ING's 2024 Form 20-F: Analysis Of Annual Report And Financial Performance

Table of Contents

Key Financial Highlights from ING's 2024 Form 20-F

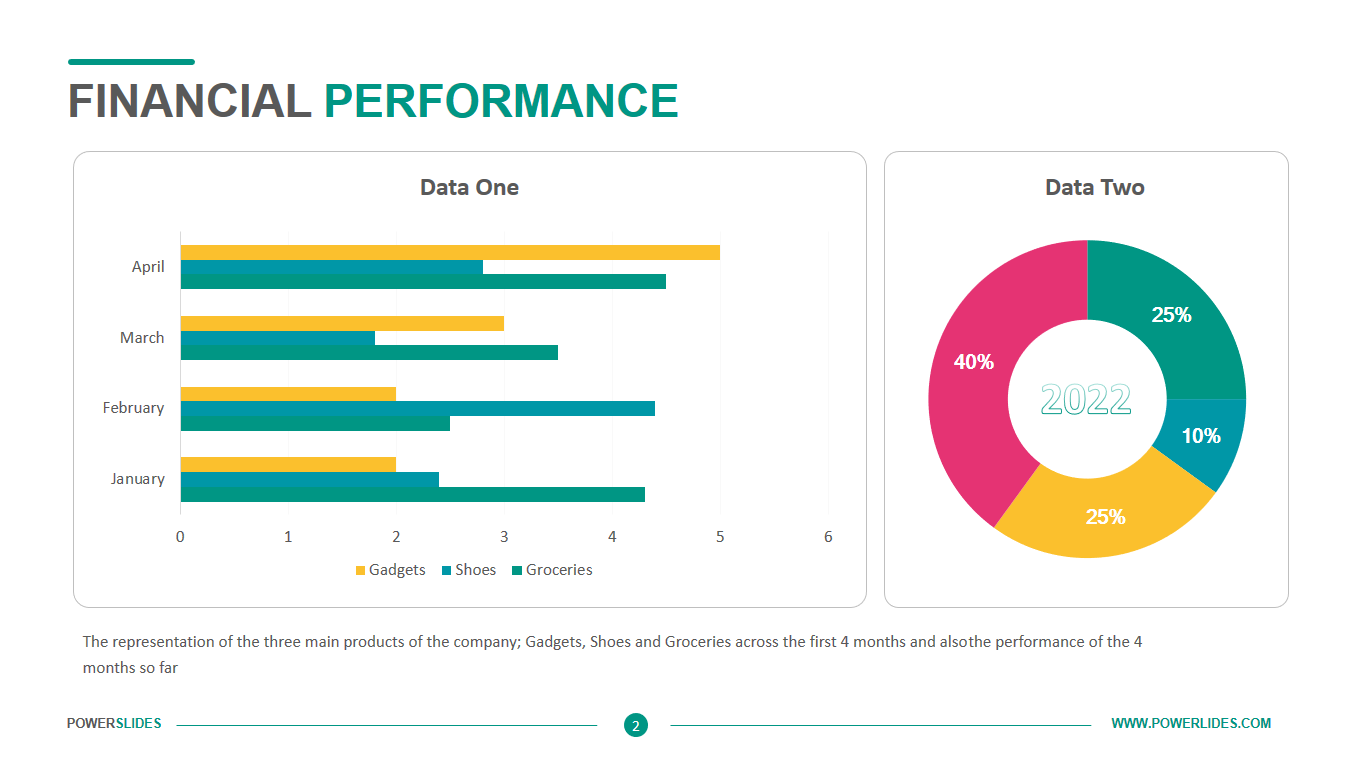

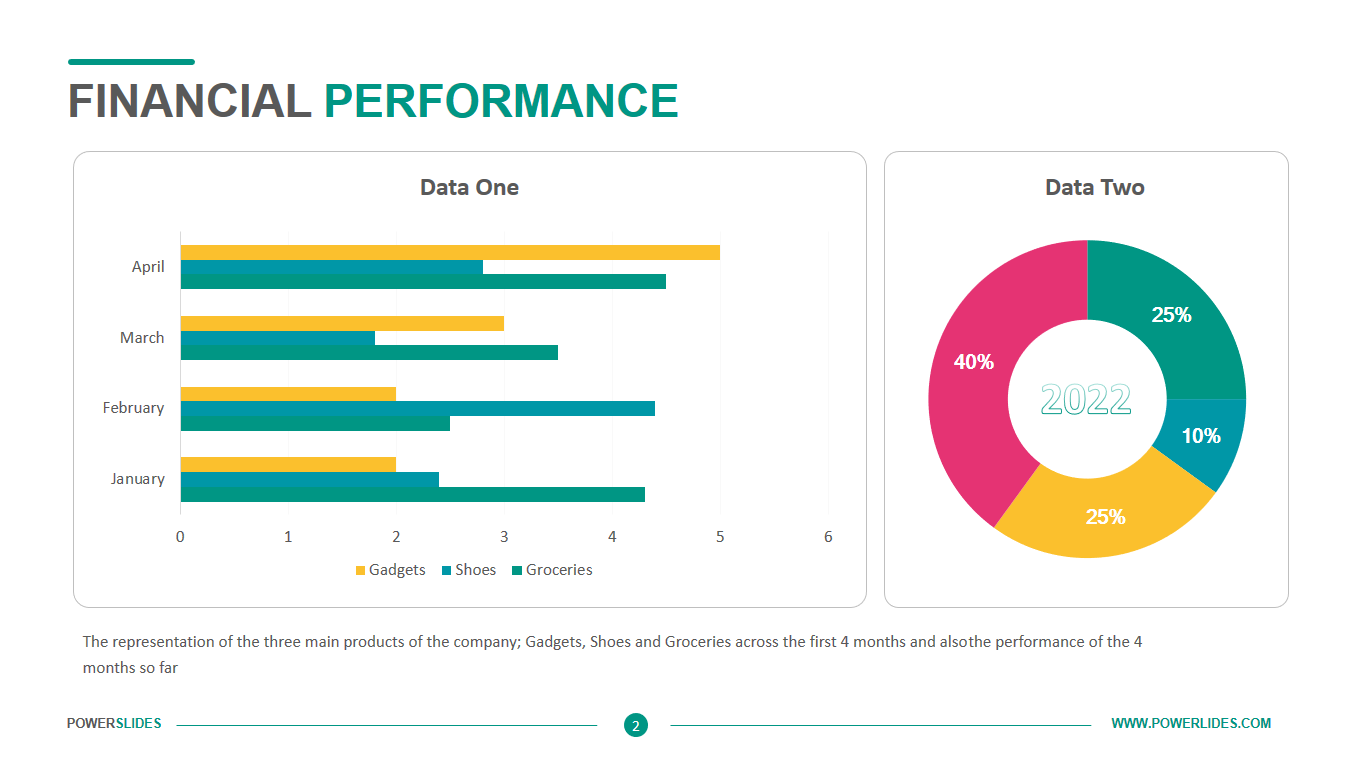

This section examines the core financial data presented in ING's 2024 Form 20-F, focusing on revenue, net income, balance sheet strength, and profitability.

Revenue and Net Income Analysis:

ING's 2024 financial performance, as detailed in its 20-F filing, reveals [insert actual data from the 2024 20-F report here. Replace bracketed information with real data].

- Wholesale Banking: [Insert data on revenue growth/decline. Example: Experienced a 5% increase in revenue driven by strong performance in its global markets division].

- Retail Banking: [Insert data on revenue growth/decline. Example: Showed a 3% decrease in revenue due to increased competition and a slight economic slowdown].

- Investment Management: [Insert data on revenue growth/decline. Example: Maintained steady revenue growth, reflecting the positive performance of its actively managed funds].

Year-over-year (YoY) growth in net income was [Insert Percentage and Context - e.g., 7%, exceeding analysts' expectations due to strategic cost-cutting measures]. The fluctuations in revenue and net income can be attributed to factors such as [Insert Factors - e.g., interest rate hikes, increased market volatility, and changes in regulatory landscape]. Key financial ratios like Return on Equity (ROE) and Return on Assets (ROA) stood at [Insert data for ROE and ROA, with context and comparison to previous years and industry benchmarks].

Balance Sheet Strength and Liquidity:

ING's 2024 Form 20-F showcases [Insert analysis of the balance sheet data - e.g., a strong balance sheet with sufficient liquidity].

