ING Provides Project Finance Facility To Freepoint Eco-Systems

Table of Contents

Details of the Project Finance Facility

ING's project finance facility for Freepoint Eco-Systems represents a substantial financial commitment to sustainable initiatives. The facility, amounting to [Insert Amount if Publicly Available] euros, is structured as a [Specify Structure: e.g., loan, equity, or hybrid]. This funding is specifically earmarked for [Detail Purpose: e.g., expansion of existing renewable energy projects, development of new waste-to-energy plants, etc.].

- Funding Allocation: The funds will be primarily used for [Specific Project Breakdown: e.g., 50% for solar farm development, 30% for wind turbine upgrades, 20% for research and development of new sustainable technologies].

- Sustainability Focus: The facility incorporates stringent ESG criteria, aligning with ING's commitment to responsible banking and sustainable development goals. This includes a focus on [Specific Sustainability Goals: e.g., reducing carbon emissions by a specific amount, achieving zero waste in operations, etc.]. It's structured as a green loan, ensuring the funds are used exclusively for environmentally beneficial purposes.

- Timeline: The project is expected to reach key milestones by [Insert Dates or Timeframes for Completion].

Freepoint Eco-Systems' Projects and Impact

Freepoint Eco-Systems is a leader in [Describe Freepoint's Core Business: e.g., renewable energy development, sustainable waste management, etc.]. Their dedication to environmental sustainability is evident in their diverse portfolio of projects, which focus on [Specific Areas of Focus: e.g., reducing landfill waste, increasing renewable energy generation, etc.]. The ING financing will significantly accelerate several key initiatives:

- Renewable Energy Projects: This includes the development of [Specific Examples: e.g., a large-scale solar farm in [Location], expansion of a wind energy project in [Location]]. These projects are projected to generate [Quantify Expected Impact: e.g., X megawatts of clean energy, reducing carbon emissions by Y tons annually].

- Waste Management Solutions: Freepoint is implementing innovative waste-to-energy solutions, transforming waste into valuable resources and significantly reducing landfill burden. The ING facility will support [Specific Examples: e.g., the construction of a new waste processing plant, upgrades to existing recycling infrastructure]. This will result in [Quantify Expected Impact: e.g., a Z% reduction in waste sent to landfills].

- Circular Economy Initiatives: Freepoint is committed to promoting a circular economy by [Describe Initiatives: e.g., recycling materials, repurposing waste products]. The project finance facility will further these goals by [Specific Examples: e.g., funding research into new recycling technologies].

ING's Commitment to Sustainable Finance

ING is a global leader in sustainable finance, actively promoting responsible investing and ESG principles. Their commitment to climate action is reflected in their ambitious targets for [Mention Specific Targets: e.g., financing renewable energy projects, reducing carbon footprint, etc.]. ING has a long history of supporting green energy projects and is actively engaged in various initiatives within the sustainable finance sector.

- ESG Investments: ING has allocated substantial resources towards ESG investments, aligning their portfolio with environmental, social, and governance goals.

- Renewable Energy Portfolio: ING's portfolio includes a diverse range of renewable energy projects globally, demonstrating a firm commitment to the energy transition.

- Partnerships: ING actively collaborates with leading organizations to drive sustainable development goals (SDGs).

The Broader Implications of the Partnership

The partnership between ING and Freepoint Eco-Systems signifies a powerful collaboration between a major financial institution and a leading sustainable business. This exemplifies the growing trend of large financial institutions actively supporting eco-conscious projects.

- Attracting Further Investment: This successful partnership is likely to attract further investment in similar sustainable initiatives, demonstrating the viability and profitability of environmentally responsible ventures.

- Sector-Wide Impact: This collaboration sets a precedent for future partnerships, encouraging other financial institutions to increase their investment in the sustainable finance sector.

- Future Collaborations: The success of this project finance facility opens doors for future collaborations between ING and Freepoint Eco-Systems, potentially expanding their portfolio of sustainable projects.

Conclusion

ING's substantial project finance facility provided to Freepoint Eco-Systems underscores the increasing importance of sustainable finance. The details of the facility, along with Freepoint’s commitment to environmental sustainability and ING's broader strategy in green financing, showcase a powerful partnership with significant positive environmental and financial implications. This collaboration demonstrates the growing recognition of the crucial role of project finance in driving sustainable development. Learn more about ING's commitment to project finance and sustainable development, and discover how you can contribute to a greener future.

