets and liabilities at the end of 2024. This crucial section helps assess the bank's financial stability and solvency.

- Key Assets: This includes loans, investments, and other financial assets held by ING Group. The 20-F will detail the composition and quality of these assets.

- Key Liabilities: This encompasses deposits, borrowings, and other obligations. Understanding the maturity profile of these liabilities is crucial for assessing risk.

Analyzing the capital structure reveals ING Group’s financial health and risk profile:

- Capital Adequacy Ratio: This ratio measures the bank's ability to absorb losses. A strong capital adequacy ratio indicates resilience and financial strength. The Form 20-F will detail this ratio, highlighting compliance with regulatory requirements.

- Debt-to-Equity Ratio: This ratio measures the proportion of debt financing relative to equity. A high ratio indicates higher financial risk. Examining this ratio within the context of industry averages, as detailed in the 20-F, is important.

Risk Management and Compliance

ING Group's approach to risk management and regulatory compliance is a critical aspect highlighted in the Form 20-F. Transparency regarding risks is essential for investors. The report will disclose:

- Credit Risk: The risk of borrowers defaulting on their loans.

- Market Risk: The risk of losses due to fluctuations in market prices.

- Operational Risk: The risk of losses due to internal failures or external events.

The Form 20-F will also provide details on ING Group's compliance with various regulations and its strategies for mitigating these risks. Significant regulatory changes and their impacts on ING Group's operations will also be discussed.

Future Outlook and Strategic Initiatives

The 2024 Form 20-F will outline ING Group's strategic plans and outlook for the future. This section is vital for understanding management's vision and expectations.

- Strategic Plans: The document will likely detail planned investments in technology, expansion into new markets, or other strategic initiatives aimed at driving growth.

- Acquisitions: Any planned mergers or acquisitions will be disclosed, potentially offering insight into ING Group’s growth strategy.

- Management Guidance: The management’s outlook for future performance, including revenue growth projections and profitability targets, will be clearly presented.

Analyzing these aspects provides valuable insights into ING Group's long-term growth prospects.

Conclusion: Understanding ING Group's 2024 Performance Through its Form 20-F

This analysis of key aspects within ING Group's 2024 Form 20-F provides a comprehensive overview of the company's financial performance, risk management, and future outlook. The report reveals valuable information regarding revenue streams, profitability, asset quality, capital strength, and strategic initiatives. Understanding these details is critical for investors seeking to evaluate ING Group's investment potential. To gain a complete understanding of ING Group’s financial health and strategic direction, we strongly encourage you to download ING Group's 20-F filing and conduct your own in-depth analysis. [Insert Link to ING Group's 20-F Filing Here] Analyzing ING Group's performance using the complete Form 20-F will provide the most comprehensive understanding of its financial statements and future prospects.

Featured Posts

-

Exploring The Depths Of Love Monsters Character

May 22, 2025

Exploring The Depths Of Love Monsters Character

May 22, 2025 -

Le Hellfest Au Noumatrouff De Mulhouse Une Experience Musicale Intense

May 22, 2025

Le Hellfest Au Noumatrouff De Mulhouse Une Experience Musicale Intense

May 22, 2025 -

Participating In The Wtt An Aimscap Perspective

May 22, 2025

Participating In The Wtt An Aimscap Perspective

May 22, 2025 -

Le Book Club Le Matin Recoit Abdelkebir Rabi Pour Les Grands Fusains De Boulemane

May 22, 2025

Le Book Club Le Matin Recoit Abdelkebir Rabi Pour Les Grands Fusains De Boulemane

May 22, 2025 -

Abn Amro Kamerbrief Certificaten Verkoopprogramma Alles Wat U Moet Weten

May 22, 2025

Abn Amro Kamerbrief Certificaten Verkoopprogramma Alles Wat U Moet Weten

May 22, 2025

Latest Posts

-

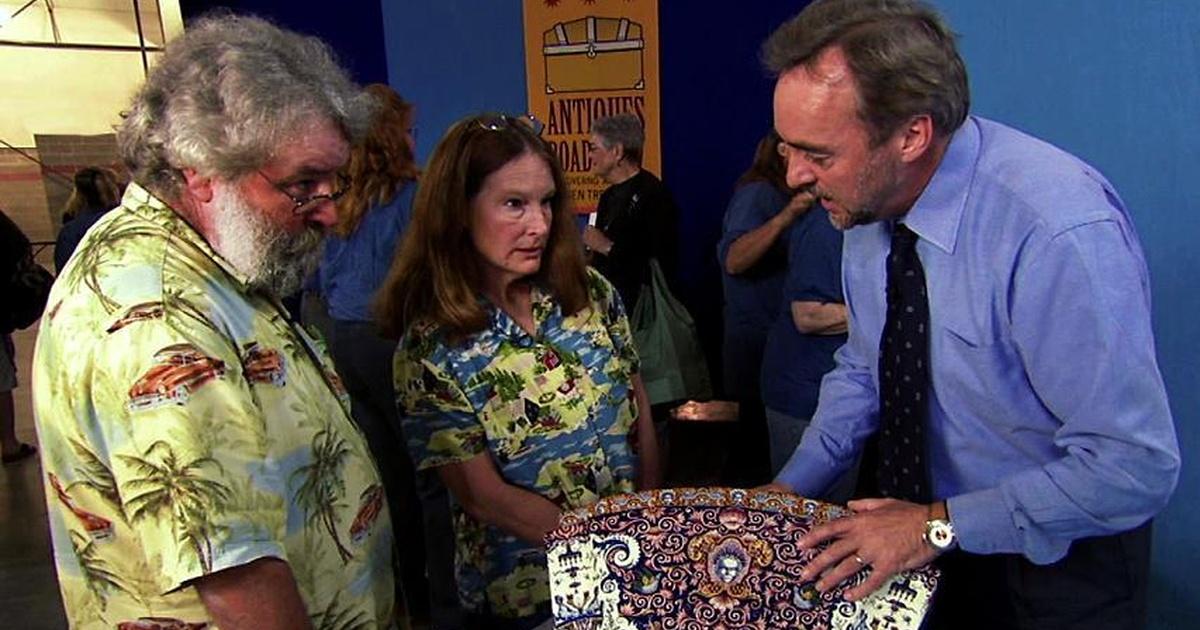

Antiques Roadshow National Treasure Appraisal Leads To Arrest Of Couple For Trafficking

May 22, 2025

Antiques Roadshow National Treasure Appraisal Leads To Arrest Of Couple For Trafficking

May 22, 2025 -

Antiques Roadshow Stolen Artifacts Result In Couples Arrest

May 22, 2025

Antiques Roadshow Stolen Artifacts Result In Couples Arrest

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025 -

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025 -

Us Couple Facing Charges After Bbc Antiques Roadshow Episode

May 22, 2025

Us Couple Facing Charges After Bbc Antiques Roadshow Episode

May 22, 2025