- Assets: [Insert data and analysis. Example: Total assets increased by X%, primarily driven by growth in loan portfolios].

- Liabilities: [Insert data and analysis. Example: Liabilities remained stable, reflecting a well-managed risk profile].

- Equity: [Insert data and analysis. Example: Equity increased by Y%, demonstrating the bank’s strong capital position].

ING's liquidity position appears robust, enabling it to comfortably meet its short-term obligations. Capital adequacy ratios are [Insert data and analysis, including context on regulatory compliance]. The bank demonstrates strong compliance with all relevant regulatory requirements.

Profitability and Efficiency Ratios:

Analysis of ING's profitability ratios provides further insights into its financial health.

- Net Interest Margin (NIM): [Insert data and analysis. Example: The NIM stood at Z%, slightly lower than the previous year, reflecting the competitive interest rate environment].

- Cost-to-Income Ratio: [Insert data and analysis. Example: The Cost-to-Income Ratio improved to A%, showcasing efficiency gains through various cost optimization initiatives].

Compared to its industry peers, ING's profitability and efficiency ratios [Insert comparative analysis. Example: are in line with or better than many of its major competitors].

Risk Factors and Challenges Highlighted in ING's 2024 Form 20-F

ING's 2024 Form 20-F transparently outlines several risk factors that could potentially impact its future performance.

Credit Risk Assessment:

ING's exposure to credit risk is [Insert analysis - e.g., diversified across various segments and geographies]. The level of non-performing loans is [Insert data and analysis]. Loan loss provisions are [Insert data and analysis. Example: adequate to cover potential losses].

Market Risk and Geopolitical Factors:

ING acknowledges exposure to various market risks, including interest rate risk and equity market risk. [Insert analysis of their management strategies for these risks. Example: These risks are mitigated through sophisticated hedging strategies]. Geopolitical events and macroeconomic conditions [Insert analysis of their impact - e.g., pose significant challenges and uncertainties].

Regulatory and Compliance Risks:

The evolving regulatory landscape presents ongoing challenges for ING. [Insert analysis of the impact of regulatory changes - e.g., Compliance with new regulations requires significant investment in technology and processes]. The potential for penalties due to non-compliance is [Insert analysis - e.g., continuously monitored and actively managed].

Investment Outlook and Future Prospects Based on ING's 2024 Form 20-F

This section explores ING's future prospects as indicated in its 2024 Form 20-F.

Management's Guidance and Outlook:

ING's management [Insert management's guidance on future performance from the 20-F. Example: expresses confidence in its ability to navigate the current economic climate and achieve its strategic objectives]. Key strategic initiatives include [Insert Examples from the 20-F].

Long-Term Growth Potential:

ING's long-term growth potential hinges on [Insert Key Factors from the 20-F. Example: its strong brand recognition, diverse business model, and strategic investments in technology]. However, challenges such as [Insert Challenges from the 20-F. Example: increasing competition and regulatory uncertainty] remain.

Valuation and Investment Implications:

(Disclaimer: This section is for informational purposes only and should not be considered financial advice. Consult a qualified financial advisor before making any investment decisions.)

[Optional: Include a brief, high-level discussion of ING's stock valuation based on publicly available data, but emphasize that it's not financial advice].

Conclusion: Understanding the Implications of ING's 2024 Form 20-F

This analysis of ING's 2024 Form 20-F reveals a [Insert Summary Assessment - e.g., financially sound institution with a strong balance sheet and diversified business model]. While risks exist, ING's management appears well-positioned to address them.

Key Takeaways:

- ING demonstrates solid financial performance despite economic headwinds.

- The bank maintains a strong capital position and robust liquidity.

- Risk management strategies are in place to mitigate potential challenges.

- Management's outlook suggests continued growth and strategic development.

To gain a complete understanding of ING's financial health and future prospects, we strongly encourage you to review the full text of ING's 2024 Form 20-F filing available on the SEC's EDGAR database [Insert Link Here]. Regularly monitoring ING’s financial performance through future filings and analysis of ING’s 20-F is essential for informed decision-making.