Featured Posts

-

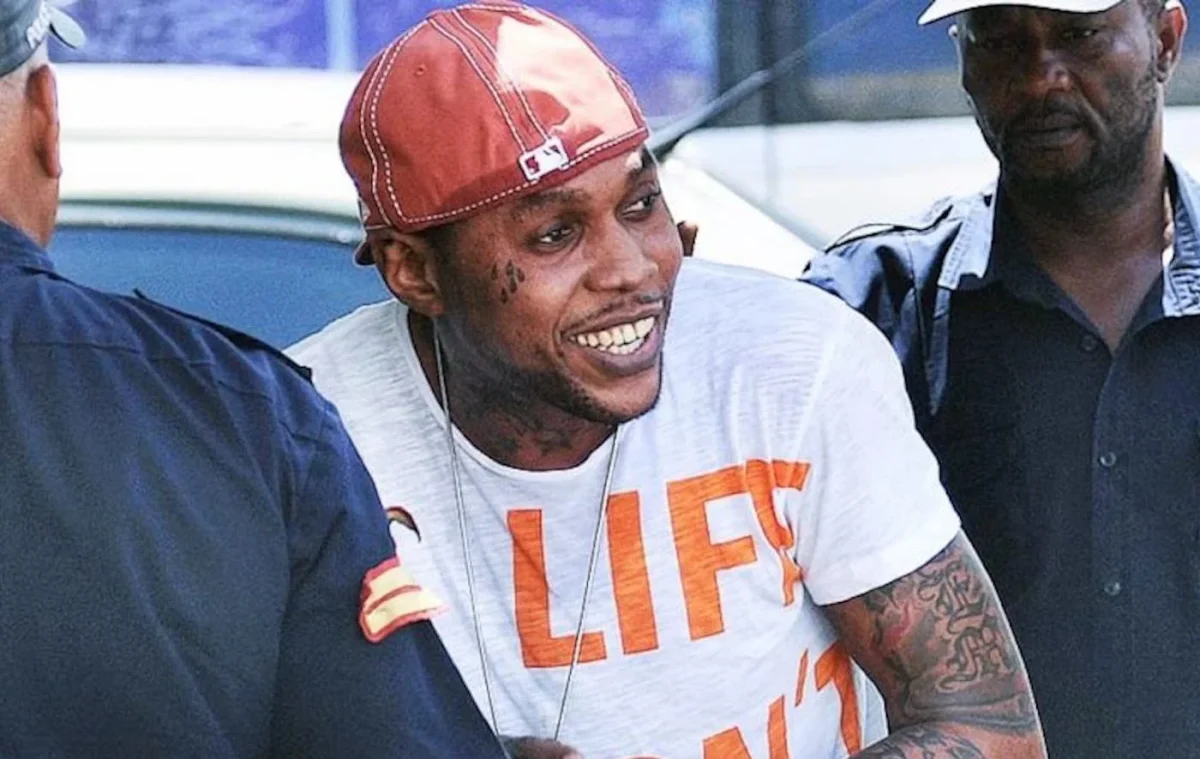

T And T Minister Restricts Vybz Kartels Movement

May 21, 2025

T And T Minister Restricts Vybz Kartels Movement

May 21, 2025 -

Gen Zs Love For Little Britain A Post Cancellation Phenomenon

May 21, 2025

Gen Zs Love For Little Britain A Post Cancellation Phenomenon

May 21, 2025 -

Prediksi Juara Liga Inggris 2024 2025 Peran Penting Sang Pelatih Untuk Liverpool

May 21, 2025

Prediksi Juara Liga Inggris 2024 2025 Peran Penting Sang Pelatih Untuk Liverpool

May 21, 2025 -

Trans Australia Run A Record Breaking Challenge

May 21, 2025

Trans Australia Run A Record Breaking Challenge

May 21, 2025 -

Foreign Minister Cassis Statement On The Pahalgam Terrorist Attack

May 21, 2025

Foreign Minister Cassis Statement On The Pahalgam Terrorist Attack

May 21, 2025

Latest Posts

-