Featured Posts

-

Southern French Alps Weather Update Unexpected Late Season Snow

May 21, 2025

Southern French Alps Weather Update Unexpected Late Season Snow

May 21, 2025 -

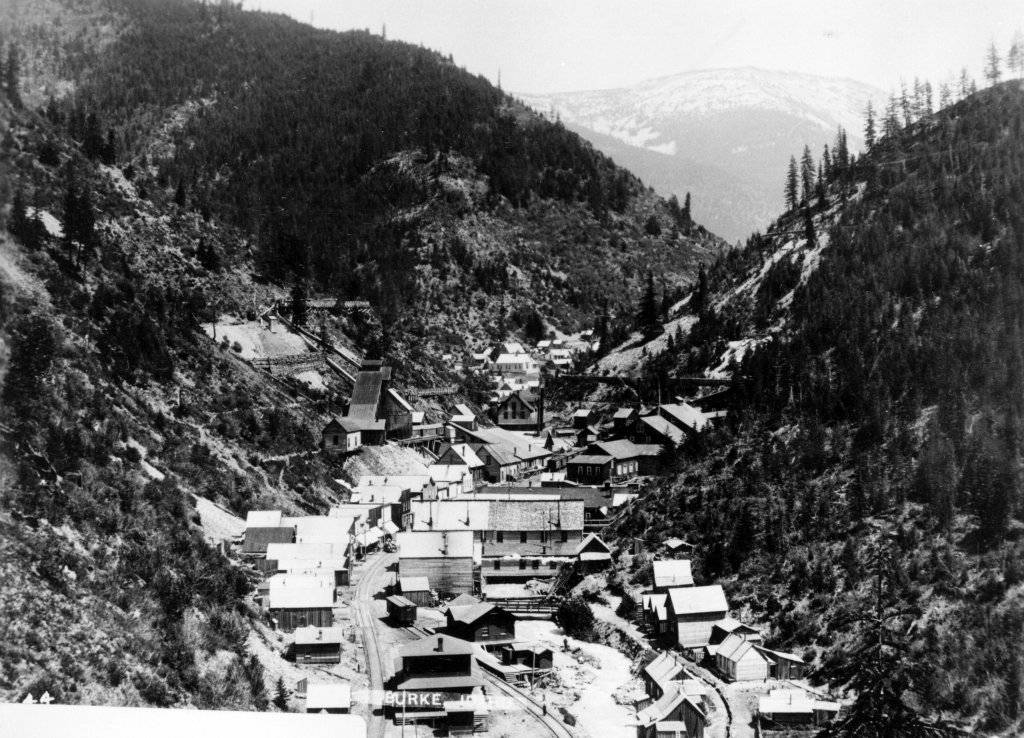

College Boom Towns Go Bust Enrollment Declines Economic Impact

May 21, 2025

College Boom Towns Go Bust Enrollment Declines Economic Impact

May 21, 2025 -

Chainalysis Acquisition Of Alterya Expanding Its Ai Capabilities

May 21, 2025

Chainalysis Acquisition Of Alterya Expanding Its Ai Capabilities

May 21, 2025 -

Fratii Tate Cum Au Fost Intampinati La Revenirea In Romania

May 21, 2025

Fratii Tate Cum Au Fost Intampinati La Revenirea In Romania

May 21, 2025 -

La Chanteuse Romande Stephane Seduit Paris

May 21, 2025

La Chanteuse Romande Stephane Seduit Paris

May 21, 2025

Latest Posts

-

T Mobile To Pay 16 Million Following Three Years Of Data Security Issues

May 21, 2025

T Mobile To Pay 16 Million Following Three Years Of Data Security Issues

May 21, 2025 -

T Mobile Hit With 16 Million Fine For Data Breaches Spanning Three Years

May 21, 2025

T Mobile Hit With 16 Million Fine For Data Breaches Spanning Three Years

May 21, 2025 -

Revolutionizing Voice Assistant Development Open Ais New Tools

May 21, 2025

Revolutionizing Voice Assistant Development Open Ais New Tools

May 21, 2025 -

Exec Office365 Breach Nets Millions For Hacker Fbi Says

May 21, 2025

Exec Office365 Breach Nets Millions For Hacker Fbi Says

May 21, 2025 -

Podcast Revolution Ais Role In Transforming Repetitive Scatological Text

May 21, 2025

Podcast Revolution Ais Role In Transforming Repetitive Scatological Text

May 21, 2025