Good Morning America Robin Roberts Shares Joyful Family News

May 21, 2025

Good Morning America Robin Roberts Shares Joyful Family News

May 21, 2025 -

Robin Roberts Gma Family Announcement A New Addition

May 21, 2025

Robin Roberts Gma Family Announcement A New Addition

May 21, 2025 -

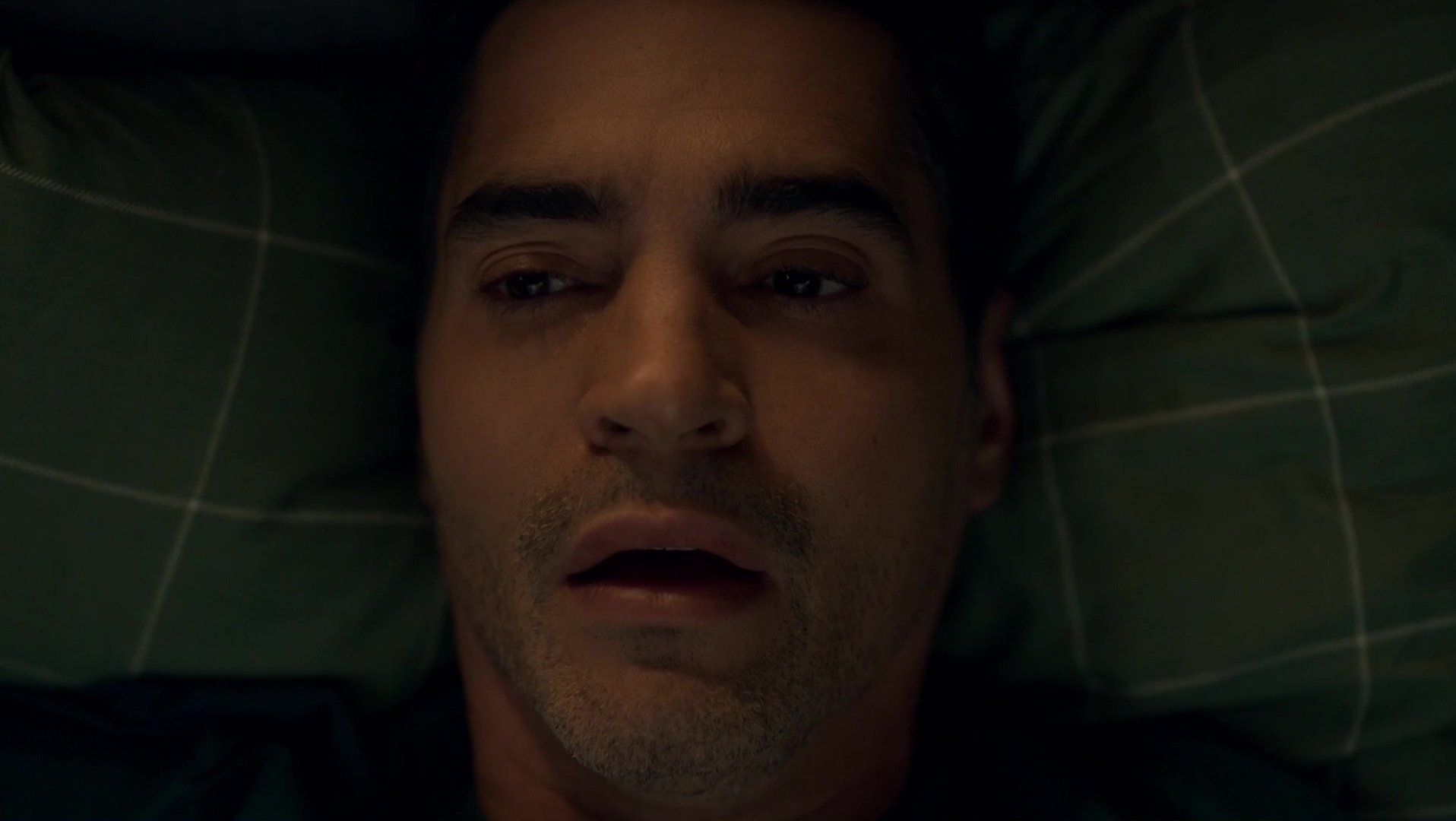

Actor Ramon Rodriguez Details Unexpected Scorpion Encounter On Will Trent Set

May 21, 2025

Actor Ramon Rodriguez Details Unexpected Scorpion Encounter On Will Trent Set

May 21, 2025 -

Ramon Rodriguez Will Trent Slept Through Three Scorpion Stings

May 21, 2025

Ramon Rodriguez Will Trent Slept Through Three Scorpion Stings

May 21, 2025 -

Good Morning America Without Michael Strahan The Story Behind His Exit

May 21, 2025

Good Morning America Without Michael Strahan The Story Behind His Exit

May 21, 2025